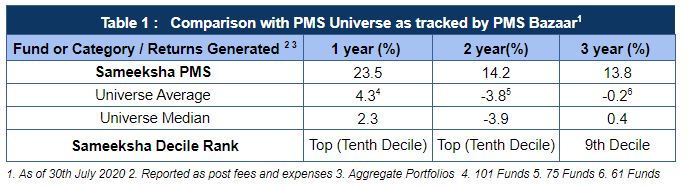

Among the funds that report data to PMS Bazaar, we finished among the top funds with substantial leads over the Universe average and median. (Table 1).

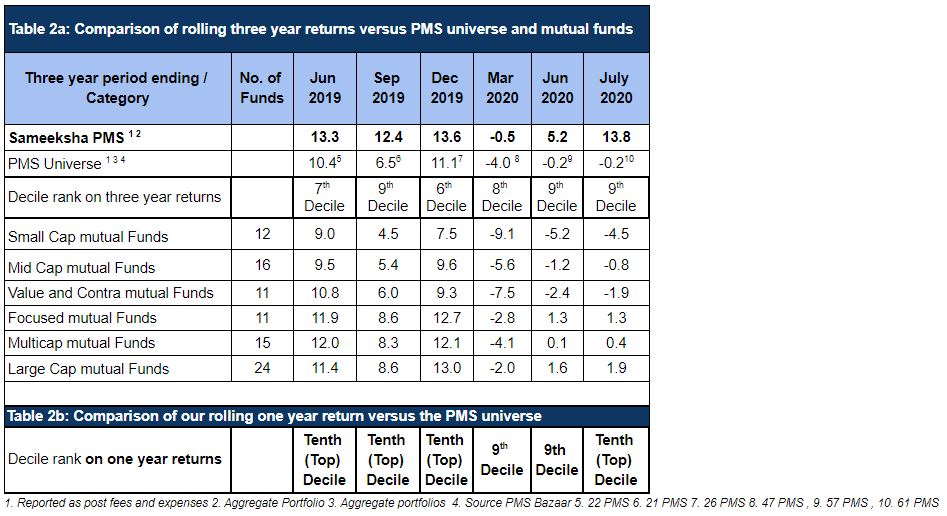

We believe it is important not to achieve good performance on a one-off basis but sustain it over time. On a rolling three year period basis, we have remained amongst the top performing PMSes on a consistent basis with a large delta over universe average. Even when we were closer to the average in one instance, we had quite respectable absolute returns. Our past performance suggests material outperformance versus all the categories of mutual funds as well. (Table 2).

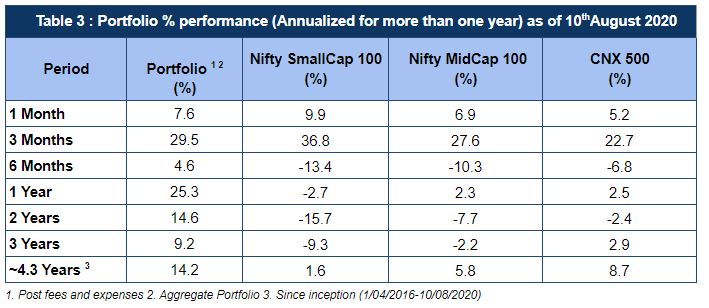

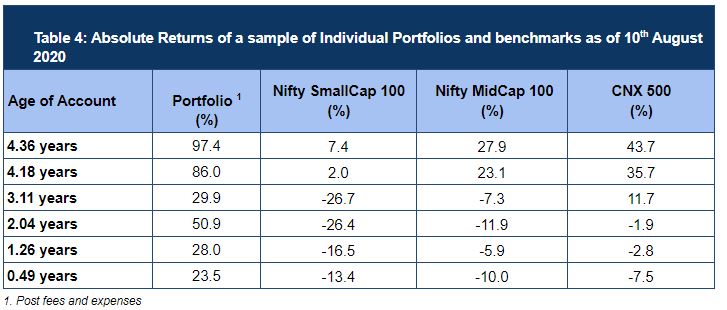

It is very important for PMS investors to not just look at aggregate performance but also at the performance for different clients based on their tenure with our fund. We have delivered strong absolute as well as relative performance based on an aggregate basis (Table 3) as well as for clients with varying tenure with us (Table 4). We believe that our customized approach to treating each client portfolio versus applying model portfolio approach has worked well.

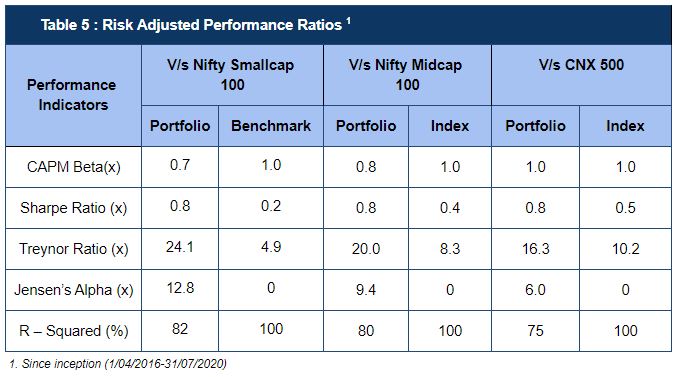

Along with absolute returns we continue to deliver superior risk adjusted performance. (Table 5)

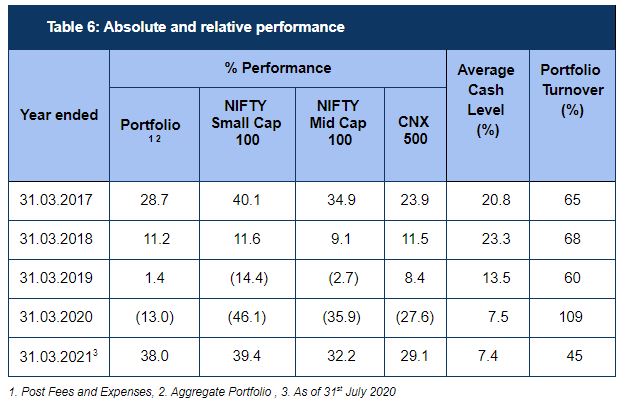

Our historical data for each of the financial years that we have been operational is presented below in Table 6.

We welcome any follow up questions.

DIsclaimer : The information contained in this newsletter has not been verified by SEBI.