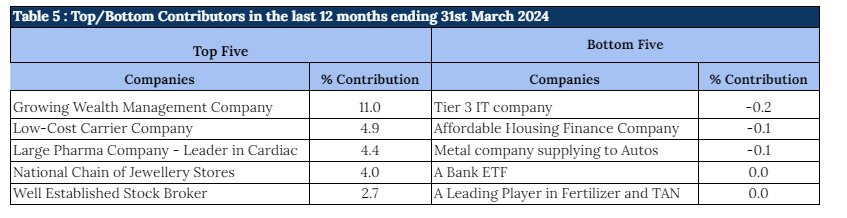

- Top and Bottom performers of FY 2024

Based on our detailed contribution analysis, we have identified underperforming stocks accounting for both – the returns as well as their position sizing in the portfolio. As such, Table 5 provides us the top and bottom contributors in our portfolio for the 12 months of FY 2023-24.

A. Below is our analysis on the Top 5 contributors for FY 2024

a) Growing Wealth Management Company

The company is a leading wealth management player and one of the top 3 largest non-bank mutual fund distributors of India. They target the HNI segment with ~INR 5 crores investible surplus, which has a very large addressable market, is not a focus area for large wealth managers and also doesn’t have bargaining power. They have a focused approach with just two products – Equity/Debt Mutual Funds and non-principal protected structured products. Investments in mutual funds are through regular schemes only. Non-principal protected structured products constitute 1/3rd of the AUM but more than 63% of the revenue and lack of understanding relating to the non-principal protected structured products was one of the factors that was leading to lower valuations for the company. Our thesis was: When equity trail fees would increase complemented with sustainable growth in AUM, the valuations should also increase.

Our thesis played out well as the company delivered AUM growth of 52% in FY24 and trail revenue grew by 65%. The company has delivered a CAGR of ~21% in revenues and ~31% in earnings over the last 5 years and an AUM growth target of 20-25% over the next few years seems achievable driven by 4 factors – Growth in number of RMs, increase in clients per RM, AUM increase per client and AUM growth due to market growth. We expect some volatility in non-principal protected structured product revenues due to the transition from 3-year to 5-year products, but despite that we expect the company to continue to perform well in its selected segment.

b) Low Cost Carrier Company

It operates the largest low cost carrier (LCC) in India with more than 60% share of the domestic market today and a fast rising share of the international market. Even as India’s domestic aviation market has witnessed healthy double digit growth in the past two and a half decades, it still remains a highly underpenetrated market and hence provides strong growth opportunities.

It has built a strong business model which focuses on strengthening its customer service by building trust (on-board and off-board engagements), convenience (frequency of flights) and offering wide connectivity to become the preferred choice of travel. Inducting fuel efficient aircraft and upping its fleet utilization between domestic (day-time travel) and international (night-time travel) travel will enable them to operate the business as one of the lowest cost airlines in the industry. Rising competition (from new and other established players) is a concern on yields, but it will be difficult to replicate Indigo’s length and breadth of network. Further, the Company’s focus on short-haul non-stop international will give them the first mover advantage which will keep the competition behind the curve for a foreseeable future. Based on our industry working, we expect it to witness 15%+ passenger CAGR growth implying overall market share (Domestic and International) gains of 150-200 bps over FY28e.

c) Large Pharma Company – Leader in Cardiac

It is one of India’s leading pharmaceutical companies incorporated in 1976. The company has been supplying products across segments like cardiovascular, gastrointestinal, and anti-infectives with the company’s top 4 brands featuring in the top 200 brands in unit terms, and two of them featuring in the top 100 brands in value terms. Post its acquisition by KKR and the appointment of a new management team, the growth of the business has accelerated. We believe that there is a healthy topline growth potential, led by synergetic acquisitions, the launch of new products and expanding customer reach. There is scope for meaningful margin expansion over the next 3-5 years led by higher domestic and CMO business, in which margins are better, increased MR productivity, along other operating leverage. We expect revenue and PAT to grow at a CAGR of 15.8% and 23.5% respectively, over the next 5 years.

d) National Chain of Jewellery Stores

It is one of the leading jewellery retailers from the South that now has a pan- india presence. The company planned to go on an asset light expansion spree via the franchise route to build a presence in the North leveraging on a brand built over the last decade. The Northern markets have a higher studded ratio and the higher margins it offered were shared with the franchises to provide them an attractive ROI. The sector had strong tailwinds with hallmarking accelerating the shift from the unorganized to organized markets and the 2 national players were set to benefit from the same. Separately, mgt delivered on its guidance given at an investor meet in December 2022 of getting non-core assets off the books during the year. Valuations were attractive with an OCF of 9% for FY24E, a rising core ROIC and at a significant discount to the leader. Our thesis played out on all counts driving a rerating in the stock. Its success brought local/regional peers to the IPO markets and we are now seeing increased competition weigh on sector margins.

e) Well established Stock Broker

The company is one of the very rare stock brokers which has successfully adapted to the changing landscape of the brokerage industry by transforming from a traditional broker into a profitable discount broker. This has enabled the company to become the second-largest retail broker in India, in terms of overall ADTO market share (esp. F&O). The ability of the company to capitalize on the pandemic-related tailwinds has resulted in higher-than-industry growth in gross/NSE active client addition, better activation rates, sustained growth in the number of orders, and an increase in the overall ADTO market share (4x since FY20). The Company’s average daily orders have grown significantly from 0.5 mn in FY20, when we turned digital, to 1.4 mn in FY21, 2.8 mn in FY22, 3.7 mn in FY23 and further to 5.4 mn in 10M FY24, with the average of January 2024 being 7.6 mn.

The company has been earning well on the MTF book with a NIM of 9% to 9.5% and is looking to become a full-service provider as it gets into the asset management business and distribution of insurance and loan products. We expect revenue and PAT to grow at a CAGR of 19.5% and 21.3% respectively, over the next 5 years.

B. Below is our analysis of Bottom 5 contributors for FY 2024

a) Tier 3 IT company

The company is a global provider of Information Technology (IT), Business Process Management (BPM) and Consulting services. The Company provides business-aligned next-generation solutions to a wide range of industry verticals that help enterprises across the world overcome their business challenges and achieve operational efficiencies. The strategic priority focuses on Products & Platforms, Automatic Fare Collection (AFC), Digital Solutions – Intelligent Automation, Digital Experiences, Cloud, Account Penetration, and Branding and Marketing. The Company’s growth strategy includes focusing on the US market – also extending the US sales force to focus on digital transformation opportunities including intelligent automation products, TruBot RPA, and TruCap+ IDP.

The company has stronger growth opportunities in robotics and Intelligent Data Capture along with improvement in margin profile with strong cash generation. However, weak macro outlook and near-term softness in deal progress velocity as experienced by the IT sector is expected to drag moderation in growth.

b) Affordable Housing Finance Company

It is a housing finance company based out of Rajasthan and present across more than 10 states. It always traded at premium (Median PB: 6.3) due to its ability to scale with industry best assets quality. It corrected by more than 50% when Ex-MD started trimming his stake and later resigned from the position of MD. At that time, we believed it was offering a reasonable amount of safety and handsome risk-reward. Given the opportunity size, It could grow at above industry growth for the next decade. They had been investing heavily into tech and even after a change in the top position, we believed there wouldn’t be any compromise on the assets quality side to grow.

We exited the stock as the bet was on the new MD to hold things together, he has not been able to do so post the exit of Ex-MD. We believe this segment is people-driven and it’ll take a while to get sustainable high growth (+25%). Apart from poor growth, people, especially at the Mid-level, are also leaving as competition has intensified in the industry and newer/smaller players are poaching people from the organization.

c) Metal Company Supplying to Autos

It is among the leading manufacturers of special alloy steel products for the automotive sector, and is preferred by OEMs due to the adoption of the EAF route of steelmaking, which provides higher quality of steel at lower batch sizes meeting the quality requirements of the OEMs. The company has also entered into a strategic alliance with one of the world’s largest automotive steelmakers in Japan for transfer of technical knowhow. This agreement is expected to be extremely beneficial for our company as it provides a long runway for growth as orders from the Japanese MNC have started ramping up from FY24 onwards as well. There is also scope for margin expansion as supplies to the MNC as well as exports are expected to be of higher margin. It also provides the company access to other Japanese OEMs given that the quality is likely to improve drastically due to the transfer of technical know-how. Company has big plans with their strategic partner to set up a large greenfield project and/or forging plant in the long term. Also, favourable PV cycle and the niche segment it is in given the only EAF player among the close competitors, will play in its favour going forward.

d) A Bank ETF

The banking sector serves as a proxy for GDP growth, demonstrating resilient loan growth despite the recent repo rate hike. While banks face pressure on the cost of funds as deposit rates align with the increased repo rates, their balance sheets remain robust due to historically low gross non-performing assets (GNPA) and slippages in the system. We anticipate that asset quality will remain strong in the near to medium term, and margin pressures will reduce, supported by more stable interest rates in the future. Banks stand to benefit directly from any increase in private capital expenditure. Major private banks have been investing in branches and technology, which could lead to improved cost-to-income ratios in the future, further enhancing return on assets (ROAs). The ETFs’ top holdings include all top banks of the country. We consider these stocks to be attractively valued. Instead of purchasing multiple individual stocks, we view ETFs as a better instrument to capitalize on this opportunity.

e) A Leading Player in Fertilizer and TAN

The company is a leader in manufacturing nitrogen-based chemicals. Its strategy is to manufacture the chemicals at scale with cost efficiency and be the market leader in that chemistry. Under the leadership of the MD, the company is moving away from pure commodity products to more value-added products in all three segments of its business. The whole chemical industry experienced inventory destocking and dumping from China which led to a correction in chemical prices. This has given us the opportunity to enter after a healthy correction in the stock.

There is scope for margin improvement due to backward integration (already commissioned ammonia plant worth 4500 cr) and improvement in realisations by 1H25 on the back of a reduction in dumping from China. The company is also expanding its TAN capacity and Nitric acid capacity.

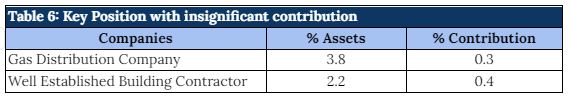

II. Key insignificant Performers of FY 2023-24

There were several stocks in which we had reasonable sized positions but they did not contribute much to the performance (Table 6). We discuss below these names, why we invested and the reason for poor performance.

a) Gas Distribution Company

It is a government owned City Gas Distribution (CGD) company with a good growth and execution track record. CGD is a monopolistic business due to license exclusivity granted to players over geographic areas and enjoys policy tailwinds as the government is focussed on improving the share of clean energy. Presently in India, the share of natural gas in the energy basket is ~6.7%. The central government has set a target to raise the share of natural gas in the energy mix to 15% by 2030. The company has been generating free cash flows from its existing GAs and investing the same in newer GAs and acquisitions. Post the Russia-Ukraine conflict, there was a sharp jump in the prices of Natural Gas that adversely impacted consumer demand and the company’s margin.

There were further headwinds to growth last year due to a higher replacement of CNG buses with electric buses in its key market. After the KP Committee approval, domestic prices have reduced but demand is not fully back; the conversion rate is slowly inching up but the company has been able to protect its margins. Going ahead we expect the vehicle conversions to increase leading to better volume offtake and stricter environmental norms to drive industrial PNG offtake in the medium term.

b) Well established Building Contractor

The company is a proxy play on pick up in the capex cycle in India from both Government and Private sector in the post-Covid period. It has consistently demonstrated execution excellence, adopted both latest construction technology and best labour practices, maintained balance sheet discipline and has become a reputed and preferred contractor in its core market. After it successfully completed the world’s largest office building in Surat, it is qualified to bid for mega sized projects of upto 2,500 Cr ticket size, joining a select club of large players. Winning large projects is likely to boost its profile and growth prospects.

In FY24, its dispute with its large client over payment delays came to the fore, leading to litigation and cash flow uncertainty. In addition, a large part of the revenue in the year came from projects in UP where it faced margin and WCAP challenges. This resulted in a large adverse operating cash flow generation and higher gearing, leading to a correction in the stock from its Sep’23 highs, despite strong revenue growth and order wins during the year..

Links:-

Appendix 1: Performance of the fund for FY2024

Appendix 3: Current view on top seven positions

Appendix 4: Analysis of our performance over last Eight years