India: Long term growth opportunity

India is one of the most populous countries (population of ~1.43 billion) along with China. India is a land of diversity. Each state distinctly differs from the other in language, culture, religious beliefs, staple diet etc., almost like multiple countries within one. India’s economy is driven by domestic consumption (60% contribution to GDP), in contrast to China (exports are 60% of GDP). The Indian economy has diverse contributors; 65% from services; 20% from manufacturing and 15% from agriculture. India has one of the youngest populations with a median age of 28 years as compared to 38 years for the US and 39 years for China. With two-third of the entire population below 35 years of age, India will continue to see a rising share of population in the working age group (25-64 years) for another two decades, unlike the rise in an ageing population being seen in Europe, Japan and now in China. India is expected to be the fastest growing major economy for a third year in a row- IMF recently raised its GDP growth forecast for FY 2025 to 6.8%.

Global macro-outlook-2024

The global economy remains remarkably resilient, with growth holding steady despite being uneven across major economies and high inflation leading to high central bank interest rates. As per the IMF’s April 2024 World Economic Outlook report, the Global growth is estimated at 3.2% in 2023, higher than its projection of 2.8% made last year. The IMF has projected the Global growth to sustain at 3.2% in 2024 and 2025. The 2025 growth estimate has been revised up by 0.3% from earlier projections mainly driven by strength in the US economy, despite headwinds from lingering high inflation, weak demand in China and Europe, and spillovers from two regional wars. The IMF revised its projections for U.S. GDP growth in 2024 sharply upward to 2.7% from the 1.6% growth projected in April 2023, on stronger-than-expected employment, high levels of government expenditures and consumer spending.

The IMF projects the Global headline inflation to fall from an annual average of 6.8% in 2023 to 5.9% in 2024 and further to 4.5% in 2005. Goods inflation has normalized due to supply increases and normalization of supply chain bottlenecks. However, service inflation is showing stickiness due to continuing wage pressures. US CPI inflation was 3.5% YoY in March 2024 Vs 3.0% in June 2023, and core CPI remains elevated at 3.8% YoY. US 10-year bond yields, which fell between October and December 2023, have risen since the start of 2024 to 4.65%. Market expectations for interest rate cuts by the Federal Reserve in 2024 have fallen from 175bps to 50bps. With inflation having peaked in 2022 and softening in 2023, central banks have been reversing their tight monetary policy stance since 2023.

Equity markets suffered a 10-15% drawdown from July to October last year and bottomed out at the end of October. Plausible factors that have supported equity markets over the last few months- reduction in inflation, interest rate cut expectations, the resiliency of the US economy and the potential for generative AI. What happens next depends on the impact of a range of things:

● Geopolitical events

● Trajectory of inflation

● Changes in interest rates, economic conditions, and earnings

● Rising interest payments by governments, real estate investors and consumers

● Impact of generative on AI on the economy

The two decades after the end of the cold war are often referred to as a period of “Pax Americana”- a dominant, but benign superpower that could enforce peace, and a world that focused on economic integration and growth. Over the last decade, both China and Russia have sought to enforce regional dominance over smaller countries, and this has raised the risk of conflict. The war in Ukraine, the renewal of conflict in the Middle East and the differing interpretations of Taiwan’s status are all issues that can escalate with severe consequences for the global political economy.

The US market advance since October 2023 has been narrow – and technology, particularly large-cap technology led. While sentiment (often a contrarian indicator) on the trajectory of the economy and the path of interest rates is quite positive, it is not extreme. The market leaders are companies that are cash generative, even if valuations may be stretched and the weight of the large cap tech companies in indices are at a historic high.

The resiliency of the US economy, despite two years of sharp interest rate hikes and a long-standing inverted yield curve, is supportive of the “no-landing” scenario. Plausible reasons why this may be happening include:

- High levels of government expenditure

- Sharp rise in immigration

- It is estimated that 50% of the growth in the labor market over the last one year has come from foreign-born workers

- Market exuberance exists in certain segments of the market- anything AI related and more recently in the crypto domain, but it is not widespread as yet.

2024 is an election year in the United States and we expect the fiscal support to remain and monetary policy to be benign (follow market expectations). It is likely that markets will overestimate the potential for generative AI, but it is unclear if we are already at that stage. Companies like Nvidia, which have grown revenue and profits significantly, are possibly over-earning in the short term. The technology sector is always vulnerable to disruption, and we think that is a key risk to the markets today.

India macro-outlook-2024

The Indian economy remains one of the fastest growing economies amidst the developing economies. There are a number of structural factors favoring a sustained period of high growth for the Indian economy under the right set of conditions.

First, with a growing and young population, the working age population will continue to rise for another two or three decades. The median age of 28 years makes it one of the youngest populations in the world. Second, with low penetration and consumption per capita levels, of a vast range of products and services, several end markets can sustain high single digit to double digit growth rates for 10 to 20+ years. Third, India is not one market but many markets: Urban versus Rural, bottom of the pyramid all the way to the super-luxury. As such, sizable opportunities exist for a wide range of products and services – from two wheelers to luxury cars, from basic consumer goods to high end fashion goods and so on. Fourth, though India may still be a difficult place to do business relative to many developed or developing countries, there has been a consistent improvement in ease of doing business over the last few years.

Historically, the Indian economy saw scaling up of some businesses that were led by very able managers, crossed many barriers and created a scale that not many others could achieve and such businesses generated very strong returns on capital and hence became great companies to invest in. Increasingly though amidst an improving climate for doing business, India is witnessing a formation of a large number of new age companies that embrace technological changes and are able to scale up rapidly thanks to availability of venture capital and new channels to sell products and services. Between the well established companies that boast superior profitability and market position and the new age companies that have potential for explosive growth, Indian equities has continued to be a ripe place for stock picking. Today, India represents one of the largest start-up ecosystems in the world aided by the presence of all the major venture capitalists and private equity firms who are funding new business ventures of thousands of dynamic entrepreneurs with potential to not only transform Indian markets but also win on a global scale.

All the structural factors can be conducive to growth only if the right environment exists. We have discussed the success of the current Indian government to both widen and deepen the structural economic reforms where it has contributed to faster economic growth and created a bigger social safety net for the indigent. Some of these include:

● Introduction of GST leading to increased formalization of the economy : This introduced a uniform indirect tax system across the country and removed the state by state taxes which had hindered inter-state commerce. There was a more than 50% increase in the number of indirect tax payers. This has not only aided the government’s efforts to widen the tax base, increase tax collection and have the capacity to provide social benefits without increasing the fiscal deficit, but from our perspective, has leveled the playing field for organised companies which were initially tax compliant.

● Demonetization and shift to digital economy : This was a controversial move in that it caused a temporary slowdown in the economy. However, it accelerated the inclusion of the poor into the banking system and greatly expanded the roll out of the digital payment system. India’s rapidly growing digital payments network has reduced transaction friction and corruption significantly. India’s unique, real-time, mobile-enabled Unified Payments Interface (UPI) continues to grow at a breakneck pace. Shift to Digital ecosystem continues to accelerate: UPI was expected to serve 100 mn merchants and 750 mn consumers and against this it reached 50 mn merchants and 300 mn consumers in FY24. The volume of UPI transactions has catapulted from 43 cr in CY17 to 11,761 cr in CY23. India is now the global leader for digital transactions accounting for 46% of the world’s digital transactions. To reach the first 1,000 cr P2M UPI transactions took 4.5 yrs, with the latest 1,000 cr transactions taking 45 days (source:RBI governor speech Mar 2024) The UPI has further evolved to allow for offline payments through near field communication (UPI Lite) and payments through feature phones (UPI 123 pay).

● Inflation targeting : The government has kept inflation under check over the last five years through prudent fiscal policies. This allows for greater predictability for businesses and consumers, and results in lower real rates in the long run. Despite increases in budget support to vulnerable groups, fiscal deficits have been kept under control. This has also allowed inflation to be lower than historic norms. Reduced corruption from direct transfer of benefits to bank accounts has helped widen benefits while keeping spending under control.

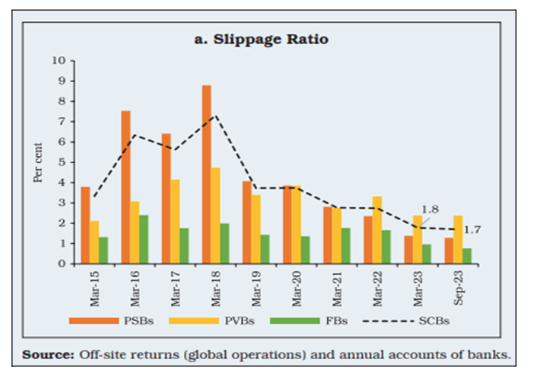

● Bankruptcy process : New laws have sped up the bankruptcy process and given greater power to Creditors. The Insolvency and Bankruptcy Code, 2016 has brought about a behavioural change among debtors. The fear of losing control over the enterprise upon initiation of Corporate Insolvency Resolution Process (CIRP) has nudged thousands of debtors to settle their dues before initiation of the process. The realization by financial creditors under resolution is ~ 177% while under Liquidation was ~ 33% of claims. In the long-term, this should facilitate lower risk for lending, faster credit and better quality credit growth.As per RBIs latest data, the GNPA ratio of scheduled commercial banks fell to ten-year low of 3.2% and NNPA fell to 0.8% as of Sept-23.The much improved bankruptcy process sess slippage ratio continuing to surprise positively with it looking set to remain below 2% for the second consecutive year in FY24 .

● Labor : More needs to be done here to compete with other Asian countries in terms of export oriented industries, but States now have the power to change laws to allow for more flexibility for companies to enter and exit as business conditions change and several states are in process of implementing simplified labor laws.

● Infrastructure : A key hurdle India has faced in rapid industrialization has been the poor infrastructure. The recent Indian budget increased infrastructure investments by the government by over 30% by 11%. Construction of roads, ports, extending freight rail infrastructure and building new airports have all accelerated over the last seven years. The NHAI’s mandatory payment of user fee through FASTags is seeing increased adoption. Further, the ministry of road transport and highways continues to work towards reducing logistics cost to single digits from 13 to 14% currently. The move has brought about much needed efficiency in toll road operations and improved revenue collection.

● Financial sector remains resilient : The credit growth in the banking system maintained its momentum growing 16.1% YoY (ex-HDFC ltd. merger) in FY24 with the unsecured retail growth outpacing overall credit growth. To rein in the growth in the unsecured retail space the RBI raised the risk weights on consumer credit from 100% to 125% and also lending by banks to NBFCs saw a similar increase in risk weights. The move is expected to bring in a much more balanced credit growth.

All the structural reforms along with the strong underlying economic factors could propel the Indian economy into a multiyear high growth journey which could far better than any other emerging economy.

Fixed income market valuation & outlook : The fixed income market was a story of 2 halves, pre and post the JP Morgan Bond inclusion event. Starting with a downward spiral that took 10-year g-sec yields to a year low of 6.9% in May 2023 supported by the MPC revising down the CPI inflation target to 5.1%. However, this was followed by a slow upward grind driven by a sharp spike in July CPI to 7.4% with yields peaking at 7.4% in the middle of the year. The fiscal consolidation smoothened the process of Indian Bonds inclusion in the JP Morgan Bond emerging market debt index and we will now be subject to more fiscal scrutiny. Inflation took a breather too, on the back of expectations of better Rabi crop and yields saw a good move down. The yields eased to 7.1% post the announcement of the Interim budget February 1, 2024, and tracked the US treasury yields thereafter ending the year at 7.05%. RBI expects CPI inflation to average 4.5% in FY25 and we believe there could be positive surprises here. We have seen core CPI (excludes food and fuel) track below RBIs 4% threshold for the last few months and the lower fuel costs are still to reflect completely in the numbers. We believe the probability for repo rate cuts in FY25 is rising.

Equity market valuation & outlook : The valuations of large cap equities are at a marginal premium to long term averages, while the mid-cap and small cap look expensive on a price to book and price to earnings perspective. However, the investment landscape is supported by a strong economy, robust corporate earnings and sound monetary policy. Investor demand has been a key driver with retail investors using SIPs to participate in the markets on a regular basis In addition, we saw sustained inflows from FIIs. We believe, in the past the constraints for growth came on the capital and energy side. With the banking sector health being its best in decades and the government has been proactive in tackling the constraints on energy, the better-than-expected GDP prints are here to stay. Moreover, India is benefitting from the resilient global growth and the reconfiguration of global supply chains and rising trade tensions between the US and China. Hence, the investment manager believes earnings momentum justifies a premium market valuation. While the Investment Manager is positive on equities with a three to five-year perspective, the Investment Manager’s focus remains on buying businesses that are available at the right price based on their intrinsic value and not on a relative basis. Investment Manager believes the markets are in a phase where we are seeing higher volatility in the near term, but with inflation easing and the uncertainty on the political front abating the risk to reward ratio could turn favourable from a medium to long term perspective.

The key factors which can impact markets and need to be closely monitored are:

1. Geopolitical situation;

2. Commodity and crude price movements;

3. Global Interest rates and credit availability; and

4. Monsoon and rural consumption.

Links:-

Appendix 1: Performance of the fund for FY2024

Appendix 2: Key Performance Contributors in FY2024

Appendix 3: Current view on top seven positions

Appendix 4: Analysis of our performance over last Eight years