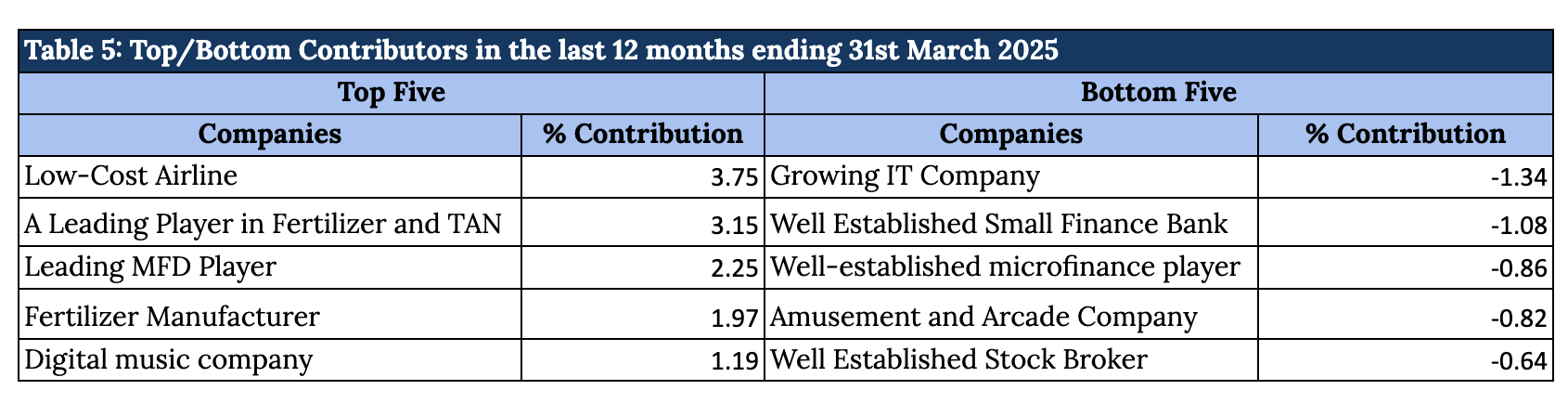

I. Top and Bottom performers of FY 2025

Based on our detailed contribution analysis, we have identified underperforming stocks accounting for both – the returns as well as their position sizing in the portfolio. As such, Table 5 provides us the top and bottom contributors in our portfolio for the 12 months of FY 2024-25.

A. Below is our analysis on the Top 5 contributors for FY 2025

a) Low-Cost Airline

It operates the largest low cost carrier (LCC) in India with more than 63% share of the domestic market today and a fast rising share of the international market. Even as India’s domestic aviation market has witnessed healthy double digit growth in the past two and a half decades, it still remains a highly underpenetrated market and hence provides strong growth opportunities. It has built a strong business model which focuses on strengthening its customer service by building trust (on-board and off-board engagements), convenience (frequency of flights) and offering wide connectivity to become the preferred choice of travel. Inducting fuel efficient aircraft and upping its fleet utilization between domestic (day-time travel) and international (night-time travel) travel will enable them to operate the business as one of the lowest cost airlines in the industry. Rising competition (from new and other established players) is a concern on yields, but it will be difficult to replicate Indigo’s length and breadth of network.

It has performed exceptionally well over the past year due to a combination of strong operational execution, strategic expansion, and favorable market dynamics. The company delivered robust financial results, reflecting higher travel demand and better cost efficiency. The company’s long-term growth vision, supported by aircraft orders and a focus on global markets, has enhanced its market valuation and attracted greater investor interest.

b) A Leading Player in Fertilizer and TAN

The company is a leader in manufacturing nitrogen-based chemicals. Its strategy is to manufacture the chemicals at scale with cost efficiency and be the market leader in that chemistry. It is transitioning from a commodity-based model to a specialty chemicals focus, aiming to provide holistic solutions and move closer to the end consumer. This strategic shift is expected to yield higher margins and sustainable growth.

During the year, favorable monsoon conditions have led to increased agricultural activity, boosting demand for fertilizers. Its specialty products, such as Smartek and Croptek, have seen significant sales growth, driven by their advanced nutrient delivery technologies. The convergence of strong financial results, strategic partnerships, capacity expansions, favorable market conditions, and a clear shift towards high-margin specialty products has propelled the good stock performance over the past year.

c) Leading MFD Player

As of March 2025, the company is the 4th largest Mutual Fund distributor in terms of Total retail AUM and 6th largest in terms of total folios. They provide financial products (mainly Mutual Funds and Insurance products) distribution service through its digitized platforms to IFAs. Hence, network of IFAs is crucial to play out operating leverage. They have more than 32,000 IFAs registered on their platforms to distribute MF products to the investors. Our thesis was: The company will have strong revenue growth along with improvement in margins. Key Drivers for the same are likely to be: Growth in revenue due to growth of AUM driven by market growth, increase in number of IFAs and AUM increase per IFA. High operating leverage and asset-light business model would lead to rise in EBITDA margins and higher efficiency.

Our thesis has played out well as the company delivered ~25% AUM growth and 37% revenue growth in FY25. The company has delivered a CAGR of ~36% in revenues and ~48% in earnings over the last 5 years. The monthly SIP Book grew by 35% YoY in March, reaching Rs 981 crore. Annualizing this, management is expecting gross flows from SIPs of at least Rs 11750 crores in FY26, which is 11% of the FY26 opening AUM. The net sales grew 15.7% YoY at Rs 12606 crore and the company expects net sales at 12% of AUM going forward. Also, the company has added 851 net MFDs, increasing the total count to 33,308 MFDs. This, coupled with strong inflows and a healthy SIP book, provides sustainable visibility over the medium term.

d) Fertilizer Manufacturer

The company specializes in fertilizers, crop protection products, specialty nutrients, and organic fertilizers. As India’s second-largest manufacturer and marketer of phosphatic fertilizers, it serves over 3 million farmers through an extensive network of more than 900 rural retail outlets across southern states. Its diverse product portfolio includes brands like Gromor, Godavari, Paramfos, Parry Gold, and Parry Super. With 18 manufacturing facilities across the country, the company is committed to delivering comprehensive agricultural solutions.

Over the past year, it has demonstrated strong performance, driven by several strategic initiatives and favorable market conditions. The company witnessed robust growth in its Nutrient and Crop Protection segments, supported by higher sales volumes and improved operational efficiency. The expansion of its retail footprint, with the addition of 100 new stores and entry into new markets like Maharashtra and Tamil Nadu, further bolstered its market presence.

e) Digital music company

The company has a large music library with a collection of over 31,000 songs across various genres and regional languages. The company has produced and released around 40 Hindi films in the past 20 years and also sells the theatrical, satellite, and various other rights to distributors, broadcasters, etc. They are engaged in the business of acquisition and exploitation of Music of Rights. The company earns 100% of its revenue from Licence fees. 75% of the revenue is from digital platforms, wherein 45-50% is through Youtube, and remaining 25-30% through other digital platforms. The remaining 25% is generated through TV and public performances. There is a clear moat in this business on account of a large library collection. The company is consistently growing much better than the overall industry. Our thesis was: the music industry is poised to grow at a healthy rate backed by: a) Increase in active users of music streaming b) Increase in no. of paid subscribers c) Hike in subscription plans as well as growth in digital advertising spends.

Our thesis played out well as the company delivered 29% revenue growth and 31% PAT growth in FY25. The management has guided for a 30% CAGR in revenue and profitability for FY26. This growth is expected to be driven by several factors, including the new content which will be released this year. A total of 12 movies are expected to be released in the coming year. Also, the company plans to focus on acquiring quality content, with a target of investing 25-28% of revenue in content acquisition. Additionally, recent collaboration with TikTok, potential monetization of YouTube shorts and Facebook reels put together could serve as a key near-term catalyst. A bigger deal with Sony Publishing and uptick in live performance rights to aid growth momentum in non-digital revenues. We expect PAT for the company to grow at ~21% CAGR over the next 5 years.

B. Below is our analysis of Bottom 5 contributors for FY 2025

a) Growing IT Company

The company is a global IT services player, providing services which generate revenue from both domestic and international business verticals. International revenue mainly comes by providing services to Microsoft as the company has been a strategic partner for 30 years. Domestic revenue comes through resale of IT products. Microsoft as a customer is 25-30% of total revenue and Dynamics implementation which is ‘Sell with Microsoft’ is around 30% of the same. They do have other tie-ups in ERP and Cloud in which they have Azure, AWS, GCP and Oracle cloud.

The company has fairly delivered returns over the previous two years, and also was one of the top performers in FY23. However, the company faced multiple headwinds: Delay in deal wins, uncertainties in US and macro environment leading to moderation in tech spends by the large clients and unexpected client ramp-down. We exited the stock as the outlook was weak on account of all these issues continuing, and prolonged slowdown in the IT sector as a whole.

b) Well Established Small Finance Bank

The company has established itself as a leading player in the small finance banking space, focusing primarily on underserved and financially excluded customer segments. It has built a strong presence across semi-urban and rural regions by offering a diverse range of products, including small business loans, vehicle finance, affordable housing loans, and deposit services.

Over the past year, the Bank has encountered several challenges that have impacted its financial performance. A significant factor has been the elevated credit costs within its microfinance portfolio. Despite microfinance constituting a smaller portion of its overall loan book, the bank faced substantial slippages in this segment, leading to increased provisioning and a notable decline in profitability. Coupled with rising operational expenses from investments in technology and new product lines, these factors have collectively exerted pressure on the bank’s earnings.

c) Well-established microfinance player

The company is an established microfinance lender headquartered in Gujarat, operating across multiple states through an extensive branch network. Its core business includes microfinance, MSME finance, and two-wheeler (2W) finance, with microfinance comprising approximately 77% of the total loan book. The company is also diversifying its portfolio by launching new products and expanding into segments such as micro LAP and business loans.

However, the company has recently faced asset quality and growth challenges, primarily due to borrower overleveraging in the microfinance segment, combined with external factors such as election-related disruptions and extreme heatwaves. These issues have adversely impacted its financial performance.

d) Amusement and Arcade Company

The company, a well-established player in the amusement park industry with a strong presence in South India, began its journey in 2000 with a single park and has expanded to four operational parks over the past 25 years. Now, it is accelerating its growth strategy, aiming to add another 4–5 parks over the next 5–7 years. With ample cash reserves, along with internal accruals and an in-house ride manufacturing facility in Kochi, the company is well-positioned for this expansion.

Last year, the company launched a new amusement park in Odisha and is set to open another in Chennai by December 2025. However, the increased costs associated with these new developments, coupled with a decline in footfall at its mature parks—mainly due to external factors—have led to a slowdown in overall revenue growth and a contraction in profit margins in FY25.

e) Well Established Stock Broker

The company is one of the very rare stock brokers which has successfully adapted to the changing landscape of the brokerage industry by transforming from a traditional broker into a profitable discount broker. This has enabled the company to become the second-largest retail broker in India, in terms of overall ADTO market share (esp. F&O). The ability of the company to capitalize on the pandemic-related tailwinds has resulted in higher-than-industry growth in gross/NSE active client addition, better activation rates, sustained growth in the number of orders, and an increase in the overall ADTO market share.

The company was one of the top portfolio contributors in FY24 and had been growing at a healthy growth rate too. However, regulatory challenges and moderation in capital market activities led to some correction. Regulatory challenges (including but not limited to SEBI’s MII regulations, F&O curbs, and recent expiry date changes) are expected to hurt near-term financial performance of the company.

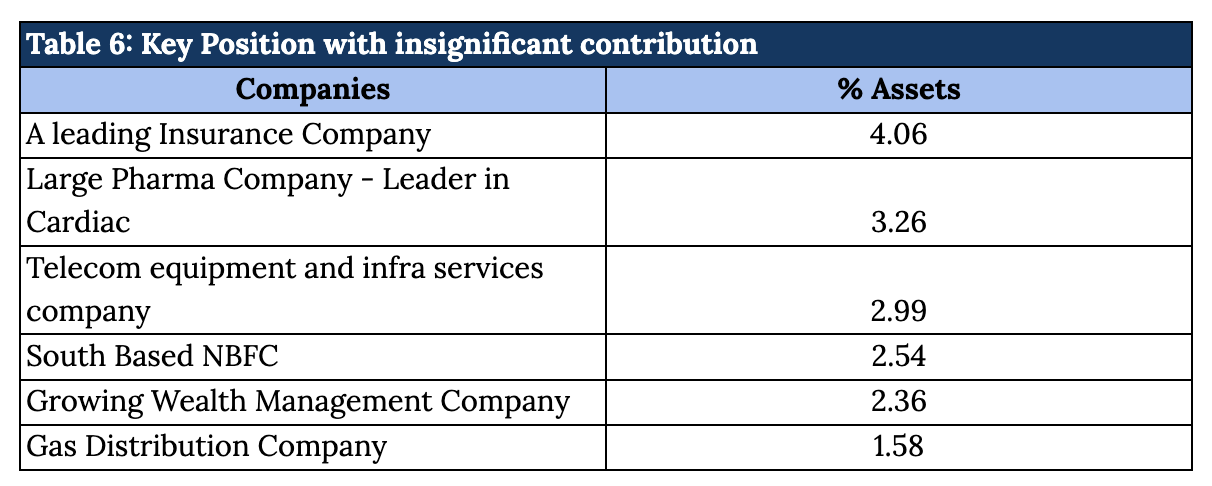

II. Key insignificant Performers of FY 2024-25

There were several stocks in which we had reasonable sized positions but they did not contribute much to the performance (Table 6). We discuss below these names, why we invested and the reason for poor performance.

a) A leading Insurance Company

The company is the largst private life insurer in terms of AUM and EV. That combined with the lowest cost ratios in the entire Life Insurance industry, the largest distribution network among the private players through its Banca partnership makes a robust case for investing in the company. Moreover, the company has best-in-class return ratios, and is available at attractive Embedded value based valuations.

The life insurance sector as a whole faced regulatory headwinds in FY25. However, the majority of the regulatory overhangs are now behind us. The company guides for healthy ~13-14% growth in individual APE, slightly higher than the expected industry growth of 12%, and with 27-28% VNB margins. There are structural tailwinds favouring the life insurance industry which is expected to lead the company to grow steadily over a longer horizon.

b) Large Pharma Company – Leader in Cardiac

It is one of India’s leading pharmaceutical companies incorporated in 1976. The company has been supplying products across segments like cardiovascular, gastrointestinal, and anti-infectives with the company’s top 6 brands featuring in the top 300 brands. Post its acquisition by KKR and the appointment of a new management team, the growth of the business has accelerated. We believe that there is a healthy topline growth potential, led by synergetic acquisitions, the launch of new products and expanding customer reach. There is scope for meaningful margin expansion over the next 3-5 years led by higher domestic and CMO business, in which margins are better, increased MR productivity, along other operating leverage.

The stock price saw some consolidation in FY25, after remaining one of the top performers in FY23 as well as FY24. We expect revenue and PAT to grow at a CAGR of 12.3% and 18.4% respectively, over the next 5 years.

c) Telecom equipment and infra services company

The company is one of the largest telecom tower and infrastructure providers in India, serving all major telecom operators. It offers a comprehensive range of passive infrastructure essential for wireless telecom services. The business model is built around long-term Master Service Agreements with telecom providers, under which it earns a fixed monthly rental for its infrastructure. The company benefits from higher tenancy on its towers, as additional tenants increase rental income and enhance economies of scale.

Previously, the stock performance remained subdued due to concerns surrounding one of its major customers. However, this customer has since cleared all outstanding dues and is now focused on expanding 4G and 5G coverage. With strong promoter backing—evidenced by an increase in promoter stake to majority ownership—the company has pivoted towards growth, targeting both organic and inorganic tower expansion. Additionally, the company has ventured into the electric vehicle charging space, launching a pilot project as part of its diversification strategy. With capital expenditures declining and tenancy ratios rising, the company is well-positioned to generate robust free cash flows, which it plans to distribute to shareholders. Moreover, the stock is currently trading at a significant discount compared to its global peers.

d) South Based NBFC

The company is a secured lender focused on small business owners in urban and semi-urban areas who lack formal credit history. It offers loans below ₹5 lakhs, typically to micro-entrepreneurs like shopkeepers and self-employed individuals. Underwriting is relationship-based, involving detailed field assessments and cash flow checks. Collections are managed through close borrower engagement and localized follow-ups, helping maintain strong asset quality.

However, the company faced certain challenges during the year. In response to sectoral headwinds and regulatory guidance, it adopted a cautious approach by moderating disbursement growth, which led to a slight decline in quarterly disbursements. Additionally, the company revised its AUM growth guidance from 30% to 25% for the fiscal year, reflecting a strategic decision to prioritize asset quality over aggressive expansion. Its disciplined approach positions it well for long-term stability and growth in the financial sector.

e) Growing Wealth Management Company

The company is a leading wealth management player and one of the top 3 largest non-bank mutual fund distributors of India. They target the HNI segment with ~INR 5 crores investible surplus, which has a very large addressable market and the same is not a focus area for large wealth managers and also doesn’t have bargaining power. They have a focused approach with just two products – Equity/Debt Mutual Funds and non-principal protected structured products.

The company had been the highest portfolio contributor in FY24 and then, the stock price saw some consolidation in FY25. The company delivered a healthy revenue growth of 30% and PAT growth of 33% in FY25. The AUM growth target of 20-25% over the next few years seems achievable driven by 4 factors – Growth in number of RMs, increase in clients per RM, AUM increase per client and AUM growth due to market growth.

f) Gas Distribution Company

It is a government owned City Gas Distribution (CGD) company with a good growth track record. CGD is a monopolistic business due to license exclusivity granted to players over geographic areas. The sector is further likely to benefit in the long term from favourable policies as the government is committed to improving the share of clean energy. The central government has set a target to raise the share of natural gas in the energy mix from the current ~7% to 15% by 2030. The company has been generating healthy operating cash flows from its existing GAs and investing the same in newer GAs.

Volume growth for the company recovered over the past year after being hit previously due to the replacement of CNG buses with electric buses in its key market. In October 2024, the government abruptly reduced the allocation of APM (Administered Price Mechanism) gas to the CGD sector. This severely hampered the EBITDA margins of the sector as companies were required to replace the cheaper APM gas with expensive international gas. Higher international gas prices continue to hamper the sector’s competitiveness.

Links:

Appendix 1: Performance of the fund for FY2025

Appendix 3: Current view on top seven positions

Appendix 4: Analysis of our performance over last Nine years