In this financial year 2023-24, Sameeksha PMS has managed to generate positive absolute return as well as meaningful outperformance as compared to the benchmark BSE500 TRI. For the year, the PMS outperformed the benchmark by 19.9%, with an average cash level of 8.8% during the year. Moreover, compared to BSE Midcap TRI and BSE SmallCap TRI we had an outperformance of 3.5% and 8.2% respectively.

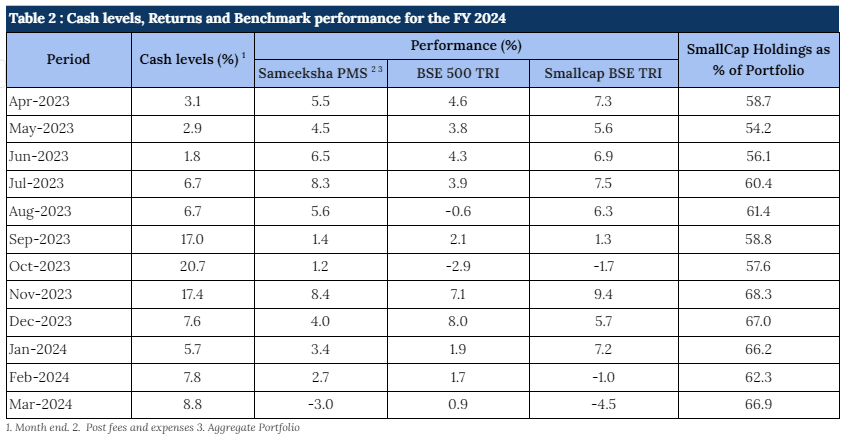

As shown in Table 2, we reduced the cash levels of the portfolio around the middle of FY24. The markets moved up sharply over Mar’23 to Jul’23, following which we exited some of positions leading to higher cash levels. The CPI inflation print in the US declined to 3.0% for the month of June and was followed by a pause in the Fed’s rate hike cycle at its Sep ’23 meeting. Subsequently, expectations of a ‘Fed Pivot’ and a peak in interest rates led to improvement in the US markets starting Oct’23. In India, the ruling party at the centre won three of the four key state elections that were held in Nov ’23, further supporting the rally. Our portfolio cash levels reduced as we deployed cash in existing and new stocks.

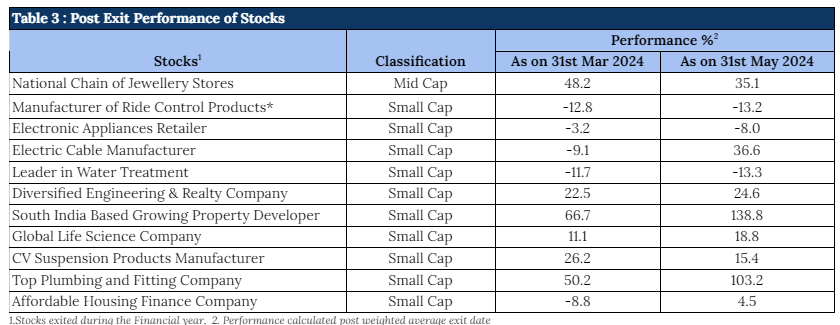

As such, early in the year, we took a decision to reduce our exposure and even exited some positions that we saw were high risk. The performance of stocks we exited has been mixed. (Table 3).

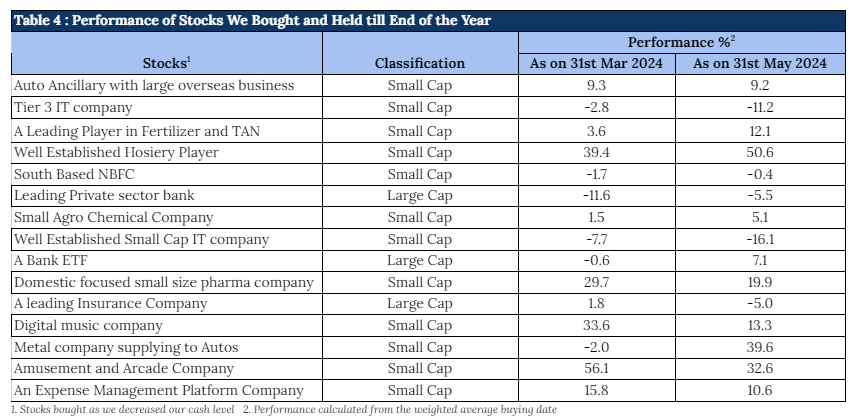

Meanwhile, we saw deeper correction in small and mid cap stocks and that presented us with many opportunities. We chose to take advantage of that and redeployed capital in the small cap space as clearly visible from our increasing exposure to small cap (Table 2). The performance of stocks that were bought during the year has been fairly strong overall (Table 4).

Overall, our decision to shift positions has worked out well with the exception of one stock that appreciated quite sharply. We will review our investment decisions more in detail in a separate note.

Links:-

Appendix 2: Key Performance Contributors in FY2024

Appendix 3: Current view on top seven positions

Appendix 4: Analysis of our performance over last Eight years