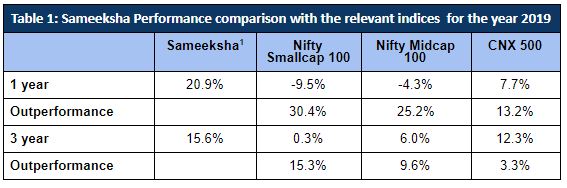

We are pleased to share with you an update on our performance for the Calendar year 2019. We retained our position among the top performing funds across the PMS universe (~100 funds) and delivered superior performance compared to various Mutual Fund categories. For the year ended 31st December 2019, we delivered one year return of 21% versus CNX500 return of 8%. Our outperformance versus small cap and mid cap indices was even more noticable. Though we are market cap agnostic, we have not historically had more than 50% of our portfolio in large caps which have disproportionate weightage in CNX500. In fact, our portfolio correlates more with small and mid cap indices and we outperformed the small and mid cap indices by 30 and 25 percentage points respectively (Table 1).

1.First Portfolio

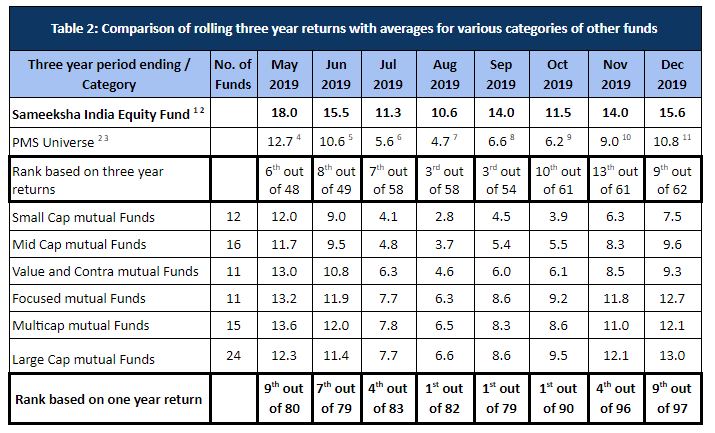

On a rolling three year period basis as well, we have maintained first or second decile position within the PMS universe and have come out ahead of relevant Mutual fund categories (Table 2).

1.First Portfolio 2. Post Fees And Expenses 3. Aggregate And Model Portfolios 4. 47 Funds 5. 48 Funds 6. 57 Funds 7. 57 Funds 8. 53 Funds 9. 60 Funds 10. 60 Funds 11. 61 Funds.

Year 2019 saw major important events that affected the Indian stock market. While Strong repeat mandate for NDA was a big positive for the market, equities suffered a major jolt when substantial tax increases were announced by NDA in its first budget for the second term. Weak economy (though headline GDP growth dropped to 4.5%, many indicators such as Auto sales, electricity production, railway freight etc. suggested much worse underlying trends) was clearly not a great backdrop for the market in any case and only major supportive factor has been the falling interest rates (RBI reduced repo rate by 135 basis points). Though we were tempted to reduce our market exposure drastically immediately upon hearing the budget announcement, we chose to stay put because of our belief that the current government tends to correct its mistakes upon receiving feedback (it would obviously be far better if they get the policy right in the first place). Our decision to stay put was vindicated when the government announced the biggest ever corporate tax cut (effective rate down from 35% to 25%) in Independent India’s history.

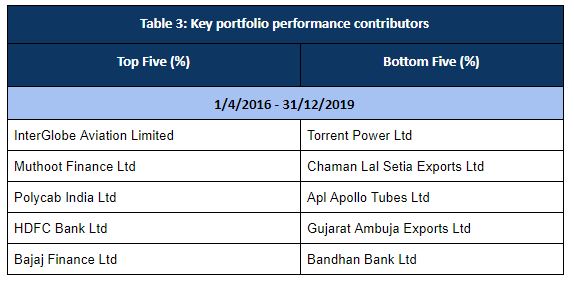

While staying invested helped us, what was even more important was our stock selection and position sizing. We invest in companies that meet our elaborate criteria. While many aspects of our criteria may overlap with other managers, what sets us apart is our focus on understanding and identifying value. Because of our focus on only investing companies for which we can understand value and identify adequate upside, we end up owning some names that are ignored by the market. However by developing deeper conviction, we are able to take sizable bets on such names and generate alpha. In Table 3, We list the top five names that have contributed to our performance positively and negatively for the entire period since inception in April 1, 2016. Please also find additional details of our performance in Annexure. We welcome any follow up questions.