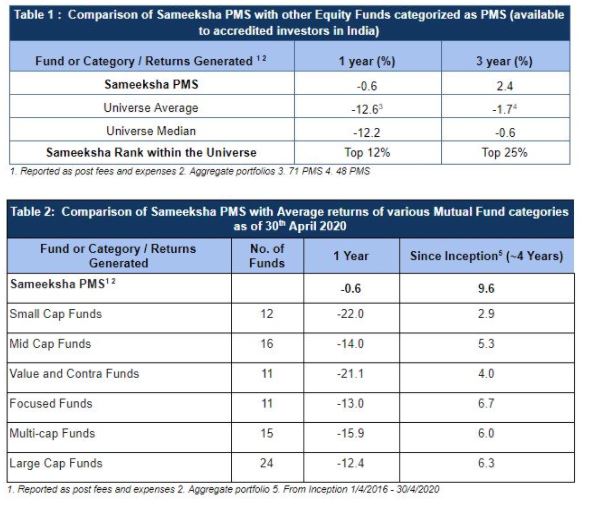

We are pleased to share with you an update on our performance for the month of April 2020. Our performance compared favorably within the PMS universe (as tracked by PMS Bazaar) and relative to major mutual fund categories. (Table 1, Table 2). However, we are not happy with the absolute returns we have generated over the last one and three years. Our mandate gives us clear freedom to do better.

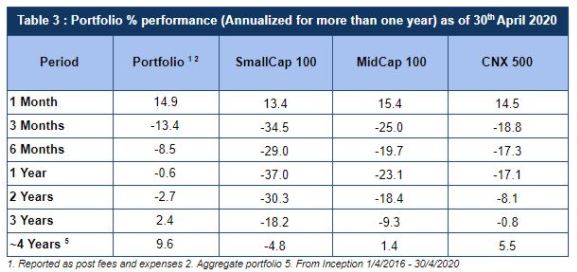

Stocks rebounded sharply in April, on the back of a flattening pandemic curve and positive results from a clinical trial carried on throughout the world. Our performance for the month of April improved marginally compared to various indices that we benchmark against. However, as we mentioned in our previous update, these numbers will remain volatile for the near future.

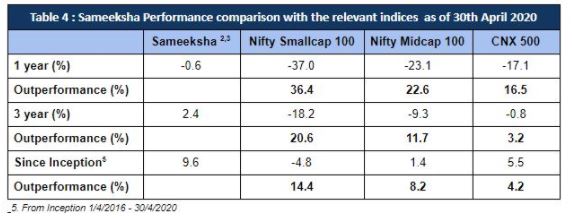

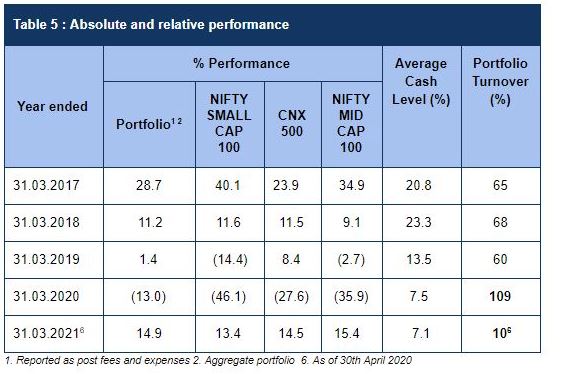

We have been able to materially outperform the relevant benchmarks over one and three year periods as well as since inception (Table 4, 5) However, we reiterate that we are not happy with the absolute returns we have generated. High portfolio turnover for financial year March 20 is a result of cash call we had to take towards the end of the year.

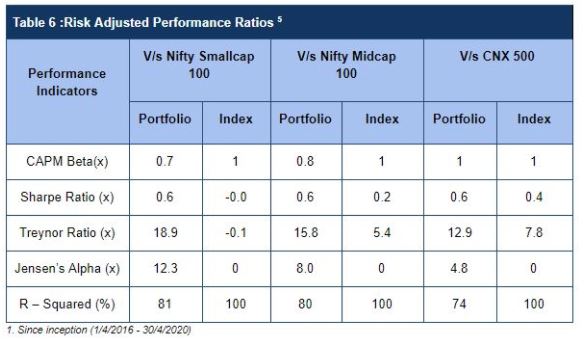

We have also delivered health risk adjusted performance versus the benchmarks. (Table 6).

Disclaimer : The information contained in this newsletter has not been verified by SEBI.