As of 31st March 2022, Sameeksha PMS has generated a return (before application of performance fees) of 25.1 % for the financial year 2021-22, beating the benchmark BSE 500 TRI which returned 22.3% during the same period. Holding an average cash level of 13-14% reduced our performance by about 3%.

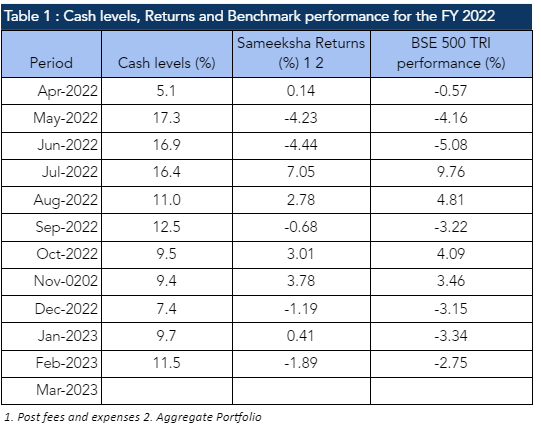

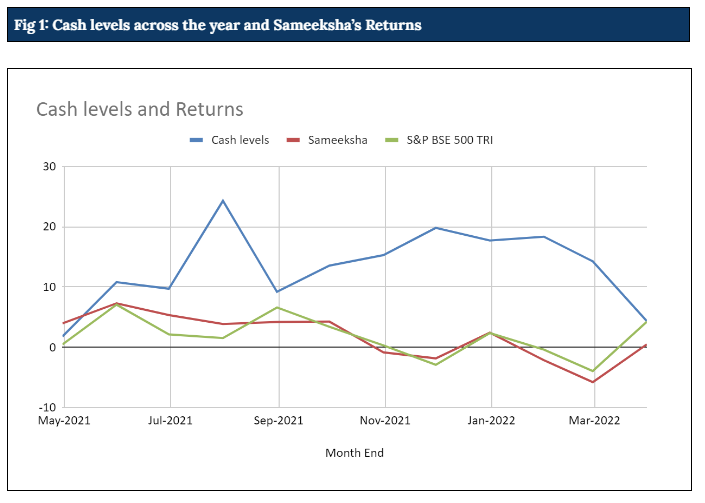

As shown in Table 1, we had double digit levels of cash for most of the year. However, looking at the performance, there appears to be very little to read from the change in cash levels. It was one such year in which after almost every correction, stocks rose again. While inflation was a factor at the back of our minds, the fall in inflation data for India towards the end of 2021 pushed us away from becoming cautious. Inflation showed a clear rising trend in the USA towards the end of 2021 and that picked up further due to the Ukraine war. While as they say hindsight is 2020, we should have given weight to our longstanding concerns about inflation and acted on that. Table 1 and Fig. 1 below show our monthly returns vis-a-vis our average cash levels.

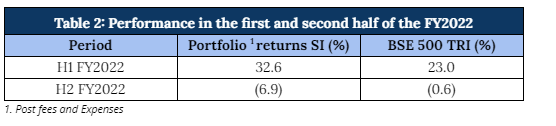

Another important aspect to evaluate is our performance during the first and second half of the financial year. While we did very well in the first half, we had noticeable under performance in the second half of the year as depicted in Table 2 below.

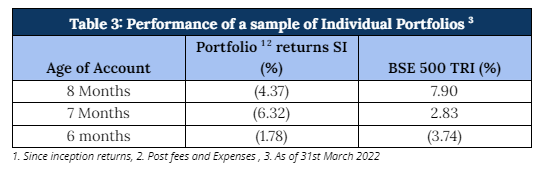

As can be seen in Table 3, the impact of the underperformance is seen more in the portfolio performance of our new investors, who have joined us in the last six to eight months.

While we can’t change the past, it is important for us to understand the reasons for such under performance for new accounts. As we have noticed in the past (2018 period), the stock selection mistakes tend to increase and we readily admit to that with respect to our investment in UTI. While the stock ticked on many boxes for us, what went against us was outrageous bonuses rolled out by the company at the detriment of minority shareholders. We also failed to pick signs of the coming slow down and added Vaibhav global after a correction in the stock.

We also observe that some of the stocks that contributed well to the performance of our older clients were not bought in many of the new accounts – these stocks were already at the price from which it made sense to not add as per our framework. One can identify this as a shortcoming of our approach of not following the Model Portfolio. However, we continue to believe that in the long run, the benefit of following this approach outweighs this apparent shortcoming.

Appendix 2: Key Performance Contributors in FY2022

Appendix 3: Current view on top seven positions

Appendix 4: Performance Analysis for Longer Periods

Appendix 5: Additional factors affecting Indian Economy / markets