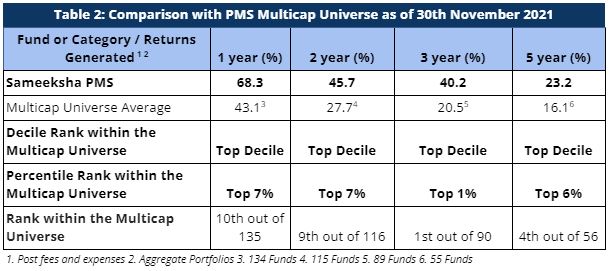

Sameeksha PMS ranks in the top decile of performance for all the relevant key periods. For the three year period ending November 2021, we are ranked 1st out of 90 multicap PMSes reporting to PMS Bazaar. For the five year period also ending November 2021, we are ranked 4th out of 56 multicap PMSes.

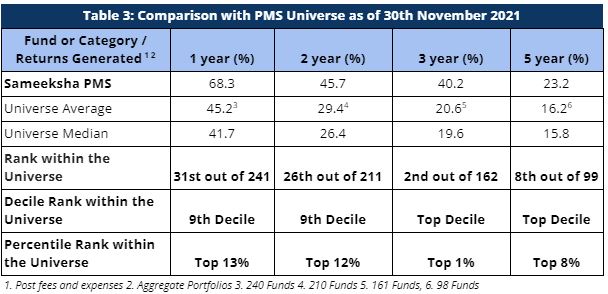

Even within the entire PMS universe, we rank among the best across all PMSes tracked by PMS Bazaar. We are ranked 2nd out of 162 PMSes for the three year period and 8th out of 99 PMSes for the five year period.

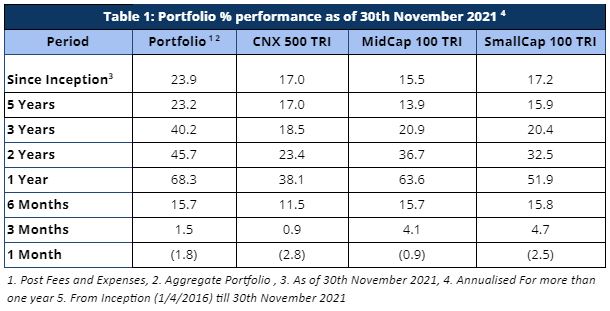

Since its inception, we have generated a return of 23.9% versus the benchmark CNX500 TRI returns of 17.0% while maintaining average cash levels in mid teens. We achieved three and five year CAGR returns of 40.2% and 23.2% respectively, easily outpacing the benchmark and putting us as the best or among the best performing funds in India depending on the time period.

Portfolio Returns

Broader markets had a down month in November 2021 with a return of -2.8%. We had a down month as well, however we were able to choke out small alpha for the month with absolute returns of -1.8% and alpha of 1% over our benchmark CNX500 TRI.

For longer periods where the outperformance is much more meaningful, we have strongly outperformed our benchmark index across all the relevant key periods – as can be observed in Table 1.

Performance Within The PMS Universe

We continue to maintain our top rankings both within the multicap PMS universe as well as the entire PMS universe. The multicap PMS universe rankings are more relevant to us since we follow multicap strategy.

We are pleased to note that our one year period ranking is back to the top decile. Although our performance has been consistently superior relative to our benchmark, we were under performing relative to small and mid cap indices in the recent months. However, it is pleasing to see results after remaining wedded to our core investment strategy of not chasing BAAP (Buy At Any Price) stocks and being cautious with our investments in small and mid caps.

For the three year period, we are ranked number 1 out of 90 PMSes. In the same vein, we are ranked 4th out of 56 funds for the five year period comparison within the Multicap universe – highlighting our superior performance over the long term.

When compared with the entire PMS universe,we again come out on top ranking in the top 15% for all the relevant key periods. The performance is even more significant for longer periods of time. We are ranked 2nd out of 162 PMSes for the three year period and 8th out of 99 PMSes for the five year period.

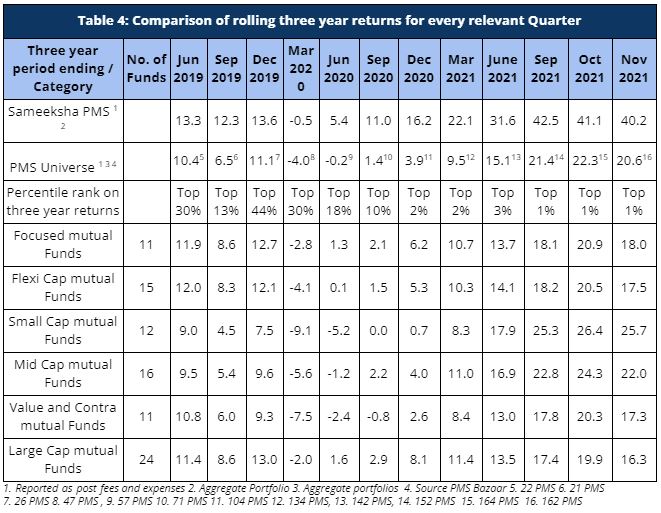

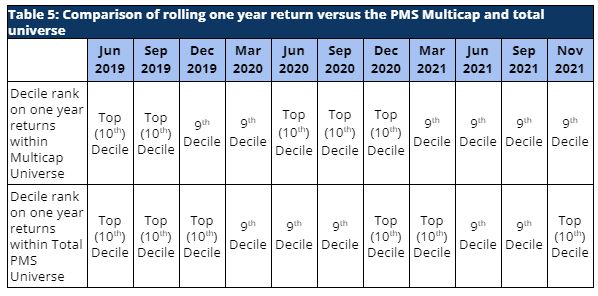

Comparison Of Rolling Returns With Other Funds

Rolling returns are a more useful indicator of consistency in performance versus single period returns. For the three year period ending November 2021, we have meaningfully outperformed all the major relevant mutual fund categories that we are comparable with and have maintained our top decile ranking across both our comparable universe of Multicap PMSes as well as across the entire PMS universe (Table 4). Furthermore, for the last four quarters, we have been consistently ranked among the top 3% and are in the top 1% consistently for the last three months.

Similarly, our rolling one-year returns have been strong and we have maintained our rankings in the top two deciles across the PMS universe consistently over the last two years (Table 5).

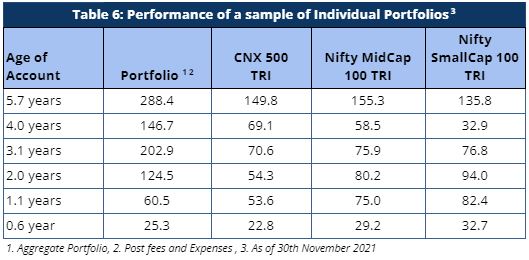

Performance Of Individual Portfolios

Irrespective of their investment timings, the portfolio returns of our clients continue to outpace the benchmarks by a significant margin (Table 6). Portfolio returns for clients who have been with us for longer periods have seen remarkably strong alpha. For a long term investor, Sameeksha PMS has proven to be a valuable partner for their investments.

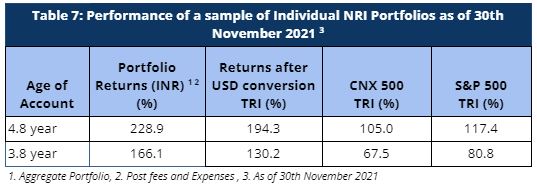

Similarly, our NRI clients have seen strong returns even after factoring in rupee depreciation against US dollars. The portfolio returns are significantly higher than both CNX 500 TRI and S&P 500 TRI, generating strong alpha over both these indices.

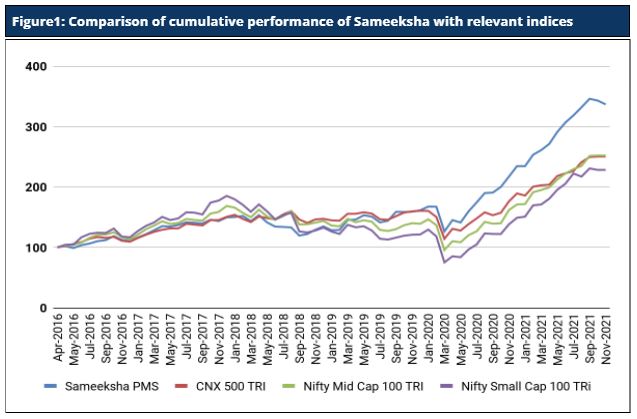

Cumulative Performance Versus The Benchmark

Sameeksha’s outperformance over its benchmark has continued to widen positively over the years. An investment of Rs. 100 with us since inception (April 2016) would have grown to Rs. 337, far outpacing what one would have earned by investing in a fund that achieved benchmark returns (Figure 1).

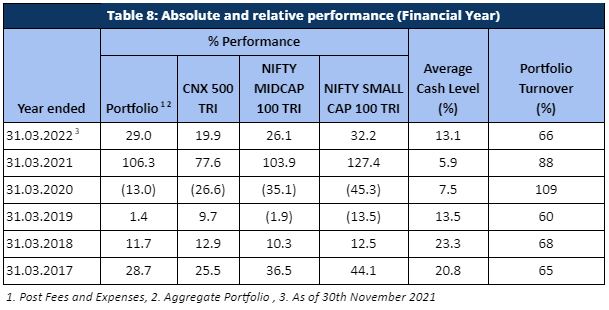

Fund Performance On A Financial Year Basis

Sameeksha PMS generated a return of 29% in eight months (April – November 2021) of the current financial year ending March 2022, outperforming its benchmark index CNX 500 TRI – which returned 19.9% over the same period (Table 8). Discerning investors would notice that we have delivered this performance despite maintaining a meaningful percentage of our portfolio in cash from time to time and that is well reflected in our risk-adjusted-performance outcomes.

When we compare the portfolio performance across financial years, we have clearly out-performed our benchmark almost all financial years except for one notable underperformance. However, our cumulative out-performance far exceeds the under-performance in that year.

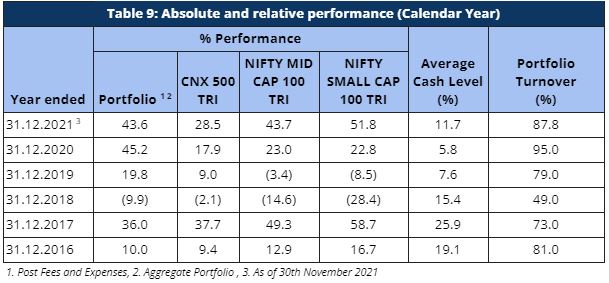

Similarly, when we compare our performance across calendar years, we have again outperformed the benchmark consistently (Table 9) despite maintaining such high cash levels.

Risk Adjusted Ratios

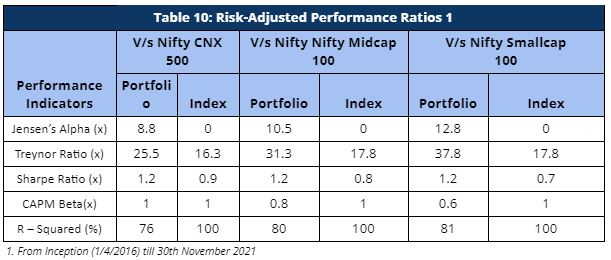

When compared on a risk-adjusted basis (Table 10), our PMS shows even stronger performance with a risk-adjusted alpha generation of 8.8% over the broad market benchmark since its inception.

Furthermore, other risk-adjusted returns – Sharpe ratio and Treynor ratio, are also significantly higher than the benchmark indices (Table 8). It is worth noting that we offer superior risk adjusted returns not only compared to the broad CNX500 index heavily weighted towards large cap but also the small cap and mid cap benchmarks as demonstrated by our sharpe ratio, alpha, Treynor ratio and beta.

Please let us know if you have any questions.

Disclaimer : The information contained in this update is based on data provided by our fund accounting platform and is not audited.