The financial year 2023-24 started on a positive note. April 2023 saw a decisive up move in the markets. The BSE Sensex and the NIFTY 50 showed resilient performance despite the IT sector’s bittersweet Q4 earnings that led to a massive selloff in tech biggies. The key indices saw robust pick up in stock prices that was helped by a strong corporate earnings season, and the Reserve Bank of India pulling the plug on consecutive rate hikes. Foreign portfolio investors (FPIs) made their highest buying of 2023 in April in Indian equities.

In April 2023, Sameeksha India Equity Fund (‘Sameeksha AIF’), a SEBI registered Category III Alternative Investment Fund gained 4.8% (net of all fees, expenses, and taxes), and managed to carve a marginal outperformance as compared to the benchmark BSE500TRI which gained 4.6%. However, post fees and expenses but prior to taxes, Sameeksha AIF has gained 5.5% for the month.

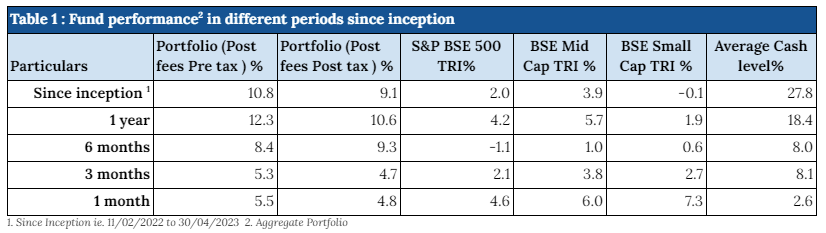

Fund Performance Across Various Periods

Since inception, we have maintained relatively higher levels of cash (28% on average over the entire period from inception) from time to time over the duration of managing the fund. Notwithstanding the same, from inception and over one year, we have generated returns of 10.8% and 12.3% beating the benchmark BSE500 TRI returns of 9.1% and 10.6% respectively after fees before taxes. (Table 1).

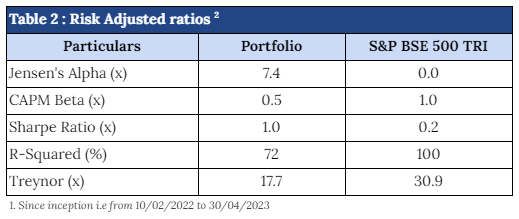

Risk Adjusted Ratios

When compared on a risk-adjusted basis, our AIF shows an even stronger performance with a risk-adjusted alpha generation of 7.4% over the broader market benchmark since its inception. While our portfolio beta has been materially lower than our benchmark, our returns have been higher than the benchmark implying superior strong risk adjusted returns.

Furthermore, other risk-adjusted returns – Sharpe ratio and Treynor ratio, are also significantly higher than the benchmark indices (Table 2).

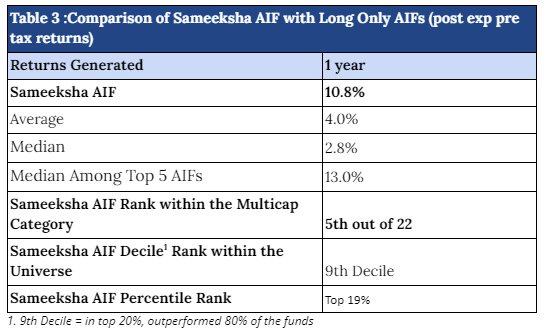

Performance Within The AIF Universe

We present our rankings among Long Only Category III AIFs who report their post expense and pre tax returns. For the period ending 30th April 2023, we are ranked 5th out of 22 AIFs (Table 3). We are ranked in the 9th Decile among 22 funds in the said category.

Analyzing The Sector Performance During The Month

During the month, our lack of exposure towards the IT sector fared well. The Healthcare, Industry Gases & Fuels and Electricals sectors were outperformers for us, whereas the benchmark was subdued. However, what hurt us is the lack of exposure towards FMCG and sectors directly related to crude oil where we missed out on participating in the rally. Below is the attribution analysis for the month of April 2023 (Table 4).

| Table 4: Sector Wise Attribution Analysis for the month of April 2023 | |||

| Sector | Portfolio Contribution | Benchmark 1 Contribution | Difference |

| IT | 0.11% | -0.46% | 0.57% |

| Healthcare | 0.79% | 0.24% | 0.55% |

| Inds. Gases & Fuels | 0.53% | 0.03% | 0.50% |

| Electricals | 0.52% | 0.03% | 0.49% |

| Chemicals | 0.56% | 0.21% | 0.35% |

| Logistics | 0.38% | 0.05% | 0.33% |

| Aviation | 0.31% | 0.01% | 0.30% |

| Media & Entertainment | 0.08% | -0.01% | 0.09% |

| Realty | 0.19% | 0.11% | 0.08% |

| Consumer Durables | 0.00% | -0.02% | 0.02% |

| Paper | 0.00% | 0.00% | 0.00% |

| Ship Building | 0.00% | 0.00% | 0.00% |

| Alcohol | 0.00% | 0.00% | 0.00% |

| Ratings | 0.00% | 0.01% | -0.01% |

| Abrasives | 0.00% | 0.01% | -0.01% |

| Construction Materials | 0.00% | 0.01% | -0.01% |

| Trading | 0.04% | 0.05% | -0.01% |

| Miscellaneous | 0.00% | 0.02% | -0.02% |

| Gas Transmission | 0.00% | 0.03% | -0.03% |

| Mining | 0.00% | 0.03% | -0.03% |

| Textile | 0.00% | 0.04% | -0.04% |

| Agri | 0.00% | 0.05% | -0.05% |

| Hospitality | 0.00% | 0.05% | -0.05% |

| Diversified | 0.00% | 0.05% | -0.05% |

| Insurance | 0.00% | 0.05% | -0.05% |

| Plastic Products | -0.03% | 0.03% | -0.06% |

| Non – Ferrous Metals | 0.00% | 0.07% | -0.07% |

| Iron & Steel | 0.00% | 0.09% | -0.09% |

| Diamond & Jewellery | -0.06% | 0.04% | -0.10% |

| Capital Goods | -0.03% | 0.09% | -0.12% |

| Power | 0.00% | 0.14% | -0.14% |

| Telecom | 0.00% | 0.15% | -0.15% |

| Retailing | -0.13% | 0.03% | -0.16% |

| Infrastructure | 0.00% | 0.25% | -0.25% |

| Bank | 0.96% | 1.22% | -0.26% |

| Finance | 0.43% | 0.69% | -0.26% |

| Automobile & Ancillaries | 0.15% | 0.43% | -0.28% |

| Crude Oil | 0.00% | 0.33% | -0.33% |

| FMCG | 0.00% | 0.48% | -0.48% |

Disclaimer – The information contained in this update is provided by our fund accounting platform and is not audited.