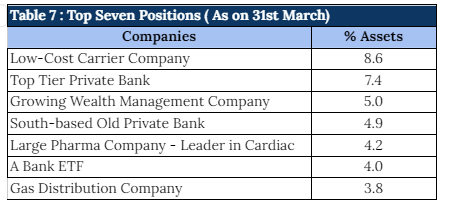

Table 7 below shows a list of our top seven positions (based on asset weight) as on March 31, 2024.

We have already discussed our investment view for five of the companies in Table 7. Our view on the remaining two companies is as follows:

a) Top Tier Private Bank

Our investment thesis was driven by the change in MD leading to a culture change with high focus on granularization of the book and sorting of the NPA mess. All parts of our thesis have played out well: Contribution of retail, rural and business banking books has gone up to 70% of total advances as compared to 60% three years ago. Also, the contribution of low yielding overseas books has simultaneously come down. Gross NPA ratio, which was at 6.7% as of March 2019, has come down to less than 2.16% as of March 2024. Also, the exposure to vulnerable accounts and restructured books over the period has come down, reducing the overall riskiness of assets. The bank has been effectively able to leverage technology, and its tie-up with various players for credit cards has been a huge success resulting in significant increase in credit card spend market share in the last one year. Our thesis has played out on all counts and RoA has improved to 2.37% in FY24 and the stock has undergone significant rerating. The bank continues to surprise with its industry leading growth (16% in FY24) in spite of significant increase in repo rates and ROA numbers.

b) South-based Old Private Bank

It is a turnaround story led by the appointment of an ex-ICICI banker as an MD in Oct, 2020 for three years. Even though the bank is privately held, it used to run like a Public Sector Bank. Post the appointment of the MD, he made numerous changes in the bank. He brought more people from top private banks in the top & second level of management. More importantly, he changed the credit culture of the bank. He gave the highest priority to asset quality rather than growth. He started to run down the book which seemed risky to him. He focused on collections, tech, and building sustainable franchises. The MD resigned citing personal reasons, completing his three-year term in Oct 2023. The new MD has done a similar type of turnaround at KVB and we believe all the blocks are well-placed for him to take the bank to another level. We believe he is a good choice to continue the legacy of the bank. The stock continues to trade below its book value.

Links:-

Appendix 1: Performance of the fund for FY2024

Appendix 2: Key Performance Contributors in FY2024

Appendix 4: Analysis of our performance over last Eight years

Appendix 5: Outlook for Indian Economy