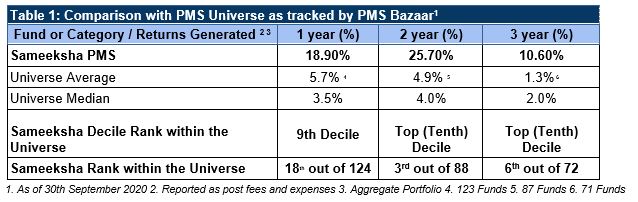

Among the universe of funds reporting to PMS bazaar, Sameeksha’s PMS has again comfortably outperformed its peers with returns comfortably above the averages for one year, two year and three year for the period ended September-2020. In fact, the performance of Sameeksha’s PMS was in top decile for two and three years and among top 20% decile for one year (Table 1)

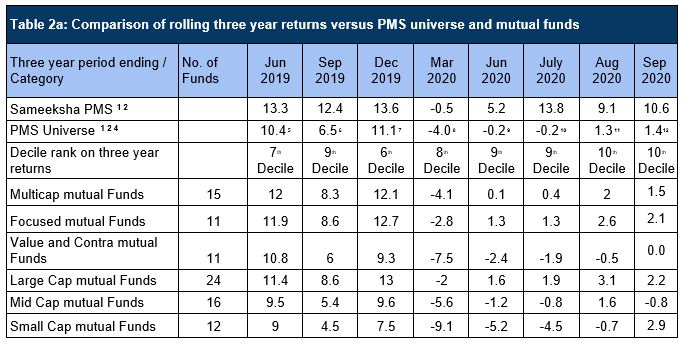

Rolling period returns provide a good indication of the consistency in fund performance. On a rolling three year basis, we have consistently outperformed the vast majority of our peers in the PMS universe achieving top decile or top 20% ranking very frequently and have never been ranked in the lower half of the pool. We have also done materially better than the average performance of every mutual fund category we track. We believe that our strategy is more comparable to Multi cap funds and Focused funds (Table 2a).

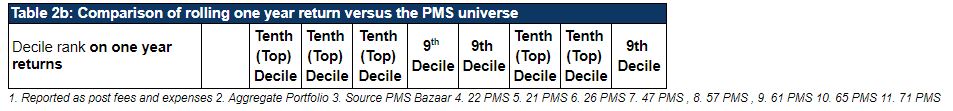

On a one year basis, we have been consistently ranked among top two deciles. (Table 2b)

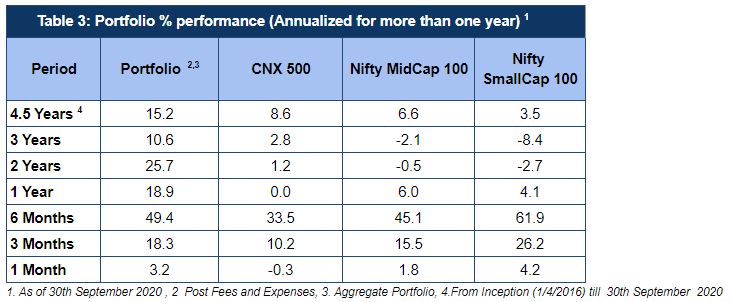

We are a multi cap fund and we have been consistent in outperforming the indices that we are most comparable with. We have consistently performed better than all three benchmark indices over a period of one year and above (Table 3).

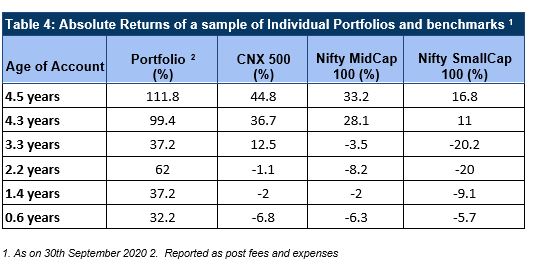

For a PMS it is important to deliver performance for clients who invest at different points in time. We have done quite well in this regard and delivered strong alpha irrespective of when an investor opened an account with us. (Table 4). We have been able to achieve this due to our strategy of treating each account as a separate account rather than following a model portfolio approach.

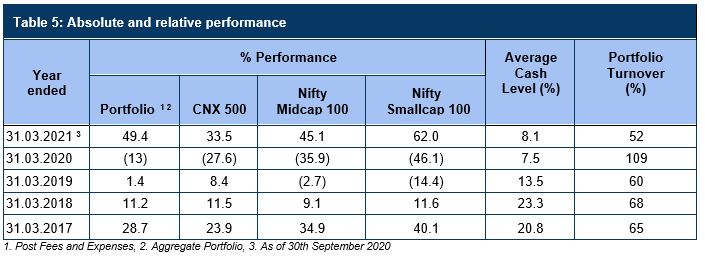

We capture our performance versus benchmarks on a financial year basis in Table 5. We have outperformed the key benchmark CNX500 materially for FY21 year to date, in FY20 and in FY17. We underperformed CNX500 in FY19 due to massive correction in small and midcap stocks.

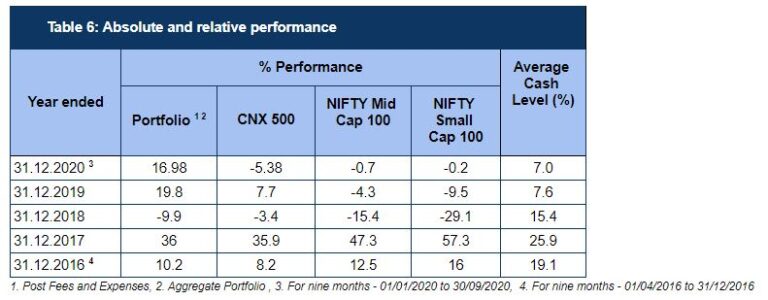

We capture our performance on a calendar year basis in Table 6.

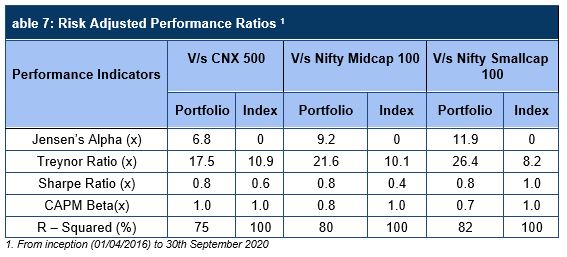

As stated in prior communication, we urge investors to not only evaluate us on our absolute performance but also look at the Risk Adjusted Ratios which we believe should be a criteria when evaluating any Fund Manager. We have delivered good Risk Adjusted returns compared to Indices that we are comparable with since our inception of the fund (Table 7)

DIsclaimer : The information contained in this newsletter has not been verified by SEBI.