Introduction Sameeksha completed nine years of managing money in Indian equities in March 2025. Back in late 2015, we started Sameeksha with the objective to manage our investors’ assets just as we manage our own by investing in businesses that were durable and were managed by stewards who view their company capital with the same …

Category: Annual Letter

Annual Letter : FY 2023-24 (Year ending Mar 31, 2024)

Introduction As of March 31 2024, Sameeksha completed eight years of managing money in Indian equities. Back in late 2015, we started Sameeksha with the objective to manage our investors’ assets just as we manage our own by investing in businesses that were durable and were managed by stewards who view their company capital with …

Annual Letter : FY 2022-23 (Year Ending Mar 31, 2023)

Introduction As of March 31 2023, Sameeksha completed seven years of managing money in Indian equities. Back in late 2015, we started Sameeksha with the objective to manage our investors’ assets just as we manage our own by investing in businesses that were durable and were managed by stewards who view their company capital with …

Annual Investor Letter : Year Ending Mar 31, 2022

Introduction When we started our investment firm six years ago, our objective was to manage our investors’ assets just as we manage our own by investing in businesses that were durable and were managed by stewards who view their company capital with the same care that we manage our investor assets. Investing in public market …

Review Of Our Journey From Inception (I.E. 1st April 2016)

COVID 19 pandemic was at an early stage when we wrote last. Our view that the significant injection of monetary and fiscal stimulus across most countries, combined with some early signs that the pandemic could be managed, led us to deploying cash, after a short period of reduced market exposure. Our fund performed extremely well for …

Navigating Through The Covid-19 Led Turbulent Period

In this letter, we discuss (a) our experience dealing with last eight weeks of extreme volatility, (b) how we navigated through this turbulent period (which admittedly may not be over yet), (c) how we are positioned for the market ahead, (d) analysis of significant portfolio decisions we took, and (e) how the outcome would have …

Evaluating Our Stock Selection Process

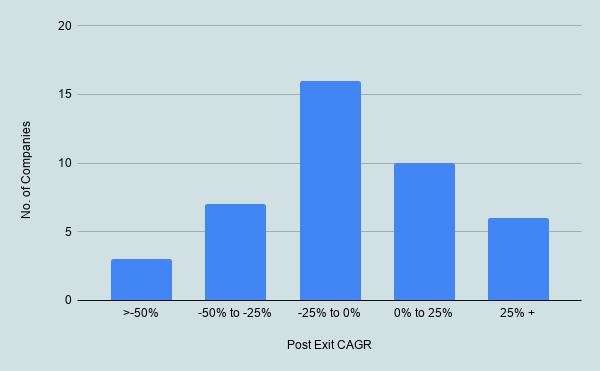

Since April 2016, we have been running a multi-cap (with emphasis on Mid and Small Cap companies) Long Only India Equity Fund under SEBI registered PMS structure. We specialize in investing in Indian listed equities as well as offshore investing through LRS route. We believe in developing and following robust processes for everything we do …

Advantages Of PMS As A Product And Prospects For The Industry

Portfolio Management Service (PMS) as an asset class has grown at exponential rates over the last few years. Over the last three years, as of June 19, the number of discretionary clients under PMS has grown by 175% from 52,761 clients to 1,44,879 clients and the AUM under discretionary mode has gone by about 56% …

Sameeksha Annual Investor Letter

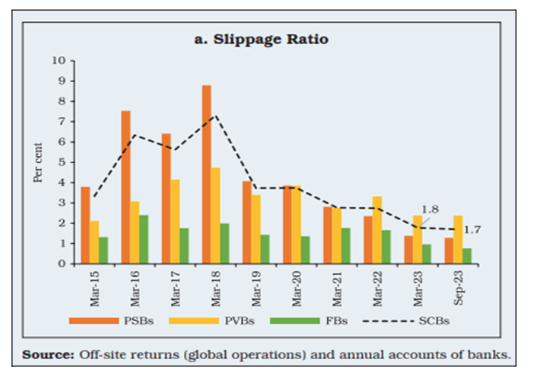

Financial year 2019 was a challenging year with slowing growth in both global as well as Indian economy. . An impressive uptick in March ended FY 19 performance of Nifty on a promising note. However, Mid Cap and Small Caps ended in red for the fiscal. Some of the major factors that led to the …