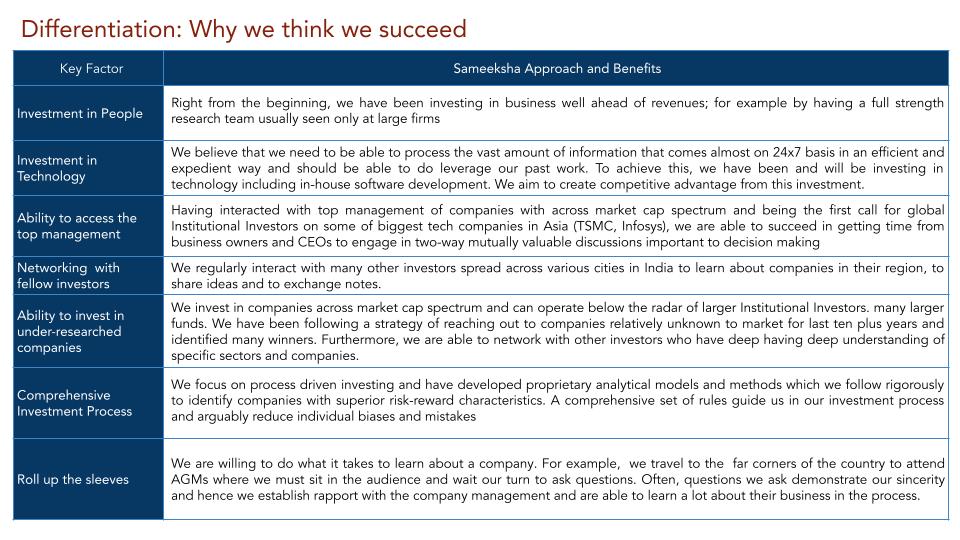

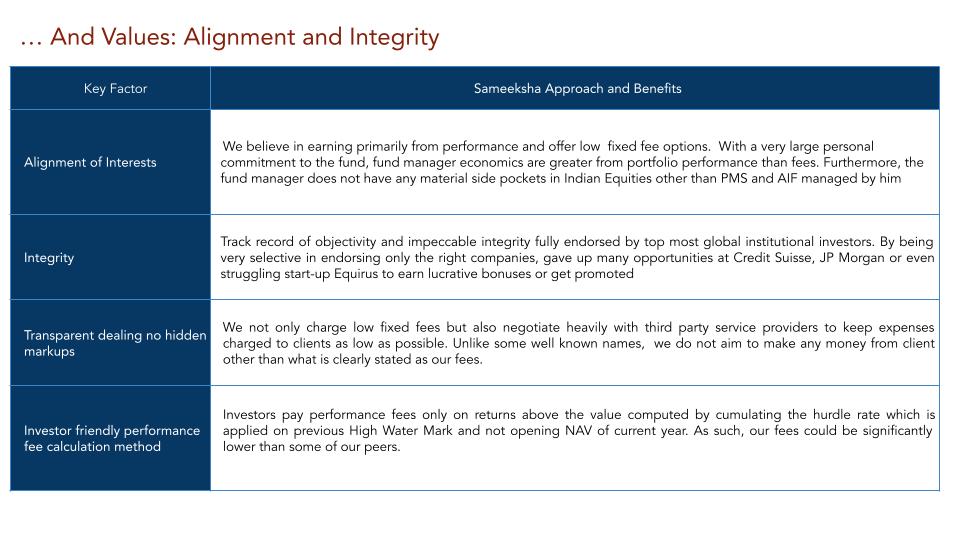

Our approach

Fund Objective and Strategy

- Provide superior long term returns while protecting against permanent loss of capital using Long biased strategy:

- Invest in long-term growth opportunities in Indian companies across market capitalization (with greater emphasis on mid and small cap companies that are not fully discovered) that have superior business model, sufficiently large market opportunity to deliver growth, strong and shareholder focused management and are available at price that would result in sufficiently attractive risk adjusted returns over a horizon of at least two years

- Have an option of investing in Index Futures in order to partially hedge the portfolio

- Manage market exposure by modulating cash position in the portfolio depending on the opportunity set and attractiveness of investment ideas and through the use of index futures and options

- Follow rigorous fundamental research-driven and rule based investment process that is disciplined and yet leaves enough room for creativity and ingenuity; Investment process entails interactions with the companies through common as well as uncommon means, detailed financial model on the company as well as the industry to properly size up the growth opportunity, completion of a detailed check-list and review of investment argument by the entire research team

- Unlike many peers, Sameeksha does not follow model portfolio approach as it nullifies the key advantage offered by PMS rules. For any new investor, we invest in companies from our existing portfolio only if it merits fresh investment in a given company at prevailing market price.

- Focus on long-term return and hence may experience short term volatility, but will use its research capability to minimize the permanent loss of capital and will adhere to established risk guidelines

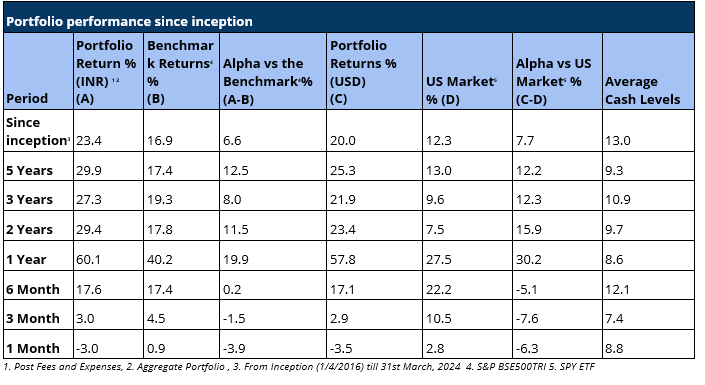

Performance of Sameeksha PMS (Segregated Accounts)

As of March 31st 2024 and since inception on aggregate basis, Sameeksha PMS has delivered returns of 23.4% net of fees and expenses versus CNX500 TRI returns of 16.9%

Noteworthy points about our performance

- For rolling five year periods since inception, outperformance (alpha) delivered 100% of the time ( 37 out of 37 observation) with a median alpha of ~ 7%

- For rolling three periods since inception, outperformance (alpha) delivered 97% of the time (58 out of 60 observations) with a median alpha of ~ 9%

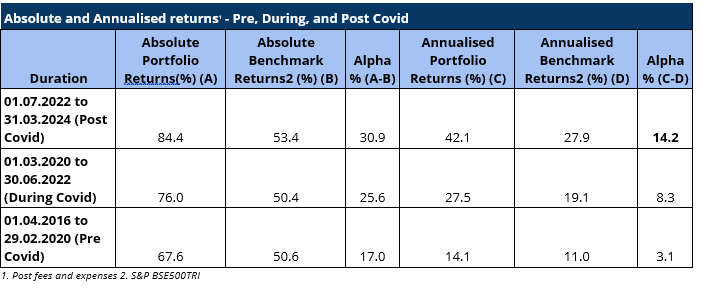

Performance of PMS over the covid timeline (Pre, During, And Post)

The Covid Pandemic induced significant volatility in the equity markets. Hence, it is useful to look at the performance across three time slices : Pre Covid, During Covid and Post Covid. Sameeksha PMS has outperformed the benchmark across all of these three time periods with meaningful alpha. This consistency of performance may be an important factor in comparing us with the other funds.

For detailed performance on our PMS, please click here