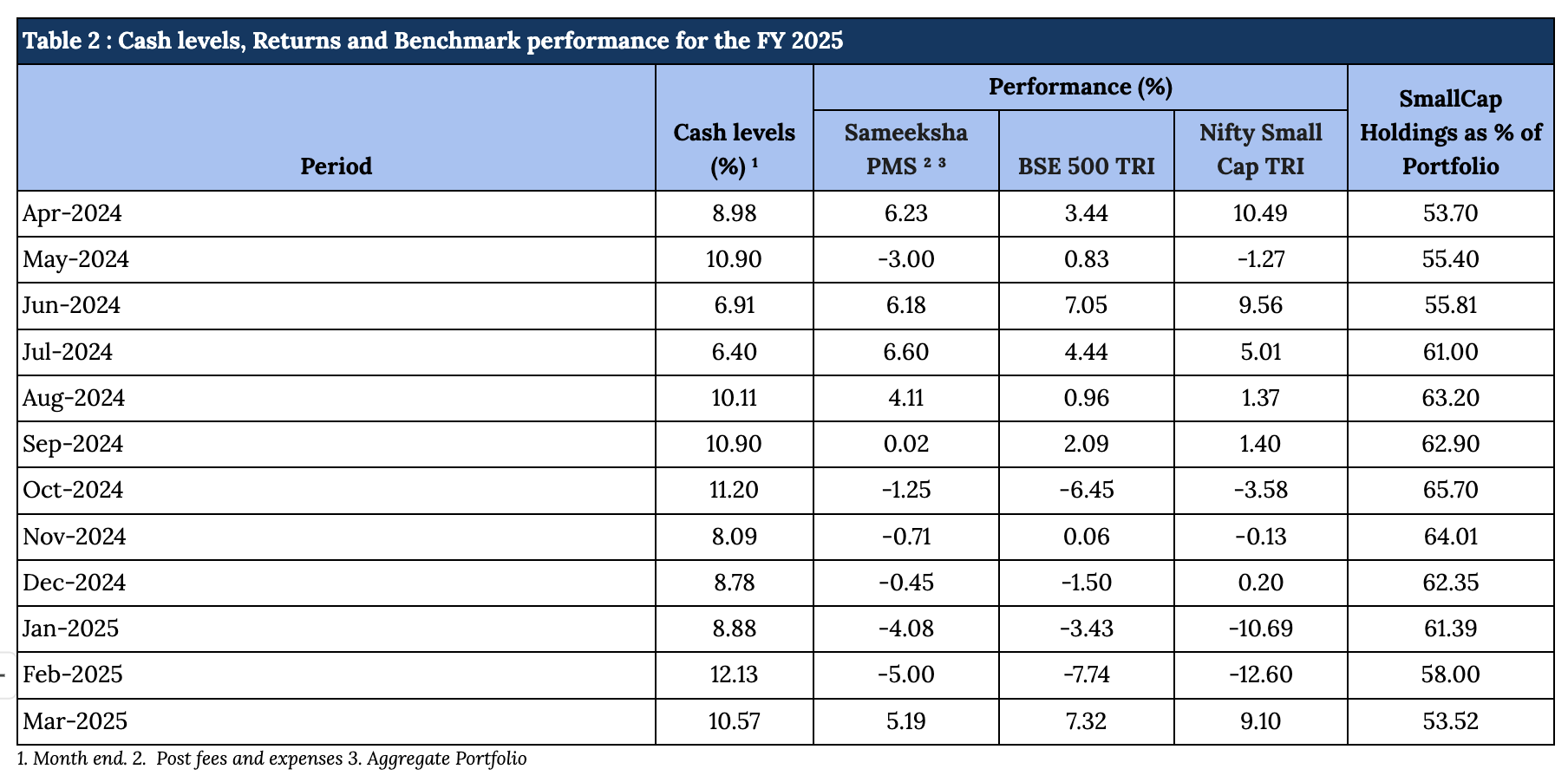

In this financial year 2024-25, Sameeksha PMS has managed to generate positive absolute return as well as meaningful outperformance as compared to the benchmark BSE500 TRI. For the year, the PMS outperformed the benchmark by 7.7%, with an average cash level of 9.5% during the year. Moreover, compared to Nifty Small Cap 250 TRI we had an outperformance of 7.6% respectively.

As shown in Table 2, we maintained relatively high cash levels through most of FY25, peaking in February 2025 at 12.13%. This cautious positioning was driven by a combination of profit-booking after a strong rally in early FY25—particularly in the small-cap segment—and heightened macroeconomic uncertainties. The sharp rise in markets between April and June 2024 led us to trim certain positions where valuations had run ahead of fundamentals, resulting in increased cash levels. While we selectively redeployed capital in July and August as inflation trends improved and earnings visibility strengthened, we maintained a prudent approach during the volatile second half of the year amid global concerns around US interest rates, geopolitical risks, and domestic political uncertainty ahead of the general elections. Corrections in the broader markets during October 2024 and February 2025 presented attractive opportunities, and by March 2025, we began deploying cash into high-conviction ideas, leading to a reduction in cash levels.

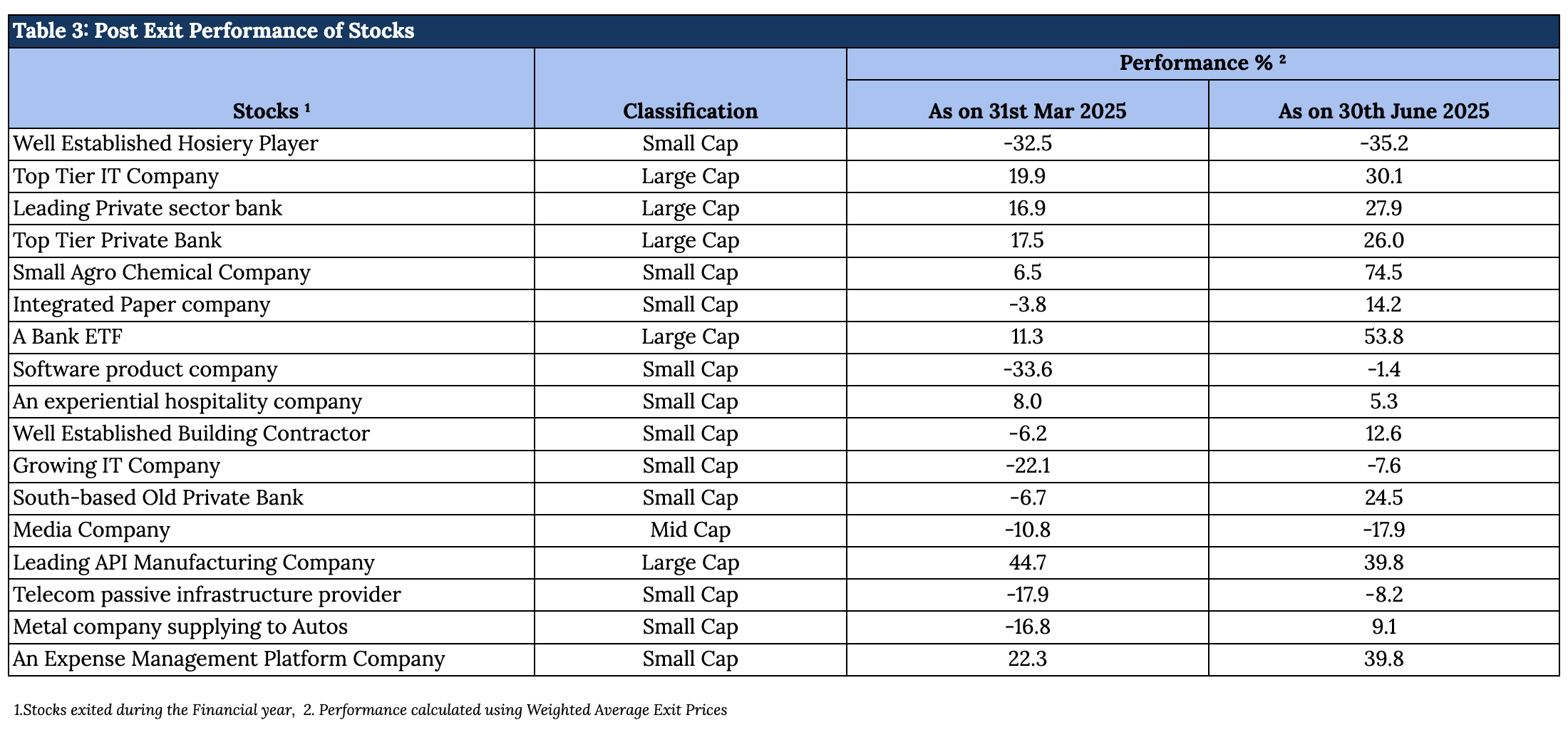

As such, during the year, we took a decision to reduce our exposure and even exited some positions that were not aligning with our criteria and were posing high risk. The performance of stocks we exited has been mixed. (Table 3).

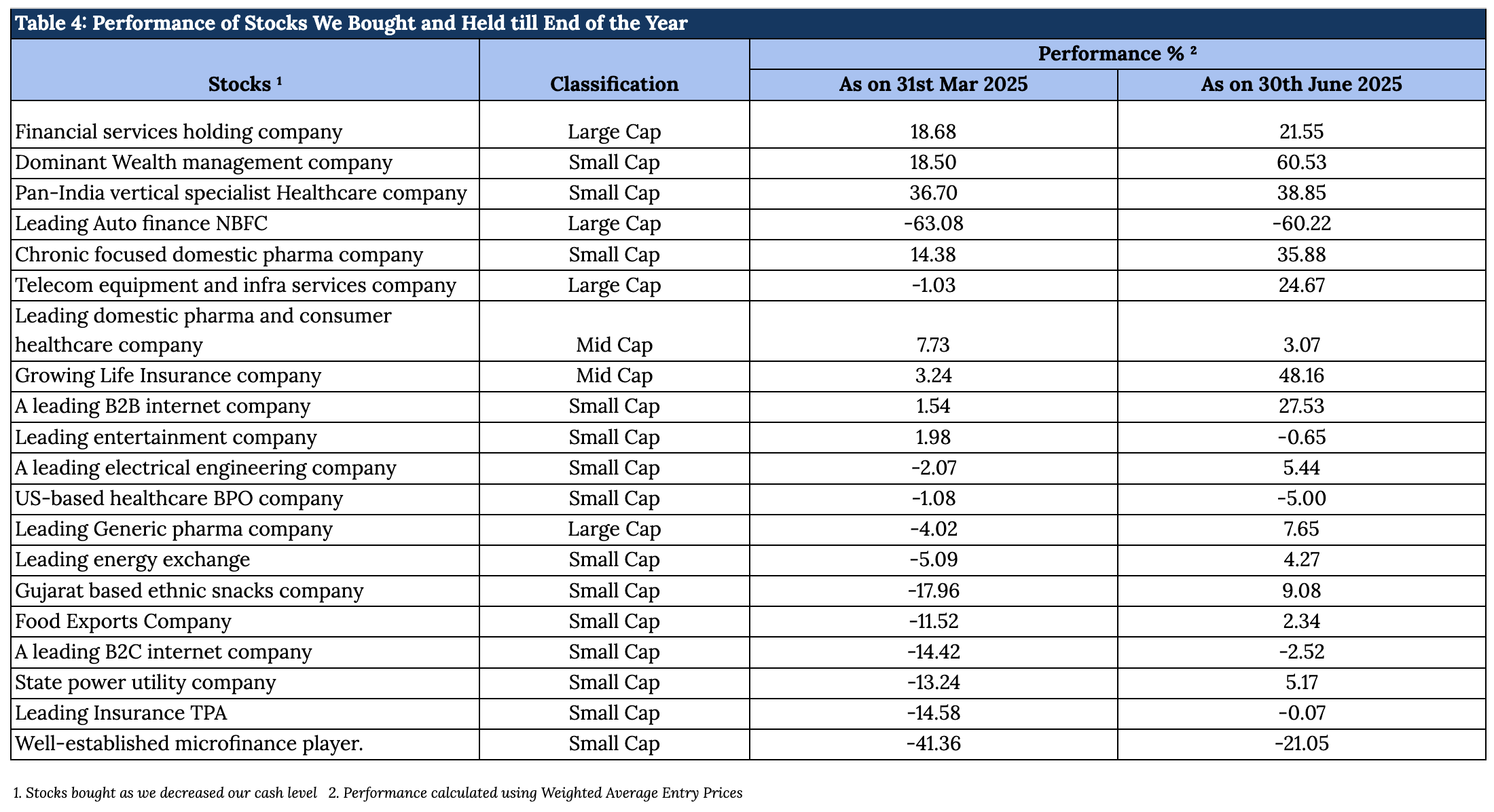

During FY2025, corrections in the small and mid-cap space—especially in October and February—offered compelling opportunities. We used this volatility to selectively redeploy capital into high-conviction small-cap ideas, as reflected in our consistently elevated small-cap allocation (Table 2). The performance of stocks that were bought during the year has been fairly strong overall (Table 4).

Overall, our decision to shift positions has worked out well with the exception of a few stocks that appreciated quite sharply. We will review our investment decisions more in detail in a separate note.

Links:

Appendix 2: Key Performance Contributors in FY2025

Appendix 3: Current view on top seven positions

Appendix 4: Analysis of our performance over last Nine years