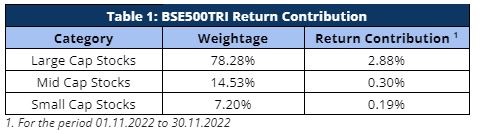

Indian markets had another positive month where the broader markets ended with gains of 3.46% for BSE500TRI. BSE MidcapTRI and BSE Smallcap TRI gained 2.50% and 2.49%, respectively. Sameeksha PMS also had a positive month where we returned 3.78% (net of all fees and taxes), outperforming the benchmark by 0.32%. As seen in Table 1, ~85% of benchmark BSE500TRI returns comes from Large Cap stocks with the highest asset allocation. It is pertinent to note that despite higher allocation to Small and Midcap stocks (~58%), Sameeksha PMS has managed to carve modest outperformance in comparison with BSE500TRI.

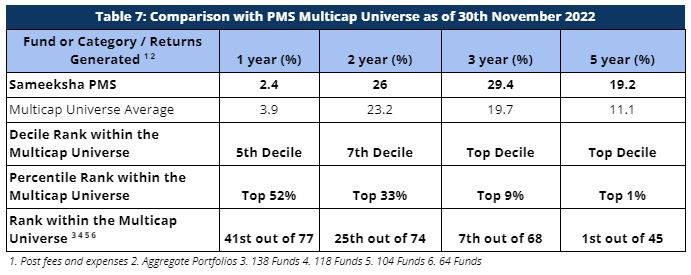

Among the multicap PMS universe with Asset Under Management (AUM) of more than INR 100 crores tracked by PMS Bazaar, we ranked 1st out of 45 multicap PMSes for the five year period ending November 2022. For the three year period ending November 2022, we are ranked 7th out of 68 multicap PMSes reporting to PMS Bazaar. Among the multicap universe (all AUM), we have been ranked in top decile for the five year period for 21 out of 21 observations reflecting well on the consistency of our performance.

Three important things must always be kept in mind when looking at performance data. First, for funds such as ours that do not follow model portfolio strategy, the performance of Individual clients for different duration is important to look at. Second, some PMSes may be charging fees outside the PMS and hence after fees, performance data may not be comparable to ours. Third, it is important to look at not only portfolio returns but also risk adjusted ratios. We provide data to address all three points later in this note.

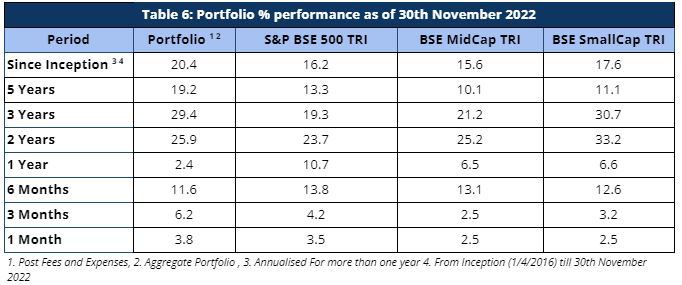

It is important to note that we have maintained relatively higher levels of cash (14% on average over the entire period from inception) from time to time over the duration of managing the portfolio. Notwithstanding the same, from inception as well as over five and three years respectively, we have generated returns of 20.4%, 19.2% and 29.4% beating the benchmark BSE500 TRI returns of 16.2%, 13.3% and 19.1% respectively after fees and expenses. Before deducting fees and expenses, we have generated returns of 21.7%, 20.4% and 31.2% for the period from inception (~6.7 years), five years and three years respectively.

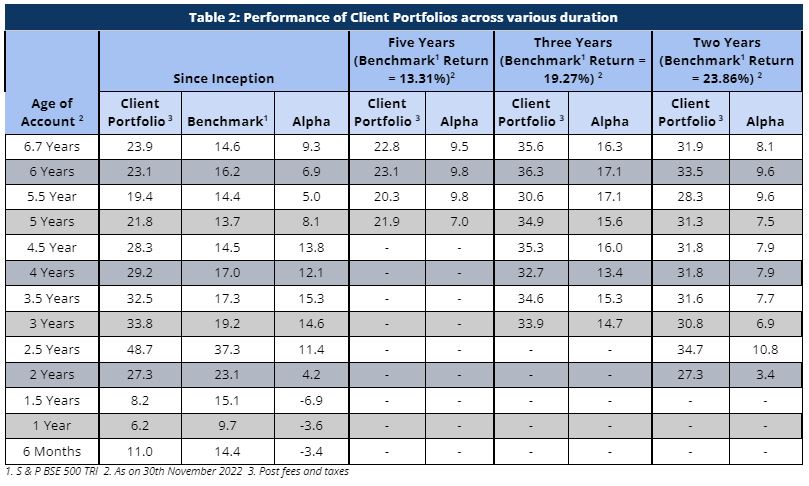

Returns Of Individual Portfolios

Performance of our client portfolios over different periods is more important to us than the aggregate portfolio returns. Portfolio returns for clients, except for investors starting with us between a period of one year ago to 18 months ago, have been remarkably strong (Table 2). Performance of portfolios of clients who joined us between a year to eighteen months ago is below par and we hope that reverses over time.

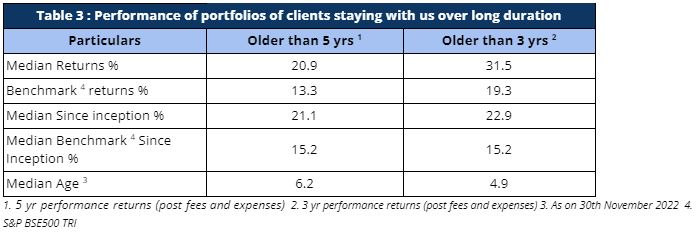

Long term investors, mainly investor accounts older than 5 years and 3 years, have carved out strong alpha, thereby proving Sameeksha PMS to be a valuable partner for their investments (Table 3).

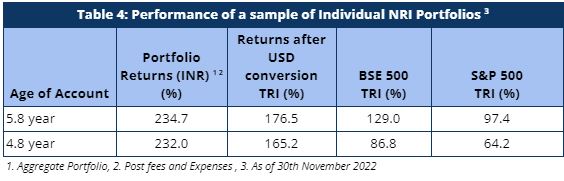

Our NRI clients have seen strong returns even after factoring in rupee depreciation against US dollars. The portfolio returns are significantly higher than both BSE 500 TRI and S&P 500 TRI, generating strong alpha over both these indices (Table 4)

Aggregate Portfolio Returns

For this month, the broader markets ended at 3.46% returns. BSE Midcap TRI and BSE Smallcap TRI returned 2.50% and 2.49%, respectively, touching their lifetime highs.

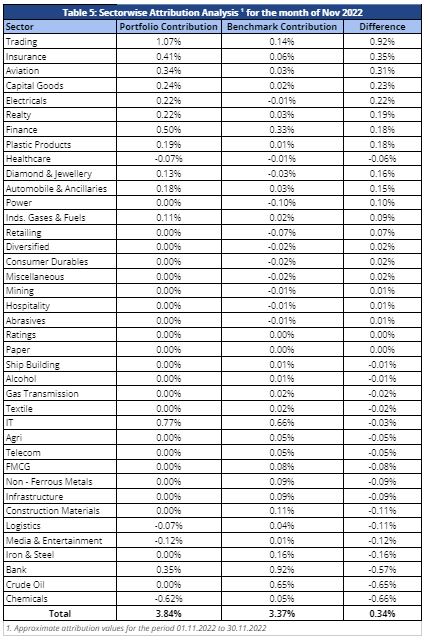

While there are sustaining concerns related to the economic outlook of the western as well as Chinese economy, India’s economy appears to be holding up quite well. Healthy reporting of high-frequency indicators such as auto sales, GST collection, retail spending, power demand, railway tonnage all point to the sustaining of economic growth. For the month of November 2022, PSU Banks continued to show their strength as more than five of them touched their 52-week highs. Our portfolio did not benefit from these moves due to lack of exposure to PSU Banks. Petrochemicals was another sector that performed well but did not help our portfolio. At the same time, Trading, Insurance, Aviation sectors generated small alpha for the portfolio (Table 5).

For longer periods where the outperformance is much more meaningful, we have strongly outperformed our benchmark index across all the relevant key periods (Table 6).

Performance Within The PMS Universe

We continue to maintain our top rankings both within the multicap PMS universe as well as the entire PMS universe for key periods of three and five years. The multicap PMS universe rankings are more relevant to us since we follow multicap strategy.

In the interest of a fair comparison, we present our rankings among those multicap PMSes with AUM more than INR 100 crs. For the three year period, we are ranked 7th out of 68 PMSes. Further, we are ranked 1st out of 45 PMSes for the five year period comparison within the multicap universe – highlighting our superior performance over the long term (Table 7).

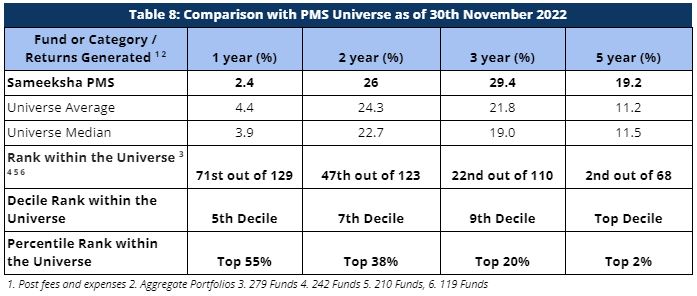

When compared with the PMS universe with AUM above INR 100 crs, we have maintained top rankings for longer key periods. We are consistently ranked in the Top Decile for the five year period (Table 8).

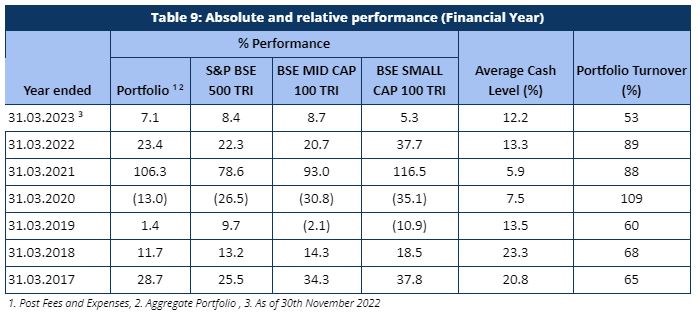

Fund Performance On A Financial Year And Calendar Year Basis

For the first 8 months of the current financial year ending March 2023 (April 2022 to November 2022), Sameeksha PMS has underperformed the benchmark BSE 500 TRI by generating 7.1% returns for the period against the benchmark 8.4% returns (Table 9).

Looking at our performance over the financial years, we have outperformed our benchmark in four out of seven financial years. Key however is that the sum of outperformance of 45% in those four years far exceeds the sum of underperformance of 11% in the remaining three years (including the current incomplete financial year).

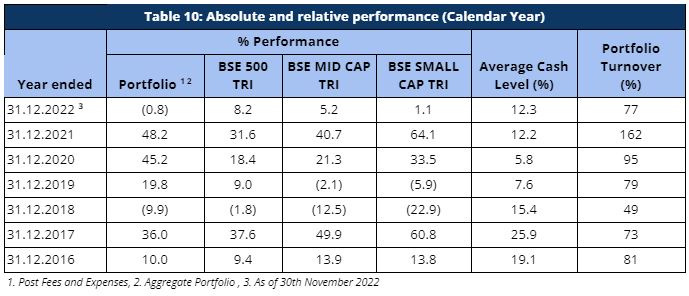

The performance pattern on a calendar year basis has been quite similar as well (Table 10). Although, for the current calendar year 2022, we are underperforming the benchmark, for the recently completed calendar year ending 2021, we have generated a return of 48.2% with an alpha of 16.6% over our benchmark BSE 500 TRI.

Rolling Returns And Rankings

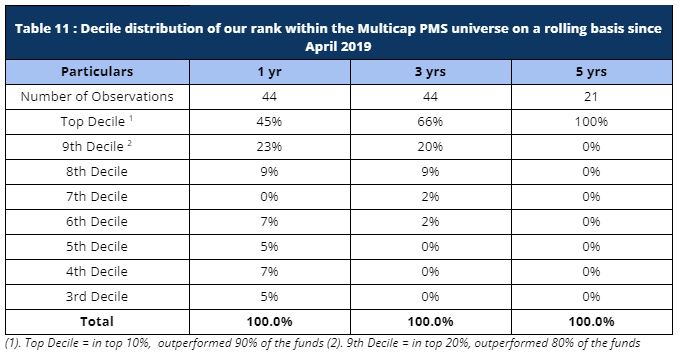

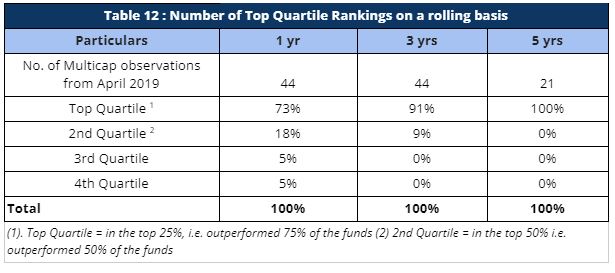

Rolling returns are a more useful indicator of consistency in performance versus single period returns. For the rolling three year periods applicable for our entire operating history, we have been ranked among the multicap universe in the top decile ~66% of the time (29 out of 44 observations) and in top Quartile 91% of the time (40 out of 44 observations). For the remaining 9% observations, we were ranked in the second quartile (Tables 11 and 12). For the rolling five year periods applicable for our entire operating history, we have been ranked among the multicap universe in the Top Decile 100% of the time (21 out of 21 observations).

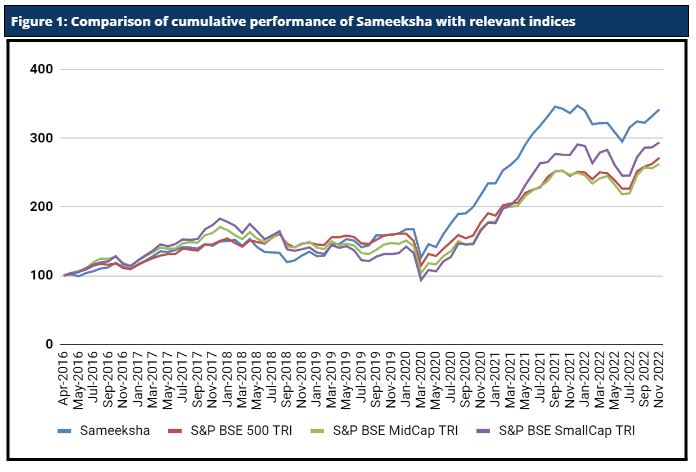

Cumulative Performance Versus The Benchmark

Sameeksha’s outperformance over its benchmark has continued to widen positively over the years. An investment of Rs. 100 with us since inception (April 2016) would have grown to Rs. 342, far outpacing what one would have earned by investing in a fund that achieved benchmark returns (Figure 1).

Risk Adjusted Ratios

When compared on a risk-adjusted basis (Table 13), our PMS shows even stronger performance with a risk-adjusted alpha generation of 8.79% over the broad market benchmark since its inception. While our portfolio beta has been materially lower than our benchmark, our returns have been higher than the benchmark since inception, implying superior strong risk adjusted returns.

Furthermore, other risk-adjusted returns – Sharpe ratio and Treynor ratio, are also significantly higher than the benchmark indices (Table 13). It is worth noting that we offer superior risk adjusted returns not only compared to the broad BSE 500 index heavily weighted towards large cap but also the small cap and mid cap benchmarks as demonstrated by our Sharpe ratio, Alpha, Treynor ratio and Beta.

Disclaimer : The Information Contained In This Update Is Based On Data Provided By Our Fund Accounting Platform And Is Not Audited