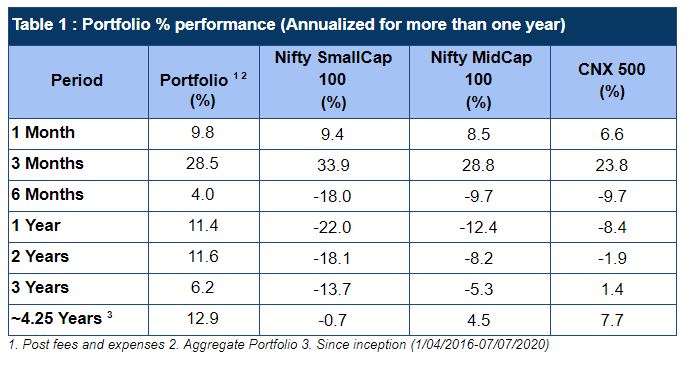

Sameeksha PMS has benefited from the recovery in the markets. What is important to notice is that we have been able to deliver clear alpha across all relevant time periods – one month, three months, six months, one year, two year, three years and since inception with Alpha over a broad market index ranging from ~3% to ~20%. Alpha has been even greater over small and mid cap indices notwithstanding meaningful presence of stocks in these segments in our portfolio (Table 1). Our investment approach requires investors to have patience with us and those who have stayed with us for a longer period have found that experience rewarding.

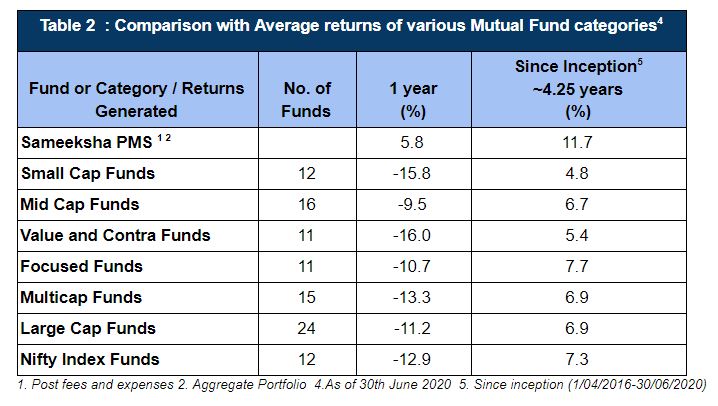

We have delivered strong performance relative to all the categories of mutual funds (Table 2). Particularly noteworthy is our performance relative to multicap and focused funds. While our strategy is multicap, we run a more concentrated portfolio than a typical multicap mutual fund and hence our performance relative to multicap and focused funds is of relevance. It is important to point out that while the vast majority of mutual funds have underperformed indices we have outperformed.

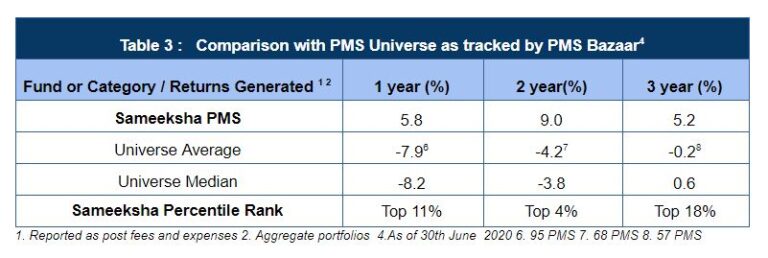

Among the funds that report data to PMS Bazaar, we have been faring quite well. Across time periods, we have come ahead and among the top performing PMSes (Table 3).

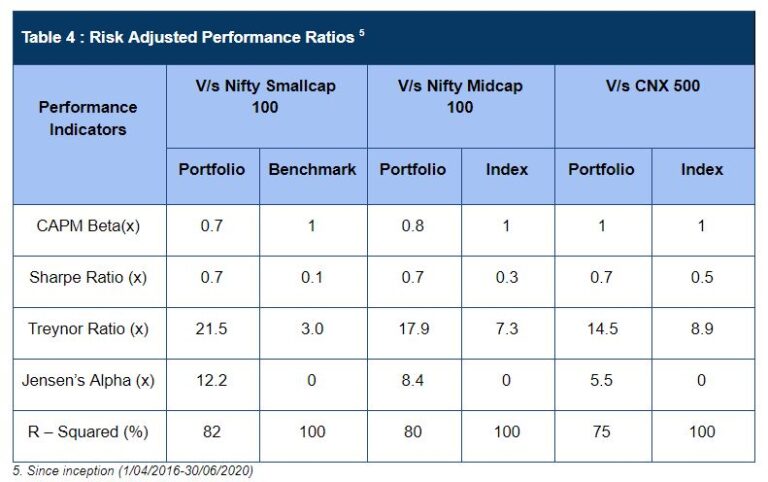

We would like to stress that investors look at risk adjusted ratios, not just absolute returns when evaluating performance of various funds. Because we don’t believe in buying or staying invested in a stock that is grossly overvalued, we may have relatively higher turnover versus some buy and hold strategy funds. However what is important is to deliver superior risk adjusted performance. We share that data in Table 4.

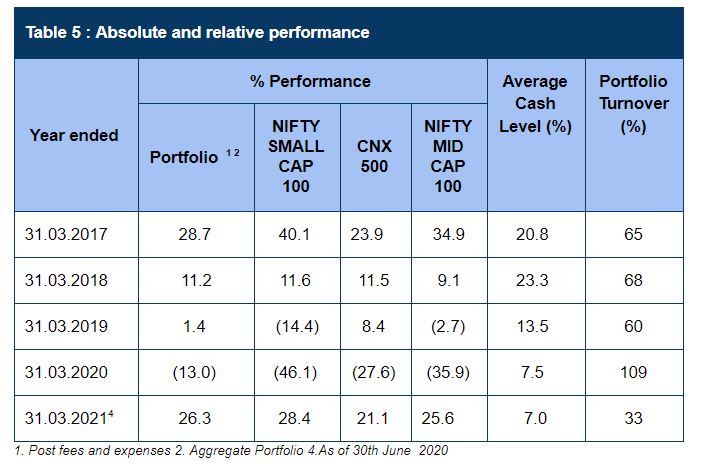

After a sharp fall at the end of the last financial year, the Financial year ending march 2021 has started off well. We share details of our performance delivered over each of the years that we have been operational (Table 5). Please note that the performance recorded in this table has been delivered despite holding relatively high levels of cash.

Disclaimer : The information contained in this newsletter has not been verified by SEBI.