The Indian economy remains one of the fastest growing economies amidst the developing economies. There are a number of structural factors favoring a sustained period of high growth for the Indian economy under the right set of conditions.

Positive Demographics:

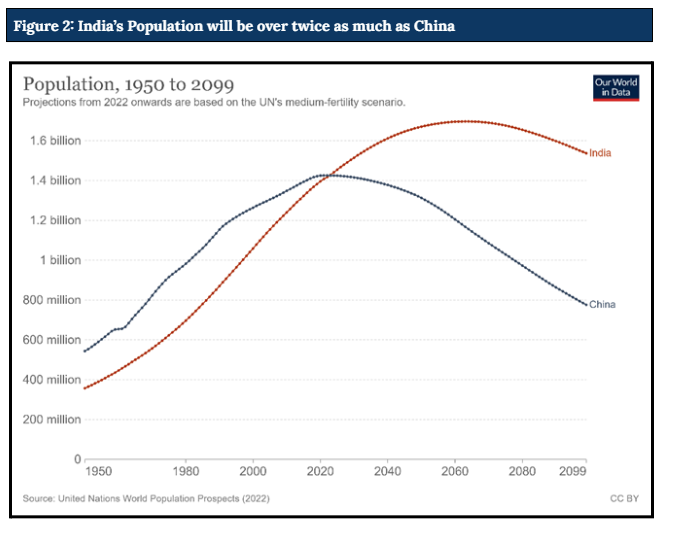

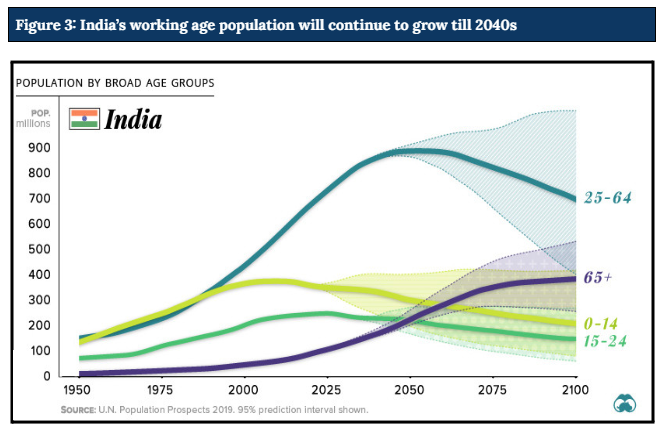

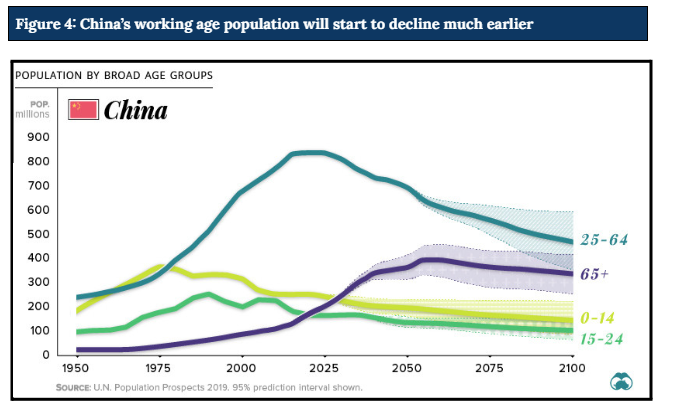

It is now estimated that India is the most populous country in the world and if current trends hold, its population may be over twice as much as China’s by the end of the 21st century (Figure 2). India’s population is also much younger and the UN estimates that India’s majority population will remain of working age (ages 15 to 64) until at least 2100 (Figure 3). Moreover, its working age population is expected to continue to rise for another two decades, whereas it will start to decline in the near future.

Comparison of populations: China Vs India

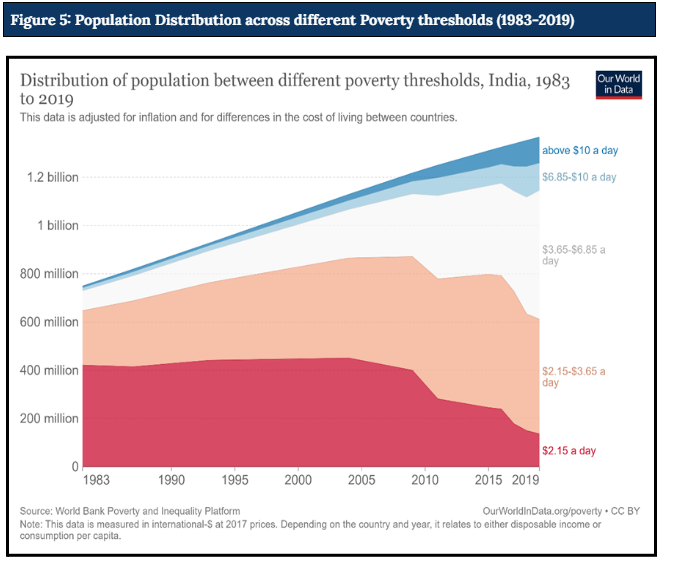

Since opening up its economy in the early 1990s, India’s real GDP growth has averaged well over 7% per year. While this lags the 10+% that China averaged for a few decades, it has resulted in a substantial reduction in poverty and improved the quality of life for all segments of its population (Figure 5). With reduction in poverty, there is a scope for increase in consumption per capita for a vast range of products and services. Hence, it is not difficult to find companies that could have an opportunity to deliver double digit growth rates for anywhere from ten to 25 years.

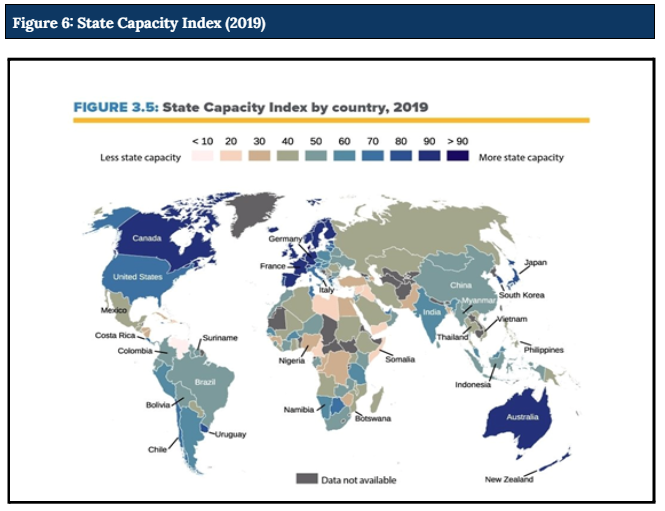

The improvement in living standards has been driven by multiple factors- rapid economic growth, higher government tax receipts supporting targeted transfer payments, improvement in state capacity (Figure 6) and reduced corruption since the current BJP government came to power in 2014. We have written in previous Letters about the rapid improvement in infrastructure and the digital transformation underway in the country. India is not one market but many markets: Urban versus Rural, bottom of the pyramid all the way to the super-luxury. As such, sizable opportunities exist for a wide range of products and services – from two wheelers to luxury cars, from basic consumer goods to high end fashion goods and so on.

Much has improved since India’s economic and political awakening in the early 1990s, but much remains to be done. Quite specifically the country has to improve its Primary and Secondary School Education and Manufacturing Capacity. When asked about India replacing China as the world’s populous country, China’s Foreign Ministry spokesperson, Wang Wenbin said it was important “to look at not just the size, but also the quality of its population”. While this is in-line with the impolitic ways of China’s “wolf warriors”, who do not lose an opportunity to highlight to the rest of the world the risks that come with a more powerful China, it is a message that India needs to heed particularly when it comes to school education and gender equality. Scaling up manufacturing in India will benefit from the infrastructure investment in recent years and the demographic dividends discussed earlier. The decision by Apple to significantly expand iPhone production including its most advanced model in India is a sign that the government’s effort to encourage “Make in India” is appreciated by global companies that seek to diversify their manufacturing beyond China. In 2021, Denmark’s Vestas, a wind-turbine manufacturer, built two new factories in the Indian state of Tamil Nadu. Vestas expects 85% of their suppliers to eventually set up Indian factories. Rivaling China’s industrial capacity will be difficult and would require a better educated workforce, further improvement in infrastructure and a better business and regulatory environment. While some economists like University of Chicago professor Raghuram Rajan suggest that India focus on service-led growth, we think this is a folly. Sustaining economic growth and improving living standards requires significant industrialization and the higher quality jobs that come with it.

Fourth, tThough India may still be a difficult place to do business relative to many developed or developing countries, there has been a consistent improvement in ease of doing business over the last few years. Historically, the Indian economy saw scaling up of some businesses that were led by very able managers, crossed many barriers and created a scale that not many others could achieve and such businesses generated very strong returns on capital, thus becoming great companies to invest in. Increasingly though amidst an improving climate for doing business, India is witnessing a formation of a large number of new age companies that embrace technological changes and are able to scale up rapidly thanks to availability of venture capital and new channels to sell products and services. Between the well established companies that boast superior profitability and market position and the new age companies that have potential for explosive growth, the Indian equity marketies has continued to be a ripe place for stock picking. Today, India represents one of the largest start-up ecosystems in the world aided by the presence of all the major venture capitalists and private equity firms who are funding new business ventures of thousands of dynamic entrepreneurs with potential to not only transform Indian markets but also win on a global scale.

All the structural reforms along with the strong underlying economic factors could propel the Indian economy into a multiyear high growth journey which could be far better than any other emerging economy. We list below some of the structural reforms that are creating substantial capacity in the economy to sustain 6-8% real GDP growth:

GST leading to formalization of the economy:

This introduced a uniform indirect tax system across the country and removed the state by state taxes which had hindered inter-state commerce. There was a more than 50% increase in the number of indirect tax payers. This has not only aided the government’s efforts to widen the tax base, increase the tax collection, and have the capacity to provide social benefits without increasing the fiscal deficit, but, from our perspective, also has leveled the playing field for organized companies which were initially tax compliant.

UPI payments:

After the blip in UPI transactions due to lockdown, the transaction value has increased significantly. These UPI transactions are not only replacing cash and helping formalization, they are also generating transaction data for the merchants which the banks and other financial service providers have started using to provide credit facilities to the merchants. In recent months, UPI transactions have reached nearly half of nominal GDP, quite a remarkable statistic in every right.

Bankruptcy process:

New laws have sped up the bankruptcy process and given greater power to creditors. The Insolvency and Bankruptcy Code, 2016 has brought about a behavioral change among debtors. The fear of losing control over the enterprise upon initiation of Corporate Insolvency Resolution Process (CIRP) has nudged thousands of debtors to settle their dues before initiation of the process. The realization by financial creditors under resolution is ~ 177% while under Liquidation was ~ 33% of claims. In the long-term, this should facilitate lower risk for lending, faster credit and better quality credit growth.As per RBI’s latest data, the GNPA ratio of scheduled commercial banks fell to a seven-year low of 5.0% and NNPA ratio has dropped to ten-year low of 1.3% in Sep-22.

Infrastructure:

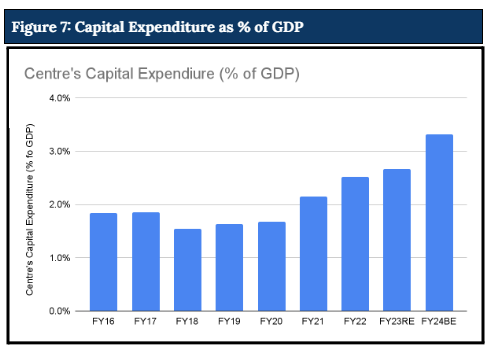

The NHAI’s mandatory payment of user fee through FASTags is seeing increased adoption. Further, the ministry of road transport and highways continues to work towards reducing logistics cost to single digits from 13 to 14% currently. The move has brought about much needed efficiency in toll road operations and improved revenue collection. The government’s thrust on infrastructure is evident from the successive increases in budgetary allocation towards capital expenditure (Figure 7).

India is rapidly expanding and upgrading roads, ports, airports, rail network as well as trains for passengers and freight, broadband connectivity and other important infrastructure that can have a huge multiplier effect. The pace of progress is unprecedented for India and impact can be very clearly seen from the order book and revenue figures of companies working in this space. There are also meaningful investments in solar and wind energy as well as other new sources of energy including lithium ion batteries or Hydrogen. The emphasis on renewable energy sources may help India reduce its dependence on import of crude oil.

Thrust for make in India to bring manufacturing revolution:

India is witnessing once in a generation expansion of manufacturing capacities both in sectors previously known and several sectors India did not previously have strong presence in such as defense, aerospace and electronics. Even in the existing sectors, there is emphasis on backward and forward integration. Emphasis on domestic manufacturing benefits India in multiple ways – improving trade deficit and creating local employment.

Appendix 1: Performance of the fund for FY2023

Appendix 2: Key Performance Contributors in FY2023

Appendix 3: Current view on top seven positions

Appendix 4: Analysis of our performance over last seven years