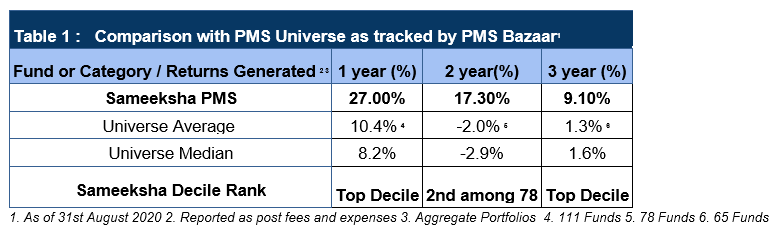

Among all the funds reporting their performance to PMS Bazar (data extracted from PMS Bazar), Sameeksha has maintained its strong showing with performance ranking in top decile for one year, two years and three years ended August 31, 2020 (Table 1).

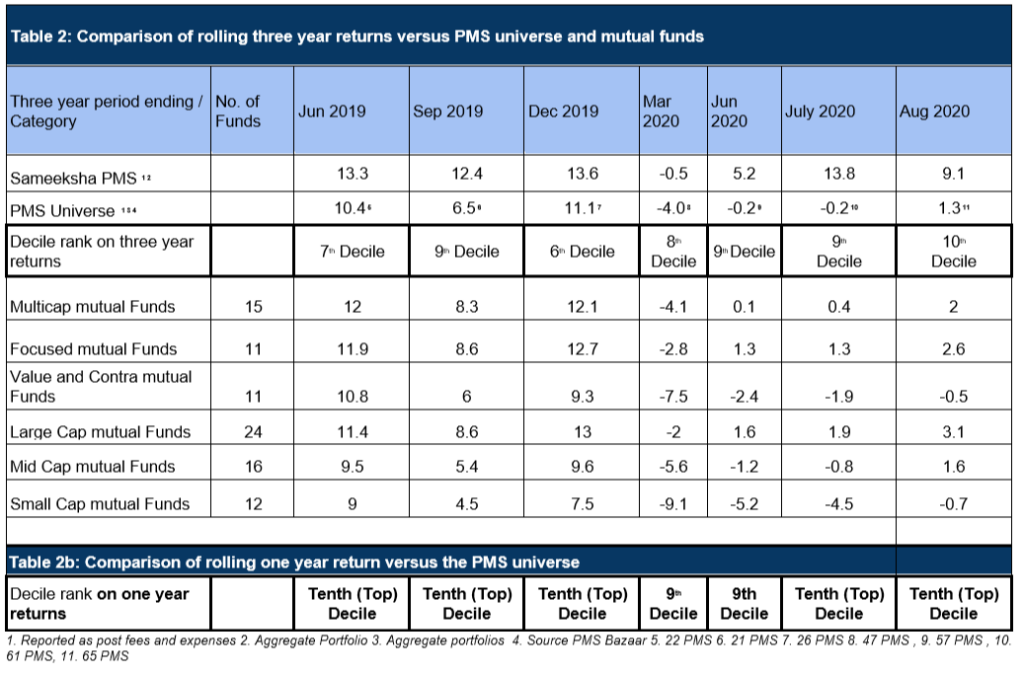

We have retained top performance ranking among the PMS Universe on a rolling basis for both one year and three year periods as well (Table 2). We run a multi-cap concentrated portfolio strategy and hence the Focussed mutual funds and multicap funds are the most relevant to compare us against and we have consistently done well in that comparison. We have also included average returns of other categories in Table 2.

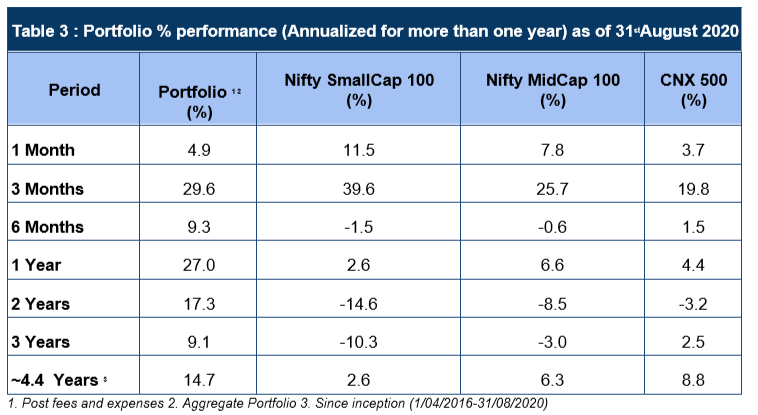

During the month of August 2020, small caps continued to rally very strongly followed by mid cap and large cap. We run a multicap portfolio and limit our exposure to small and midcap stocks based on liquidity criteria as any prudent risk management philosophy would suggest. We continue to report strong alpha versus CNX500, the broad based for the shortest (one month) to the longest period (since inception) as well as versus the Midcap index, we have underperformed the small cap index over the last three months (Table 3). As we do not take very large bets on stocks with low liquidity, such an outcome is unavoidable.

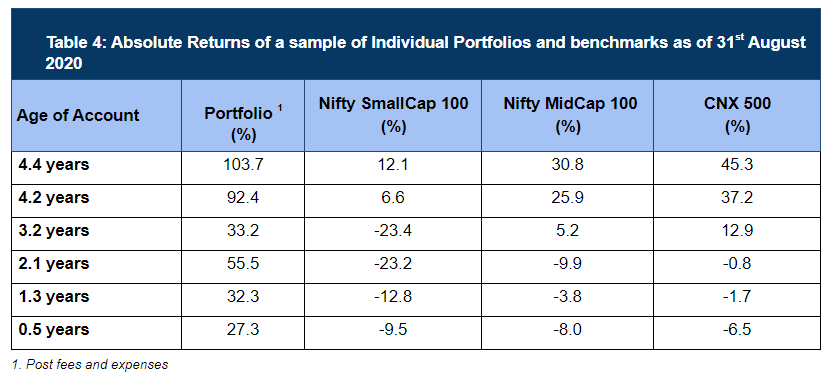

We do not follow the model portfolio approach popular with many large PMSes. For any new investor portfolio, we only buy those stocks within our portfolio that are still available at the right price. In Table 4, we provide data on performance of a sample of clients who have been with us for a varied range of time. Indeed, based on historical data, those who kept faith for a long time have benefitted.

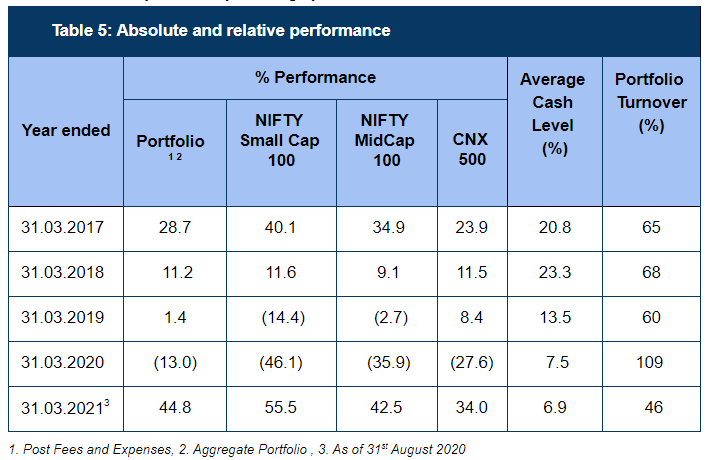

This is our fifth year of operation. Except for the financial year ending 31/3/2019, We have performed consistently well versus CNX500 (Table 5). The fact that there is not a single index fund tracking CNX500 is reflective of the challenges in matching the performance of this index which includes many illiquid small and mid cap stocks. Furthermore, our performance has been achieved while maintaining relatively high cash levels through our operating history. High turnover in the financial year ending 31/3/2020 was very necessary and largely due to our decision to increase the cash levels in early March 2020 and then redeploy those funds by the end of March 2020.

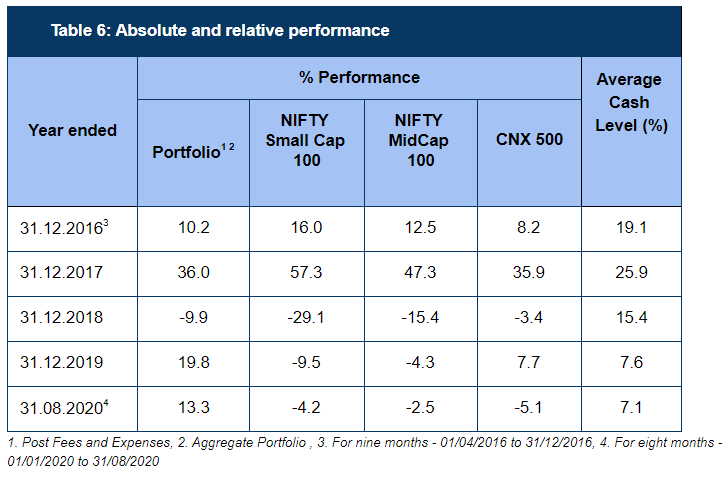

We also provide details of our performance by calendar year (Table 6)

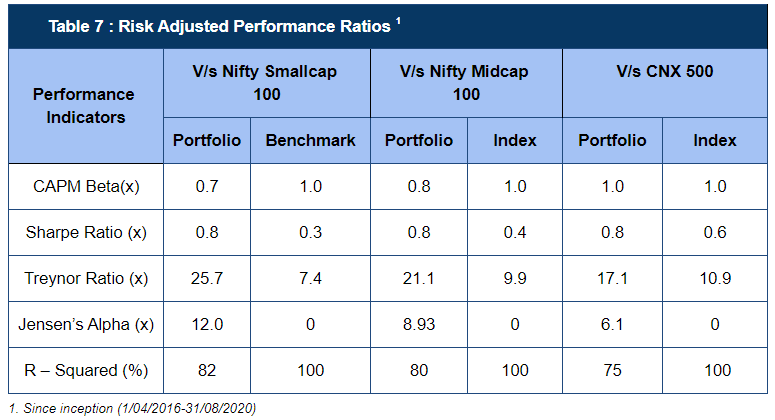

Finally, though not actively looked at by most investors in India, we firmly believe that fund performance should be reviewed on a risk adjusted basis. We provide such details in Table 7.

We welcome any follow up questions.

DIsclaimer : The information contained in this newsletter has not been verified by SEBI.