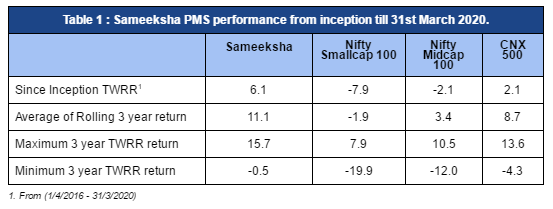

Through this period of extreme volatility, we have managed to retain our outperformance versus benchmarks (Table 1). It is constructive to note that not a single index fund exists today to mimic CNX500, the broad based market index we benchmark ourselves against. We would submit that if an index fund did exist, the managers of such a fund would find it hard to track the index because of liquidity issues with stocks outside of top 50-100 names. In other words, such a strategy would not really work at meaningful AUM. As such, our outperformance versus CNX500 should be viewed in that context. Having said that, we are certainly not happy with the performance we have delivered. We understand quite well that investors look to us to deliver higher positive absolute returns. We will continue to work hard towards that goal.

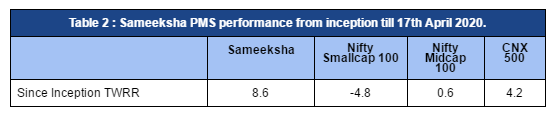

Our inception till date TWRR returns as well as outperformance have marginally improved as of 17th April 2020 (Table 2). However, we understand that this data is very volatile.

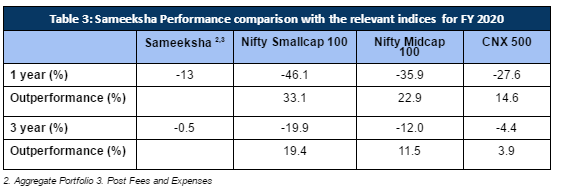

For the year ended March 31st, 2020, We generated -13% return for the year. While that compares well versus major relevant indices (Table 3), we are not happy with a negative absolute return. We could have certainly done better by moving into cash a bit earlier. We note also that hedging of the portfolio through index derivative would have also helped. On a three year basis, we achieved zero return. As such, this must be a tough reading for some of our investors. Only thing we can say is that these readings are hopefully right at the bottom of the market.

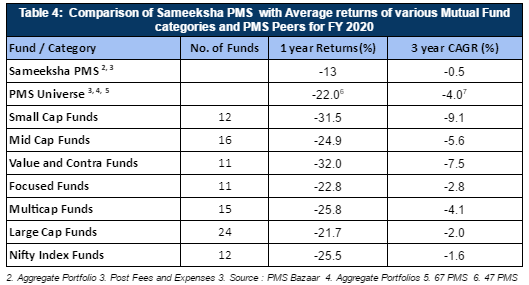

We have performed relatively well compared to the PMS universe as well as mutual funds (Table 4).

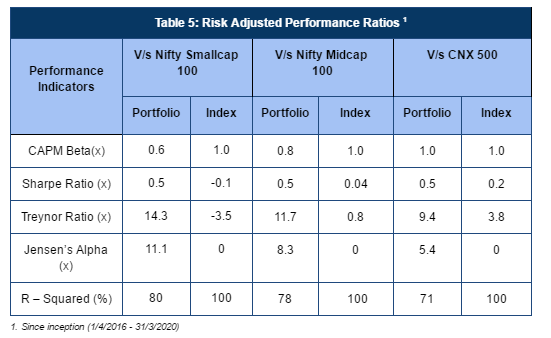

Absolute performance is very important to many investors. However, risk adjusted performance ratios indicate the fund manager’s abilities more accurately. We provide such data in Table 5.

Disclaimer : The information contained in this newsletter has not been verified by SEBI.