Introduction

As of March 31 2024, Sameeksha completed eight years of managing money in Indian equities. Back in late 2015, we started Sameeksha with the objective to manage our investors’ assets just as we manage our own by investing in businesses that were durable and were managed by stewards who view their company capital with the same care that we manage our investor assets. In Appendix 4, we discuss the performance of our fund over eight years. We have discussed the highlights of our investment process in prior letters. This year, we will focus on the incremental changes to our entire process- from gathering information, sourcing ideas, analysis of companies, portfolio construction and risk management. .

We are in an era where the limitations to research is not the lack of information, but how the vast quantity of information and data can be organized to provide valuable insights. With the passage of time, we have researched and documented hundreds of companies and that information is readily available if we choose to review a company that we may not have invested in before, or one that we invested in and then exited. We have a new internal data organization tool called RAW that will allow us to employ machine learning capabilities to derive insights.

We have continued to build a large research team, added experienced analysts and set up an Investment Committee. The team has in-depth expertise in specific industries and a broad awareness of important market dynamics. We have built a collaborative environment where the value creation from the entire team is far greater than the sum of individual efforts. Our analytical work has built on the knowledge gained from both – good investments and the occasional mistakes. Our documentation of our process has allowed us to gain insights that have improved our investment results over time.

Our investment process emphasizes the following metrics in companies. These are required, but not exhaustive:

- Strong cash flow generation

- Ability to earn return on capital in excess of cost of capital

- Attractive cash flow based valuation

- Healthy balance sheet

- High quality management

Our research process seeks to uncover companies with these characteristics before they are well known in the market.

Our portfolio construction process seeks to build all-cap portfolios and we have the flexibility to change small-cap exposure based on which segment of the market may be undervalued.

Risk management is addressed both at the individual stock level and on a portfolio basis. Our process emphasizes the avoidance of loss of capital which is done through rigorous due diligence before purchase of a security and the adherence to our investment discipline. At a portfolio level, we add diversification on an individual holding level and across sectors, industries and themes. We review performance and ensure that our ex-post results are in-line with exante expectations.

Review of the Year

The Indian equity markets saw a record breaking rally in the benchmark indices, making it the fourth largest equity market globally for the first time in January 2024. The investment landscape was supported by increased government spending, robust earnings, sound monetary policy and a healthy banking sector .

The rationalization of subsidies for electric vehicles positively impacted conventional ice-engine sales – benefitting traditional auto players. The capital goods sector was driven by increased government capex, improving outlook in select international geographies and a favorable raw material scenario. Residential real estate absorption was a strong point and benefitted the listed realty developers with the realty sector leading the gains among sectoral indices. A sub-par monsoon negatively impacted rural consumption and the FMCG sector was in pain for most of the year.

The financial sector was an important pillar of growth with credit growth (excluding HDFC ltd merger) of 16.1% being driven by retail credit. However, the RBI was concerned by the unbridled growth in certain unsecured retail loans and loans to NBFC. As it looked to control the emerging risks, it increased the risk weights for certain retail loans and loans to NBFCs by 25% to 125%. The above was followed by RBI plugging a loophole on the AIF route, as it restricted banks and financial institutions from investing in AIFs, where there was any downstream link or exposure to a debtor company. Hence, if a bank has lent to a debtor firm in the past 12 months it cannot invest in an AIF investing in the same company. The RBI directed them to liquidate such assets within 30 days or keep a 100% provision for the same. The above measures had the desired impact with lending by banks slowing down in the targeted segments towards the end of year.

Inflation was an issue through the year with CPI peaking in July at 7.4% and ending the year at 4.9%, still 90 bps above RBIs comfort level. Food inflation remained sticky, ending at 8.5%, with the climatic issues calling the shots. The fiscal consolidation smoothened the process for Indian bonds inclusion in the JP Morgan debt indices and this supported the mid-year downward spiral of the 10-year yield curve. Thereafter, the fixed income markets followed the inflation prints with 10-year g-sec ending at 7.05% for the year

India’s merchandise exports fell 3.2% in FY24 due to lower oil (down 1.4%) and lower gems and jewellery exports (down 14%). On the other hand, import growth was lagging as it slipped 3.6% yoy, with lower oil imports more than offsetting the growth in electronics and gold imports. Capital good imports declined 7.6% yoy and this partly syncs with growth being more investments led than consumption.

For the financial year, our benchmark index BSE500 TRI was up by 40%. The Indian equity markets for the year 2023-24 had a smooth ride, undeterred by the rising geopolitical tensions in the Middle-East and events in the Red Sea. The outperformance of Indian markets was driven by strong domestic participation with retail investors using SIPs to participate in the markets on a regular basis. In addition, we saw sustained inflows from FIIs.

In this solid financial year 2023-24, Sameeksha PMS has managed to generate positive absolute return as well as meaningful outperformance as compared to our benchmark BSE500 TRI. The PMS returned 63.4% before performance fees but with the application of performance fees, our returns came to 60.1%, outperforming the benchmark BSE500 TRI by 19.9 percentage points. We analyze the Fund performance for the year in greater detail in Appendix 1. Further, we discuss key contributors to the portfolio performance in Appendix 2. We discuss the outlook for our key investment positions in Appendix 3. We have further discussed the performance of the Fund over the last eight years in Appendix 4. Lastly, we discuss in detail the outlook of the Indian economy in Appendix 5.

Market Outlook

We believe the past constraints to growth: capital and energy, are being unshackled with a relentless focus on sustainable growth.. The banking sector benefits from better bankruptcy laws, with gross NPAs at 10-year lows and growth capital is no longer an issue for industry. The government has been proactive in tackling the constraints on energy and its focus on promoting renewable sources of energy continued to be on display even in the Interim budget. The GST has gone through multiple iterations, as policy makers learnt fast from failures and implemented reforms fast. The gross GST collections at 20.1 lac cr (+11.7% yoy) in FY 24, saw a monthly average collection of 1.7 lac crores. These gains are not being frittered away but are being deployed in infrastructure projects. We believe policymakers are creating the right framework to put India on the path to becoming the third largest economy by 2027. Hence, we believe the better-than-expected GDP prints are here to stay. Moreover, India is benefitting from the resilient global growth and the reconfiguration of global supply chains and rising trade tensions between the US and China.

The GDP prints surprised positively through last year, and as a result the IMF had to consistently adjust its GDP forecast upwards, currently at 6.8% for FY25 and 6.5% for FY26. While this implies a slowdown from FY24 levels it remains a strong number given the global environment. We believe RBIs target for a CPI inflation print of 4.5% in FY25 has room to surprise positively. While food inflation is likely to be volatile, core CPI is likely to remain benign. Fiscal prudence is likely to continue and may limit government capital spending, given the inclusion of Indian bonds in JP Morgan’s bond index in June 2024 ,hence we believe private capex needs to step up.

Premiumisation of the economy will see luxury goods continue to dominate the growth in spending. This theme cuts across sectors- cars in the above 7.5 lac range are seeing blooming of variety and volumes, real estate sector sees the share of upper segment home sales rising to 28% while middle segment was stable and lower segment lost share. Tipplers are getting high on high end bottles and in consumer durables it’s the larger capacity refrigerators flying off the shelves.

The charisma of Modi and political astuteness of Amit Shah is getting difficult for any opposition to manage. Historically, election years have been positive for the stock market performance, both pre and post-elections results, as market focus shifts to the fundamentals post the event. The Vajpayee government lost in 2004 and that led to a 3 day index return of -17%, with the index coming back strongly to give a +19% return for the 1-year post election.

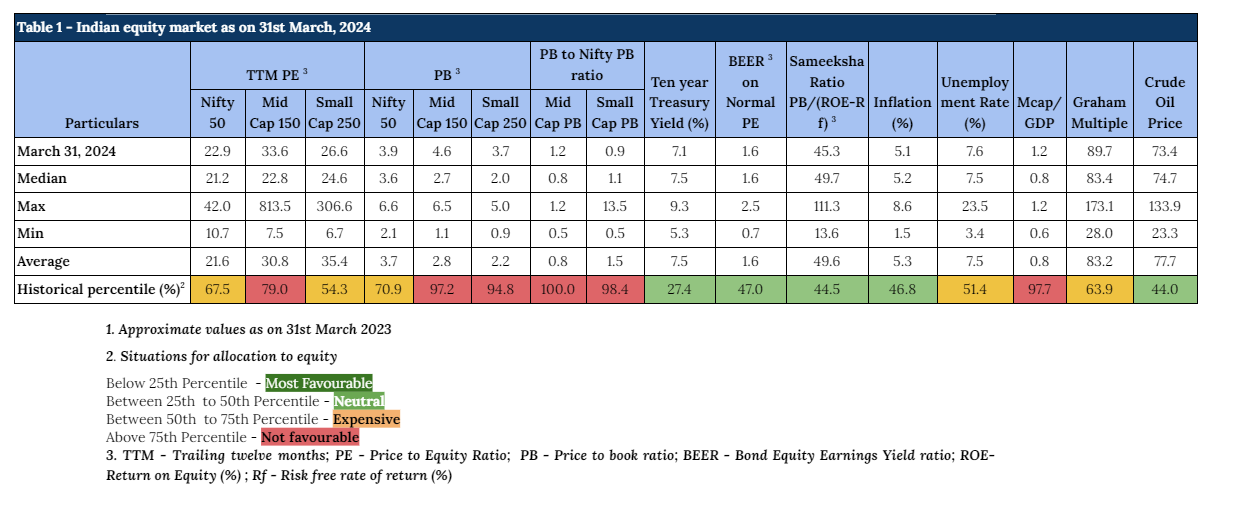

The Nifty50 valuations on PE basis are at slight premium to historical average. We believe there are pockets of value within large caps such as in financials and consumer discretionaries. The surge in domestic retail activity bodes well for small and mid-cap stocks, as it enabled businesses to raise low cost equity funds. However, this makes the risk reward less favourable for the broader markets. Meanwhile, we remain focussed on identifying bottom up opportunities across market cap. (Table 1)

Links:-

Appendix 1: Performance of the fund for FY2024

Appendix 2: Key Performance Contributors in FY2024

Appendix 3: Current view on top seven positions

Appendix 4: Analysis of our performance over last Eight years