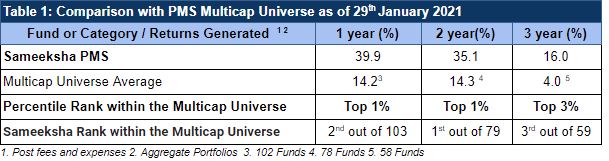

Sameeksha PMS continues to retain its top performer billing. For the period ending 31st January 2021, we have achieved top three rank within the Multicap PMS category for all the periods with comparable data – one year, two years and three years (Table 1) based on data available with PMS Bazaar.

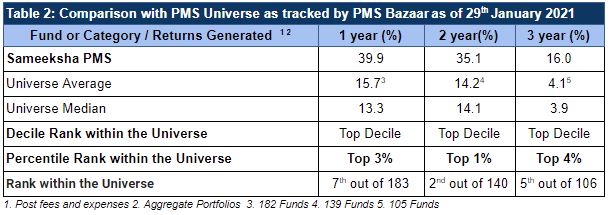

Amongst all the PMSes representing all the strategies, Sameeksha PMS retained its Top Decile Position across one, two and three year time periods. We ranked second out of 140 funds based for the two year period(Table 2). This universe includes small and mid cap funds as well as other strategies. Our achievement should be viewed in the context that one and two year Performance of small and mid cap strategies is elevated due to sharp rally in small and mid cap stocks post COVID low.

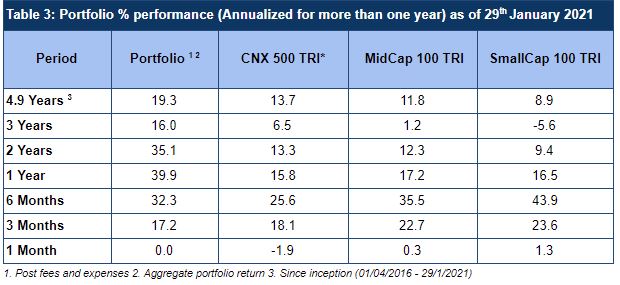

Indian markets remained volatile during the last week of January 2021, and broader indices fell close to about 6.5% from its January high, sending CNX 500 to close in red for the month. However, Sameeksha managed to end the month on a flat note (Table 3).

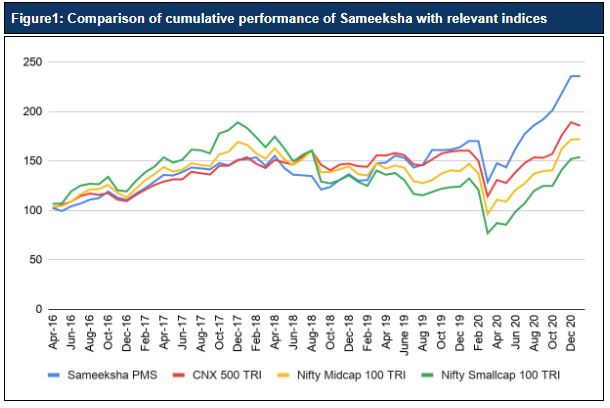

An investment of Rs. 100 with us since inception would have grown to Rs. 236 over 4.8 years, hugely outpacing the relevant indices (Figure 1).

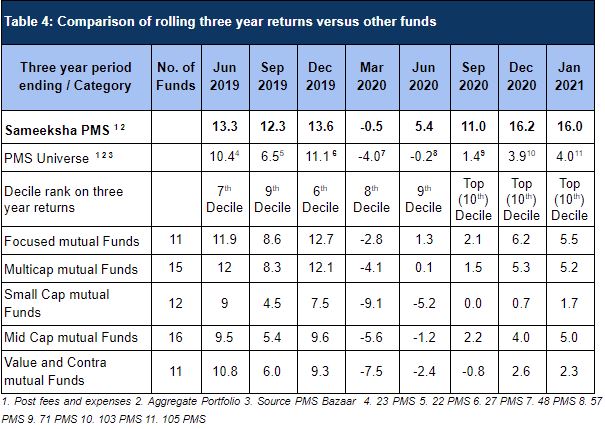

It is important to not be a flash in the pan. It is important to achieve good performance on a rolling basis. We have been consistently outperforming PMS universe and relevant mutual fund categories on a rolling three year basis (Table 4).

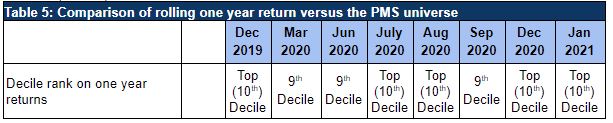

On a rolling one year basis, we have been consistently ranked in the top two deciles among the PMS universe (Table 5).

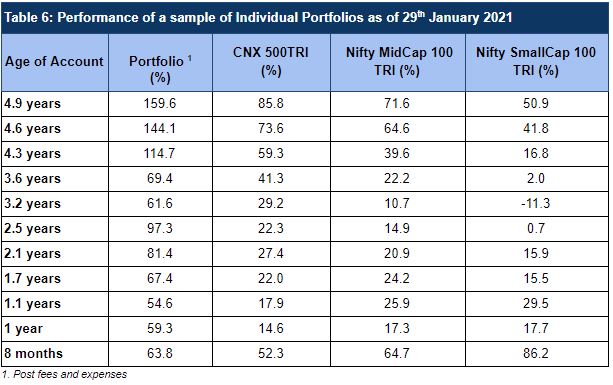

Our strategy to not follow a model portfolio approach differentiates us from many other PMSes. In fact, we deploy technology to manage the complexity of not following the easier model portfolio approach. Our Investors have benefitted from our approach. Irrespective of their timing of investment, our clients have seen strong performance. (Table 6).

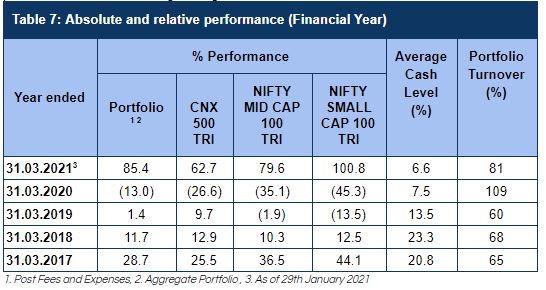

We capture our performance versus benchmarks on a financial year basis in Table 7. We have outperformed the key benchmark CNX500 materially for FY21 till date. Also worth noting our performance notwithstanding average cash level.

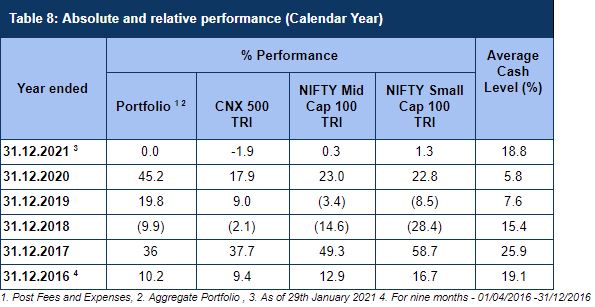

In Table 8, we capture our calendar year performance for years since the inception of the fund.

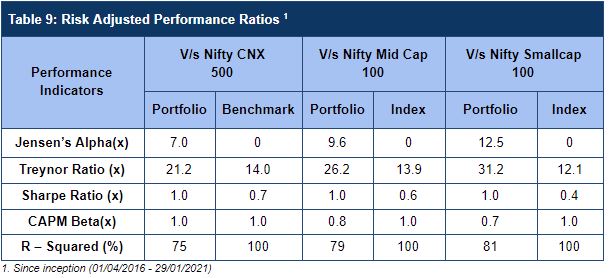

We have delivered good Risk Adjusted returns on a since inception basis compared to Indices that we are comparable with (Table 9).

We welcome any follow up questions.

DIsclaimer : The information contained in this newsletter has not been verified by SEBI.