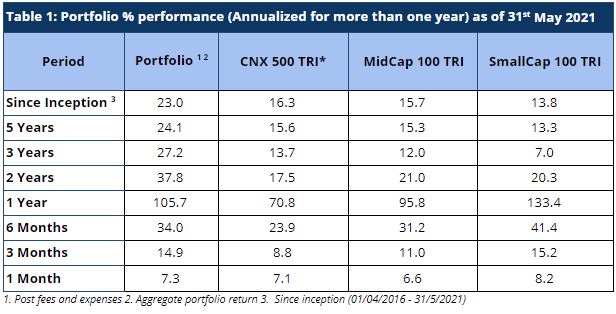

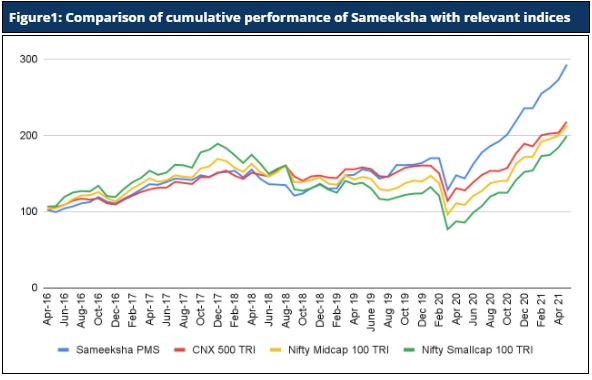

Sameeksha PMS continues to generate superior returns for its investors with a CAGR returns of 23% since inception on an aggregate basis versus the benchmark index CNX500 TRI returns of 16.3% during the same period. This outperformance has been achieved in spite of maintaining average cash levels above 10% over the entire period. Indeed, this combination of sub 90% average exposure and strong alpha has translated into strong risk adjusted return indicators as well.

Portfolio Returns

For the month of May 2021, Sameeksha PMS generated a return of 7.3%, broadly in line with our main benchmark CNX 500 TRI (Table 1). For all the trailing periods beyond one month (three months, six months, one year, two years, three years and five years) Sameeksha PMS delivered very strong alpha versus the benchmark.

Performance Within The PMS Universe

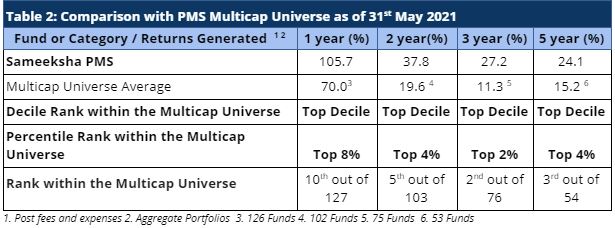

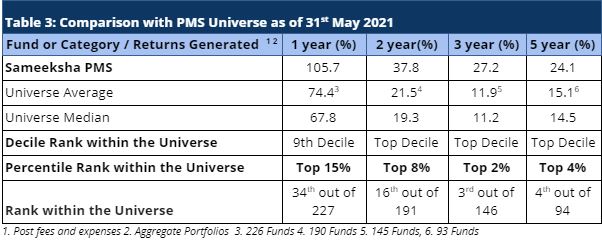

Sameeksha PMS continues to rank in the top deciles – both within the multicap PMS universe as well as the entire PMS universe. We follow multicap strategy and hence our rank among multicap universe is of more relevance.

We retained our top decile and even more so top two to five ranking for periods of two to five years and remained among top ten PMSes for the one year period (Table 2).

Strong performance in mid and small cap stocks have enabled PMSes focussed on those categories to deliver strong one year performance. However, over longer periods, we have retained our top decile position when compared with the entire PMS universe (Table 3).

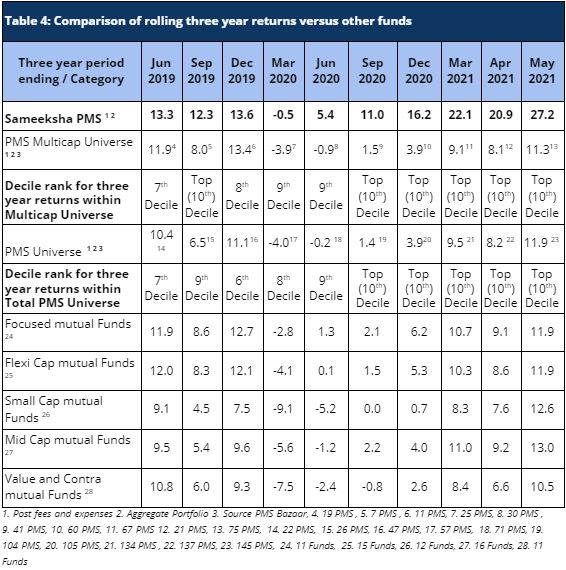

Comparison Of Rolling Returns With Other Funds

Rolling returns provide a much better comparison than a snapshot of one period. We continue to come out extremely well on this measure on a three year basis when compared to the PMS universe as well as relevant categories of mutual funds – focused, flexicap, small cap, midcap, value and contra funds (Table 4). In fact, we have done far better than the category averages. In addition, for two years running, we have consistently maintained top two decile rank within multicap as well as the entire PMS universe.

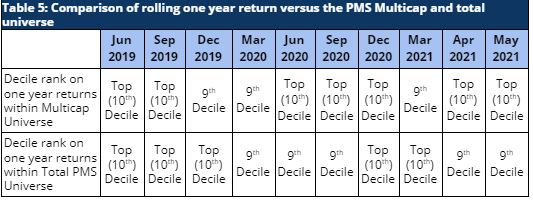

For two years running, we have consistently maintained top two decile rank for one year returns within multicap as well as the entire PMS universe.

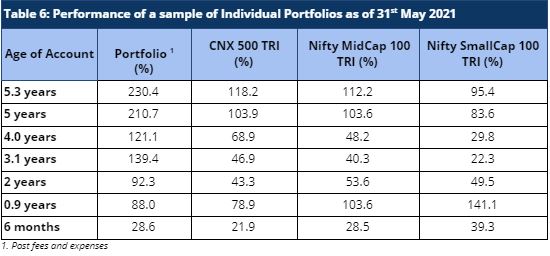

Performance Of Individual Portfolios

As can be observed from Table 6, the individual portfolios in our PMS – irrespective of their investment timing – have beat the market benchmarks by a significant margin. For a long term investor, Sameeksha PMS proves to be a valuable partner for their investments.

Fund Performance And Risk Adjusted Ratios

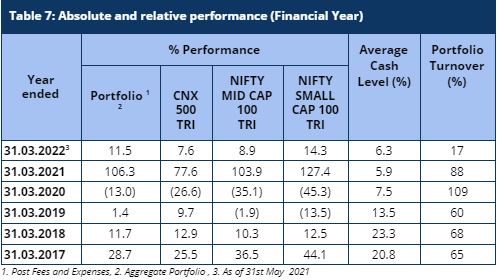

For the financial year 2022, Sameeksha PMS generated a return of 11.5% in two months (April – May 2021), outperforming it’s broad market index CNX 500 TRI – which returned 7.6% over the same period (Table 7).

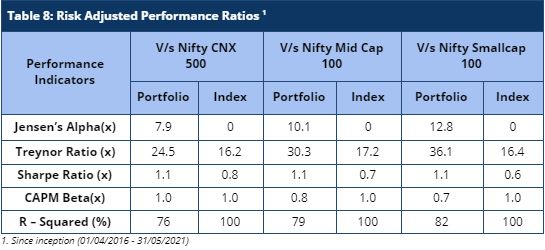

When compared on a risk adjusted basis (Table 8), our PMS shows even stronger performance with a risk adjusted alpha generation of 7.9% over the broad market benchmark since its inception.

Furthermore, other risk adjusted returns – Sharpe ratio and Treynor ratio, are also significantly higher than that for the benchmark indices (Table 8). Clearly, we have been able to generate strong risk adjusted returns.

Please let us know if you have any questions.

Disclaimer : The information contained in this update is based on data provided by our fund accounting platform and is not fully audited.