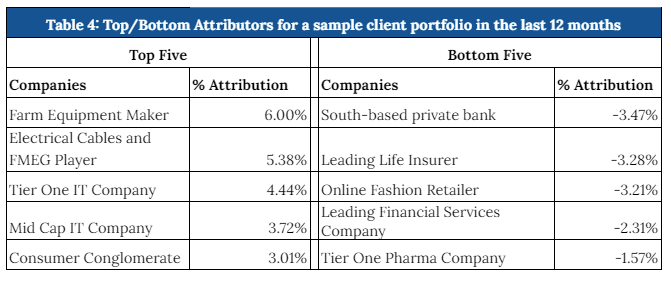

Top and Bottom performers of FY 2022

Based on our detailed contribution analysis, we have identified underperforming stocks accounting for both – the returns as well as their position sizing in the portfolio. As such, Table 4 provides us the top and bottom contributors in our portfolio for the last 12 months.

A. Below is our analysis on the Top 5 contributors for FY 2022 –

a) Farm Equipment Maker (Exited the position)

We were investors in the company till early parts of FY21 when we exited on account of overvaluation. Since then, the company delivered better numbers versus our expectation while the stock price moved down marginally, resulting in a meaningful decrease in valuation multiples. In the near term, the monsoon season was expected to be good for FY22 as per IMD forecast and the management was also expecting mid single digit growth in volumes in the agri-segment driven by better farm income. We did anticipate FY23 to be slow for the company due to the cyclical nature but despite considering a degrowth in our model for FY23, the stock was attractively valued and so we entered the stock. Later in September 2021, Kubota announced in its global call that it may increase stake in the Farm Equipment Maker and then the transaction was announced in November 2022 along with an open offer by Kubota at Rs. 2000 per share. This special situation increased our returns from the stock meaningfully. Around that point, considering the Diwali volumes being below our expectation and the impending slowdown in FY23 as well as potential stock price correction post open offer, we exited our holdings at an average. Our average selling price was INR 1,833.62 while post that the stock has corrected meaningfully and traded at INR 1,556.80 as of 17-Jun-2022.

b) Electrical Cables and FMEG Player (Exited the position)

The company is one of the largest Cables and Wires (C&W) manufacturers and is one of the fastest growing fast moving electrical goods (FMEG) players in India. What attracted us towards the company is their deep rooted distributor loyalty which they have built over multiple decades, a strong manufacturing footprint and in-house capability to introduce newer and innovative products supported by a well structured and professionalized management team. Through our channel checks with dealers and our visit to the company’s plants, we got the first hand impression on the strength of the business. With the foundation work in place, we concluded that business has the potential to generate higher return on capital than what it has delivered in the past. True to our expectation, the Company delivered ~19% earnings CAGR (over FY19-22) and averaged ~22% core ROIC (over FY19-FY22 period), despite facing Covid induced challenges over the past two years. We made investment when business was available at sub-18x trailing earnings, added again around 25-26x trailing earnings and exited at >40x trailing earnings while earnings grew at 19% CAGR as mentioned earlier. We continue to believe in the long term potential of this business but the current valuation is outside our comfort level and thus we booked out from our investment in the company. Our average exit price was about INR 2,283.56 while the stock corrected post that and was trading at INR 2,185 as of 17-Jun-2022

c) Tier One IT Company (Exited the position)

The company is India’s fourth largest IT services company. Its growth had lagged peers in the past few years and that had led to significant derating in the stock. Even in the upswing in the IT Stocks post the lockdown, the company had been a relative underperformer. We were positive on the IT Sector on account of the pandemic driving cloud adoption which should benefit Indian IT Services players. Our thesis for investing in the company was – (1) The company had appointed Mr. Thierry Delaporte as the new MD and CEO, who came with a proven track record of delivering superior growth in another global IT company; and (2) Extremely lucrative risk-reward ratio in terms of absolute valuations as well as relative to the peers.

The company was factoring in less than one year of high growth. Based on our long term DCF model, we expected the company to deliver a 37% CAGR over the next 2 years from our initial buying price of Rs. 218. Since there were sectoral tailwinds for the next few years, we had upgraded our estimates and were considering very optimistic growth and margin assumptions for the company and on the basis of that, we arrived at a target price of INR 690 for March 2024. The stock crossed that price in December 2021, which meant that our expected returns over the next 3 years from holding this stock would have been negligible. Also on multiples, the stock was trading at a TTM PE of 33X and NTM PE of 30.59X and the occurrence above these levels in the last 22 years have been just 8% and 6% respectively, all of which indicated a very unfavorable risk reward with a decent chance of correction. So we decided to exit our position. Our average selling price was INR 628.89 while post that the stock has corrected meaningfully and traded at INR 405.2 as of 17-Jun-2022.

d) Midcap IT Company (Exited the position)

We were positive on the IT Sector on account of the pandemic driving cloud adoption which should benefit Indian IT Services players. This particular company stood out in the pack of midcap IT companies on account of two factors – (1) The promoter, which is a very large PE fund, bought a substantial stake in the company post the pandemic, despite its exit time horizon of less than 2 years; and (2) Though the headline numbers weren’t showing growth, that was due to decline in a defined legacy business, while the new direct business was growing at a very rapid pace. There was also an improvement in margin profile driven by this change in business mix.

The market was also undervaluing the business because it had doubts on whether the direct business would be able to cover for the legacy business which was scheduled to go down to 0 in 6 quarters. We felt that the stock was reasonably valued even if there was a small dip in revenue after 6 quarters. We had bought the stock when it was trading at a PE of less than 12X. Over the period, the new business did better than expected and was more than able to cover up for the legacy business. The average large deal size started moving favorably for the company due to its skills and it also won a $250 million deal which is rare for the company of its size. Market recognised this and the stock saw massive rerating. At some point around September, the company acquired another company which, according to us,was at an expensive valuation. The stock was also trading at a PE of upwards of 45X with our model indicating no further upside 2 years out. So we decided to exit. Our average exit price was about INR 2,663 while the stock corrected post that and was trading at INR 2,195 as of 17-Jun-2022.

e) Consumer Conglomerate (Exited the position)

We invested in the Conglomerate when the stock was underperforming due to the ESG concerns and decline in the cigarette segment (which contributed 85% to the overall profits). We invested with a thesis that the cigarette sales will be back to the pre-Covid levels once the Covid-induced lockdowns ease and the investments in the FMCG segment will start yielding good returns since some of its in-house brands had reached a mature stage. The company did perform as per our expectations delivering ~17% profit growth in FY22. The cigarette and FMCG segment both performed well with the brand gaining market share in their respective segments. Also the Paper, IT and Agricultural segment performed better than our expectations, majorly led by the industry tailwinds. The stock price also reacted positively to the improved performance and we decided to exit our position as we felt that most of the positive expectations were already priced in. Our average exit price was slightly lower at ~ INR 259.79 while the stock was trading at ~ INR 264.20 as of 17-Jun-2022

B. Below is our analysis of Bottom 5 contributors for FY 2022

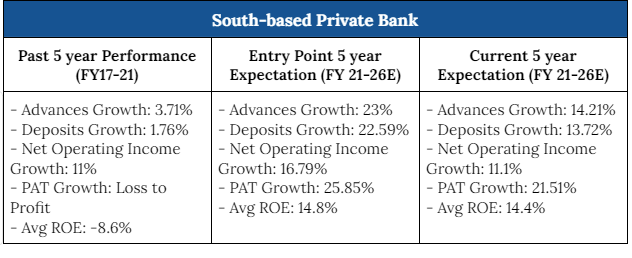

a) South-based Private Bank (Currently Invested)

Our Investment thesis in this Bank was on the basis of 3 points: (a) Improving asset quality and conservative provisioning (b) decreasing IBA headcount leading to cost efficiencies and (c) Faster growth in advances driven by gold loans and SME/MSME. In the last one year, the first two parts have played out well. The Bank has seen a significant reduction in their GNPA, increased provision coverage as well as adoption of a very conservative provisioning policy leading to a higher profitability for the bank.

The Bank also saw a reduction in IBA Headcount and increase in employee productivity which has driven cost efficiencies. They have also expanded their branches to increase geographical footprint and bring in diversification. They have a strong team at the top to drive the Bank on its growth path. All these factors should cumulatively impact the Bank’s ROE – expanding meaningfully over the next 5 years.

Advanced growth has been a sore point in our thesis. Gold loans grew at a very rapid pace in Fy21 and reversal of that loan book led to the volatility in growth seen in the current year. However being an extremely secure product, the losses were very low and the Bank saw provisions writeback in the last two quarters. Gold loans at present contribute 40% of the total loan book and going forward we expect it to remain a dominant part, despite other segments growing faster. Also with the increasing interest rates, their competitive positioning in SME & MSME improves, enabling faster growth.

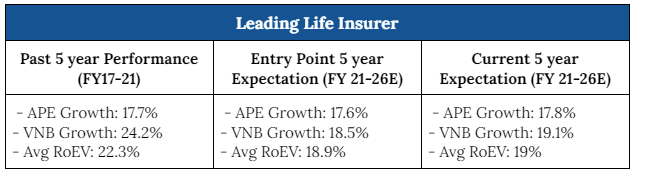

b) Leading Life Insurer (Currently Invested)

Life insurance, we believe, is a large underpenetrated protection market with the protection gap in India is amongst the highest in large economies. The awareness about the need for insurance cover has if anything, increased significantly after covid.

The company is an innovator in designing insurance products. They were the first to launch online policies at lower rates and the first to market non-par savings products. They have been gaining market share from LIC and other private players in the life insurance space. Their consistent product mix with no dependence on any single product to drive growth as well as having amongst the highest VNB margins in the industry made for a compelling case for us to invest in the company.

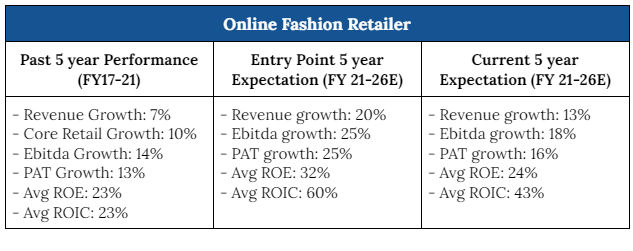

c) Online Fashion Retailer (Currently Invested, reduced position)

The company is a fashion jewelry and lifestyle products retailer. They mainly market the products through their proprietary TV and web platforms targeted towards mid-age women in the US and UK region.

The company is expanding both their market reach (expansion in Germany) as well as product extension (fashion apparel, beauty etc) to drive higher growth. They have a wide sourcing network from low cost markets like India, China, and South-East Asian countries – which gives them a significant cost advantage. Adopting new age tools like social media, influencer marketing, marketplace listing have helped in deepening their customer management. And most of all, they have an asset light high ROI model with prudent dividend policy in place.

After having very strong traction between 4Q20 to 1Q22 led by Covid-induced shift to online shopping, demand has started to normalize and has impacted growth in the recent quarters from the high base of last year. We were of view that the normalization of growth will be transient as base turns favorable from 2Q22 onwards but as the growth outlook in the US market is slowing, we now believe demand to remain challenging over the medium term. Consequently, we reduced our position in the company but may relook at it again as the growth outlook improves.

d) Leading Financial Services Company (Currently Invested):

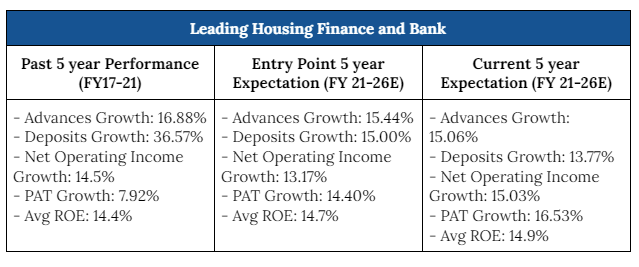

The company’s performance on all business parameters has been better than our initial expectations and that is visible in the improvement in our current expectation for most parameters versus entry point expectation. PAT growth is expected to be faster than advances growth now since the provisioning requirement had been far lower than expectation driven by lower stage 3 assets vs expectations. With the expected increase in interest rates going forward, it would be beneficial to the company as almost all loans get repriced higher when benchmark repo rate increases but not the liabilities.

The market was taking cognizance of the improving fundamentals and the stock price performance in the first half of the fiscal year was pretty strong. However in the second half, the stock performance reversed on the back of negative market sentiments and FII selling.

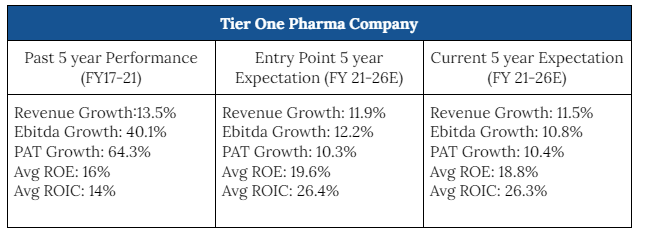

e) Tier One Pharma Company (Currently Invested, Reduced position)

The company has a strong domestic franchise growing at 13-15%. They have a good API business with clear leadership in several molecules like Atenolol, Chloroquine, Chlorthalidone, Furosemide, Losartan, Metoprolol. We also expect their vertical integration strategy to start paying dividends in the medium to long term. Their history of focusing on a few things and scaling them up is one more reason why we invested in them. Their pain segment leadership in the domestic market and their leadership in several anti hypertension APIs are few such clear examples.

Despite being conservative in our estimates (our expectations were lower than what management was guiding), the company reported lower than our expectations for 3Q22 and 4Q22 led by decline in API exports (one of their key API losartan faced Azido Impurity issue due to which sales stopped and they had to change the process. While they have addressed the issue, it will take some time to stabilize and they will have to regain the lost market share) and decline in generic exports. The company is changing its business model in the UK business from distributor-led to its own front end. Building the business back will take time as they have to again get all the product approvals; currently in their own label they only have 7 registrations which they have commercialized compared to 43-44 products they were selling with the help of distributors. Both these issues will be a drag in FY23 as well and combined with elevated freight and power costs due to the external environment, we feel it may take some time before growth comes back for the company. Considering the headwinds and disappointment in management’s delivery, we have reduced our position in the stock. We would continue to track the business to see if any opportunity arises in future.

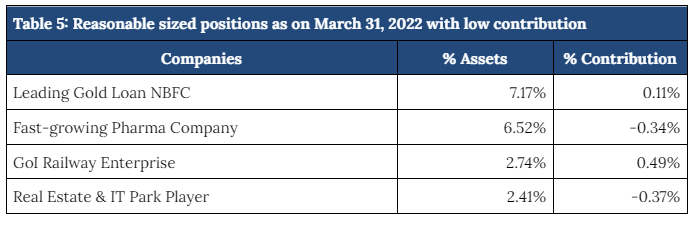

Key positions with insignificant contribution

Furthermore, there were several stocks in which we had reasonable sized positions but they did not contribute much to the performance (Table 5). We discuss below these names, why we invested and the reason for poor performance.

a) Leading Gold Loan NBFC

The company is India’s largest gold finance company with an AUM of INR 64,494 crores. It has been a long term holding for us and has delivered significant returns over the period driven by growth in gold loan book, RoA expansion and rerating. The past year has been hard for them as they faced significant competition from banks driven by high liquidity and reduced alternatives to lend. Also, while gold loans are extremely secure, the lockdown and moratorium resulted in very high delinquent assets which had to be sorted through auctions. This led to lower growth in the previous year, however in the current year we expect Muthoot Finance to return to its 15% growth trajectory and continue to hold.

b) Fast-growing Pharma Company focused on domestic market

The Company is one of India’s leading pharmaceutical companies incorporated in 1976. The company has been supplying products across segments like cardiovascular, gastrointestinal and anti infectives with the company’s top 4 brands featuring in top 200 brands in unit terms and two of them feature in the top 100 brands in value terms. The company was acquired by PE firm KKR in July 2020. Our thesis of private equity coming in and accelerating the growth (as the erstwhile promoters were very conservative) has played well till now resulting in the company achieving 25th rank in the Indian pharma market within 2 years of acquisition from 32nd during the erstwhile promoters, increasing the number of new launches reflecting the increased contribution from new products to 4% in FY22 from 1.4% in FY21, moving into newer therapies like Nephrology, respiratory and Diabetes and expanding the scope of growth. In international markets, the company is well diversified across geographies with Russia and South Africa being key markets. Domestic and export mix stands at 50:50 and the target is to take it to 60:40. The company’s strategy in the international market is to launch new products and penetrate deeper into existing markets. For the export market, contract manufacturing of lozenges is a high gross margin/high ROCE business for the company and it strategy is to scale that business by adding new MNC clients (recently added Reckitt) and also new concepts (from traditional cough & cold to wellness, immunity and sleep disorders). Recently the company made 2 synergetic acquisitions in the domestic market i) Acquired Sanzyme’s portfolio which Offers potential for revenue synergies through geographic and distribution expansion, along with prescriber overlaps ii) Acquired Azmarda brand used in treating heart failure which extends its presence in cardiac from hypertension to heart failure management and also leverages the existing prescriber base. We continue to be positive on the business as we expect the topline to grow faster than industry driven by line extension in existing brands, launching new products and synergetic acquisitions; we expect the bottomline to grow faster than topline over next 3-5 years driven by higher contribution of chronic therapies where margins are higher and operating leverage led by higher MR productivity and existing headroom in manufacturing facilities.

c) GoI Railway Enterprise

The company is a Miniratna (Category-I) Schedule A’ Public Sector Enterprise established under the Ministry of Railways in 1974. Over the past four decades, the company has transformed from a pure railway consultancy arm into a leading transport consultancy and engineering player having diversified services and geographical reach. Since our investment, the company has delivered earnings growth of ~11% CAGR (over FY18-FY22 period) despite recovery from Covid for the company was slower than other industries as the investments in the key segments were progressing at a slower pace. During the Covid period of FY21 and FY22, Company has generated cumulative INR 600 crs. free cash flows and distributed over INR 1000 crs. to shareholders in form of dividends and buyback and continues to hold sizable cash on books. On the business front, order book has slowed down in the absence of xports rolling stock orders as global investments in transportation infrastructure was halted during Covid but now is recovering with enquiry levels improving. Near-term growth looks muted but sectoral tailwinds from the government’s infrastructure push across transport infrastructure segments bodes well for the company over the medium term. Valuation at sub-10x with ~5% dividend yield provides a required margin of safety for us to hold on to the name despite near term weakness in earnings.

d) Real Estate & IT Park Player

The conglomerate runs one of the largest private sector exhibition centers and operates an IT Park along with associated services such as food parks, events etc on a 75-acre estate (usable area 60 acre of which only 30% is developed) located at the heart of Western Express Highway, Goregaon in Mumbai. During Covid period, their exhibition business was severely impacted due to restrictions on public events as well as large part of their exhibition halls were occupied by Municipal Corporation of Greater Mumbai (MCGM) for dispensing Covid care to the general public. Since one of the key business divisions was not contributing to overall earnings, the company’s performance for the past two years has been muted. However, as things are reopening and MCGM is releasing the exhibition halls, one can expect exhibition business to recover fully by FY24. We made our investments around ~20x trailing earnings on depressed profitability and expect that as earnings catch up over the next two years, we will make up more than what we lost in the past one year.

Appendix 1: Performance of the fund for FY2022

Appendix 3: Current view on top seven positions

Appendix 4: Performance Analysis for Longer Periods

Appendix 5: Additional factors affecting Indian Economy / markets