We are pleased to share with you an update on our performance for the Calendar year 2019. We retained our position among the top performing funds across the PMS universe (~100 funds) and delivered superior performance compared to various Mutual Fund categories. For the year ended 31st December 2019, we delivered one year return of …

Year: 2019

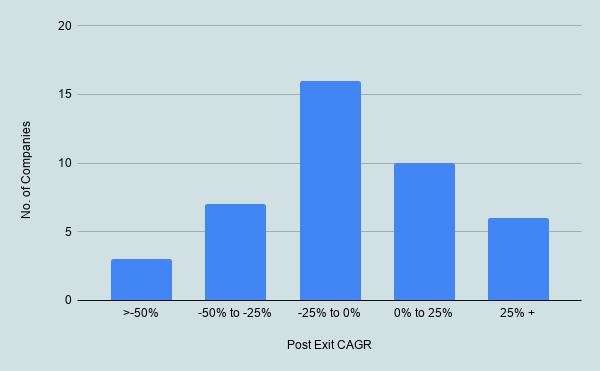

Evaluating Our Stock Selection Process

Since April 2016, we have been running a multi-cap (with emphasis on Mid and Small Cap companies) Long Only India Equity Fund under SEBI registered PMS structure. We specialize in investing in Indian listed equities as well as offshore investing through LRS route. We believe in developing and following robust processes for everything we do …

Advantages Of PMS As A Product And Prospects For The Industry

Portfolio Management Service (PMS) as an asset class has grown at exponential rates over the last few years. Over the last three years, as of June 19, the number of discretionary clients under PMS has grown by 175% from 52,761 clients to 1,44,879 clients and the AUM under discretionary mode has gone by about 56% …

Performance Update : October 2019

We are pleased to share with you an update on our performance. Specifically, we would like to highlight the following: We specialize in equity investing in India as well as abroad through LRS route. Our founder has had a stellar track record in the global equity investment space. We will be happy to furnish additional …

Sameeksha Annual Investor Letter

Financial year 2019 was a challenging year with slowing growth in both global as well as Indian economy. . An impressive uptick in March ended FY 19 performance of Nifty on a promising note. However, Mid Cap and Small Caps ended in red for the fiscal. Some of the major factors that led to the …