There are a number of structural factors favoring a sustained period of high growth for Indian economy under the right set of conditions. . First, with a growing and young population, the working age population will continue to rise for another two decades or so. Second, with low penetration levels and consumption per capita levels of a vast range of products and services several end markets can sustain high single digit to double digit growth rates for anywhere from 10 to 20 plus years. Third, India is not one market but many markets: Urban versus Rural, Bottom of the pyramid all the way to the super-luxury. As such, sizable opportunities exist for a wide range of products and services – from two wheelers to luxury cars, from basic consumer goods to high end fashion goods and so on. Fourth, though India has been a difficult place to do business, there is a strong entrepreneurship culture that leads to formation and scaling up of some great businesses.

All the structural factors can be conducive to growth only if the right environment exists. In this context, the current government has initiated a number of long-term structural reforms which should bring economic growth closer to potential. Some of these include:

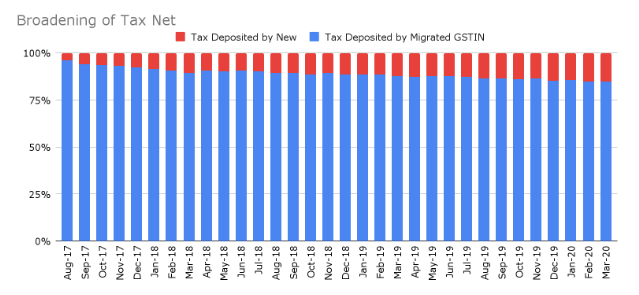

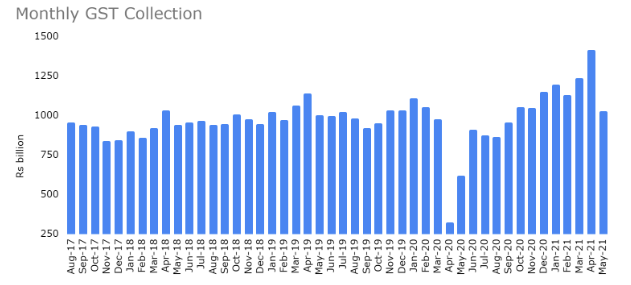

- Introduction of GST leading to formalization of the economy: This introduced a uniform indirect tax system across the country and removed the state by state taxes which had hindered inter-state commerce. There was a more than 50% increase in the number of indirect tax payers. Based on the latest data available for June 2020, there were 12.31 million tax payers registered with GST of which 5.33 million taxpayers migrated from the older system while 6.98 million new tax payers were registered. While tax deposited by the newly registered taxpayers cumulatively forms only 11% of the total tax collected since GST implementation, their proportion has been increasing gradually and contributed 15.07% of the total tax collection in March 2020. This has not only aided the government’s efforts to widen the tax base, increase tax collection and have the capacity to provide social benefits without increasing the fiscal deficit, but from our perspective has leveled the playing field for organised companies which were initially tax compliant.

Though there were several hiccups in the rollout of GST related to technology infrastructure, complex rules, COVID led disruption, reluctance among segments of economy to accept GST or take advantage of loopholes, the benefits of GST are quite apparent to listed companies (in which we can invest) and are visible through market share shifts. Industry participants otherwise reluctant to accept GST have no choice but to do so. Though COVID second wave has affected segments of the economy in recent months, sharp rise in GST collections is a clear sign of things to come.

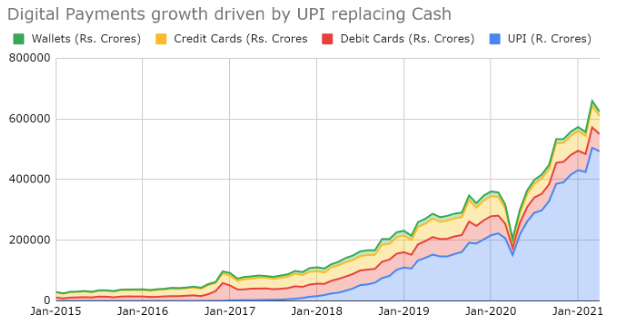

- Demonetization and shift to digital economy: This was a controversial move in that it caused a temporary slowdown in the economy. However, it accelerated the inclusion of the poor into the banking system and greatly expanded the roll out of the digital payment system. Concurrent efforts by the government to reform the direct tax system is leading to widening of the taxpayer base and further formalization of the economy.

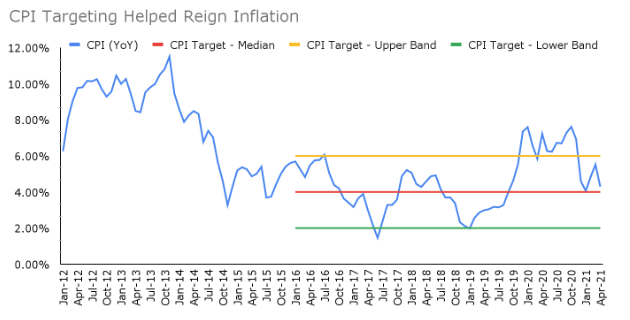

- Inflation targeting: The government has kept inflation under check over the last five years through prudent fiscal policies. This allows for greater predictability for businesses and consumers, and results in lower real rates in the long run. Recent surge in crude and other measures to promote local manufacturing have put a strong upward pressure on inflation and we will have to watch how inflation targeting plays out in coming months.

- Bankruptcy process: New laws speed up the bankruptcy process and give greater power to Creditors. In the long-term this should facilitate lower risk for Lending, faster credit and better quality credit growth.

- Agriculture: Though currently put on hold by the Supreme Court, proposed reform for agriculture can transform the rural economy and drive stronger economic growth.

- Labor: More needs to be done here to compete with other Asian countries in terms of export oriented industries, but States now have the power to change laws to allow for more flexibility for companies to enter and exit as business conditions change and several states are in process of implementing simplified labor laws.

- Infrastructure: The government has invested heavily in improving India’s poor infrastructure. On an average 37km per day of highways were constructed in FY 20-21. This can aid faster growth in rural areas, facilitate greater competitiveness for exports, improve economic productivity

Appendix 1: Update on the performance of our fund

Appendix 3: Investment philosophy and lessons learned

Appendix 4: Cash Calls and Portfolio mix across market cap buckets

Appendix 5: Examples of strong positive and negative performance contributors