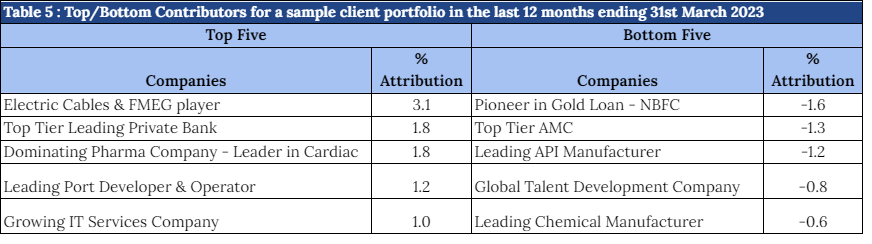

Top and Bottom performers of FY 2023

Based on our detailed contribution analysis, we have identified underperforming stocks accounting for both – the returns as well as their position sizing in the portfolio. As such, Table 5 provides us the top and bottom contributors in our portfolio for the 12 months of FY 2022-23.

A. Below is our analysis on the Top 5 contributors for FY 2023 –

a. Electric Cables & FMEG Player (Currently Invested)

The company is one of the leading electrical cables brands in India with 22% market share in the organized wires segment and also has also forayed into the manufacturing of Fast-Moving Electrical Goods (FMEG) and home appliances. To expand its market reach, the company, over the past three years, has revamped its distribution network which enabled it to connect with over 175k retailers directly through 700 distributors. Along with expanding the distribution, the company is also introducing newer SKUs and product categories within the electricals segment, leveraging its electrical wires brand to drive growth. After a few years of hiatus, as the company was restrategizing on its distribution, things started to fall in place and it was able to reduce the gap in growth vs peers. It also holds ~32% stake in its sister company which is worth ~ Rs 3,500 cr. The Company is available at a significant discount to its peers and to its historical trading range. With building blocks in place, we expect the Company to revert to its growth trajectory and deliver a 16.5% CAGR in revenue and a 21.7% CAGR in PAT over a 5 year period.

b. Top Tier Leading Private Bank (Currently Invested)

Our investment thesis was driven by the change in MD leading to a culture change with high focus on granularization of the book and sorting of the NPA mess. All parts of our thesis have played out well: Contribution of retail, rural and business banking books has gone up to 70% of total advances as compared to 60% three years ago. Also, the contribution of low yielding overseas book has simultaneously come down. Gross NPA ratio, which was at 6.7% as of March 2019, has come down to less than 3.6% as of March 2023. Also, the exposure to vulnerable accounts and restructured books over the period has come down, reducing the overall riskiness of assets. The bank has been effectively able to leverage technology, and its tie-up with Amazon for credit cards has been a huge success resulting in significant increase in credit card spend market share from 16.2% to 21% in the last one year. Our thesis has played out on all counts and RoA has improved to 2.1% in FY23 and the stock has undergone significant rerating. Given the increasing interest rate environment and the significant exposure to repo linked loans as well as the expectation of benign credit cost over the next couple of years, we expect a further scope for RoA expansion. We expect the bank to deliver an average RoE of 16% over the next 5 years as compared to 8.7% in the past 5 years.

c. Dominating Pharma Company – Leader in Cardiac (Currently Invested)

It is one of India’s leading pharmaceutical companies incorporated in 1976. The company has been supplying products across segments like cardiovascular, gastrointestinal and anti infectives with the company’s top 4 brands featuring in top 200 brands in unit terms and two of them feature in the top 100 brands in value terms. Post its acquisition by KKR and the appointment of a new management team, the growth of the business has accelerated. We believe that there is a healthy topline growth potential, led by synergetic acquisitions, launch of new products and expanding customer reach. There is scope for meaningful margin expansion over the next 2-3 years led by higher domestic and CMO business, in which margins are better, increased MR productivity, along with other operating leverage. We expect revenue and PAT to grow at a CAGR of 17.7% and 27.1% respectively, over the next 5 years.

d. Leading Port Developer & Operator (Exited the position)

It is one of the largest port operators in the country, with an expanding footprint globally as well. They aim to become a full-fledged logistic player in the country, from first mile to last mile. The company has been on an acquiring spree to garner more market share domestically, as well as globally to be a key part of the global supply chain. Given the recent turn of events, valuations became attractive given the quality of assets that they hold, their cash flow generation ability & the strong parentage.

e. Growing IT Services Company (Currently Invested)

The company is a global IT Services company, providing services which generate revenue from both domestic and international business verticals. International revenue mainly comes by providing services to Microsoft, as the company has been a strategic partner for 30 years. Domestic revenue comes through resale of IT products. Microsoft as a customer is 25-30% of total revenue and Dynamics implementation, which is ‘Sell with Microsoft’ is around 30% of the same. They do have other tie-ups in ERP and Cloud, in which they have Azure, AWS, GCP and Oracle cloud etc. The company has invested in a strong leadership team over the last 18 months and a recent acquisition brings new capabilities to the table. We expect the company to deliver healthy double digit – mid teens growth in revenue and potentially superior growth in earnings.

B. Below is our analysis of Bottom 5 contributors for FY 2023

a. Pioneer in Gold Loan – NBFC (Exited the position)

The gold loan business that was dominated by two NBFCs saw disruption as Covid led to a surge in demand and the entry of new players such as banks and fintechs. The NBFCs responded with rate cuts, however the damage was done and business underwent a structural change with return ratios being reset at lower levels. The street is still looking for competition to be dialed down, as people intensive business was never considered to be a business that banks could manage as efficiently as the NBFCs. However, as banks and fintechs struggle for lending opportunities, we believe that they have built capabilities to manage the unique nature of this business and are here to stay. Hence, we decided to exit the position.

b. Top Tier AMC (Exited the position)

We had a broad two point investment thesis for investing in this company- 1) steady or increasing its market share in mutual fund AUM due to its superior performance and 2) decreasing expenses as a percentage of management fee due to steady employee costs on account of natural retirement benefits expected to flow over the next 3-4 years. However, both parts of the thesis have not played out as per our expectations. Market share in equity oriented MF AUM has declined considerably, from 5.29% in Dec 21 to 4.99% in Sep 22 and further down to 4.82% in Dec 22. In addition, there was a substantial increase in employee and other admin costs. We exited the stock expecting subpar performance. Eventually, the stock fell further, reacting negatively to its poor results.

c. Leading API Manufacturer (Currently Invested)

A niche player in the API industry, the company has a leading market share in its top 3 products. Its fully backward integrated facility, entry into less competitive molecules and its ability to handle narcotic products helps it enjoy healthy margins. The company is embarking on a growth journey and is adding capacities aggressively. The company is also currently working on several CMO projects with MNC companies, owing to its competencies in certain chemistries and processes. In FY23, the company suffered due to lockdowns in China – a key end market for the company. The stock also corrected in line with its poor operating performance. We believe the China impact is temporary and we expect the company to resume growing at a healthy pace for the next several years. We expect the revenue and PAT to grow at a CAGR of 25.2% and 20.6% respectively over the next 5 years.

d. Global Talent & Skill Development Company (Exited the position):

The company is one of the 5 largest managed training service providers globally. Over the past decade, the company has established itself as a reliable and trusted partner for the training services needs of global corporations.

During the 1st quarter of FY23, we exited this stock. The reason for the same was the sudden change in perceived economic conditions of Canada Real estate market due to expected increase in interest rates. The Real Estate Council of Ontario project of the company is significantly dependent on the condition of the mortgage market there. The company had seen supernormal profitability and this project alone was contributing to more than 50% of the total EBITDA. With headwinds in this project, it was likely that there would be reduction in volumes and also significant compression in margins.

On top of that, since the general economic situation in the US and Europe worsened significantly since our investment in January driven by the Ukraine war, our understanding was that training services would be far more impacted than IT services. This was a negative perception in the street which led to sharp correction in stock price and the company also performed worse in the second quarter of FY22.

e. Leading Chemical Manufacturer (Exited the position)

The company is an Indian chemical manufacturer having market leadership in most of its products. It has a well diversified product portfolio with more than 1000 customers supplying to 30 countries. The company has a track record of launching new products and attaining leading market share in those and thus benefiting from economies of scale. Putting up a large-scale plant of Phenol-Acetone was a game changer for the company as it replaced 60% of imports happening in the country. The company has performed quite well and the stock has given us good returns since the time we invested in it. Owing to weak industry demand and higher input prices, led by rise in crude prices, there were near term headwinds visible. Moreover, as valuations became high, we decided to exit the stock.

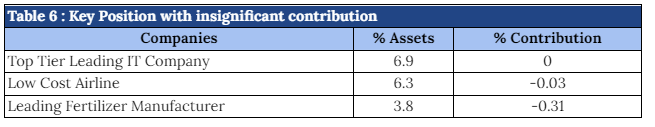

Key positions with insignificant contribution

Furthermore, there were several stocks in which we had reasonable sized positions but they did not contribute much to the performance (Table 6). We discuss below these names, why we invested and the reason for poor performance.

a. Top Tier Leading IT Company

The company is the third largest IT company with strong presence across various countries. About 90% of the revenue comes from services and the rest comes from Products and Platforms business. Within services, IT service contributes 72% of total revenue and ER&D services contribute the rest. The company was a pioneer in the ER&D services and is still one of the largest players in ER&D outsourcing. The share price of the company has not changed significantly in FY23 because of the sectoral headwinds expected to affect Tier 1 IT companies in FY24, thus the same is not resulting in upward movement in the stock price.

Unlike other large IT companies, which have higher concentration to BFSI, the company’s industry exposure is widely diversified with financials contributing only about 21%. This places it in a relatively beneficial position as IT spends are getting more diversified across sectors. Though the company has not contributed significantly in FY23, it has stellar revenue growth of 18.5% with EBIT margin of 18.2%. Also, the company has performed better than its peers (other tier 1 IT companies) in terms of the stock price. We continue to hold a significant position in this stock as it looks attractive on valuation parameters and we think that the downside is protected in this stock. Valuation at sub-20x with ~4.5% dividend yield and ~5% FCF yield provides a required margin of safety to hold on to the name despite near time slowdown in earnings. Over the next 5 years, we expect the Company to deliver 9.3% revenue growth and 8.9% PAT growth as the margin normalizes. Despite this, Core ROIC is expected to improve to 40%+ vs 27% in the last 5 years driven by the increase in payout ratio from 50% to 75%.

b. Low Cost Airline

It operates the largest low cost carrier (LCC) in India with nearly 56% share of the domestic market (market share as of 9M FY23) and fast rising share of the international market. Even as India’s domestic aviation market has witnessed healthy double digit growth in the past two and a half decades, it still remains a highly underpenetrated market and hence provides strong growth opportunities. For the past two years, industry has moved from one crisis (Covid) to another (Crude price) which has severely impacted its profitability.

The company has built a strong business model, which focuses on strengthening its customer service by building trust (on-board and off-board engagements), convenience (frequency of flights) and offering wide connectivity, to become the preferred choice of travel. Inducting fuel efficient aircraft and upping its fleet utilization between domestic (day-time travel) and international (night-time travel) travel, will enable them to continue to operate the business as one of the lowest cost airlines in the industry. Rising competition is a concern on yields, but it will be difficult to replicate the Company’s length and breadth of network. Further, the Company’s focus on short-haul non-stop international flights, will give them the first mover advantage, and which will keep the competition behind the curve for a foreseeable future. Based on our industry working, we expect it to witness 20%+ passenger CAGR growth implying overall market share (Domestic and International) gains of 150-200 bps by FY28.

c. Leading Fertilizer Manufacturer

The company is one of India’s largest Phosphatic fertilizer players and is engaged in the business segments of Fertilizers, Specialty Nutrients, Crop Protection and Retail. The company has 750 rural retail outlets across Andhra Pradesh, Telangana and Karnataka with 1000+ crop advisors.

It is also focusing on growing its crop protection chemicals business, which is a higher growth and higher margin business. Recently, it has also announced capex to foray into speciality chemicals and CDMO business, which appears to be a step in the right direction for the company. Over the next 5 years, we expect the industry volume growth to remain in line with agricultural GDP growth, while we expect realizations to normalize from their FY23 highs on account of correction of raw material prices from their peaks, resulting in a slowdown in the nominal growth compared to the past 5 years. However, the Company with its strong backward integration and raw material security, robust cash flow generation healthy return ratios and increasing share of contribution from faster growing crop protection segment, is expected to do well in the future. The company is well positioned to ride the structural growth in the agriculture sector.

Appendix 1: Performance of the fund for FY2023

Appendix 3: Current view on top seven positions

Appendix 4: Analysis of our performance over last seven years