Some wealth advisors, institutional investors and family offices prefer to see at least five years of track

record before they consider a short listing a fund for recommendation or investment. We have reached

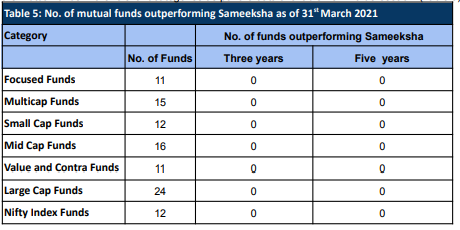

that milestone of five years. As per the data compiled by PMS Bazaar and Valueresearch, not a single

PMS has outperformed us for all four key periods (one ,two, three and five years). Also, not a single

multi-cap PMS has outperformed us for any three out of four such periods. Furthermore, for the periods of

three and five years, we have done better than every single mutual fund in all the relevant categories i.e.

multi-cap, flexi-cap, focussed, Mid cap, Small cap, large cap and index (Table 5).

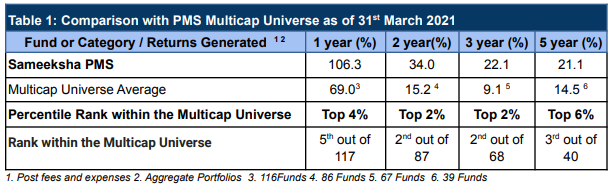

Among all the Multi-cap PMSes (that report to PMS Bazaar) We have achieved top three performance for

five years, top two for two and three years and top five for one year only adding to our long running streak

of top notch performance for the periods of one two and three years. Our performance is also materially

above the Multicap universe average (Table 1). What is also important to note is that not a single PMS

has outperformed us for all the four periods (one,two, three, four and five years

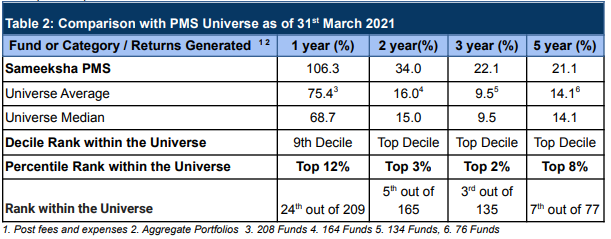

For the entire PMS universe (as per PMS Bazaar), we continue to sustain our top five to top ten percentile rank. (Table 2).

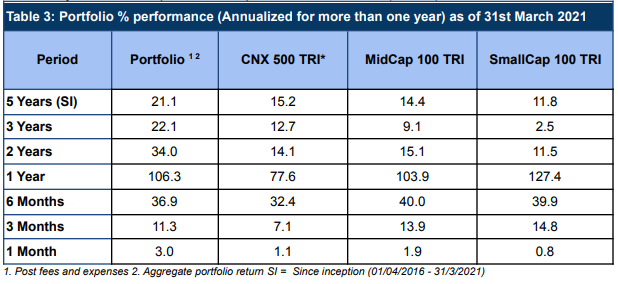

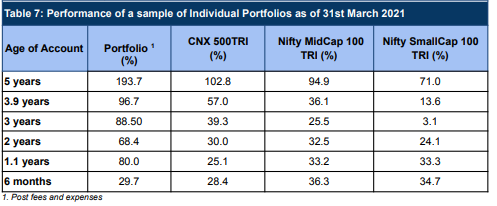

Across all the time periods, we have materially beaten our benchmark of CNX 500 TRI and have also

consistently beaten Mid cap and small cap indices in most cases (Table 3).

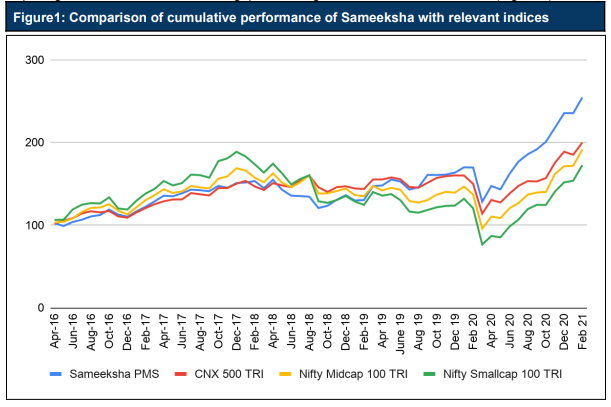

An investment of Rs. 100 with us since inception would have grown to Rs. 262 over 5 years, hugely

outpacing the relevant indices with the gap continuing to widen over recent months (Figure 1).

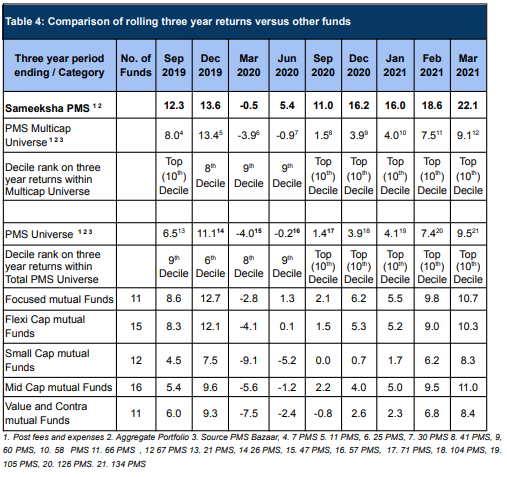

Delivering good performance on a consistent basis is more important than being a “flash in the pan”. We include here (Table 4) comparison of our three year performance with the rest of the category universe of PMSes as well as all the PMSes. For the month ended March 2021, we have meaningfully outperformed all the major relevant mutual fund categories that we are comparable with and maintained our top decile ranking.

We have not only beaten the mutual fund averages by a big margin, we have been able to outperform all the mutual funds in the relevant categories as per the data available from Valuereseach. (Table 5).

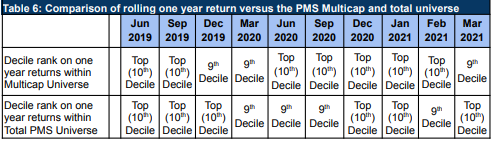

On a rolling one year basis, we have been consistently ranked in the top two deciles among the PMS

universe (Table 6).

Portfolio returns of our clients irrespective of their date of investing with us, continue to far outpace the benchmarks (Table 7)

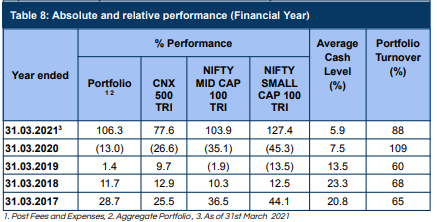

We capture our performance versus benchmarks on a financial year basis in Table 8. We have

outperformed the key benchmark CNX500 TRI materially for FY21.

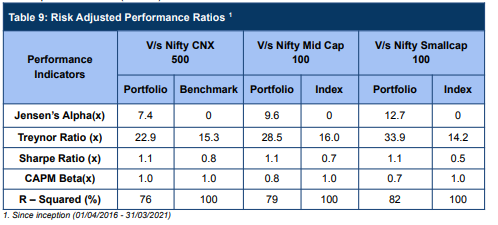

We have delivered good Risk Adjusted returns compared to Indices that we are comparable with since

our inception of the fund (Table 9).

We welcome any follow up questions.

DIsclaimer : The information contained in this newsletter has not been verified by SEBI.