* Period ending 30th November, 2024 ** Till Date. *** Among multicap PMSes for five year period **** Five year Period In the month of November, the benchmark S&P BSE 500 TRI was up by 0.1%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) was down by -0.7% (net of all …

Year: 2024

October 2024* : Meaningful alpha so far for FY25**, Forty fourth consecutive month of Top decile performance***; Upside capture**** 105%, Downside capture**** 49%

* Period ending 31st October, 2024 ** Till Date. *** Among multicap PMSes for five year period **** Five year Period In the month of October, the benchmark S&P BSE 500 TRI was down by 6.4%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) was down by 1.2% (net of all fees …

September 2024* : Underperformance for the month, marginal alpha for FY25 till date, Forty third consecutive month of Top decile performance; Upside capture* 105%, Downside capture*** 52%

* Period ending 30th September, 2024 ** Among multicap PMSes for five year period *** Five year Period In the month of September, the benchmark S&P BSE 500 TRI was up 2.1%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) was up by 0.02% (net of all fees and expenses), …

August 2024* : Top decile performance** every month for 42 months in a row; Upside capture*** 110%, Downside capture*** 49%

* Period ending 31st August, 2024, ** Among multicap PMSes for five year period, *** Five year Period In the month of August, the benchmark S&P BSE 500 TRI was up 1.0%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) was up 4.1% (net of all fees and expenses), indicating an alpha …

Performance of Sameeksha over 7 months

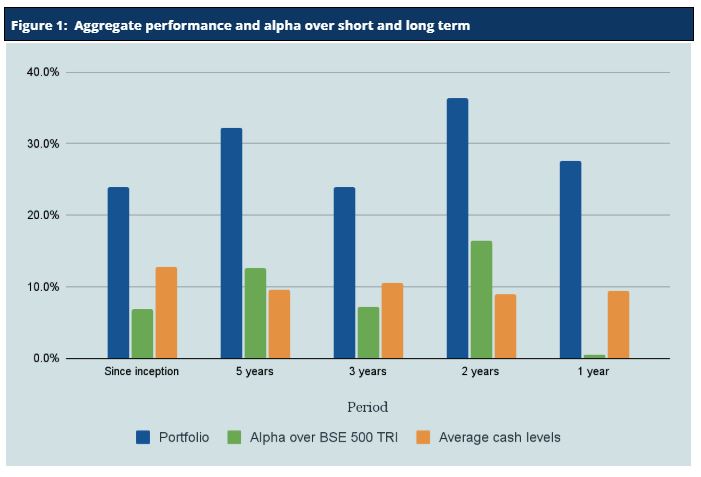

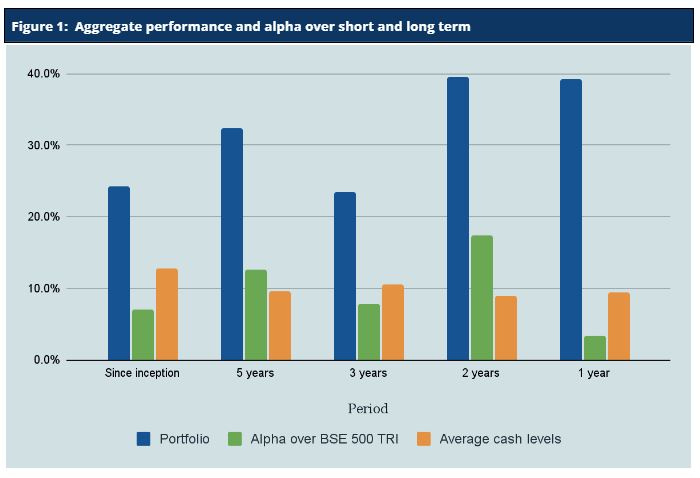

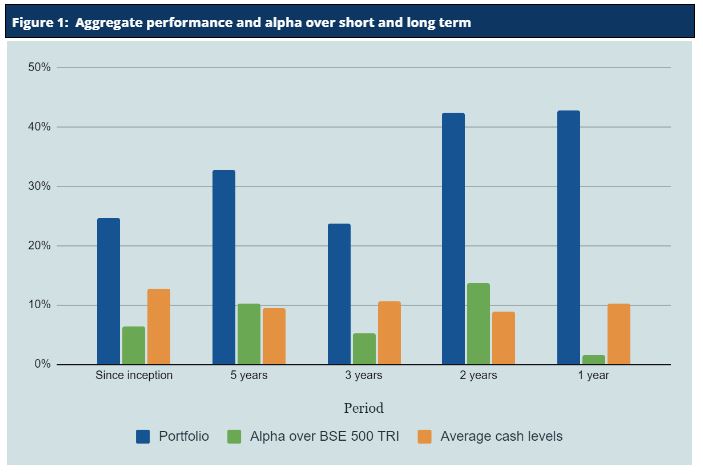

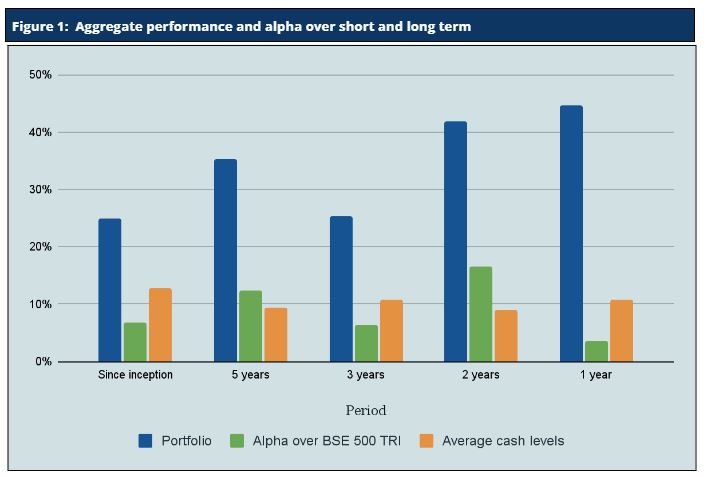

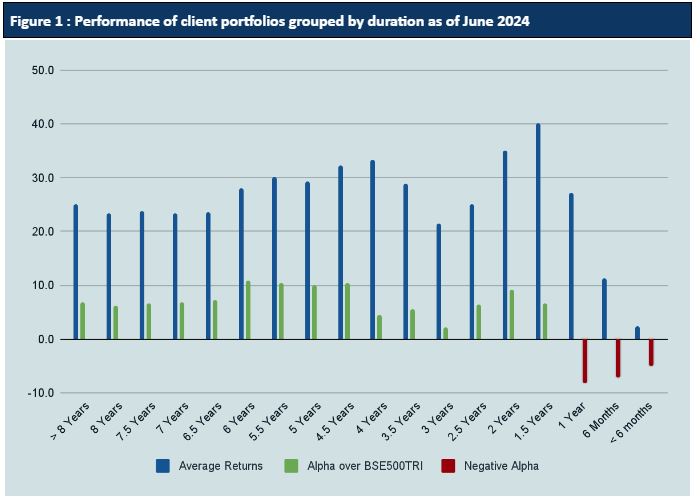

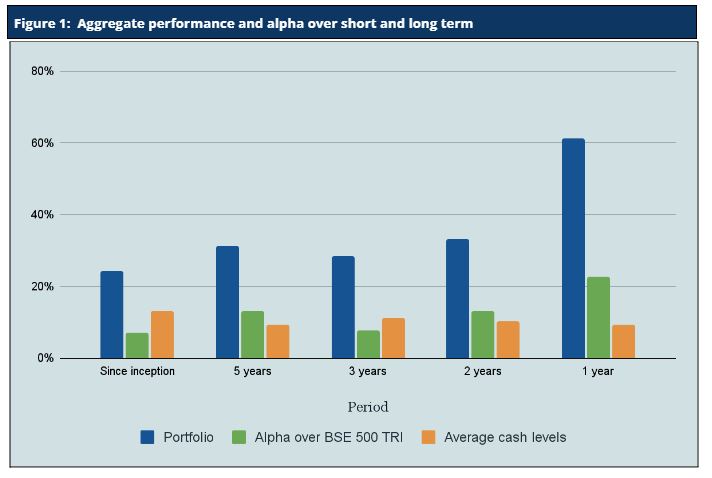

In this note, we address two specific issues. Underperformance on an aggregate basis over the the period between November 2023 to June 2024 and performance of new accounts opened in November-December 2023. We have prepared this note to address questions we have received about the same and to also put that into the context of …

July 2024* : Forty first consecutive month of top decile performance**, upside capture*** 108%, downside capture*** 53%

* Period ending 31st July, 2024 ** Among multicap PMSes for five year period *** Five year Period In the month of July, the benchmark S&P BSE 500 TRI has grown by 4.4%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) has grown by 6.6% (net of all fees and …

June 2024* : Marginal Underperformance, 40th consecutive month*** of top decile performance**

* Period ending 30th June, 2024 , ** Among multicap PMSes for five year period , *** Five year Period In the month of June, the benchmark S&P BSE 500 TRI has grown by 7.1%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) has grown by 6.2% (net of all fees and expenses) …

May 2024* : Thirty ninth consecutive month of top decile performance**, upside capture*** 108%, downside capture*** 54

* Period ending 31st May, 2024, ** Among multicap PMSes for five year period, *** Five year Period In the month of May, the benchmark S&P BSE 500 TRI has grown by 0.83%. Against that, Sameeksha PMS(Portfolio Management Service = Separately Managed Accounts) declined by 3.00% (net of all fees and expenses) while having …

Annual Letter : FY 2023-24 (Year ending Mar 31, 2024)

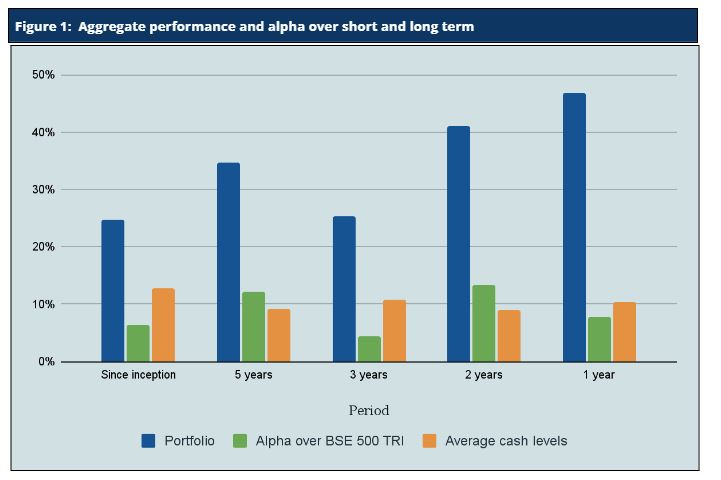

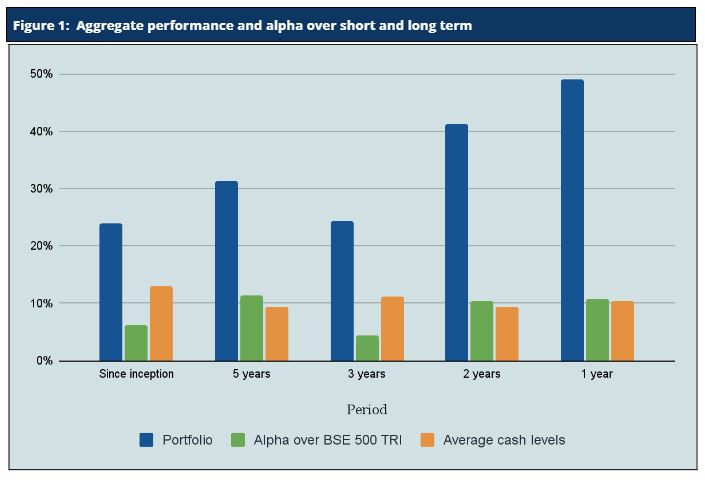

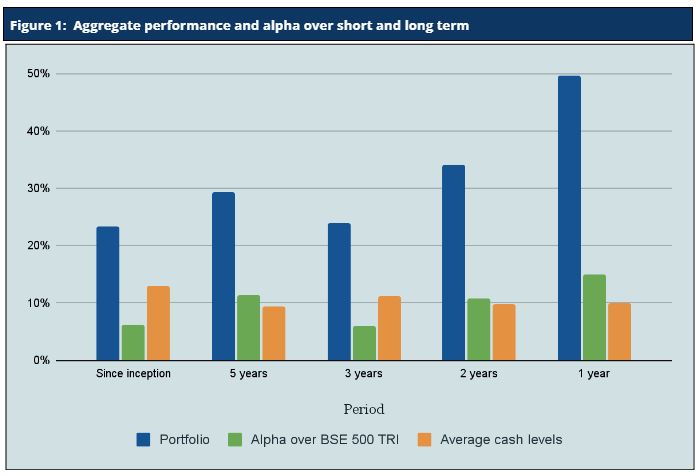

Introduction As of March 31 2024, Sameeksha completed eight years of managing money in Indian equities. Back in late 2015, we started Sameeksha with the objective to manage our investors’ assets just as we manage our own by investing in businesses that were durable and were managed by stewards who view their company capital with …

April 2024* : Thirty eighth consecutive month of top decile performance**, upside capture*** 112%, downside capture*** 54%

* Period ending 30th April, 2024, ** Among multicap PMSes for five year period, *** Five year Period In the month of April, the benchmark S&P BSE 500 TRI has grown by 3.44%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 6.23% (net of all fees and expenses) while having cash levels …