After successive rises in the last two months, the market ended December 2022 on a negative note as Covid-19 fears in China and US dented the market sentiments. Broader indices – BSE500 TRI, BSE Midcap TRI and BSE Smallcap TRI returned -3.2%, -2.5%, and -2% respectively. We also had a negative month but we managed to carve a decent outperformance when compared to BSE500TRI by returning -1.2% (net of all fees and taxes).

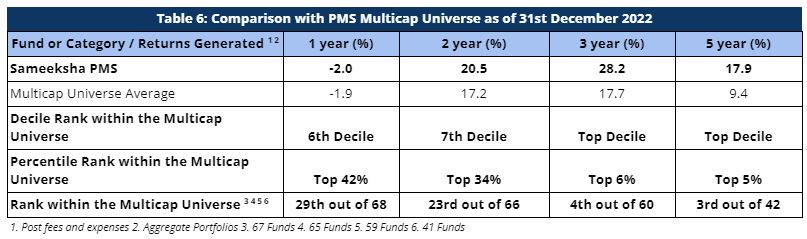

Among the multicap PMS universe with Asset Under Management (AUM) of more than INR 100 crores tracked by PMS Bazaar, we ranked 3rd out of 42 multicap PMSes for the five year period ending December 2022. For the three year period ending December 2022, we are ranked 4th out of 60 multicap PMSes reporting to PMS Bazaar. Among the multicap universe (considering all AUM), we are ranked in the Top Decile for the five year period for 22 out of 22 observations reflecting well on the consistency of our performance.

Three important things must always be kept in mind when looking at performance data. First, for funds such as ours that do not follow model portfolio strategy, the performance of Individual clients for different duration is important to look at. Second, some PMSes may be charging fees outside the PMS and hence after fees, performance data may not be comparable to ours. Third, it is important to look at not only portfolio returns but also risk adjusted ratios. We provide data to address all three points later in this note.

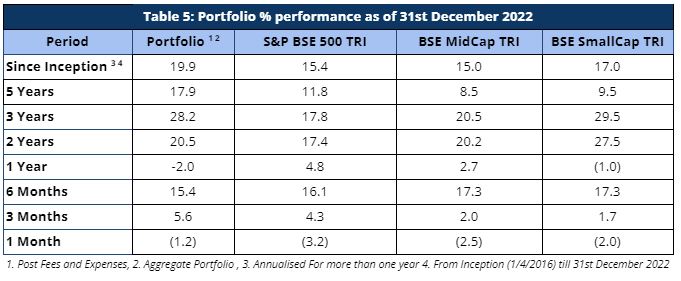

It is important to note that we have maintained relatively higher levels of cash (14% on average over the entire period from inception) from time to time over the duration of managing the portfolio. Notwithstanding the same, from inception as well as over five and three years respectively, we have generated returns of 19.9%, 17.9% and 28.3% beating the benchmark BSE500 TRI returns of 15.4%, 11.8% and 17.8% respectively after fees and expenses. Before deducting fees and expenses, we have generated returns of 21.2%, 19.1% and 30% for the period from inception (~6.8 years), five years and three years respectively.

Returns Of Individual Portfolios

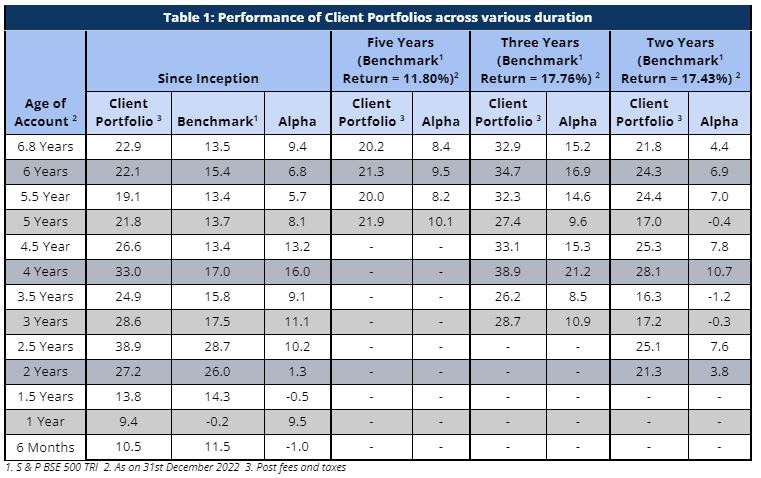

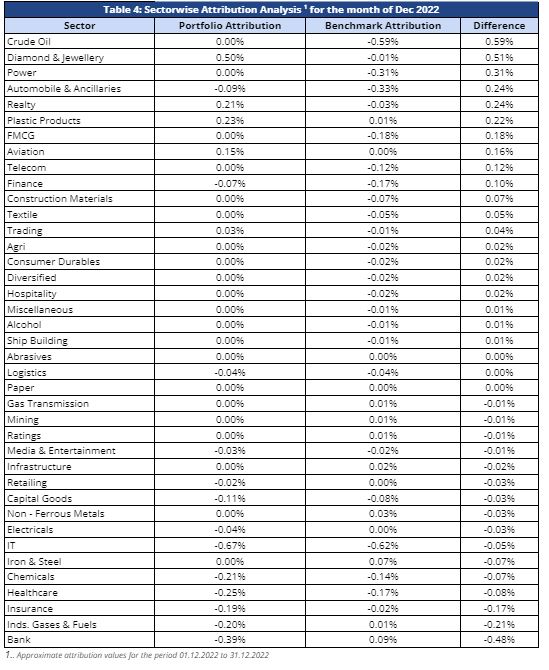

Performance of our client portfolios over different periods is more important to us than the aggregate portfolio returns. Portfolio returns for clients, except for investors starting with us between the period of one year to 18 months ago, have been remarkably strong (Table 1). Performance of portfolios of clients who joined us between a year to eighteen months ago is below par and we hope that reverses over time.

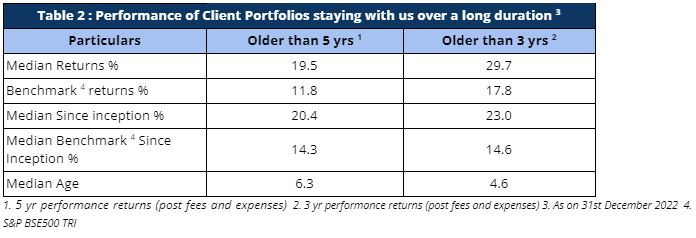

Long term investors, mainly investor accounts older than 5 years and 3 years, have carved out strong alpha, thereby proving Sameeksha PMS to be a valuable partner for their investments (Table 2).

Our NRI clients have seen strong returns even after factoring in rupee depreciation against US dollars. The portfolio returns are significantly higher than both BSE 500 TRI and S&P 500 TRI, generating strong alpha over both these indices (Table 3)

Aggregate Portfolio Returns

For this month, the broader markets ended negative at -3.2%. BSE Midcap TRI and BSE Smallcap TRI returned -2.50% and -2% respectively.

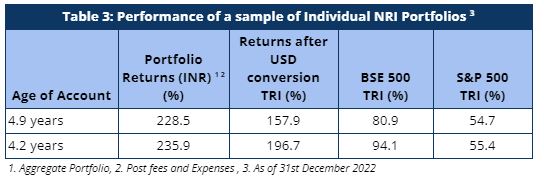

While the broader indices ended CY 2022 on a negative note, the Indian economy has proven to be remarkably resilient in the face of deteriorating global situations such as soaring inflation, risk of recession in the US and Europe, rising Covid-19 fears, among other geopolitical concerns. On December 6, 2022, the World Bank revised its GDP growth outlook for India for 2022-23 from 6.5% to 6.9%, on the back of the economy’s strong performance in Q2. The World Bank went on to say that the nation was “well placed” to steer through any potential global headwinds in 2023. During the month, our lack of exposure towards sectors directly related to Crude Oil and Power benefitted us. The Diamond & Jewellery sector was an outperformer for us, whereas the benchmark contributed negatively. This was also the case with Realty, Plastic Products and Aviation sectors in which we delivered outperformance. However, what hurt us is the underperformance of the IT, Healthcare, and Chemical sectors in which our performance was in tandem with the benchmark. While the Banking sector delivered positive albeit below par benchmark performance, we contributed negatively. Below is the attribution analysis for the month of December 2022 (Table 4).

For longer periods where the outperformance is much more meaningful, we have strongly outperformed our benchmark index across all the relevant key periods (Table 5).

Performance Within The PMS Universe

We continue to maintain our top rankings both within the multicap PMS universe as well as the entire PMS universe for key periods of three and five years. The multicap PMS universe rankings are more relevant to us since we follow multicap strategy.

In the interest of a fair comparison, we present our rankings among those multicap PMSes with AUM more than INR 100 crs. For the three year period, we are ranked 4th out of 60 PMSes. Further, we are ranked 3rd out of 42 PMSes for the five year period comparison within the multicap universe – highlighting our superior performance over the long term (Table 6).

Fund Performance On A Financial Year And Calendar Year Basis

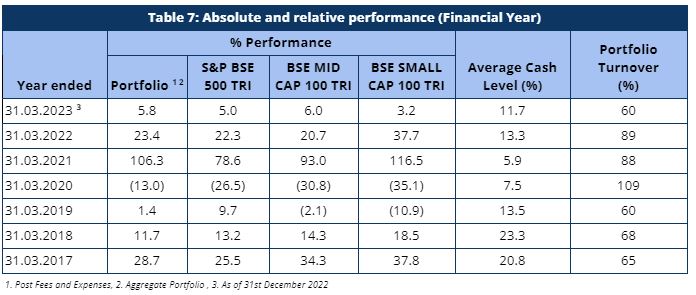

For the first 9 months of the current financial year ending March 2023 (April 2022 to December 2022), Sameeksha PMS has marginally overperformed the benchmark BSE 500 TRI by generating 5.8% returns for the period against the benchmark 5.0% returns (Table 7).

Looking at our performance over the financial years, we have outperformed our benchmark in five out of seven financial years (including the current incomplete financial year). Key however is that the sum of outperformance of 46% in those five years far exceeds the sum of underperformance of 10% in the remaining two years.

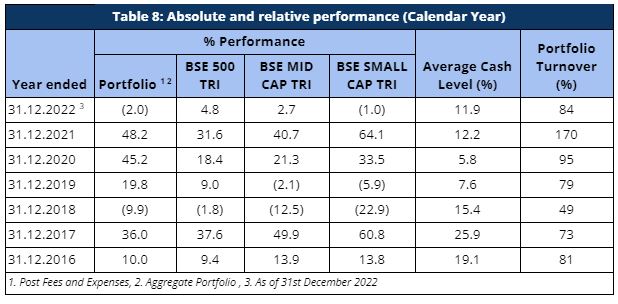

For the just completed calendar year 2022, we are underperforming the benchmark BSE500 TRI by 6.8% (Table 8). This can be mainly attributed to the onset of the Ukraine-Russia war at the start of the calendar year and the ensuing global economic crisis. However, we have taken corrective actions since then and we hope to reverse the same in the coming months.

Rolling Returns And Rankings

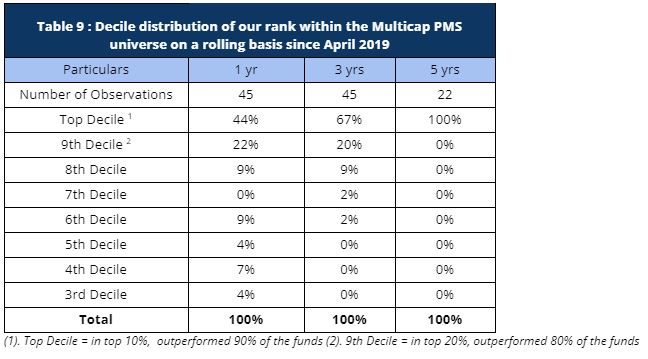

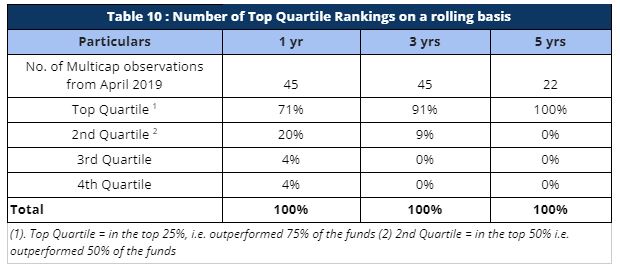

Rolling returns are a more useful indicator of consistency in performance versus single period returns. For the rolling three year periods applicable to our entire operating history, we have been ranked among the multicap universe in the Top Decile 67% of the time (30 out of 45 observations) and in the Top Quartile 91% of the time (41 out of 45 observations). For the remaining 9% observations, we were ranked in the Second Quartile (Tables 9 and 10). For the rolling five year periods applicable for our entire operating history, we have been ranked among the multicap universe in the Top Decile 100% of the time (22 out of 22 observations).

Cumulative Performance Versus The Benchmark

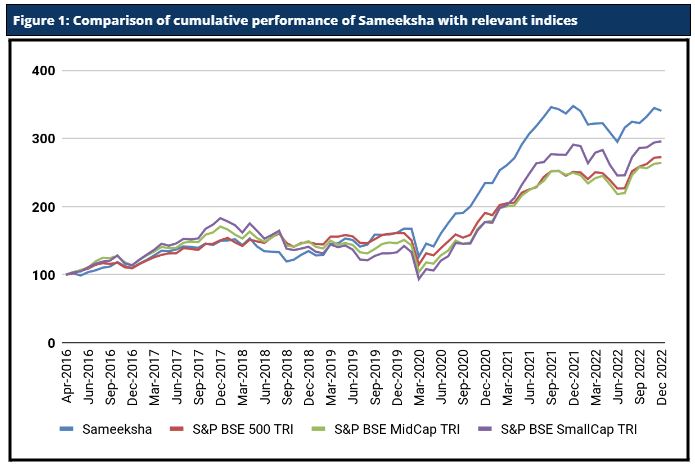

Sameeksha’s outperformance over its benchmark has continued to widen positively over the years. An investment of Rs. 100 with us since inception (April 2016) would have grown to Rs. 341, far outpacing what one would have earned by investing in a fund that achieved benchmark returns (Figure 1).

Risk Adjusted Ratios

When compared on a risk-adjusted basis, our PMS shows even stronger performance with a risk-adjusted alpha generation of 8.85% over the broad market benchmark since its inception. While our portfolio beta has been materially lower than our benchmark, our returns have been higher than the benchmark since inception, implying superior strong risk adjusted returns.

Furthermore, other risk-adjusted returns – Sharpe ratio and Treynor ratio, are also significantly higher than the benchmark indices (Table 11). It is worth noting that we offer superior risk adjusted returns not only compared to the broad BSE 500 index heavily weighted towards large cap but also the small cap and mid cap benchmarks as demonstrated by our Sharpe ratio, Alpha, Treynor ratio and Beta.

Disclaimer : The information contained in this update is based on data provided by our fund accounting platform and is not audited