Having launched our fund on 1st April 2016, December 2020 marked completion of the fifth calendar year of our operation. We are pleased to share with you an update on our performance of Sameeksha PMS, a multicap India equity fund suitable for qualified high networth investors and institutions.

When we launched our fund, we set ourselves an expectation of aiming for 12-15% return over a long period of time based on two main factors: First, the economic growth prospects of India and second our proprietary valuation framework that requires us to quantify the return potential for every investment and allows us to invest only when that potential meets or exceeds our minimum risk adjusted return criteria. Furthermore, we consciously chose to not adopt the mass-market/mutual fund type low cost model portfolio strategy and decided to treat every new capital contribution to our fund as unique. For every new account, we bought stocks that were still available at a price meeting our return expectations rather than simply copying our existing portfolio. We felt that investors in our fund deserve such customization and buying only what is available at the right price ought to be the most sensible way to invest. This approach required both more work as well as build out of internal capability but we decided to invest in that and now that we are approaching a completion of five year period for our fund, we can observe that such investments have clearly paid off. From inception till date, we have generated TWRR returns of ~20% at least five percentage points above the benchmark (CNX 500 Total Return Index) and that surely puts us among the top 2-3 best performing funds in India.

While we share with you the details of our performance taking various slices, we would like to stress that our performance has been achieved not just due to our stock selection and portfolio construction but also due to several factors favorable to equities such as structural corporate tax reforms undertaken by India and the drop in interest rates. As things stand today, inflation poses a clear risk and if that leads to a monetary tightening cycle, stock prices can experience a sharp correction.

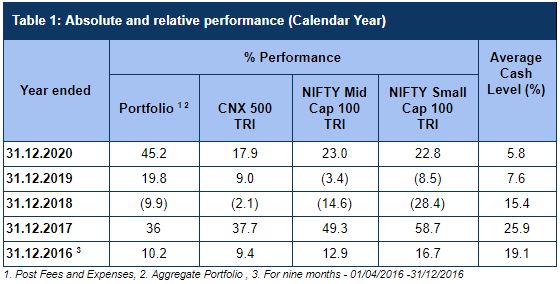

Since we just completed our fifth calendar year, it makes sense to first review our performance by calendar year. In 2020, we delivered our best outperformance versus benchmark following a strong year of outperformance in 2019 (Table 1). We would note that an absence of any index fund till date that copies the performance of CNX500 TRI is an indication that even matching CNX500 TRI would be a good achievement. It is important to note that we have achieved this performance despite maintaining varying levels of cash in the portfolio.

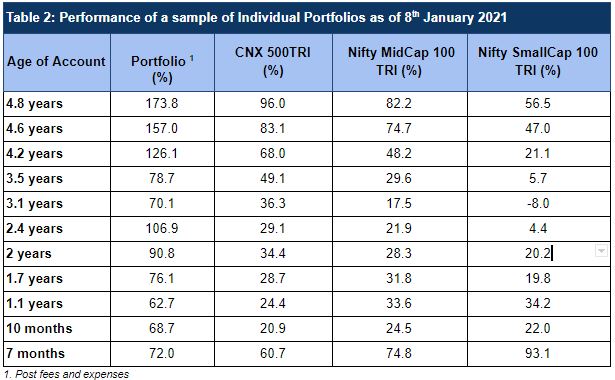

As stated previously, we aim to deliver good long term performance for investors irrespective of when they invest with us. Over the course of the years, we have delivered material outperformance over the benchmark to the clients who have joined us at different points in time and chosen to stay invested with us over a long period of time (Table 2).

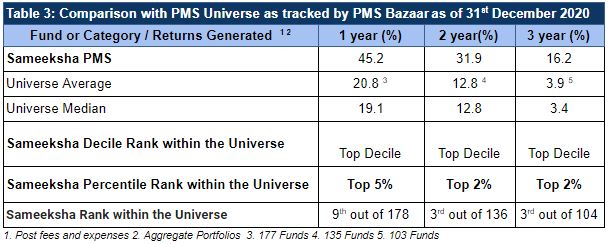

Amongst the Indian PMS universe we continue to perform materially above the average and maintain our position as one of the Top performing PMSes in India. We are among the top three performers based on the performance of two and three years and among the top five percent based on performance of one year. (Table 3).

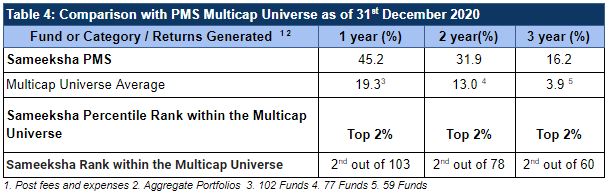

If we focus on the specific category of PMSes offering multicap strategy, we ranked as second among all PMSes offering similar strategy based on performance for one, two and three years. (Table 4).

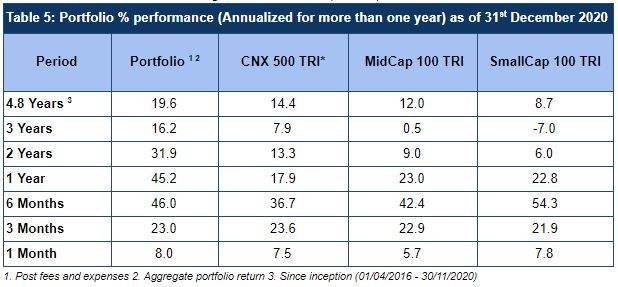

We continue to deliver material outperformance across various time periods over the relevant benchmarks with CNX500 TRI being the most relevant (Table 5).

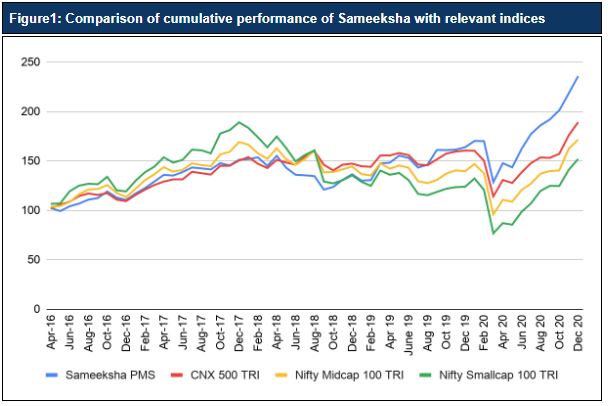

An investment of Rs. 100 with us since inception would have grown to Rs. 236 over 4.8 years, hugely outpacing the relevant indices (Figure 1).

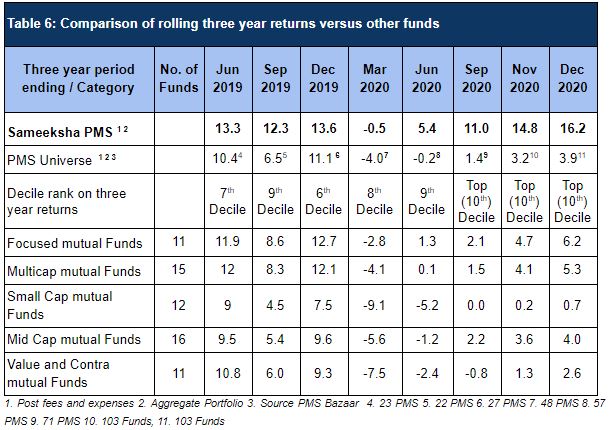

Consistency in performance is very important rather than being a one month wonder. We have been consistent in our performance, on a rolling three year basis when comparing our performance with the PMS universe as well as most of the relevant mutual fund categories (Table 6).

We have 21 monthly observation points for three year performance starting from April 2019. Based on this data set we observe as follows: Among the PMS universe, our performance has been in the top quartile 11 times and in the second quartile the remaining 10 times. In other words, our three year performance has always been above average. For the same dataset, we have delivered an average alpha of 4.5% and 3.9% respectively versus the categories of multicap and focused mutual funds respectively. In fact our average alpha since April 2020 is 7.4% and 6.5% versus the multicap and focussed funds respectively.

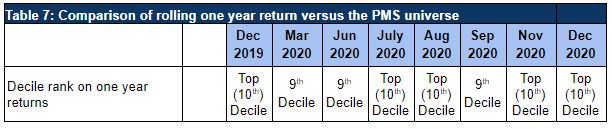

On a rolling basis, we have been consistently ranked in the top two deciles among the PMS universe for one year periods (Table 7).

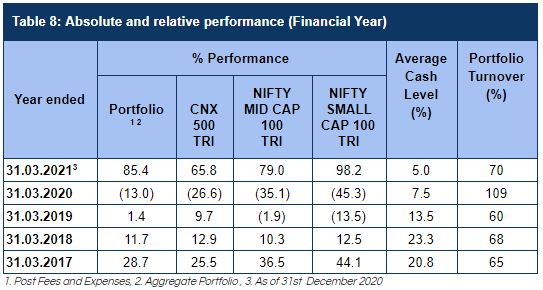

We capture our performance versus benchmarks on a financial year basis in Table 8. We have outperformed the key benchmark CNX500 materially for FY21 till date.

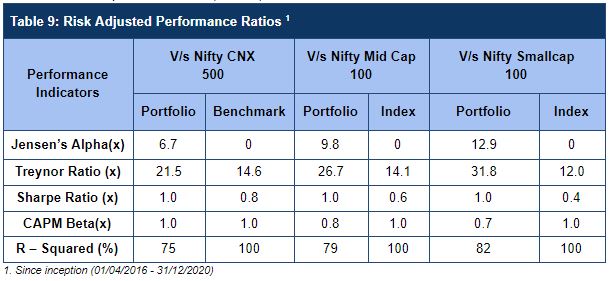

We have delivered superior risk-adjusted returns over the relevant indices that we are comparable with since the inception of the fund (Table 9).

We welcome any follow up questions.

DIsclaimer : The information contained in this newsletter has not been verified by SEBI.