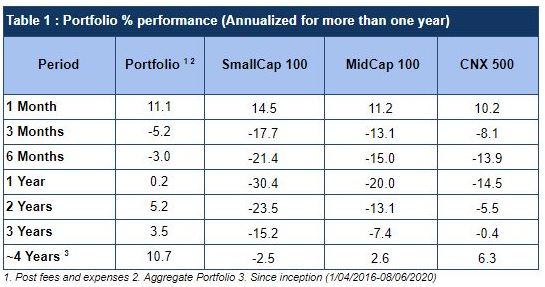

We share with you a monthly update of our performance. As of June 8th, our portfolio has delivered CAGR returns of 10.7% on TWRR basis from inception versus CNX 500 at 6.3% suggesting a clear annualized Alpha of 4.4% (Table 1).

An important observation we would like to make is that the portfolios we have had for a longer time have done exceedingly well. It is unclear to us if regulations allow us to publish such details and hence we refrain from doing that. However we would be happy to discuss this aspect with interested investors. Because of the way we invest, new clients may see a meaningful part of their investments stay in cash and hence short term performance may not look attractive. However, performance of client portfolios that have been around with us longer have been very strong. This gives us immense confidence in our strategy.

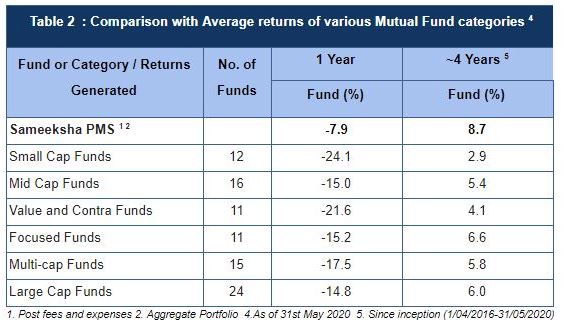

Either for one year or four years (we are operational for four years and two months), our performance compares very favorably with the averages for all the mutual fund categories (Table 2) . However, we do reckon negative absolute performance in FY20 and hence negative returns on a one year basis (just being much better than the benchmarks is not enough when we have the flexibility to shift into cash).

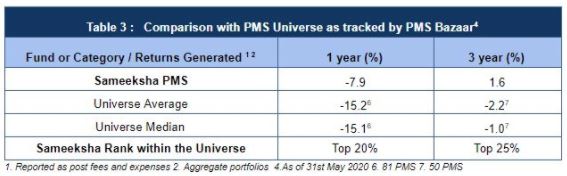

Our return compares favourably with the PMS universe as tracked by PMS Bazaar (Table 3).

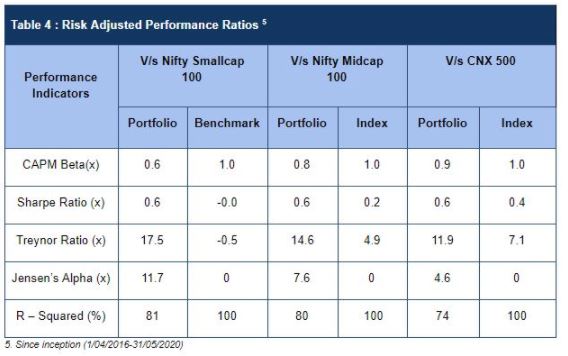

Risk adjusted performance is a far better measure of performance versus a simple comparison of returns. We have delivered very healthy risk adjusted performance when compared to various benchmarks. (Table 4).

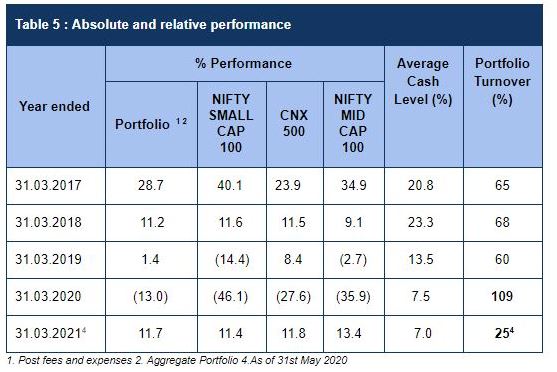

Finally in Table 5, we compare our performance versus benchmarks for each of the financial years that we have been operational.

Disclaimer : The information contained in this newsletter has not been verified by SEBI.