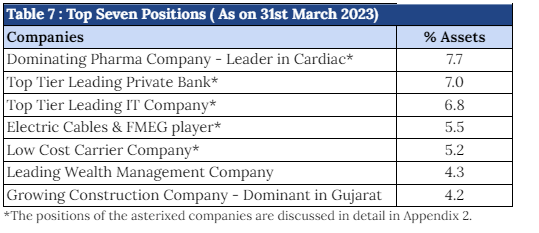

Table 7 below shows a list of our top seven positions (based on asset weight) as on March 31, 2023.

We have already discussed our investment view for the first five companies in Table 7. Our view on the remaining two companies is as follows:

a. Leading Wealth Management Company

The company is a leading wealth management player and one of the top 3 largest non-bank mutual fund distributors of India. They target the HNI segment with ~INR 5 crores investible surplus, which has a very large addressable market, is not a focus area for large wealth managers and also doesn’t have bargaining power. They have a focused approach with just two products – Equity and Debt Mutual Funds and non-principal protected structured products. Investments in mutual funds are through regular schemes only. Non-principal protected structured products constitutes 1/3rd of the AUM but more than 63% of the revenue and lack of understanding relating to the non principal protected structured products is leading to lower valuations for the company. As equity trail fees increase, the valuations should also increase.

The company has delivered CAGR of ~20% in revenues and ~30% in earnings over the last 5 years and the growth target of 25% over then next few years which seems achievable driven by 4 factors – Growth in non of RM, More customers per RM, AUM increase per client and AUM growth due to market growth. We expect some volatility in non-principal protected structured product revenues due to the transition from 3 year to 5 year products, but despite that we expect the company to continue to perform well in its selected segment.

b. Growing Construction Company – Dominant in Gujarat

The Company has an established presence in the civil construction industry with an operational track record of over a decade, culminating in repeat orders from reputed clientele. It is a proxy play on pick up in the capex cycle in India from both Government and Private sector after a long lull due to Covid. After the successful completion of the large and prestigious Surat Diamond Bourse project, the Company is eligible to bid for similar larger sized projects, adding further upside to business growth potential going forward. They have consistently demonstrated execution excellence, adopted both latest construction technology and best labor practices, maintained balance sheet discipline and are selectively capitalizing opportunities to grow sustainably going forward. Medium term earnings growth outlook is positive given the current order backlog and healthy pipeline.. Based on the existing order book and upcoming opportunities, we expect it to deliver a CAGR of 20.1% in revenues and 24.6% in PAT over the next 5-years.

Appendix 1: Performance of the fund for FY2023

Appendix 2: Key Performance Contributors in FY2023

Appendix 4: Analysis of our performance over last seven years