As Sameeksha has completed seven years of operating the PMS, it is worth reviewing seven key aspects of our performance.

| Particulars | Summary of our performance | |

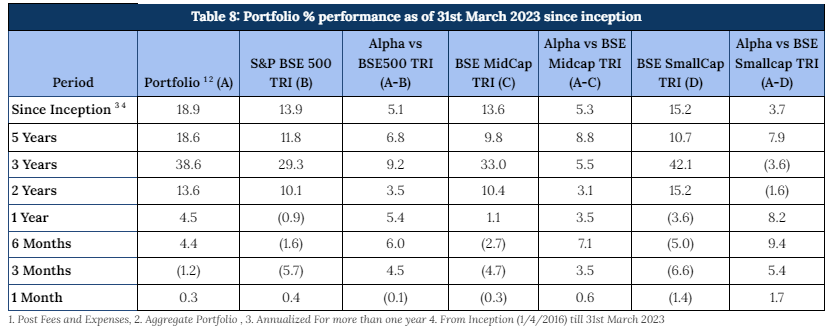

| 1. | Aggregate portfolio returns as of March 31, 2023 (Refer Table 8- Appendix 4) | Since inception3 till March 31st 2023, Sameeksha PMS has delivered annualized alpha of 5%.For the five year and three year periods ending 31st March 2023, Sameeksha PMS has delivered annualized alpha of 7% and 9% respectively. |

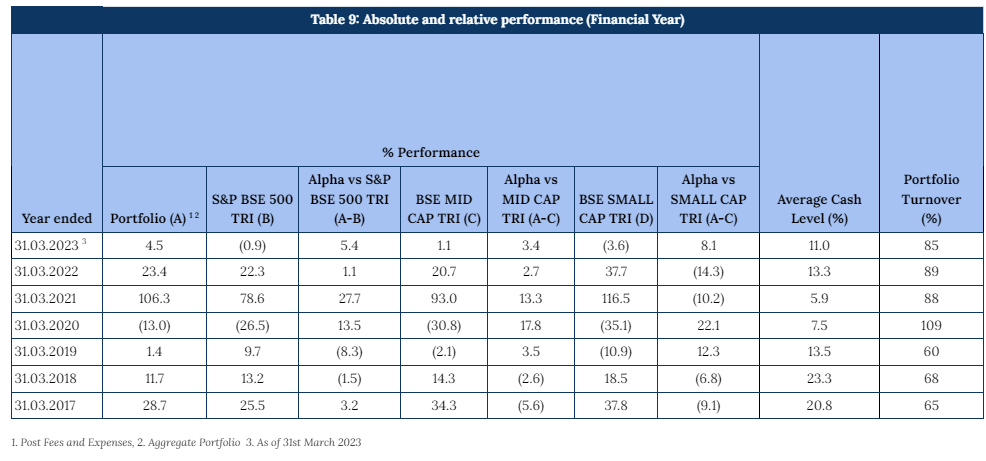

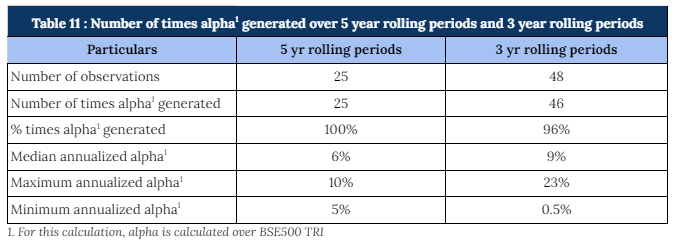

| 2. | Fund performance on a Financial Year basis (Refer Table 9 and 10- Appendix 4) | Delivered alpha1 (outperformance over the benchmark 2) in 5 out of 7 Years Aggregate annual alpha over all the seven years ~ 41% Median alpha ~ 3.2% |

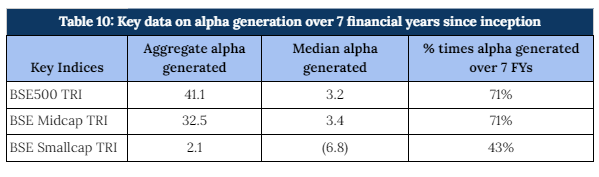

| 3. | Fund performance on a rolling period basis(Refer Table 11 – Appendix 4) | 5 year rolling period since inceptionAlpha delivered 100% of the time (i.e 25 out of 25 observations)Median alpha ~ 6%3 year rolling period since inceptionAlpha delivered 96% of the time (i.e 46 out of 48 observations)Median alpha ~ 9% |

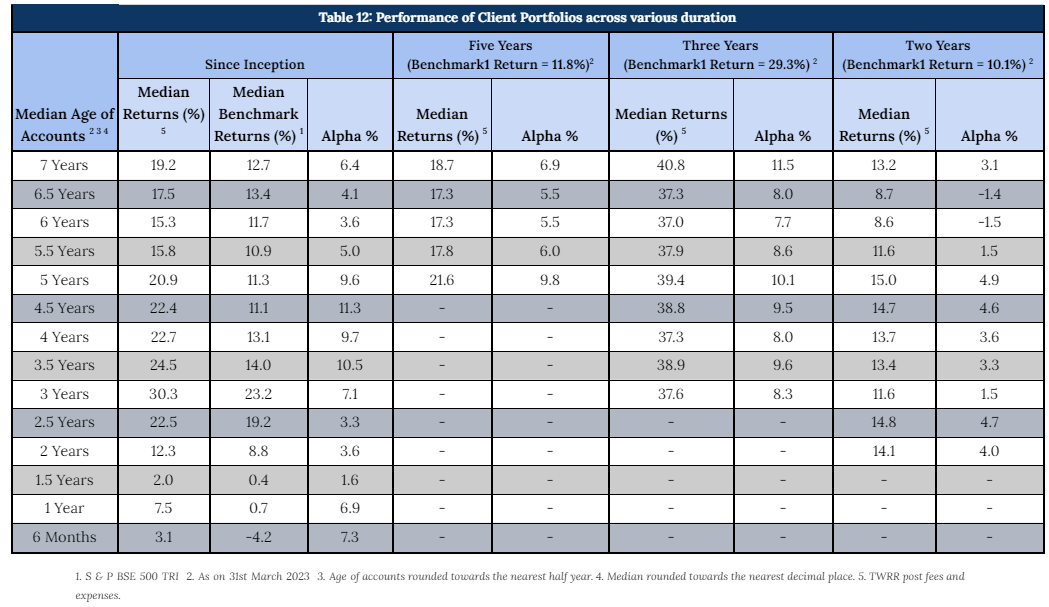

| 4. | Returns of Individual portfolios(Refer Table 12, Table 13 and Table 14 – Appendix 4) | As Sameeksha PMS does not follow model portfolio approach, tracking individual client performance becomes more relevantFor example, a client who invested in our PMS approximately Five years ago has realized an annualized alpha of 10% over benchmark as of March 2023. A vast majority of our clients with an age of account from six months to seven years have realized positive alpha. |

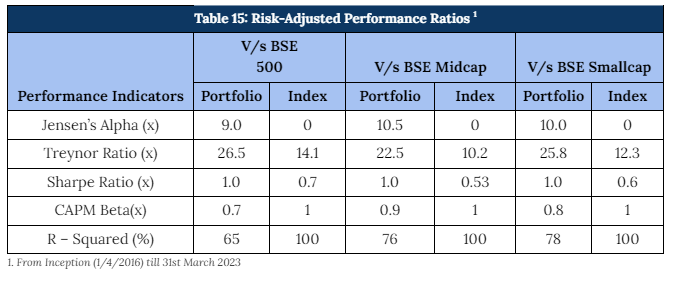

| 5. | Risk Adjusted Ratios(Refer Table 15 – Appendix 4) | Our portfolio beta (0.7) has been materially lower than the benchmark, and our returns have been higher than the benchmark since inception, implying superior risk adjusted performance |

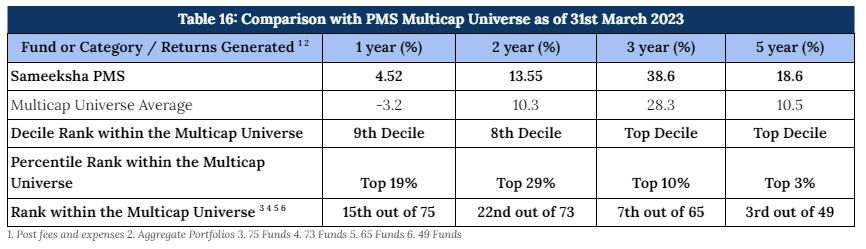

| 6. | PMS Universe rankings(Refer Table 16 – Appendix 4) | Among multicap PMSes with AUM more than INR 100 crs as of March 31st 2023, Sameeksha is ranked 3rd out of 49 funds for five year period and 7th out of 65 PMSes for the three period as per performance reported to PMS Bazaar. |

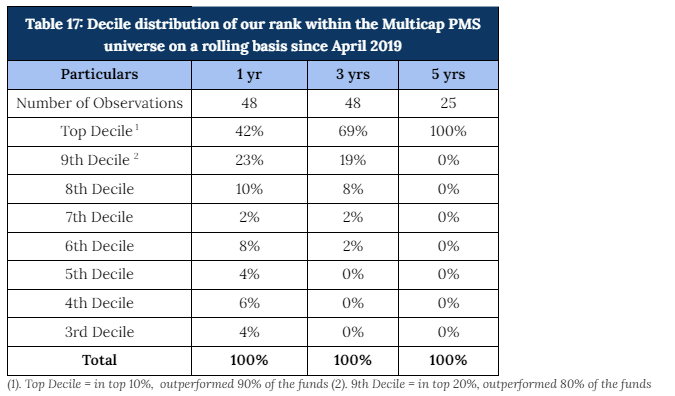

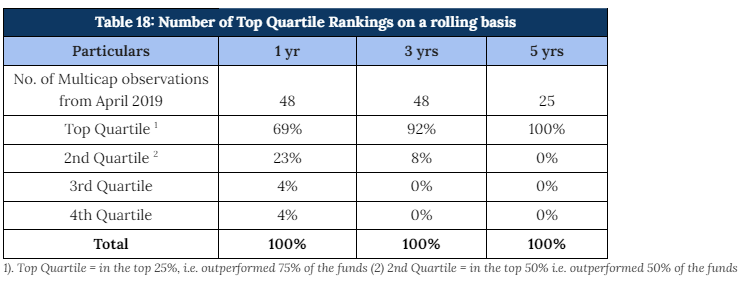

| 7. | Rolling returns and rankings(Refer Table 17 and Table 18 – Appendix 4) | For the rolling five year period, we have been in the Top Decile 100% of the time (25 out of 25 observations)For the rolling 3 yr period, we have been in the Top Decile 69% of the time (33 out of 48 observations). |

1. For the purpose of this summary table, alpha over the benchmark BSE500TRI is mentioned. 2. Benchmark is BSE500TRI 3. Inception is 01.04.2016

It is important to note that we have maintained relatively higher levels of cash (13.6% on average over the entire period from inception) from time to time over the duration of managing the portfolio. Notwithstanding the same, from inception as well as over five and three years respectively, we have generated returns of 18.9%, 18.6% and 38.6% beating the benchmark BSE500 TRI returns of 13.9%, 11.8% and 29.3% respectively after fees and expenses. Before deducting fees and expenses, we have generated returns of 20.3%, 19.9% and 40.8% for the period from inception (~7 years), five years and three years respectively. We have delivered strong returns relative to benchmark across various key time periods. (Table 8).

Performance on a Financial Year basis

For the current financial year ending March 2023 (April 2022 to March 2023), Sameeksha PMS has outperformed the benchmark BSE 500 TRI by generating 4.5% returns against the benchmark BSE500TRI returns of -0.9% (Table 9). Discerning investors would notice that we have delivered this performance despite maintaining a meaningful percentage of our portfolio in cash from time to time and that is well reflected in our risk-adjusted-performance outcomes.

Looking at our performance over the financial years, we have outperformed the broader indices BSE500 TRI and BSE Midcap TRI in five out of seven financial years. That is to say, we managed to carve out an annual alpha 71% of the times over the seven financial years. It is important to note that we delivered this alpha despite maintaining a median cash level of 13.3% across the seven financial years. Further, our PMS has delivered a substantial aggregate annual alpha of 41.1% over BSE500 TRI with a median alpha of 3.2% (Table 10).

Fund performance on a rolling period basis

Rolling returns are a more useful indicator of consistency in performance versus single period returns. For the rolling three year periods applicable to our entire operating history, Sameeksha PMS has delivered annualized alpha 96% of the times (46 out of 48 observations) ranging from 0.5% to 23% alpha. For the rolling five year periods applicable, Sameeksha PMS has delivered annualized alpha 100% of the time (25 out of 25 observations) ranging from 5% to 10% alpha (Table 11).

Performance Of Individual Portfolios

Because we don’t follow model portfolio strategy, the performance of individual clients is far more important than overall portfolio aggregate returns. For investors who are with us for 3 years and more, Sameeksha PMS has returned a very substantial alpha with a median annualized alpha of approx. 8% for the three year period ending 31st March 2023. Similarly, for investors who are with us for 5 years and more, Sameeksha PMS has returned substantial alpha with a median annualized alpha of approx. 6% for the five year period ending 31st March 2023. As shown in Table 12, the vast majority of our clients have seen positive alpha over benchmark.

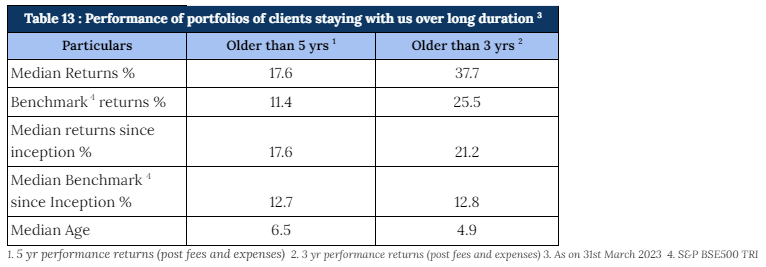

Long term investors, mainly investor accounts older than 5 years and 3 years, have carved out strong alpha, thereby proving Sameeksha PMS to be a valuable partner for their investments (Table 13).

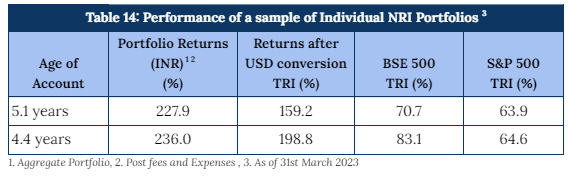

Our NRI clients have also seen strong returns even after factoring in rupee depreciation against US dollars. The portfolio returns are significantly higher than both BSE 500 TRI and S&P 500 TRI, generating strong alpha over both these indices (Table 14)

Risk Adjusted Ratios

When compared on a risk-adjusted basis, our PMS shows an even stronger performance with a risk-adjusted alpha generation of 9.0% over the broader market benchmark since its inception. While our portfolio beta has been materially lower than our benchmark, our returns have been higher than the benchmark since inception, implying superior strong risk adjusted returns.

Furthermore, other risk-adjusted returns – Sharpe ratio and Treynor ratio, are also significantly higher than the benchmark indices (Table 15). It is worth noting that we offer superior risk adjusted returns not only compared to the broad BSE500 index heavily weighted towards large cap but also the small cap and mid cap benchmarks as demonstrated by our Sharpe ratio, Alpha, Treynor ratio and Beta.

Performance within the PMS Universe

We continue to maintain our top rankings both within the multicap PMS universe as well as the entire PMS universe for key periods of three and five years. The multicap PMS universe rankings are more relevant to us since we follow the multicap strategy.

In the interest of a fair comparison, we present our rankings among those multicap PMSes with AUM more than INR 100 crs. For the three year period, we are ranked 7th out of 65 PMSes. Further, we are ranked 3rd out of 49 PMSes for the five year period comparison within the multicap universe – highlighting our superior performance over the long term periods (Table 16). Among the multicap universe (considering all AUM), we are consistently ranked in the Top Decile for the five year period for all 25 out of 25 observations reflecting well on the consistency of our performance.

Rolling Returns and Rankings

For the rolling three year periods applicable to our entire operating history, we have been ranked among the multicap universe in the Top Decile 69% of the time (33 out of 48 observations) and in the Top Quartile 92% of the time (44 out of 48 observations). For the remaining 8% observations, we were ranked in the Second Quartile (Tables 17 and 18). For the rolling five year periods applicable for our entire operating history, we have been ranked among the multicap universe in the Top Decile 100% of the time (25 out of 25 observations).

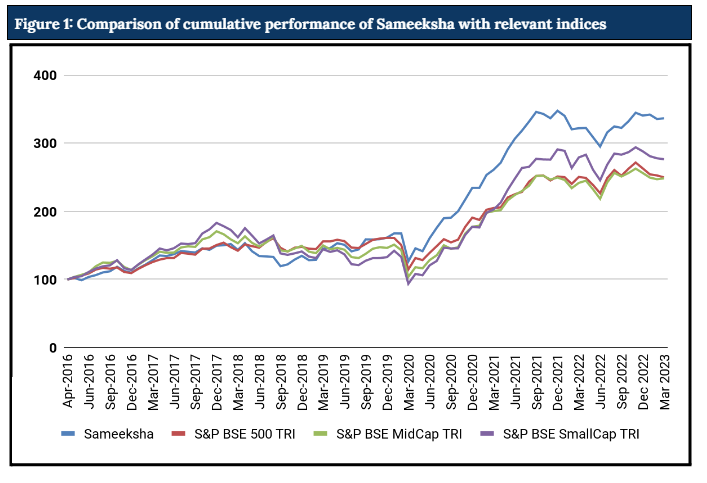

Cumulative Performance versus the benchmark

Sameeksha’s outperformance over its benchmark has continued to widen positively over the years. An investment of Rs. 100 with us since inception (April 2016) would have grown to Rs. 336, far outpacing what one would have earned by investing in a fund that achieved benchmark returns (Figure 1).

Appendix 1: Performance of the fund for FY2023

Appendix 2: Key Performance Contributors in FY2023