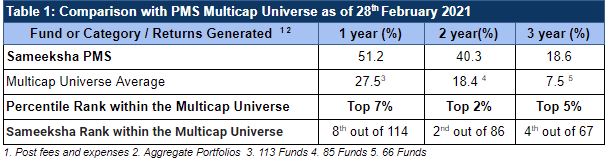

For the month ended February 2021, Sameeksha PMS was 2nd Ranked PMS out of 86 PMSes on a 2 year basis amongst the Multicap category and it was in Top 7% and Top 5% for 1 year and 3 year period respectively as per the data available by PMS Bazaar (Table 1).

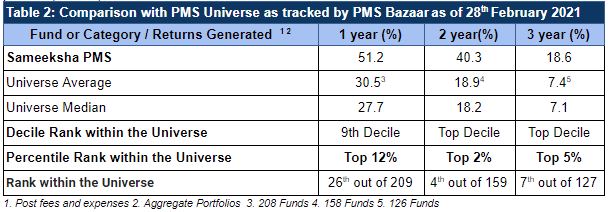

Amongst the PMS universe that represent all the strategies, Sameeksha PMS managed to outperform the universe average and was amongst in Top 2% and Top 5% respectively for 2 year and 3 year periods (Table 2).

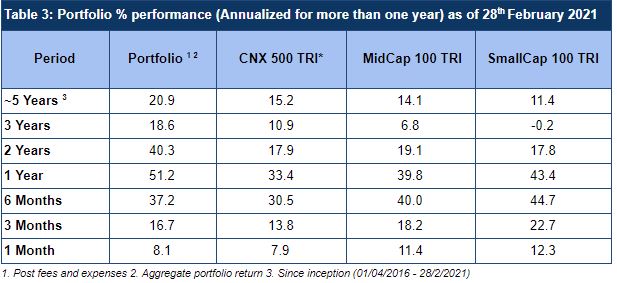

Equity markets welcomed the budget that was presented in February, and markets rallied on the backdrop of turbocharging the economy that was contracted due to Covid 19. Sameeksha managed to outperform its benchmark CNX 500 TRI over all the relevant periods albeit with only a minor outperformance for the month of February (Table 3).

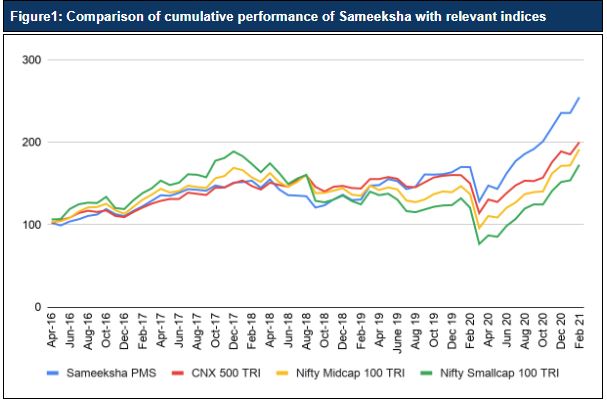

In Figure 1, we show how on a cumulative basis our divergence with the indices have widened since the inception of the fund. An investment of Rs. 100 with us since inception would have grown to Rs. 256 over ~5 years, hugely outpacing the relevant indices with the gap continuing to widen over recent months.

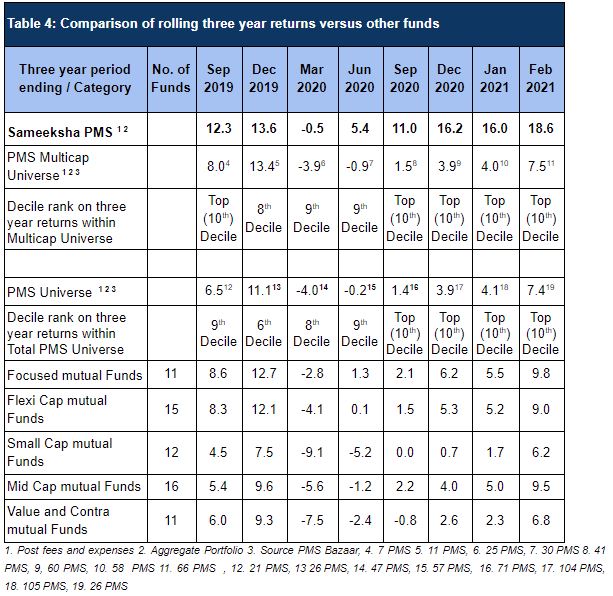

Delivering good performance on a consistent basis is more important than being a “flash in the pan”. We include here (Table 4) comparison of our three year performance with the rest of the category universe of PMSes as well as all the PMSes. For the month ended Feb 2021, we have meaningfully outperformed all the major relevant mutual fund categories that we are comparable with and maintained our top decline ranking.

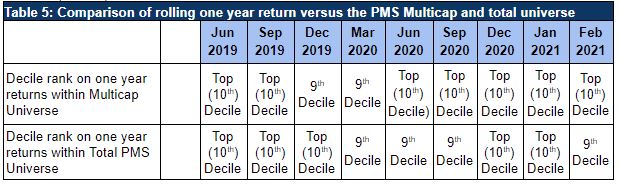

On a rolling one year basis, we have been consistently ranked in the top two deciles among the PMS universe (Table 5).

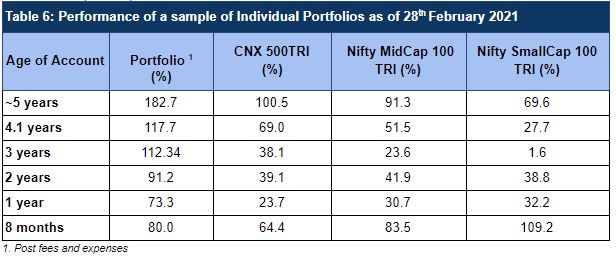

Portfolio returns of our clients irrespective of their date of investing with us, continue to far outpace the benchmarks (Table 6).

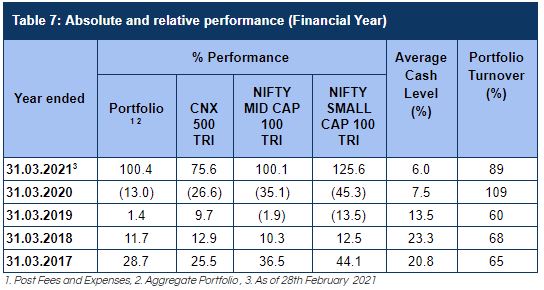

We capture our performance versus benchmarks on a financial year basis in Table 7. We have outperformed the key benchmark CNX500 TRI materially for FY21 till date.

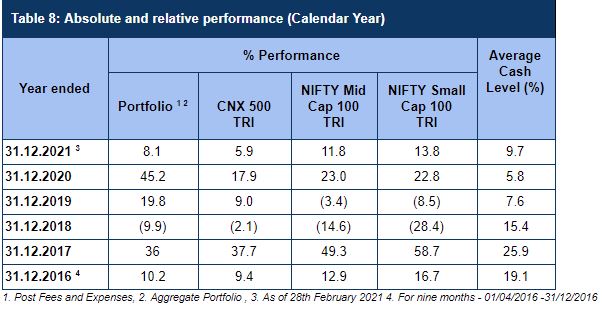

In Table 8, we capture our calendar year performance for all the years since the inception of the fund. For the last two completed calendar years, our outperformance versus the benchmarks has been quite strong.

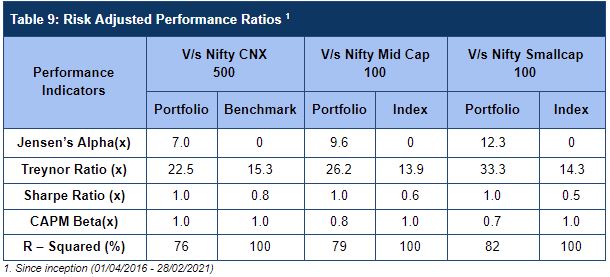

We have delivered good Risk Adjusted returns compared to Indices that we are comparable with since our inception of the fund (Table 9).

We welcome any follow up questions.

DIsclaimer : The information contained in this newsletter has not been verified by SEBI.