* Period ending 30th September, 2024 ** Among multicap PMSes for five year period *** Five year Period In the month of September, the benchmark S&P BSE 500 TRI was up 2.1%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) was up by 0.02% (net of all fees and expenses), …

Category: PMS & AIF

August 2024* : Top decile performance** every month for 42 months in a row; Upside capture*** 110%, Downside capture*** 49%

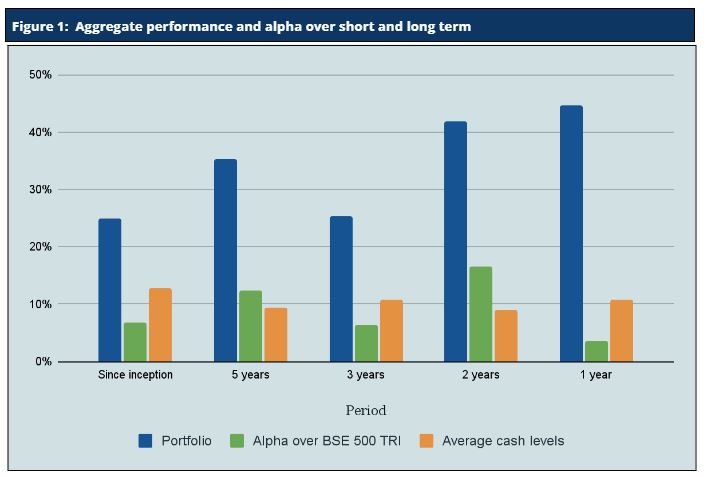

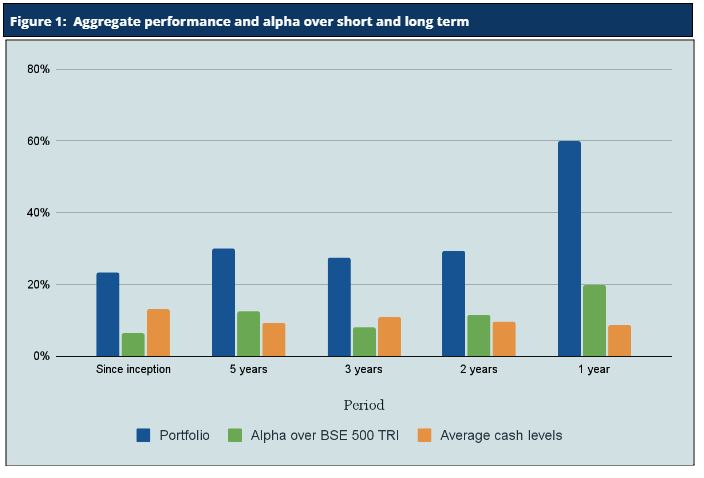

* Period ending 31st August, 2024, ** Among multicap PMSes for five year period, *** Five year Period In the month of August, the benchmark S&P BSE 500 TRI was up 1.0%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) was up 4.1% (net of all fees and expenses), indicating an alpha …

July 2024* : Forty first consecutive month of top decile performance**, upside capture*** 108%, downside capture*** 53%

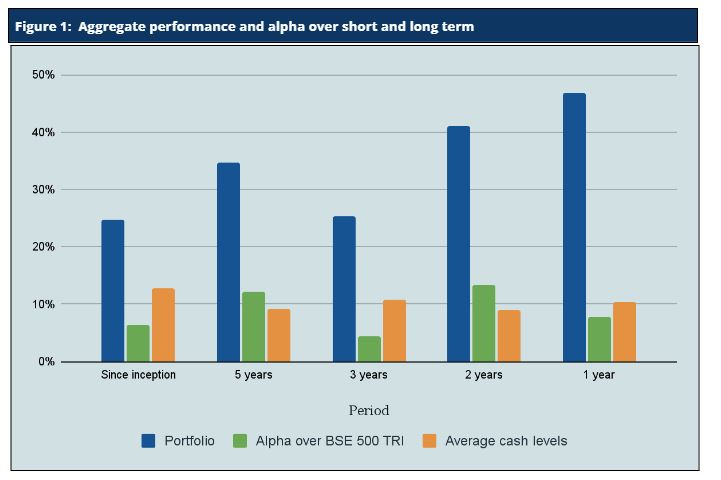

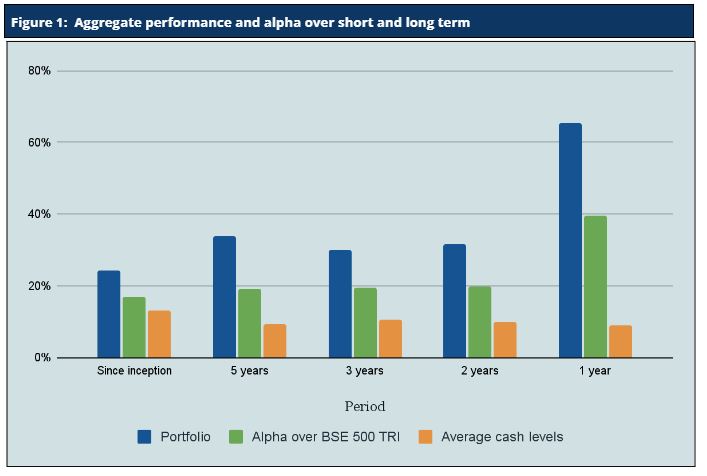

* Period ending 31st July, 2024 ** Among multicap PMSes for five year period *** Five year Period In the month of July, the benchmark S&P BSE 500 TRI has grown by 4.4%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) has grown by 6.6% (net of all fees and …

June 2024* : Marginal Underperformance, 40th consecutive month*** of top decile performance**

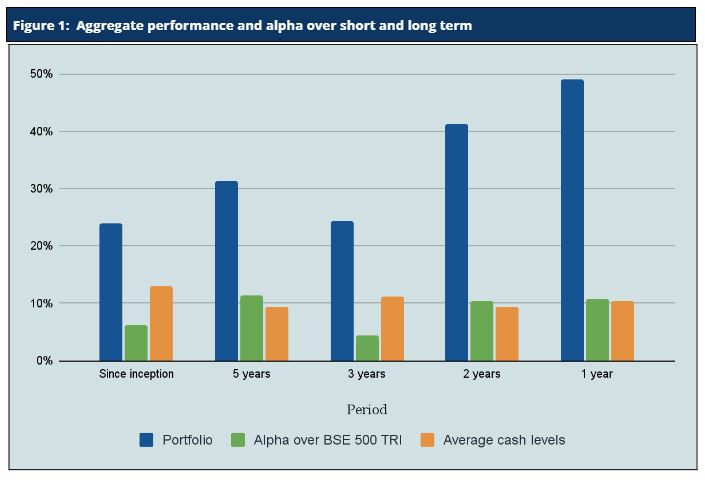

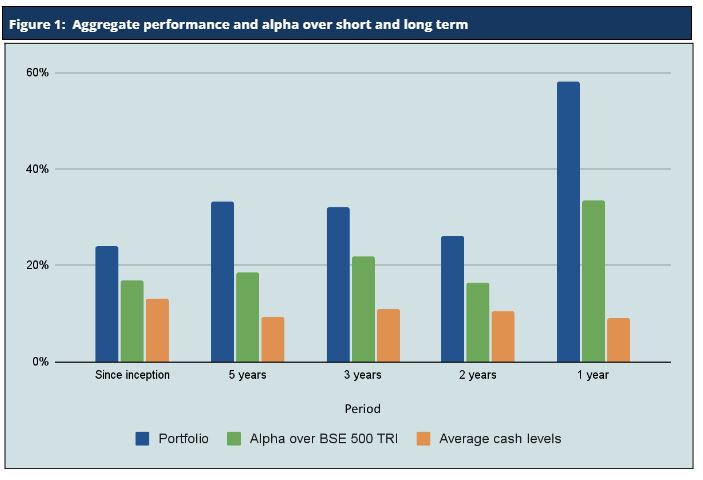

* Period ending 30th June, 2024 , ** Among multicap PMSes for five year period , *** Five year Period In the month of June, the benchmark S&P BSE 500 TRI has grown by 7.1%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) has grown by 6.2% (net of all fees and expenses) …

May 2024* : Thirty ninth consecutive month of top decile performance**, upside capture*** 108%, downside capture*** 54

* Period ending 31st May, 2024, ** Among multicap PMSes for five year period, *** Five year Period In the month of May, the benchmark S&P BSE 500 TRI has grown by 0.83%. Against that, Sameeksha PMS(Portfolio Management Service = Separately Managed Accounts) declined by 3.00% (net of all fees and expenses) while having …

March 2024* : Number One Again** And Thirty Seventh Consecutive Month Of Top Decile Performance***, Upside Capture**** 111%, Downside Capture**** 54%

* Period Ending 31st March, 2024, **; For Five Year Period Among Multicap PMSes With >Rs. 100 Crore AUM, *** Among Multicap PMSes For Five Year Period, **** Five Year Period In the month of March, the benchmark S&P BSE 500 TRI rose by 0.9%, whereas the S&P BSE Smallcap Index experienced a decline of …

February 2024* : Number one again** and thirty sixth consecutive month of top decile performance***, upside capture**** 115%, downside capture**** 60%

* Period ending 29th February, 2024 , ** For five year period among multicap PMSes with >Rs. 100 crore AUM , *** Among multicap PMSes for five year period, **** Five year Period In the month of February, the benchmark S&P BSE 500 TRI has grown by 1.7%. Against that, Sameeksha PMS (Portfolio Management Service = Separately …

January 2024* : Thirty Fifth Consecutive Month Of Top Decile Performance**, Upside Capture*** 115%, Downside Capture*** 58%

* Period ending 31st January, 2024 ** Among multicap PMSes for five year period *** Five year Period In the month of January, the benchmark S&P BSE 500 TRI has grown by 1.9%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 3.4% (net of all fees and expenses) while having cash …

Number One For The Fifth Consecutive Month* , Top Decile Ranking For The 32nd Consecutive Month*

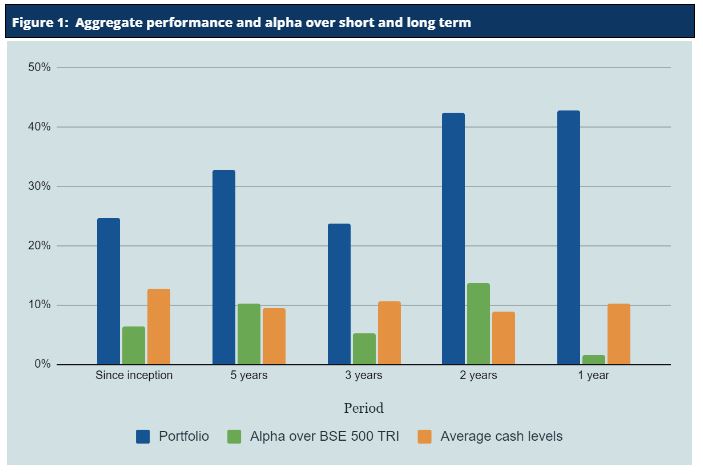

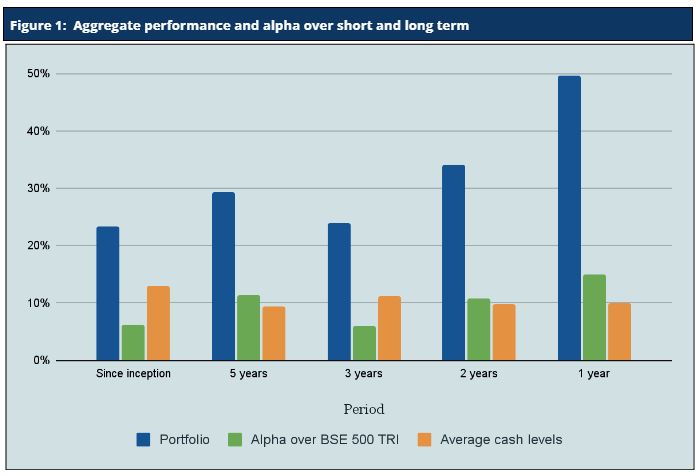

* For Five Year period In the month of October, the benchmark S&P BSE 500 TRI fell 2.9%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 1.2% (net of all fees and expenses), resulting in a meaningful outperformance. Sameeksha AIF (Alternative Investment Fund = “Hedge Fund”) also gained 1.7% (post expenses pre tax), …

On Five Year Basis, Number One For The Fourth Consecutive Month, Top Decile Ranking For The 31st Consecutive Month

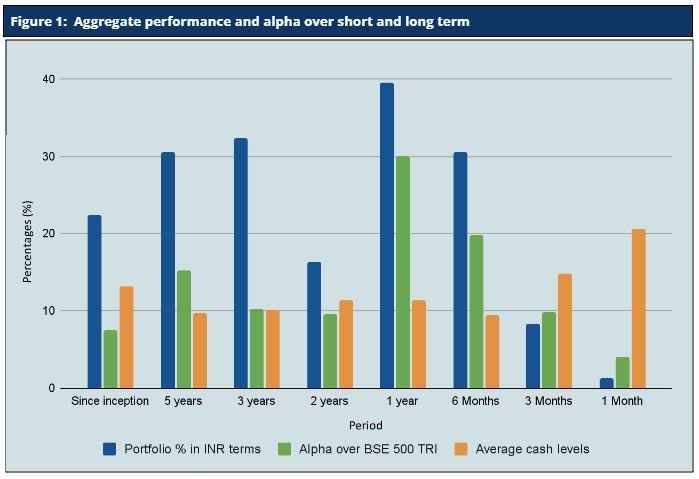

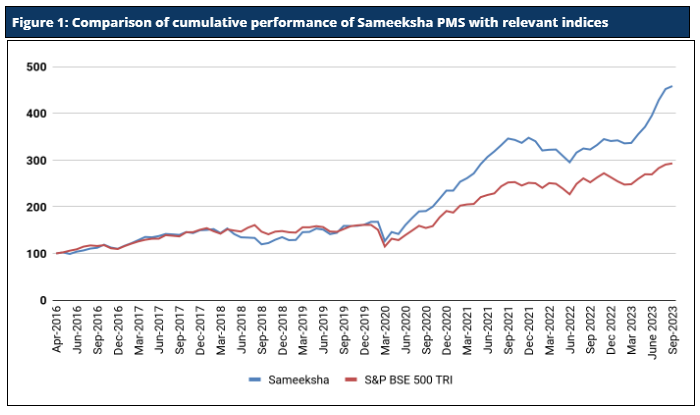

In September 2023, Indian markets decoupled with key global markets; as against 4.5% drop for S&P 500, BSE500 TRI went up 2%. Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 1.4% (net of all fees and expenses), resulting in a small underperformance. Sameeksha AIF (Alternative Investment Fund = “Hedge Fund”) also gained 1.4% (post …