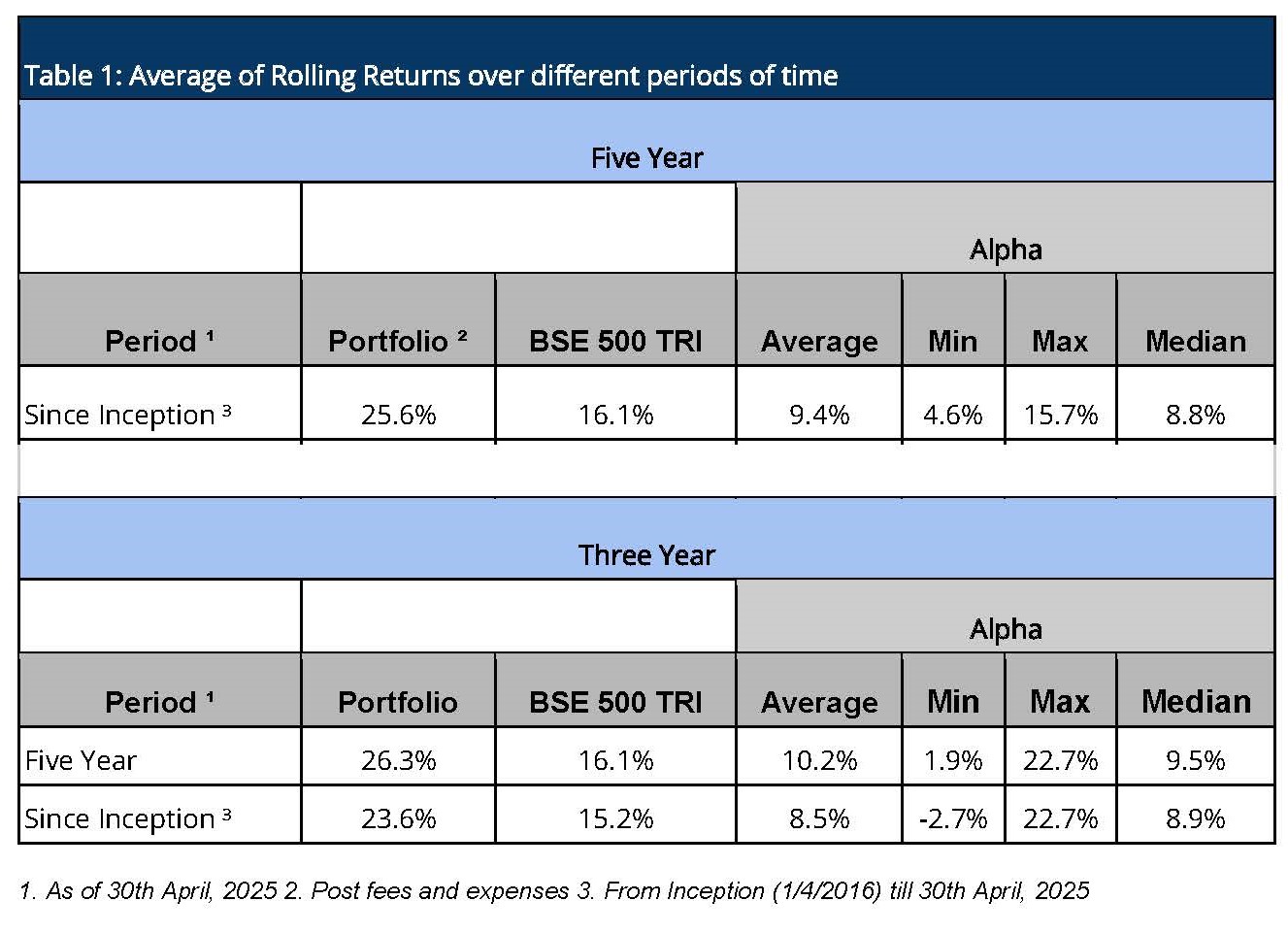

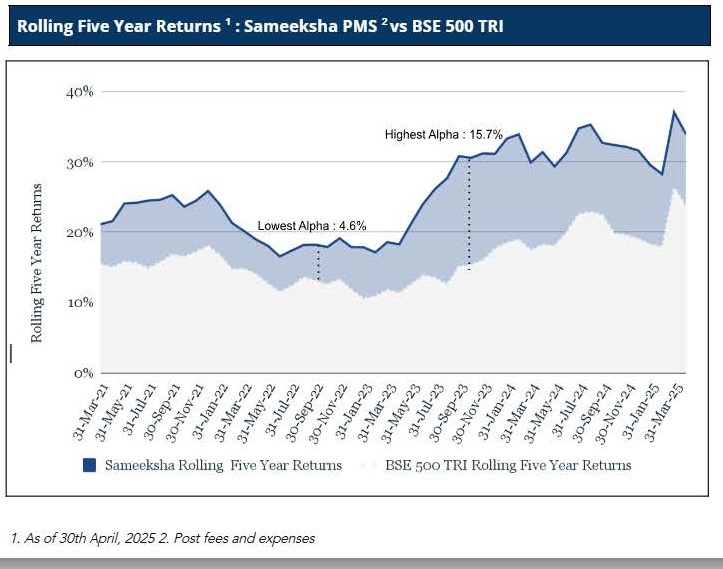

For evaluating performance, returns calculated on a rolling basis are often considered to look across time. We carried out the same analysis for Sameeksha’s PMS which is currently in its tenth year of operation. We carried out this analysis for rolling five and three year returns respectively (Table 1). By averaging these rolling returns over different lookback periods, we can gain a deeper understanding of how consistently the portfolio has delivered value over time, compared to the BSE 500 TRI benchmark.

The results reveal a strong and persistent pattern of outperformance. Across all measured periods, average three-year or five-year rolling returns have consistently outpaced the benchmark. The average alpha—representing the excess return generated over the index—has remained meaningfully positive, at 10.2 % for rolling three period years over the last five years and at 9.4% for all the rolling five year periods. . This steady performance across multiple time frames highlights the portfolio’s ability to generate value not just in specific cycles, but throughout varying market conditions.

What stands out in particular is the stability of alpha across different lookback periods. This consistency suggests that the portfolio’s success is not driven by isolated bets or favorable market timing, but rather by a disciplined and repeatable process. The rolling return framework helps illustrate that this performance is not a result of temporary market positioning, but instead reflects a reliable, long-term approach to investing.

At Sameeksha, the investment philosophy is centered on sustainable, risk-adjusted returns. Rather than reacting to short-term market fluctuations or chasing momentum, the team follows a research-intensive, bottom-up strategy focused on identifying high-quality companies with robust fundamentals, sound governance, and long-term growth potential. This is complemented by a strong emphasis on risk management, ensuring that return generation does not come at the cost of elevated volatility or downside exposure.

This disciplined, fundamentals-first approach has enabled the portfolio to perform consistently across market cycles—capturing upside during favorable periods while maintaining resilience during downturns. The rolling return data confirms that this is not a case of one-off success, but the result of a well-structured and consistently executed investment process. Ultimately, the portfolio’s long-term track record reflects Sameeksha’s focus on creating enduring value for investors through thoughtful, research-driven investing.