In this note, we address two specific issues. Underperformance on an aggregate basis over the the period between November 2023 to June 2024 and performance of new accounts opened in November-December 2023. We have prepared this note to address questions we have received about the same and to also put that into the context of how our strategy works.

Underperformance at aggregate level during Nov 23 – June 2024

The US S&P500 Index, that was correcting since July 2023, bottomed out in October 2023 and has moved up strongly since then on the back of resilient economic performance and softening of inflation.

Elections for five state assemblies were held on November 17, 2023 with the voting results declared on December 3, 2023. The BJP won handsomely in 3 of the 4 major states – MP, Rajasthan and Chattisgarh and lost in Telangana – and performed much better than the pre poll surveys. As a result, BSE500TRI Index was up 7.1% in November 2023 and 8.0% in December 2023.

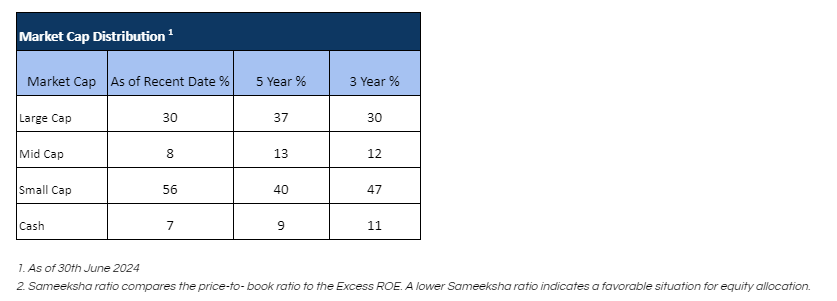

Over the last five years, our average cash levels have been ~9%. As we exited several positions (Nesco, Brigade, Finolex Cables and Jamna Auto) between August 2023 and September 2023, our cash levels increased to 21% during those months.

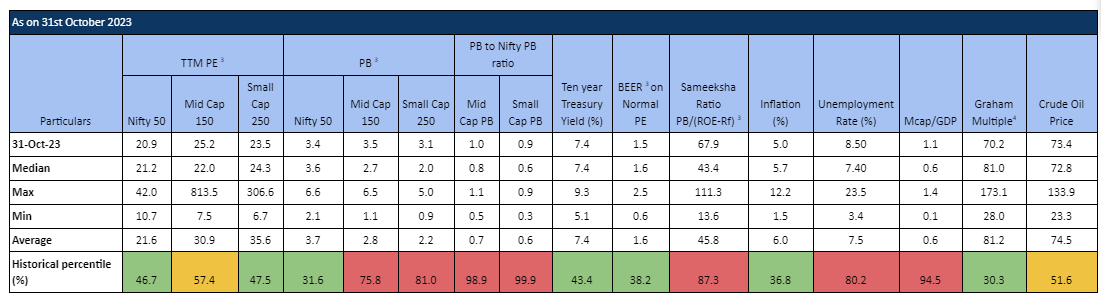

Based on our own India equity Monitor (Appendix 1), several key valuation indicators for NIFTY 50 were reasonable in October 2023: PE at 46.7 percentile, PB at only 31.6 percentile, Bond Equity Earnings Yield Ratio(BEER) at 38.2 percentile but Sameeksha Ratio (PB/(ROE-Rf) was high at 87.3 percentile and that prevented us from deploying cash aggressively during that time. (Refer Appendix-1)

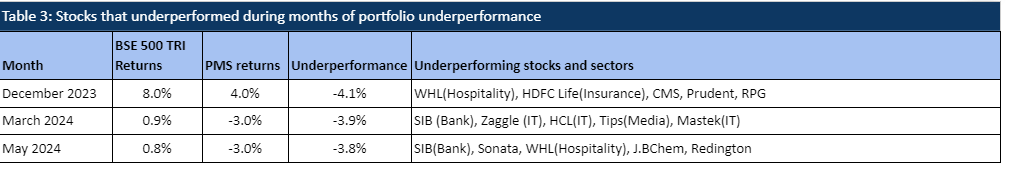

Though we added five new stocks to our portfolio and brought down our cash levels to 5.7% by end of January 2024, exit of stocks and increase in cash levels affected our performance in December 2023 when market rallied sharply as a result of state election results. Weak performance during the month of March 2024 can be attributed to the underperformance of IT and Banking sector stocks in which we had high weightage.

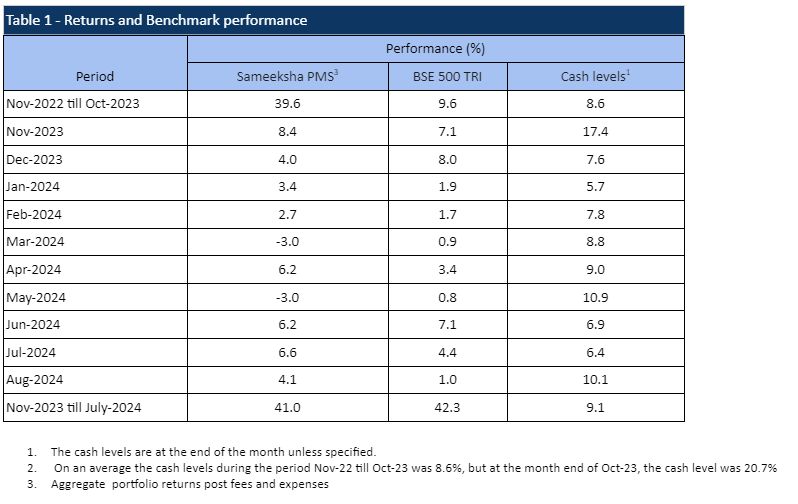

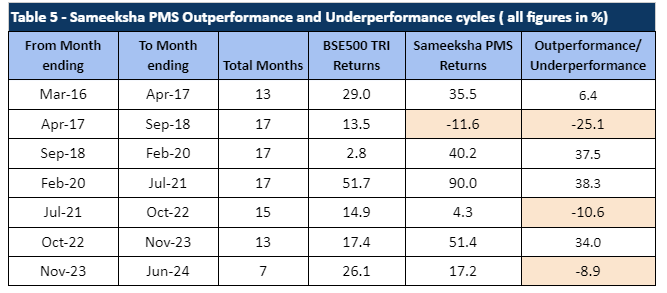

Looking at performance over aggregate periods, we can see that Sameeksha massively outperformed the benchmark during November 2022 to October 2023 period but had modest under performance during November 2023 to June 2024 period (Table 1)

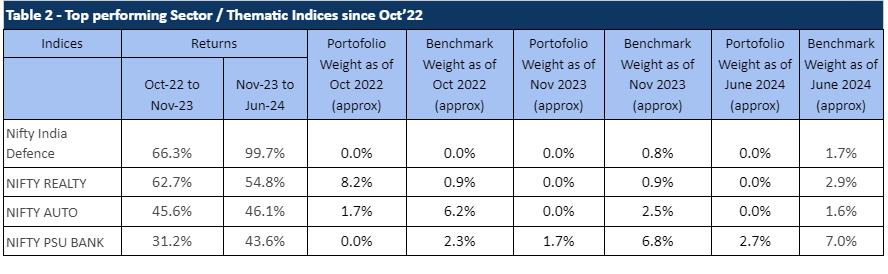

Sector Positioning and performance during October 22 to June 2024

From October 2022 till November 2023, our portfolio outperformed the benchmark by generating alpha of 34% in spite of being substantially underweight in four sectors that delivered strong performance (Table 2). We were heavily invested in the Finance, IT and Healthcare sectors that delivered promising outperformance. From November 2023 to June 2024, our Portfolio was up by 17.2% as compared to 26.1% returned by the Benchmark resulting in sharp underperformance. Because of continued strong performance in Defence, Realty, PSU Banks and Auto (Table 2) and relatively weak performance in sectors we were invested in, our portfolio underperformed the benchmark. However, it is important to note that our outperformance in prior thirteen months was much higher than under performance in subsequent eight months.

Stocks that specifically contributed to under performance

Post the state elections verdict in November 2023, we increased the weightage of large cap Private Banks as a proxy play on the India growth story but this sector has underperformed in the subsequent eight months.

We added Insecticides India, Banco Products, Mastek, VSSL and Tips Industries over September to December 2023. Our cash levels reduced to 5.7% at the end of January 2024 but we missed deploying higher cash when the markets dipped at the end of October 2023 and some of the valuation parameters turned favorable.

In the month of March 2024, there was also ~ 1.5% drag on the portfolio performance due to charging of performance fees at the end of the year.

Many of the stocks mentioned above have performed well subsequent to their period of underperformance.

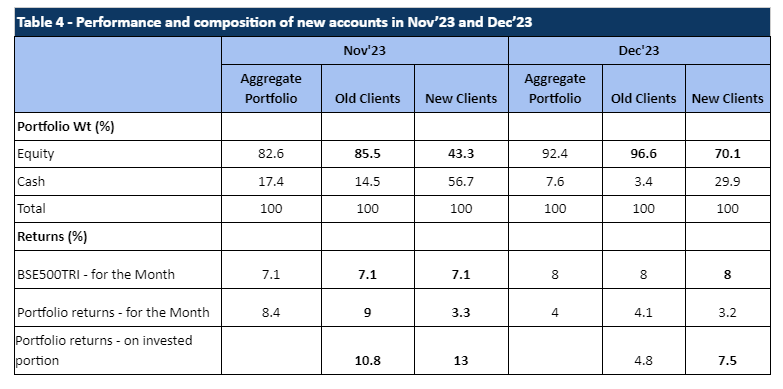

Performance of new accounts vs mature accounts in Nov 2023 and Dec 2023

In our conversation and communication to any potential client, we point out a few things:

- We do not follow a model portfolio approach.

- We invest in names that meet our buy criteria and do not chase stocks if fundamentals look promising but price is not right

- We follow strict position size rules based on liquidity in the stock

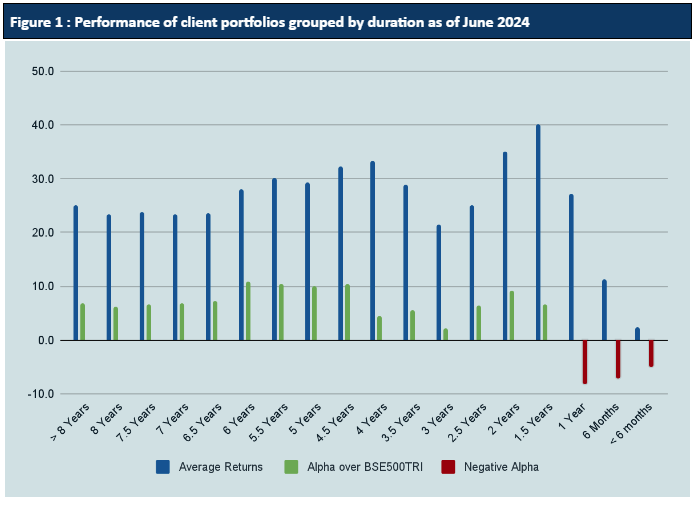

- We ask investors to take a five year horizon when they invest with us.

Let’s discuss the implications of our approach to investing. First and foremost, not following the model portfolio approach means that we do not replicate existing portfolios in new accounts but build portfolios for new accounts based on what meets our buy criteria when a new account is funded. The pace at which we build our target position size for every stock depends on how attractively valued the stock is and how our overall sense of the market is. If both are very attractively priced and we are generally happy with the economic backdrop, we would go aggressive in building the positions. However, if we feel that the market overall is a bit stretched or the stock under consideration while meeting our buy criteria is not much below our buy level, we may take a more conservative approach. As such, a new account may not have full equity exposure for a period of time after opening of an account. If the market rallies strongly in that period, the portfolio is very likely to underperform. Conversely, if there is a sharp correction, a new portfolio may not be hit by that in the same proportion as our older accounts. It is our view that if we wait for the right opportunities to deploy funds, the returns are likely to be superior over a longer term. This is how we have invested over the last eight and half years with generally very favorable results (Fig. 1).

Based on the broader market volatility and our threshold price within the buy-sell framework, we would invest the funds gradually. Accordingly, investors who joined us over the last 12 months have seen a larger underperformance as compared to the Benchmark and also as compared to the Old Clients’ performance. This is due to (i) a sharp up move in some of the top holdings during these months, and (ii) our error in not deploying the cash faster – partly as the stocks were not available below our Buy-Below Price framework.

As we do not follow a model portfolio approach in PMS, there could be higher cash levels maintained in the new accounts, and the deployment is made only at the right valuations. At this point of time, if there is a strong upward movement in the market, the aggregate returns of the fund is impacted. Most of the underperformance in new client portfolios was due to sharp up move in some of our top weight stocks but which were not available below the Buy-Price as per our framework. For example,

- Anand Rathi Wealth with an average 7.9% weight in older clients’ portfolios was up 30% in November 2023 leading to an average 134 bps underperformance for the 2 new clients (having average of just 2.9% weight in their portfolio)

- JB Chemicals and Pharma with an average 4.8% weight in older clients’ portfolios was up 10.6% in December 2023 leading to average 50-bps underperformance for the 2 new clients (having 0% weight in their portfolio)

Besides, the returns generated (13%) by the invested amount (43.3%) of the new accounts in the month of Nov 2023 were greater than the benchmark BSE500TRI (7.1%) (Table 4). But due to higher cash levels, the overall portfolio returns (3.3%) were low for the new accounts. In the month of Dec 2023, the portfolio returns of all the clients were low because in this month, the market continued to rally but our portfolio was not positioned in the sectors that delivered strong performance.

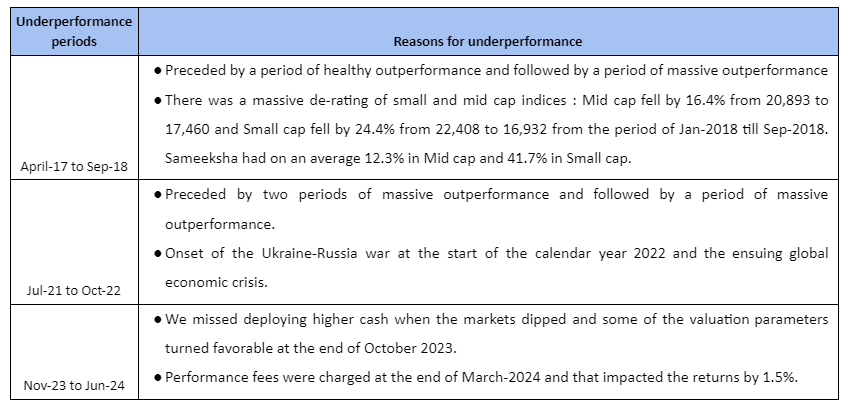

Underperformance has typically been followed and preceded by strong outperformance

We have had periods of underperformance on a 6-month basis in the past too. The period of underperformance has extended over 12-13 month periods with the level of underperformance ranging from 8.9% to 25.1% (Table 5). We have been able to take corrective actions in the past – including reducing the cash levels and improving the stock selection – that have resulted in the Portfolio generating strong outperformance in the subsequent 12-month period and longer. The cash level was reduced from 22.4% in April 2017 to 12.2% in December 2018 and from 24.3% in July 2021 to 9.4% in December 2022. We managed to pick stocks like Nesco, BAF, Rites in 2018 and Finolex Cables, Indigo, Kalyan Jewellers in 2022 at good value that resulted in strong returns from these stocks in the subsequent periods.

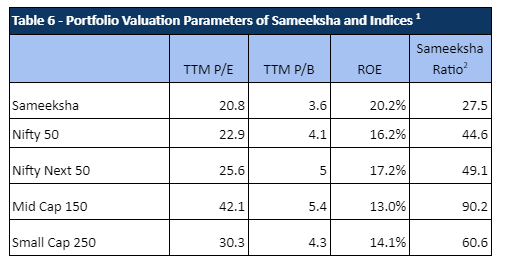

Portfolio reasonably valued relative to the benchmark

As can be seen from Table 6, our portfolio valuation is quite reasonable as the P/E is only 20.8 and P/B is only 3.6 for trailing 12 months whereas for the next 12 months, the P/E is 19.7 and P/B is 3.4. This shows that while valuations are extended in the market, our portfolio is reasonably valued.

We follow an absolute return framework and only buy stocks available at price from which we can expect to generate sufficient returns commensurate with risk and we derive these expected returns using a sound framework. An outcome of this methodology is that we often end up missing out on “hot” stocks in the market. However, that also helps us prevent sharp negative impact on the portfolio during market correction. Over the last five years, our upside capture (relative performance during up months) is 107%, not significantly higher than benchmark but downside capture is only 53%, sharply lower than the benchmark.

How we aim to retain our ability to generate outperformance

To effectively capitalize on market opportunities and achieve superior risk-adjusted returns, a strategic approach focused on technology, research, and timely action is essential. Here are the steps we are taking to sustain our history of outperformance –

- Continued and heavy investment in in-house Technology: Utilize technology to accelerate and aid our equity research work so that we are able to identify suitable investment opportunities in a timely manner.

- Sector Analysis: Regularly analyze various sectors to identify those that could be primed for a meaningful move. Create watchlists for different sectors and regularly update them based on the latest market data and fundamental analysis and stay informed about macroeconomic trends and sector-specific developments through continuous research and analysis.

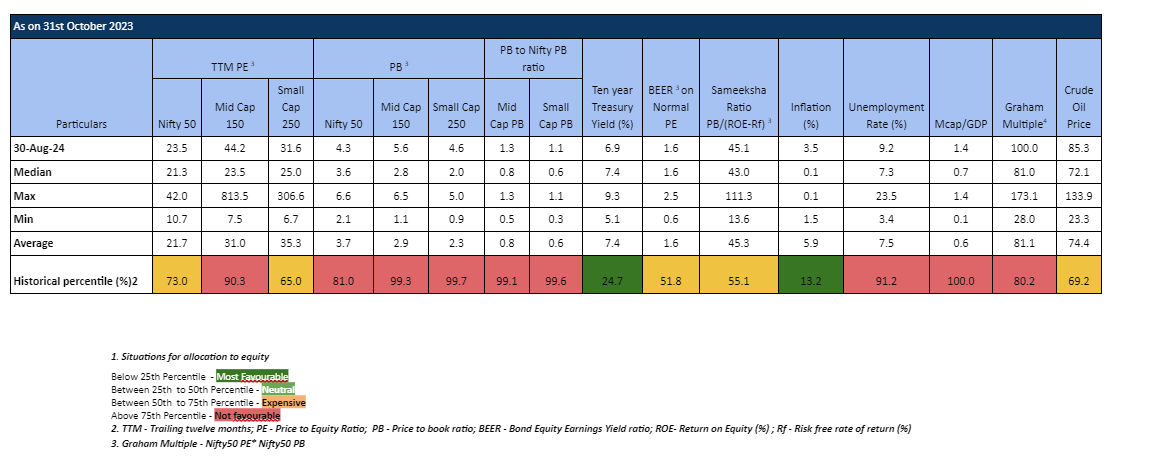

- Timely Cash Deployment: Make use of our in-house Equity Monitor to help us take equity asset allocation decisions in a timely manner

- Investment in Equity Research: We continue to invest in having strong talent in equity research both at entry level and senior level

- Analyze past decisions to improve our stock picking: Carry out detailed analysis of past decisions to understand what has worked for us and why so that we can follow what works in a more systematic way

Appendix 1: India Equity Monitor

You can also view the above details in this presentation – Link