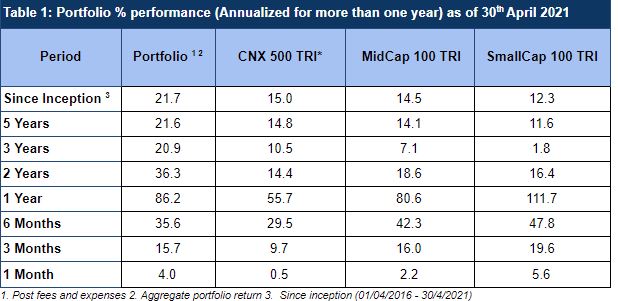

Broader markets for the month of April remained flat amidst rising second wave of Covid 19. Sameeksha PMS, however delivered a significant alpha of over 3.5 percentage points over its benchmark CNX 500 TRI (Table 1).

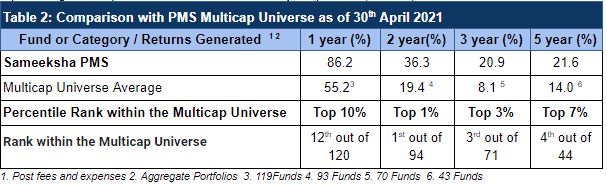

We maintained our top ranking within our PMS universe across all time periods with right at or near top ranking for the periods of two, three and five year periods (Table 2).

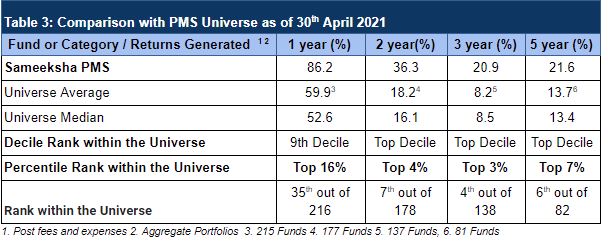

For the entire PMS universe, we sustained our top ranking for longer durations of two, three and four years. Sharp rally in small cap and mid cap stocks has enabled PMSes focussed on those categories to deliver strong performance and yet, we have come through within top two deciles across all PMSes (Table 3). What is also important to note is that not a single PMS has outperformed us for all the four periods (one,two, three, four and five years).

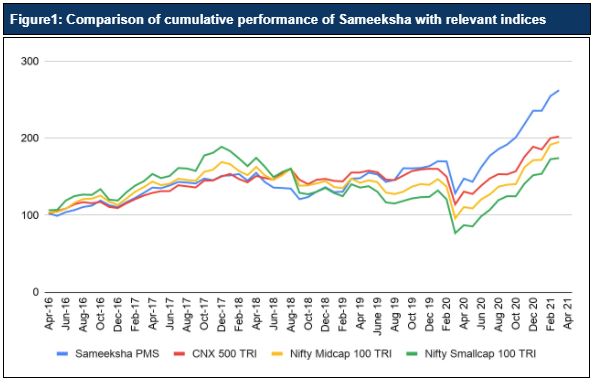

An investment of Rs. 100 with us since inception would have grown to Rs. 273, hugely outpacing the relevant indices with the gap continuing to widen over recent months (Figure 1).

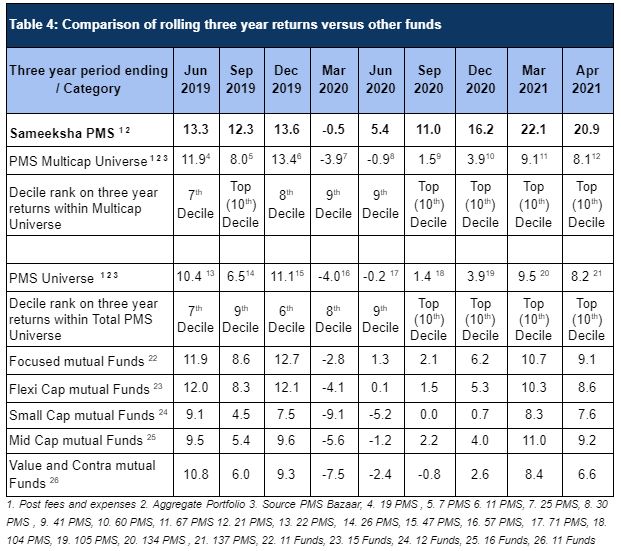

For a three year period ending April 2021, we have meaningfully outperformed all the major relevant mutual fund categories that we are comparable with and maintained our top decile ranking across both our comparable universe of Multicap PMSes as well as across the entire PMS universe (Table 4). Also included in Table 4 is a similar comparison on a rolling three year basis over the last eight quarters.

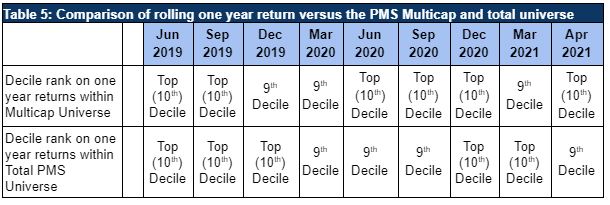

On a rolling one year basis, we have been consistently ranked in the top two deciles among the PMS universe (Table 5).

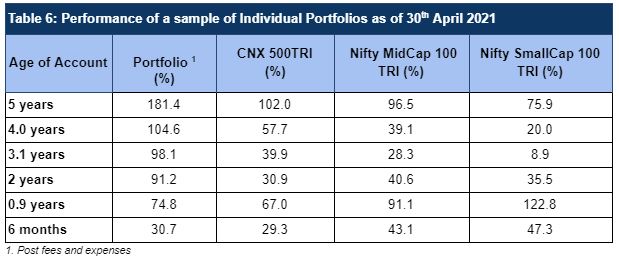

Portfolio returns of our clients irrespective of their date of investing with us, continue to far outpace the benchmarks (Table 6).

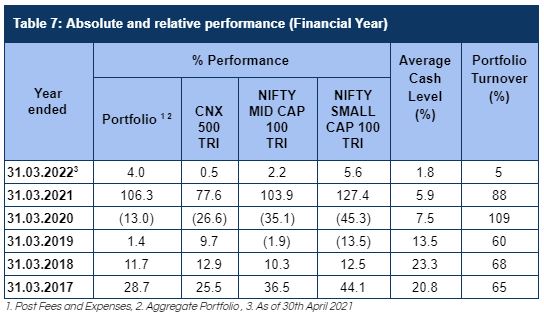

We capture our performance versus benchmarks on a financial year basis in Table 7. We have kick started FY22 on a strong note delivering significant outperformance over our benchmark CNX 500 TRI(Table 7).

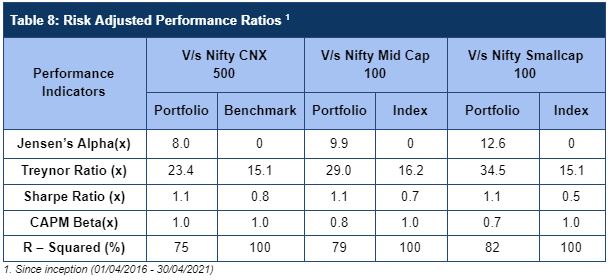

We have delivered good Risk Adjusted returns compared to Indices that we are comparable with since our inception of the fund (Table 8).

We welcome any follow up questions.

DIsclaimer : The information contained in this newsletter has not been verified by SEBI.