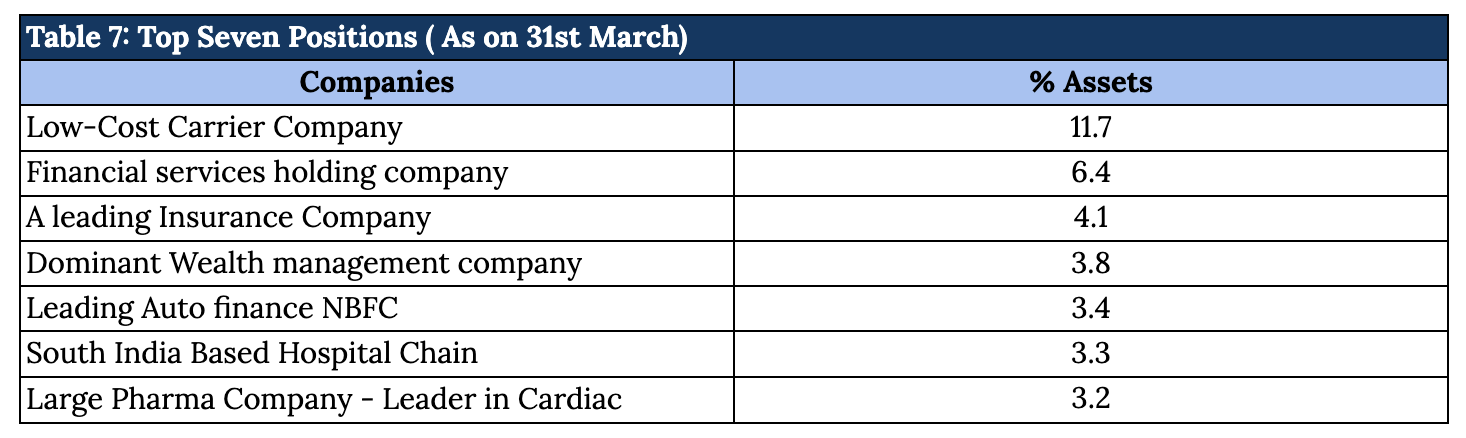

Table 7 below shows a list of our top seven positions (based on asset weight) as on March 31, 2025.

a) Low-Cost Carrier Company

Discussed above

b) Financial services holding company

The company owns one of the most profitable and best-managed NBFCs and general insurers. Also, its life insurance arm is showing strong growth with a turnaround played out in the last 4 years. With all cylinders firing, it is the best proxy to take exposure to the Indian financial sector. Their key subsidiary is a leading NBFC that started with vehicle financing for Auto’s customers and then expanded into all retail credit segments and now also into commercial and SME lending. General Insurance subsidiary is a diversified multi-line insurer present across B2C, B2B, and institutional segments with a focus on profitable growth. Their life insurance subsidiary is one of the fastest-growing life insurers (sixth largest among private players) and has seen a turnaround in terms of profitability over the last 5 years. APE and VNB growth has been solid historically and is expected to perform well, albeit at a lower pace on account of the base effect. The insurance sector is more defensive and attractively valued. A focus on technology driven solutions for financial product distribution and health-tech ventures, will enable an investor to participate in emerging trends. Furthermore, the launch of the AMC plugs the gap in the company’s portfolio as a financial product manufacturer.

c) Dominant Wealth management company

The company is a reputed wealth management firm in India formed as a de-merger of the wealth management arm of another listed company. The company focuses on multi-product multi-customer architecture, leading to a diversified distribution model and this helps the company to get huge benefits from the growing formalization of managed wealth in India. Through the Private segment, the company serves UHNI clients and through the Wealth segment, the company serves the HNI/affluent segment all across India. It generates revenue from capital markets (custody, clearing, and IB/IE), which provides flywheel to customer acquisition and retention.

Overall, there are multiple growth levers for the company. The stickiness with clients as well as RMs, under-penetration of equity and equity-oriented products as a percent of retail assets in India, and steady additions in the number of HNIs will lead the company to enjoy steady growth. AUM growth drivers are: 1) Consistent RM addition/geographic expansion in UHNI (Private) vertical and consequent family additions, 2) Focus on Mid-market led by internal & external RM/ geographic expansion, & 3) Scaling of AMC business driven by Pvt/Public market and new strategies in real estate/credit.

d) Leading Auto finance NBFC

Our investment thesis is supported by a shift in the company’s product mix following its merger with a sister company, which reduces reliance on a single segment and creates cross-selling opportunities across product lines.

Additionally, the company’s relatively higher stage-wise provisioning compared to peers reflects prudent risk management practices. The NBFC continues to outperform its own guidance, with advances growing at a 16% rate and delivering a return on equity (RoE) of over 15%.

Furthermore, the company is actively expanding and diversifying its offerings—such as gold loans and MSME loans—to reduce dependency on the auto segment, thereby mitigating earnings volatility and cyclical risk.

e) South India Based Hospital Chain

It is a regional hospital chain with a strong brand presence and an established track record of over 2 decades. It operates a large multispeciality hospital along with hub and spoke model catering to surrounding areas. It has emerged as one of the most successful ‘Multi Organ Transplant Center’ indicating its clinical excellence. It has also forayed into education and training that helps alleviate the problem of trained manpower shortage in the sector.

It enjoys strong profitability with EBITDA margins that are better than most amongst listed peers. Its receivables days are amongst one of the lowest in the Industry. It has plans for further expansion and geographic diversification in the coming years that are well supported by low levels of financial leverage. It enjoys a large growth opportunity and ongoing capex plans signal a growing appetite for growth by the management.

Links:-

Appendix 1: Performance of the fund for FY2025

Appendix 2: Key Performance Contributors in FY2025

Appendix 4: Analysis of our performance over last Nine years