Since April 2016, we have been running a multi-cap (with emphasis on Mid and Small Cap companies) Long Only India Equity Fund under SEBI registered PMS structure. We specialize in investing in Indian listed equities as well as offshore investing through LRS route. We believe in developing and following robust processes for everything we do – whether it is recruiting or investing. We have defined elaborate processes for our research and investment work and we have also mapped these processes to productivity tool help us implement such processes. In addition, by observing the outcome of our past decisions, we strive to improve our processes on an ongoing basis. In this note, we take a look at efficacy of our stock selection process.

While we are aware that based on our methodology and analytical capacity, it is impossible to not miss stocks that perform well, the main purpose behind this analysis is to improve our research process so that we can improve our odds. Over the course of the last four years, we have evaluated approximately 400 companies. From these, we rejected approximately 200 companies comprising names that were either popular or were reporting stellar results on a consistent basis or both. These included the likes of Yes Bank or RBL Bank as well as the likes of Shankara Buildpro, Manpasand Beverages and Arvind Limited.

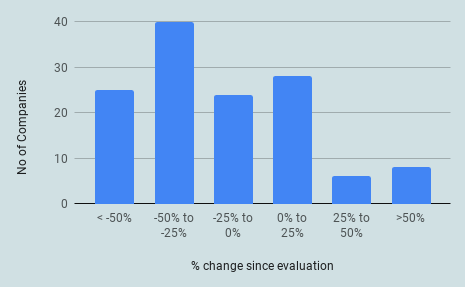

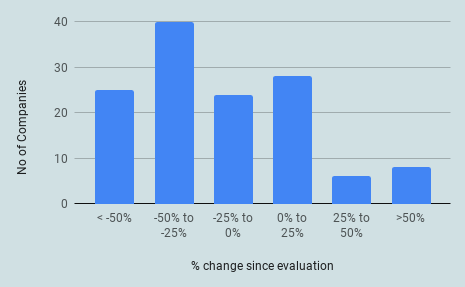

Our research process is broken into two main steps – initial and full evaluation. Some 59 companies were rejected after our initial evaluation. From this lot, 48 % of the companies are down more than 50% since our evaluation and 20% are down between 25-50%. Only 5% of the companies we rejected are up more than 10% since our evaluation (Chart 1). Furthermore, we rejected 135 companies after full evaluation. From this lot, 20% of the companies are down more than 50% since evaluation and another 38% are down between 25-50%. About 25% are up more than 10% since our evaluation (Chart 2).

In our evaluation process, we focus on eliminating companies with dubious history of corporate governance or capital allocation, inferior business model, fraudulent financial reporting or expensive valuation among many other factors. We also evaluate what we missed in rejecting companies that have gone up sharply and try to incorporate any appropriate modifications to our stock selection process. For example, reasons we missed out on some good companies were: underestimating earnings growth, positive impact of corporate action, impact of management change, companies seeing a cyclical upturn and slow growth but high quality business getting re-rated due to ongoing “Quality Bubble” in Indian stock market. It is important for us to understand which of these reasons can be addressed through better processes and focus. We certainly could improve in identifying the opportunities related to management change or impact of corporate action.

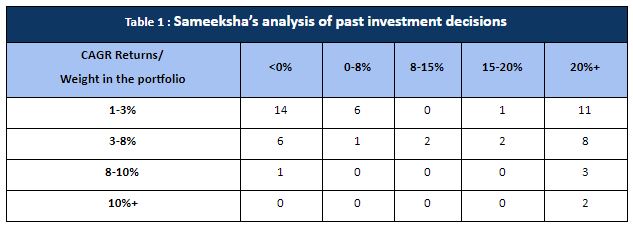

While we have analyzed the performance of companies we rejected, it is far more important to analyse the performance of the actual investments we made. Our analysis of our past investment decisions can be categorized in Table 1.

What has helped our performance is that a vast majority of our large bets have worked well. We also had good success with medium size bets. What we need to work on is to reduce the number of smaller bets. It is clear that we are not convinced enough to or willing to (stocks runs up while we are buying to) take larger bets in number of situations and our track record from such bets is clearly choppy. By focussing on our energy on our higher conviction ideas and perhaps even increasing the size of such bets, we should be able to improve our performance. We also analyzed mistakes we made in investing companies we should not have invested in the first place. We did well in avoiding investing in companies with poor corporate governance. However, we were sometimes excessively cautious with some faster growth companies where the valuations appeared high.

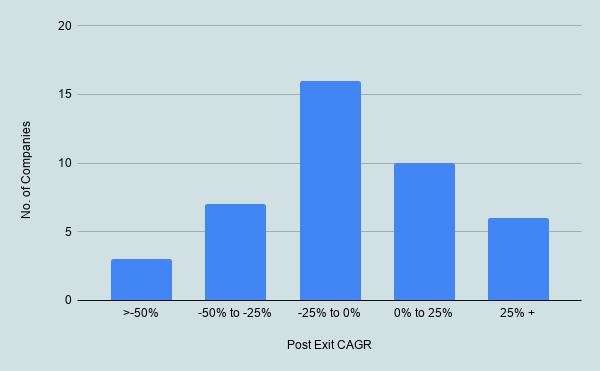

Apart from analyzing the performance of our investments, we have also analyzed post exit performance of stocks that we sold (Table 3). Much higher percentage of stocks performed poorly after we sold than those that performed well. However, we are not happy that we have sold some of the investments too early. Analyzing the reasons, we identify reasons as either the valuation criteria or under-estimating of long term growth. While we aim not to deviate from our valuation criteria, we would certainly spend some more effort trying to gauge the potential of improvement in fundamentals that we may not have factored in.

Chart 3 : Post Exit CAGR Of Companies Sameeksha Invested In

We also sold some investments immediately when we identified a red flag related to corporate governance that was not previously known to us. A couple of such stocks have gone up sharply since we sold them as these companies have tried to address the governance issue and their business fundamentals have remained robust (which was the reason we invested in the first place).There are no easy answers for such situations but we would prefer to err on the side of caution notwithstanding some loss of performance.

We believe that our focus on robust investment processes which we continuously strive to improve is a key to our success so far. We also believe that our ability to analyze our past investment decisions is reflective of our focus on capturing data.

We welcome any follow up questions.