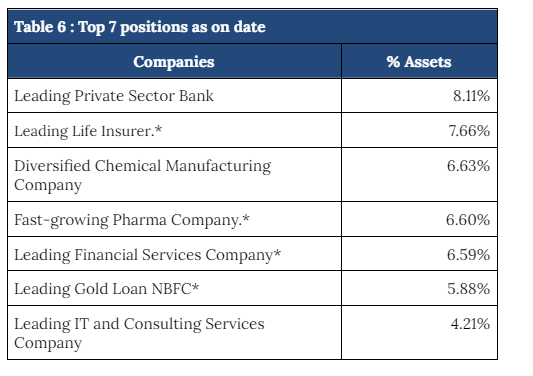

Table 6 below shows a list of our top seven positions (based on asset weight) as on June 17, 2022.

*The positions of the said asterixed companies are discussed in detail in Appendix 2. Our view on the remaining companies of the Top seven positions is as under-

a) Leading Private Sector Bank

Our investment thesis in the bank was driven by the change in MD leading to a culture change with high focus on granularization of the book and sorting of the NPA mess. All parts of our thesis have played out well: Contribution of retail, rural and business banking book has gone up to 68% of total advances as compared to 60% 3 years back. Also the contribution of low yielding overseas book has simultaneously come down from 10.7% to 4.8% over the same period. Gross NPA ratio, which was at 6.7% as of March 2019, has come down to 3.6% as of March 2022. Also the exposure to vulnerable accounts and restructured book over the period has come down, reducing the overall riskiness of assets. The bank has been effectively able to leverage technology and its tie-up with Amazon for credit card has been a huge success as well resulting in significant increase in credit card spend market share from 16.2% to 20.9% in the last one year. Our thesis has played out on all counts and RoA has improved to 1.77% in FY22 and the stock has undergone significant rerating. However given the increasing interest rate environment and the significant exposure to repo linked loans, there is further scope for RoA expansion and so we continue to hold.

b) Diversified Chemical Manufacturing Company

The company is a diversified chemical company. It has 4 business segments comprising i) Basic chemicals, ii) Fine & specialty chemicals, iii) Performance chemicals and iv) Phenol-Acetone. It has a history of bringing in new products and attaining market leadership in those. The company’s strategy over the last 50 years has been import substitution, cost optimisation and market leadership which has worked very well and it continues to focus on these 3 pillars for future growth as well. In 2014 the company announced a large Phenol-Acetone project which was a game changer for the company and the plant which got operationalized in Nov-18 achieved 100% utilization within 5 months. The execution shown by the management over the years has been excellent and they have achieved their targets before time. We continue to be positive on it going forward given their excellent execution track record of large scale projects by the management and expansion plans in the new products in areas of –

a) value added intermediates finding applications in pharma and agrochemicals which are import substitutes and match well with Company’s existing competencies.

b) downstream products of Phenol-Acetone which are being imported currently and where the company will have a clear cut competitive edge as they have the feedstock inhouse.

c) Leading IT and Consulting Services Company

While we have exited our holdings in the IT sector late in 2021 on account of steep valuations, this company stood apart based on the results it was reporting and the valuations. The company was trading at a substantial discount to the peers due to the products and platforms business which is still in investment mode. However, the core services business which contributes 88% of the revenue has been growing at a CQGR of 5% for the past 3 quarters and has built strong pipelines. We also expected the capital allocation to improve going forward driven by the company’s decision to have a payout ratio of 75% of the FCFF. While we draw comfort from the valuations and the business, there are headwinds emanating from the potential slowdown in the US economy which we are watchful of.

Appendix 1: Performance of the fund for FY2022

Appendix 2: Key Performance Contributors in FY2022

Appendix 4: Performance Analysis for Longer Periods

Appendix 5: Additional factors affecting Indian Economy / markets