India: Long term growth opportunity

India is now the most populous country (population of ~1.43 billion) surpassing China recently. India is a land of diversity where each state distinctly differs from the other in language, culture, religious beliefs, staple diet etc., almost like multiple countries within one continent. India’s economy is driven by domestic consumption (60% contribution to GDP), in contrast to China (exports are 60% of GDP). The Indian GDP contribution comes 65% from services, 20% from manufacturing and 15% from agriculture. India has one of the youngest populations with a median age of 28 years as compared to 38 years for the US and 39 years for China. With two-thirds of the entire population below 35 years of age, India will continue to see a rising share of population in the working age group (25-64 years) for another two decades, unlike the rise in an ageing population being seen in Europe, Japan and now in China. India is expected to be the fastest growing major economy for a third year in a row- IMF has forecast India’s GDP growth to sustain at 6.5% in FY 2025.

Global macro-outlook-2025:

The global economy remains remarkably resilient but uneven across major economies with robust momentum in the United States being in contrast to a mild slowdown in several other countries. Global disinflation continues though with signs of stalling in further progress. As per the IMF’s January 2025 World Economic Outlook report, the Global growth is estimated at 3.2% in 2024, higher than its projection of 3.1% made a year earlier. The IMF has projected the Global growth to sustain at 3.3% in 2025 and 2026. The 2025 growth projection has been revised up by 0.1% from its earlier October 2024 projections, mainly driven by strength in the US economy, despite headwinds from lingering high inflation, weak demand in China and Europe, and spillovers from two regional wars. The IMF revised its projections for U.S. GDP growth in 2025 sharply upwards to 2.7% from the 2.2% growth projected in October 2024, on a less restrictive monetary policy stance, supportive financial conditions and a stronger-than-expected employment driving consumer spending.

US CPI inflation was 2.4% YoY in March 2025 as compared to 3.5% a year ago with core CPI remaining elevated at 2.8% YoY. The IMF projects the Global headline inflation to fall from an annual average of 5.7% in 2024 to 4.2% in 2025 and further to 3.5% in 2026. While core goods price inflation has fallen back to or below trend, services price inflation is still running above pre–COVID-19 averages in many economies, including the US and the Euro area. Concerns about tepid economic growth in several economies have increased the expectations of central bank monetary policy easing at a faster rate. In contrast, the US 10-year bond yields, hit a low of 3.62% in September 2024 and have rallied since and closed at 4.21% at the end of March 2025 on the back of receding expectations on the size and pace of further rate cuts.

Equities in the US market have rallied over the past year on several plausible factors including the resilience of the US economy, softening inflation, potential for generative AI and in response to the outcome of November 2024 US Presidential elections. What happens next depends on the impact of a range of things:

- Geopolitical events

- Trajectory of inflation

- Changes in interest rates, economic conditions, and earnings

- Tariffs and Trade impact

- Impact of generative on AI on the economy

The two decades after the end of the cold war are often referred to as a period of “Pax Americana”- a dominant, but benign superpower that could enforce peace, and a world that focused on economic integration and growth. Over the last decade, both China and Russia have sought to enforce regional dominance over smaller countries, and this has raised the risk of conflict. The war in Ukraine, the renewal of conflict in the Middle East and the differing interpretations of Taiwan’s status are all issues that can escalate with severe consequences for the global political economy.

The market advance since October 2023 has been narrow and led by technology, particularly the large-caps. This has changed somewhat in the Q1 2025 with S&P 500 and NASDAQ 100 correcting by 4.3% and 8.1% respectively. Further, the Magnificent Seven stocks which had driven indices significantly in the recent years corrected by 16.0% in Q1 2025. With this backdrop of the recent correction are two positives; one, S&P 500 corporate EPS is forecasted to grow at 11.5% in CY 2025 and two, 8 of the 11 large cap sectors are positive on a year to date basis reflecting a positive sentiment in the broader markets. .

The resiliency of the US economy, despite elevated interest rates, is supportive of the “no-landing” scenario. Plausible reasons why this may be happening include:

High levels of government expenditure

It is estimated that 50% of the growth in the labor market in previous years has come from foreign-born workers.

Market exuberance exists in certain segments of the market- anything AI related and more recently in the crypto domain, but it is not widespread as yet.

Post the elections in the United States in 2024, there are expectations of long term benefits that may accrue from lower regulations and more business friendly policies, tax cuts and lower fiscal deficit. Improving efficiency of government spending is likely to help reduce debt and interest rates. There may also be an easing of the geopolitical tensions in the EU and that may help with further softening of energy prices. However, in the short term, there are increased uncertainties in relation to trade and immigration policies which are expected to be inflationary. These have led to a broad based strengthening of the US Dollar and a rise in US bond yields since September 2024. Financial market volatility may remain heightened over the next 6 to 9 months till the policy uncertainty subsides and the positive impact of long term measures start making an impact. A further easing of monetary policy is expected going forward with the US Fed’s commentary projecting 2 policy rate cuts in 2025. It is likely that markets will overestimate the potential for generative AI, but it is unclear if we are already at that stage. The technology sector is always vulnerable to disruption, and we think that is a key risk to the markets today. China’s unveiling of the Deepseek AI model has challenged the dominance of US tech giants and demonstrated limited success of isolation and technology denial policies.

India macro-outlook-2025:

The Indian economy remains one of the fastest growing economies amidst the developing economies. There are a number of structural factors favoring a sustained period of high growth for the Indian economy under the right set of conditions.

First, with a growing and young population, the working age population will continue to rise for another two or three decades. The median age of 28 years makes it one of the youngest populations in the world. Second, with low penetration and consumption per capita levels, of a vast range of products and services, several end markets can sustain high single digit to double digit growth rates for 10 to 20+ years. Third, India is not one market but many markets: Urban versus Rural, bottom of the pyramid all the way to the super-luxury. As such, sizable opportunities exist for a wide range of products and services – from two wheelers to luxury cars, from basic consumer goods to high end fashion goods, from retail to travel sector and so on. There is a strong trend being witnessed in several of the Infrastructure sub-sectors renewables, electronics manufacturing etc. as well. Fourth, though India may still be a difficult place to do business relative to many developed or developing countries, there has been a consistent improvement in ease of doing business over the last few years.

Historically, the Indian economy saw scaling up being driven by select business groups that possessed management capabilities and the capital strength and such companies were favoured for investment. Increasingly though amidst an improving climate for doing business, India is witnessing a formation of a large number of new age companies and entrepreneurs that embrace technological changes and are able to scale up rapidly thanks to availability of venture capital and new channels to sell products and services. Between the well established companies that boast superior profitability and market position and the new age companies that have potential for explosive growth, Indian equities has continued to be a ripe place for stock picking. Today, India represents one of the largest start-up ecosystems in the world aided by the presence of all the major venture capitalists and private equity firms who are funding new business ventures of thousands of dynamic entrepreneurs with potential to not only transform Indian markets but also win on a global scale.

All the structural factors can be conducive to growth only if the right environment exists. We have discussed the success of the current Indian government to both widen and deepen the structural economic reforms where it has contributed to faster economic growth and created a bigger social safety net for the indigent. Some of these include:

Introduction of GST leading to increased formalization of the economy: This introduced a uniform indirect tax system across the country and removed the state by state taxes which had hindered inter-state commerce. There was a more than 50% increase in the number of indirect tax payers. This has not only aided the government’s efforts to widen the tax base, increase tax collection and have the capacity to provide social benefits without increasing the fiscal deficit, but from our perspective, has created a level-playing field.

Demonetization and shift to digital economy: This was a controversial move in that it caused a temporary slowdown in the economy. However, it accelerated the inclusion of the poor into the banking system and greatly expanded the roll out of the digital payment system. India’s rapidly growing digital payments network has reduced transaction friction and corruption significantly. India’s unique, real-time, mobile-enabled Unified Payments Interface (UPI) continues to grow at a breakneck pace.

Shift to Digital ecosystem continues to accelerate: UPI was expected to serve 100 mn merchants and 750 mn consumers and against this it reached 50 mn merchants and 300 mn consumers in FY24. The volume of UPI transactions has catapulted from 375 cr in CY18 to 17,221 cr in CY24. India, is the global leader for digital payment innovations, accounting for 49% of all global real-time transactions in 2023. To reach the first 1,000 cr P2M UPI transactions took 4.5 yrs, with the latest 1,000 cr transactions taking 45 days (source:RBI governor speech Mar 2024) The UPI has further evolved to allow for offline payments through near field communication (UPI Tap & Pay), offline payments (UPI Lite) and payments through feature phones (UPI 123 pay).

Inflation targeting: The government has kept inflation under check over the last five years through prudent fiscal policies. This allows for greater predictability for businesses and consumers, and results in lower real rates in the long run. Despite increases in budget support to vulnerable groups, fiscal deficits have been kept under control. This has also allowed inflation to be lower than historic norms. Reduced corruption from direct transfer of benefits to bank accounts has helped widen benefits while keeping spending under control.

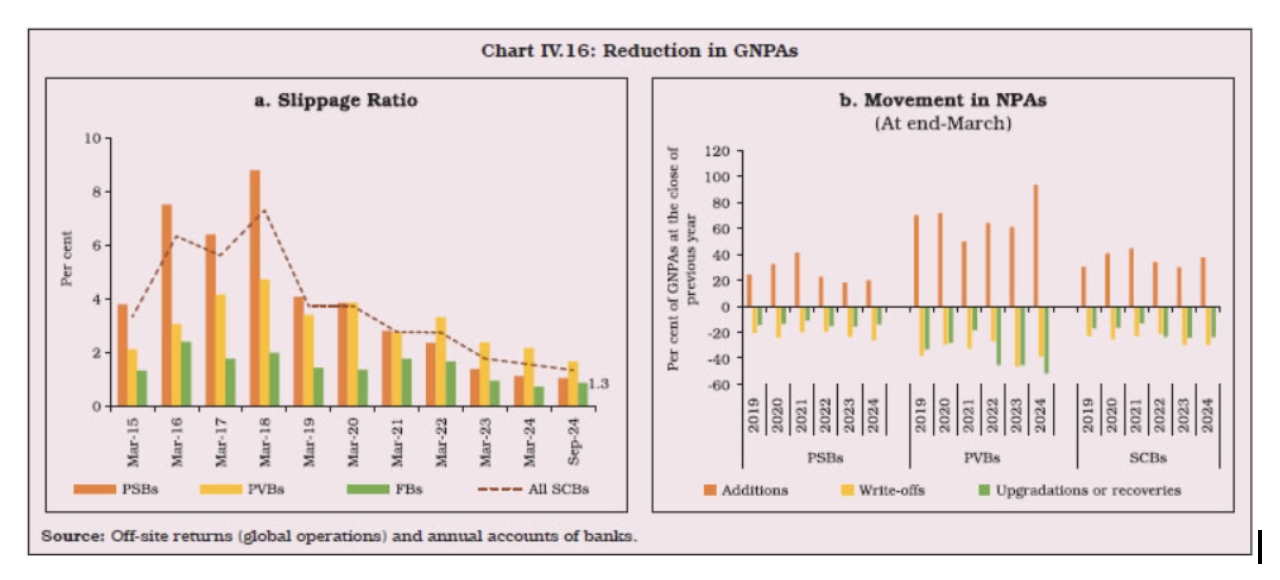

Bankruptcy process: New laws have sped up the bankruptcy process and given greater power to Creditors. The Insolvency and Bankruptcy Code, 2016 has brought about a behavioural change among debtors. The fear of losing control over the enterprise upon initiation of Corporate Insolvency Resolution Process (CIRP) has nudged thousands of debtors to settle their dues before initiation of the process. The realization by financial creditors under resolution is ~ 177% while under Liquidation was ~ 33% of claims. In the long-term, this should facilitate lower risk for lending, faster credit and better quality credit growth.As per RBI’s latest data, the GNPA ratio of scheduled commercial banks fell to at least a twelve-year low of 2.6% and NNPA fell to 0.57% as of Sept-24. The much improved bankruptcy process’s slippage ratio continued to surprise positively with it looking set to remain below 2% for the second consecutive year in FY25.

Labor: More needs to be done here to compete with other Asian countries in terms of export oriented industries, but States now have the power to change laws to allow for more flexibility for companies to enter and exit as business conditions change and several states are in process of implementing simplified labor laws.

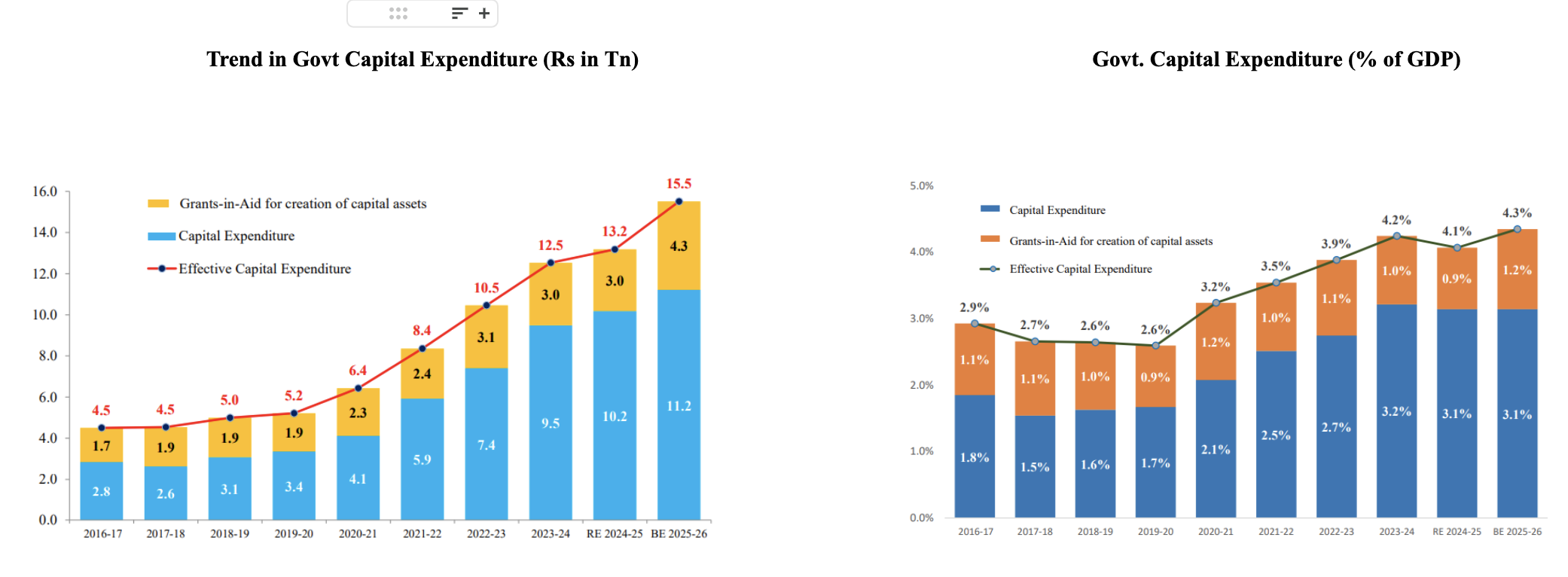

Infrastructure: A key hurdle India has faced in rapid industrialization has been the poor infrastructure. The recent Indian budget increased the total outlay for capital expenditure by 17.4% to Rs 1.55 tn i.e. 4.34% of GDP. Construction of roads, ports, extending freight rail infrastructure and building new airports have all accelerated over the last seven years. The NHAI’s mandatory payment of user fee through FASTags is seeing increased adoption. Further, the ministry of road transport and highways continues to work towards reducing logistics cost to single digits from 13% to 14% currently. The move has brought about much needed efficiency in toll road operations and improved revenue collection.

Financial sector remains resilient: The credit growth in the banking system maintained its momentum growing at 12% YoY (ex-HDFC ltd. merger) in FY25 with the unsecured retail growth outpacing overall credit growth. In February 2025, the RBI rolled back the additional 25% risk weights on bank loans to NBFCs and MFIs, that was imposed in November 2023. Starting April 1, 2025, banks will go back to assigning risk weights based on NBFCs’ external credit ratings. This move is expected to reduce the cost of credit for NBFCs, which in turn will enhance credit availability in the retail segment as well as improve the CAR for banks.

All the structural reforms along with the strong underlying economic factors could propel the Indian economy into a multiyear high growth journey which could be far better than any other emerging economy.

Fixed income market valuation & outlook:

The RBI’s MPC in October 2024 voted to change the monetary policy stance from “withdrawal of accommodation” to “neutral”. Subsequently, RBI cut the CRR by 50 bps in December 2025 and the Repo rate by 25 bps in February 2025, cutting rates for the first time in nearly five years. Headline inflation over the past year has mostly stayed aligned within the targeted inflation band barring a few occasions. CPI inflation, after moving above the upper tolerance band in October 2024 to 6.21%, has seen a substantial moderation to the level of 3.61% in February 2025, aided by lower food inflation. With favorable rabi crop prospects and absent any supply shocks, the Core inflation is expected to remain moderate. The RBI has projected the average CPI inflation rate to fall from 4.8% in FY 2025 to 4.2% in FY2026.

FII flows into the bond markets saw an increase YoY in FY2025 while the flows from MFs were negative. This was the reverse of the trends seen in the equity markets. India’s inclusion in more global bond indices is likely to continue to attract flows into the bond markets.

We believe the expected growth-inflation dynamics, fiscal consolidation and easing of rates by other large central banks is likely to aid in a softer monetary stance in the coming year. The India 10 Year GSec yield closed FY 2025 at 6.58%, down from 7.05% at the end of FY 2024. Based on the projected CPI inflation for FY 2026, the real rates remain above 200 bps and provide room for further moderation in the policy rates and Bond yields.

Equity market valuation & outlook: Elections at the start of the FY 2025 impacted government spending due to the election code of conduct coming into force. Urban consumption demand saw a slowdown following high retail inflation. These led to a lower than projected growth in GDP and corporate earnings in FY 2025. In addition, a significant strengthening of the US dollar and relative attractiveness of other markets, led to significant outflow of FII funds from Indian equity markets. Consequently, there has been a sharp correction in the markets over September 2024 through March 2025. Valuations of large cap equities are now at a discount to their long term averages on a price to book and price to earnings basis. In comparison, the mid-cap and small cap indices have seen a larger correction during the same period though their valuations remain at a relative premium to their historical averages. Retail flows into the markets via the Mutual Fund SIP route have remained steadfast and which have supported the markets in the face of significant FII outflows.

The investment landscape remains favorably supported by sound government policies, robust corporate balance sheets and while it is being challenged by an adverse external environment, India’s global economic stature is on the ascent. In the Budget for FY 2026, the government has given a substantial tax relief to the middle class that is likely to aid consumption and savings, improve utilization levels in the industry and spur private investments. Energy prices are expected to remain benign, easing inflation pressures. Prudent fiscal policies and moderate inflation are likely to create room for further monetary policy easing. Transmission of lower rates into the economy are likely to aid consumption as well as support the earnings growth and valuations for the broader markets. The government continues to take steps to attract investment through the PLI scheme that will improve global manufacturing competitiveness, boost jobs and improve the trade balance. Given the trade tensions between the United States and China, India is well placed to benefit from any global supply chain re-alignment. India continues to attract investments in emerging areas like alternate fuels, data centres and GCCs.

Hence, the investment manager believes consumption and economic activity is likely to pick up going forward. While the Investment Manager is positive on equities with a three to five-year perspective, the Investment Manager’s focus remains on buying businesses that are available at the right price based on their intrinsic value and not on a relative basis. The Investment Manager believes the markets are in a phase where we are seeing higher volatility in the near term, and this could provide interesting buying opportunities. With inflation easing and the risks relating to tariffs abating, the risk to reward ratio could turn favorable from a medium to long term perspective.

The key factors which can impact markets and need to be closely monitored are:

- Geopolitical situation;

- Commodity and crude price movements;

- Global Interest rates and capital flows;

- Tariffs and trade imbalances; and

- Monsoon and rural consumption.

Links:

Appendix 1: Performance of the fund for FY2025

Appendix 2: Key Performance Contributors in FY2025

Appendix 3: Current view on top seven positions

Appendix 4: Analysis of our performance over last Nine years