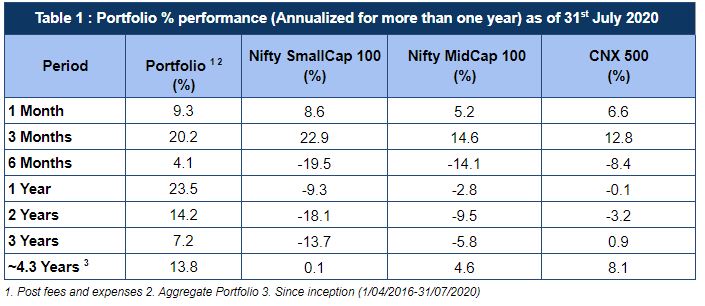

July 2020 was a strong month for global equities as well as India. The beaten down small cap stocks also participated in the rally this month. Sameeksha had another very strong month and noteworthy was our outperformance against all relevant benchmarks over almost every relevant time period. . (Table 1). The alpha generated versus all the benchmarks for longer time periods – one year, two years, three years and since inception is particularly noteworthy.

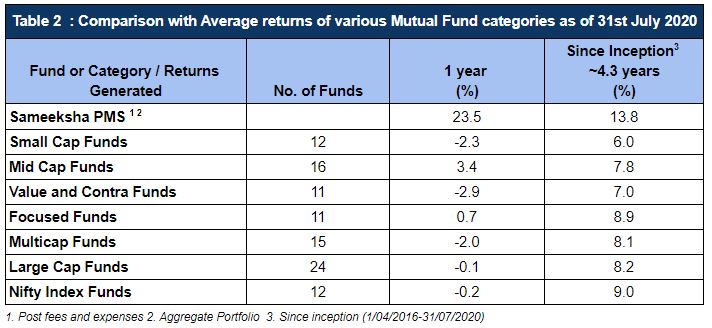

Our fund has delivered very material outperformance versus average returns of various Mutual fund categories over the last one year as well as since inception of our fund. (Table 2)

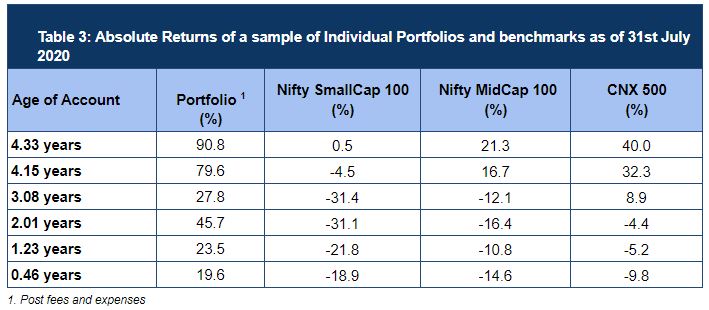

While it is important to stress that investors should look at our aggregate performance data as required by SEBI (Table 1). we would also like to provide an update on how portfolios of clients who have been with us for different lengths of time have done (Table 3). Both absolute and relative Performance of client portfolios have been quite strong for clients whether they have been with us for around six months or thirty six months or more than fifty months.

Disclaimer : The information contained in this newsletter has not been verified by SEBI.