We are pleased to share with you an update on our performance. Specifically, we would like to highlight the following:

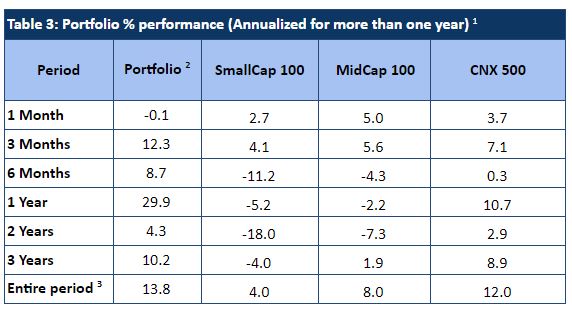

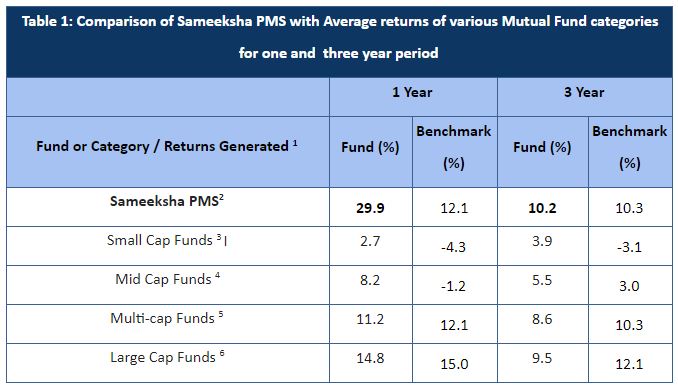

- Sameeksha maintained its number one position among 90 PMSes tracked by PMS Bazaar and delivered one year returns of 30% versus median of 9% for the PMS universe. Our three year performance has also been consistently and comfortably above PMS universe average.

- Please note that :

- Unlike some PMSes who report model portfolio returns, we report the data on aggregate portfolio basis. If proposed revisions to performance reporting rules are implemented by SEBI, all PMSes may have to report their performance on an aggregate basis.

- Our performance has been achieved despite not benefiting from IPO listing gains that mutual funds do.

- Our investment style precludes simply buying popular but high P/E stocks. We buy stocks for which we are able to justify value based on our proprietary dynamic discounted cash flow /Excess return on equity model and hence offer superior risk/reward tradeoff. As such, we have delivered this performance without benefitting from “the Quality Bubble.”

- Because of our strategy focussed on absolute value, we often end up carrying cash and may have higher than average cash levels. That should be taken into account while comparing our performance with other funds.

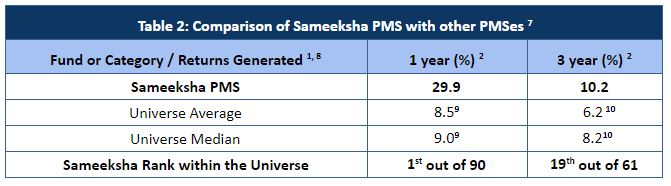

- For both one and three year periods, we delivered superior performance compared to most of the relevant categories of Mutual funds as well as the Indices. In fact we have delivered superior returns compared to mutual fund categories for all the three year periods ending March 2019 and beyond. (we completed three years in March 2019).

- We invest any new money only based on opportunities that meet our criteria. This is an important distinction from funds that replicate their model portfolio for every new account.

We specialize in equity investing in India as well as abroad through LRS route. Our founder has had a stellar track record in the global equity investment space. We will be happy to furnish additional details and welcome any follow up questions.

Since April 2016, we have been running a multi-cap (with emphasis on Mid and Small cap companies) India Equity Fund under SEBI registered PMS structure. Founders of some of the most respected Indian companies have invested in our flagship Equity Scheme and we have delivered strong risk adjusted performance.

1. As Of 31st October 2019, 2. Reported As Post Fees And Expenses , 3. 12 Funds 4. 16 Funds , 5. 15 Funds, 6. 24 Funds, 7. Source : PMS Bazaar 8 Aggregate And Model Portfolios 9. 89 PMS 10. 60 PMS