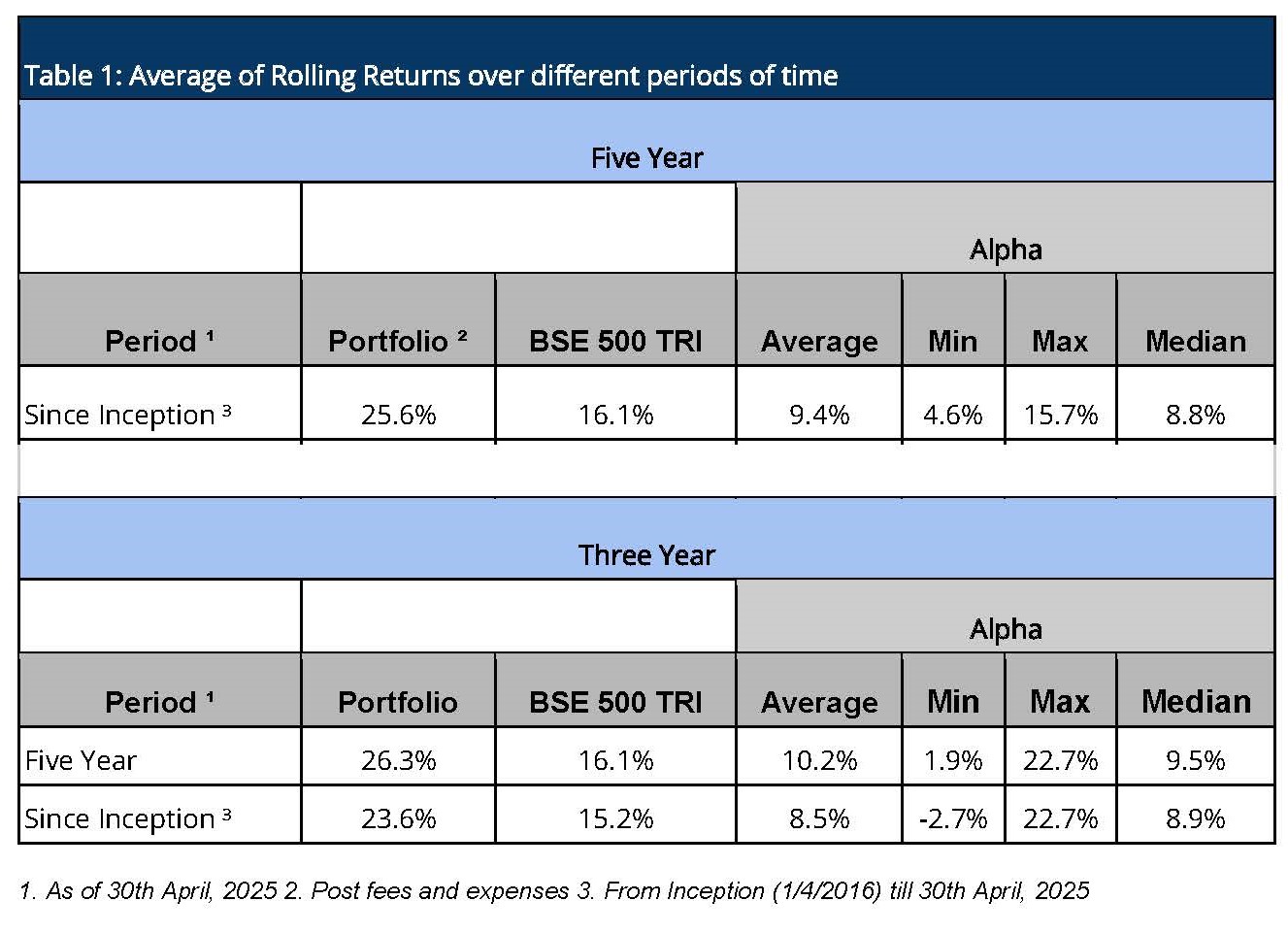

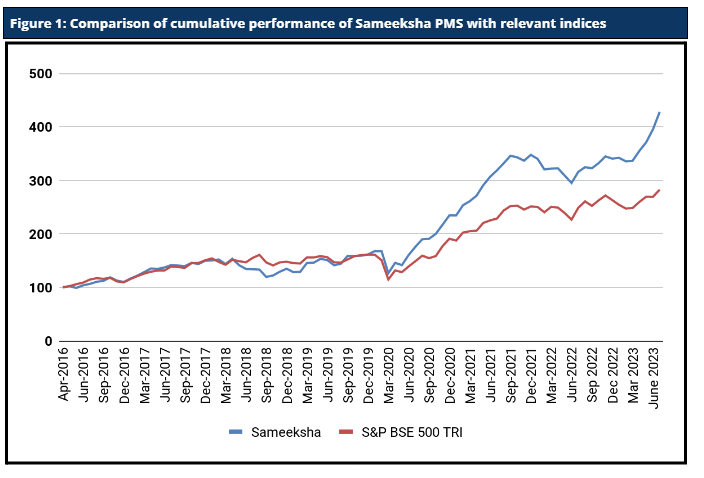

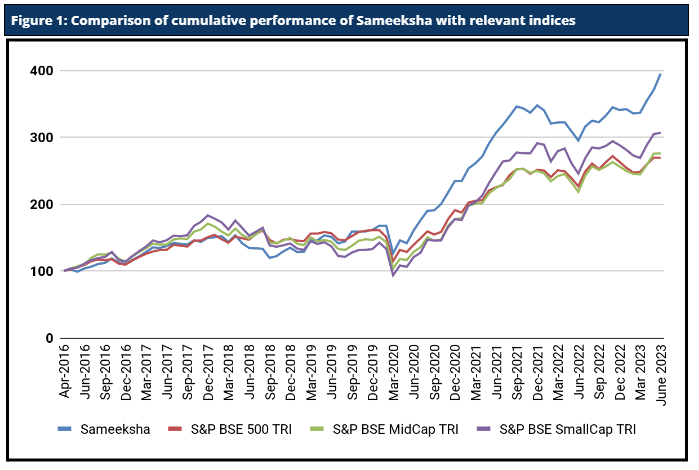

For evaluating performance, returns calculated on a rolling basis are often considered to look across time. We carried out the same analysis for Sameeksha’s PMS which is currently in its tenth year of operation. We carried out this analysis for rolling five and three year returns respectively (Table 1). By averaging these rolling returns over …

Category: PMS

March 2024* : Number One Again** And Thirty Seventh Consecutive Month Of Top Decile Performance***, Upside Capture**** 111%, Downside Capture**** 54%

* Period Ending 31st March, 2024, **; For Five Year Period Among Multicap PMSes With >Rs. 100 Crore AUM, *** Among Multicap PMSes For Five Year Period, **** Five Year Period In the month of March, the benchmark S&P BSE 500 TRI rose by 0.9%, whereas the S&P BSE Smallcap Index experienced a decline of …

February 2024* : Number one again** and thirty sixth consecutive month of top decile performance***, upside capture**** 115%, downside capture**** 60%

* Period ending 29th February, 2024 , ** For five year period among multicap PMSes with >Rs. 100 crore AUM , *** Among multicap PMSes for five year period, **** Five year Period In the month of February, the benchmark S&P BSE 500 TRI has grown by 1.7%. Against that, Sameeksha PMS (Portfolio Management Service = Separately …

January 2024* : Thirty Fifth Consecutive Month Of Top Decile Performance**, Upside Capture*** 115%, Downside Capture*** 58%

* Period ending 31st January, 2024 ** Among multicap PMSes for five year period *** Five year Period In the month of January, the benchmark S&P BSE 500 TRI has grown by 1.9%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 3.4% (net of all fees and expenses) while having cash …

Number One For The Fifth Consecutive Month* , Top Decile Ranking For The 32nd Consecutive Month*

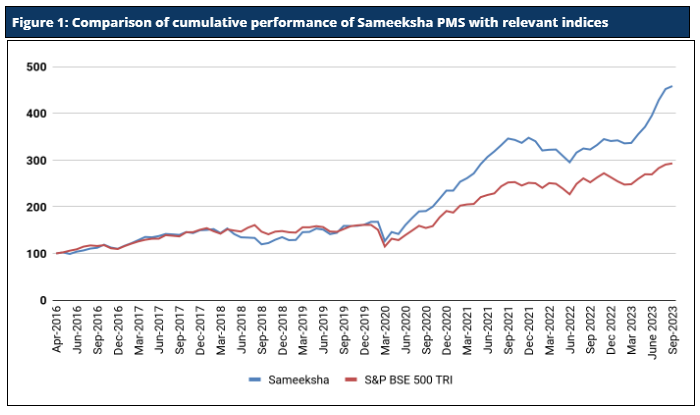

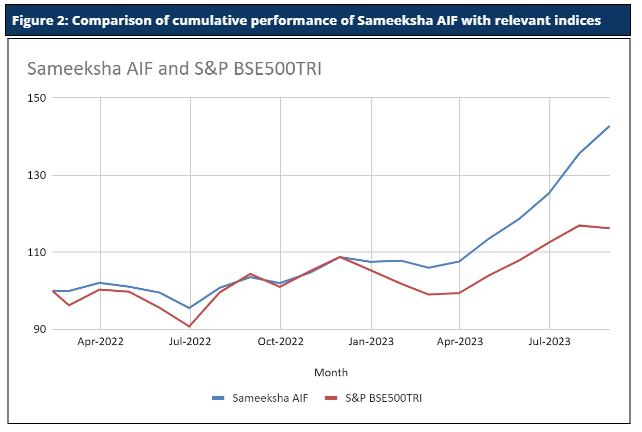

* For Five Year period In the month of October, the benchmark S&P BSE 500 TRI fell 2.9%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 1.2% (net of all fees and expenses), resulting in a meaningful outperformance. Sameeksha AIF (Alternative Investment Fund = “Hedge Fund”) also gained 1.7% (post expenses pre tax), …

On Five Year Basis, Number One For The Fourth Consecutive Month, Top Decile Ranking For The 31st Consecutive Month

In September 2023, Indian markets decoupled with key global markets; as against 4.5% drop for S&P 500, BSE500 TRI went up 2%. Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 1.4% (net of all fees and expenses), resulting in a small underperformance. Sameeksha AIF (Alternative Investment Fund = “Hedge Fund”) also gained 1.4% (post …

Five Year Data – Ranked Number One For Three Consecutive Months, Top Decile For 30th Consecutive Month

After a relentless streak of advancement spanning 5 consecutive months from March 2023 to July 2023, the benchmark BSE500 index cooled off in August 2023. In contrast, both the Midcap and Small cap indices stayed buoyant. In August 2023, the benchmark BSE500TRI was down 0.61% while the BSE Midcap and BSE Smallcap were up by …

Big Outperformance For PMS And AIF In A Strong Month, Number One Rank Again For PMS Based On Five Year Performance

After a strong rally in June, the market showed further positive performance for the month of July that led broad market indices to all time high. Lower energy prices over the month were helpful, as was the government’s reversal of a windfall tax on local crude oil sales and fuel exports. The S&P Global India …

Outperformance In Strong Month, At The Top Again For The Five Year Period

The month of June presented a blockbuster rally in the Indian stock market, both the market Indices NIFTY 50 and BSE Sensex to climb to their all-time highs. The month ended on the back of strong inflows from foreign institutional investors (FIIs), robust corporate balance sheets, moderating inflation and growth picking up coupled with expectations …

Another Month Of Outperformance, Top Rankings For Three And Five Years Retained

Buoyed by strong news from the Indian Economy (accelerating growth momentum and falling inflation) , the markets posted a strong month. Key market indices including the NIFTY 50 and the BSE Sensex clocked 2.2% and 2.1% respectively for the month of May. Sameeksha PMS gained 4.5% (net of all fees and expenses), and managed to …