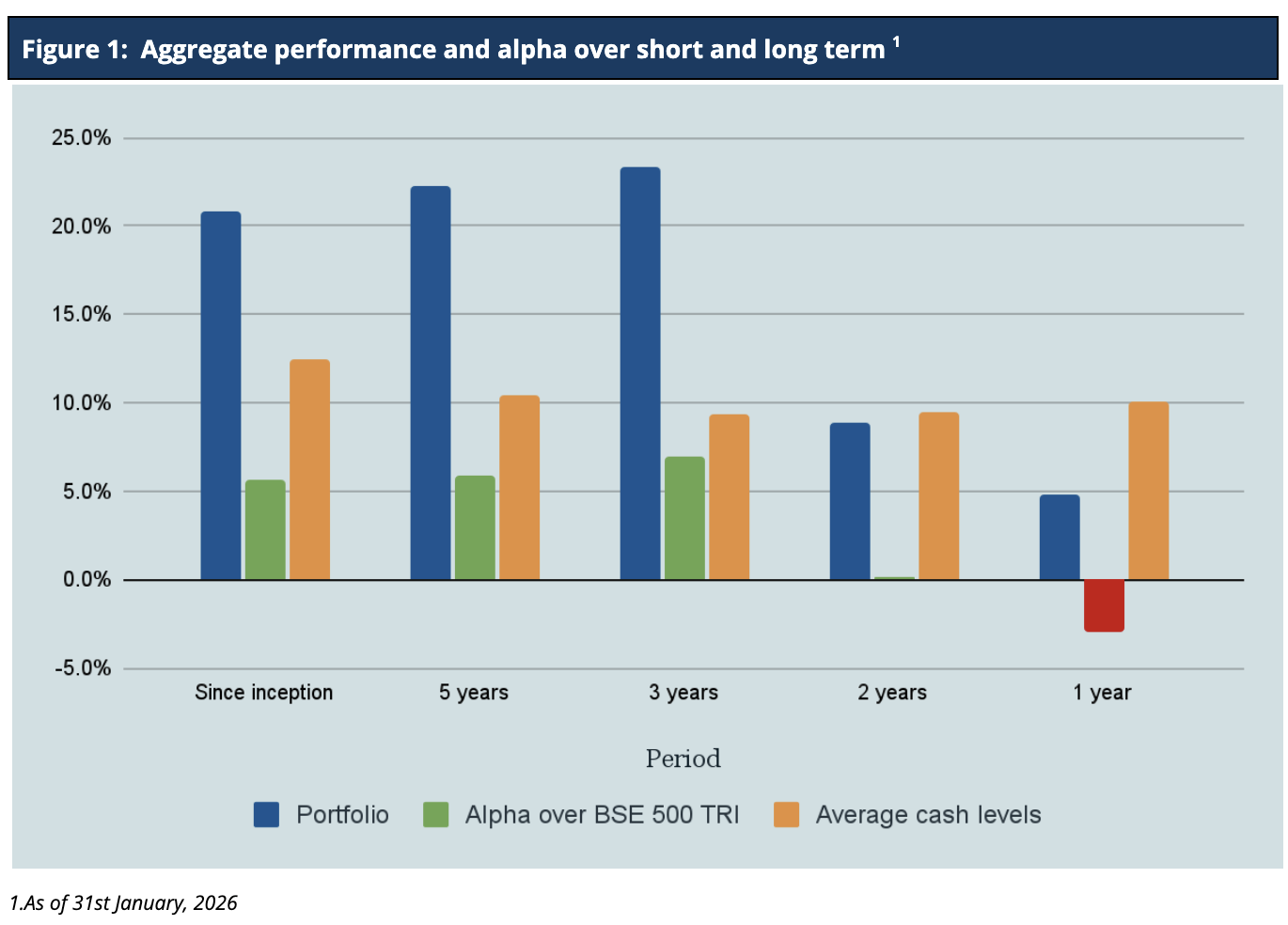

* Period ending 31st January, 2026, ** Three-year period for PMS and AIF, also five year period for PMS, *** Rolling five-year returns of all the Multicap PMSes reporting to PMS Bazaar, **** For rolling five year periods from inception till date, ***** Five-year Period In January 2026, Indian equity markets remained under pressure as …

Category: undefined

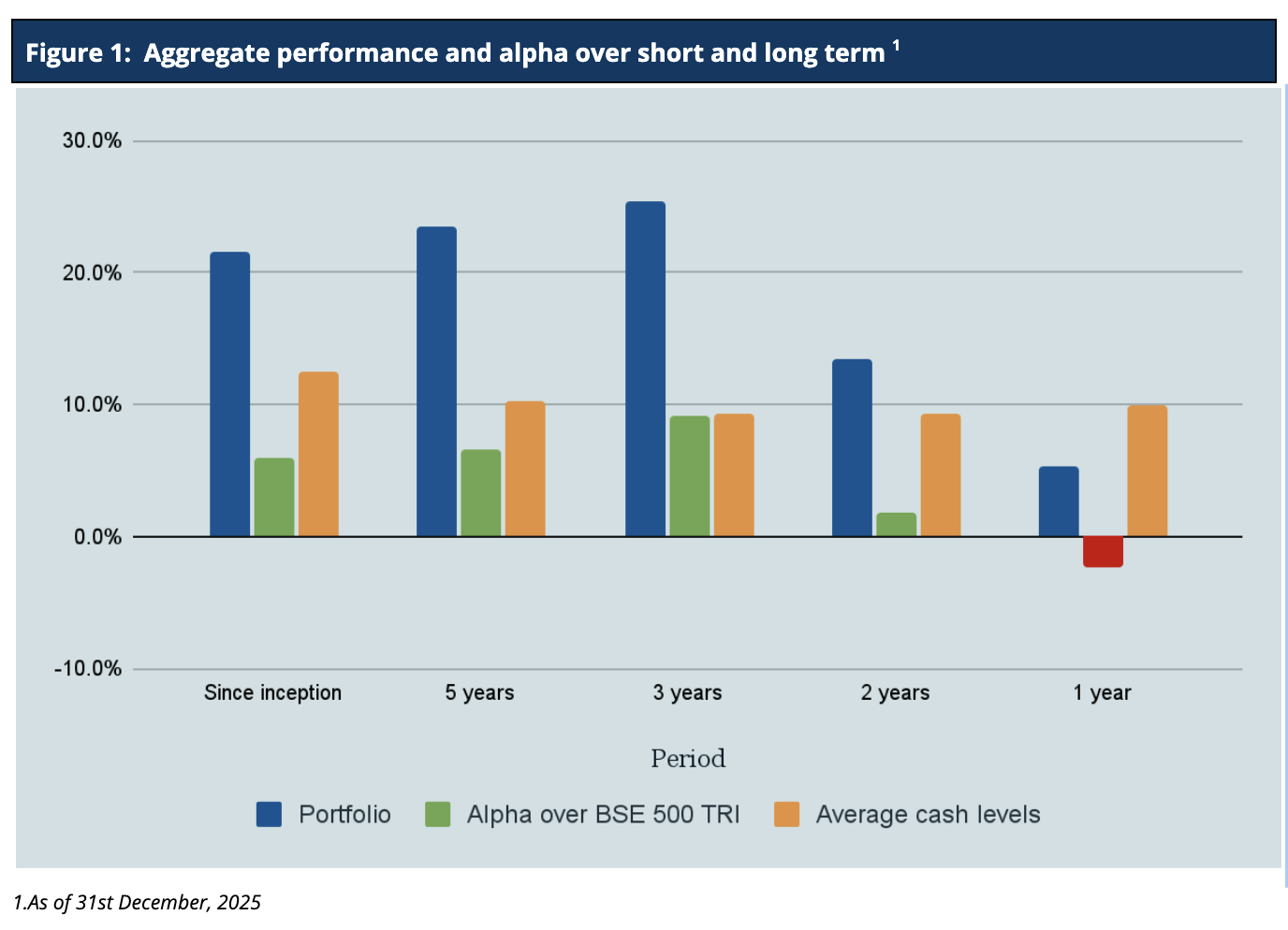

December 2025*: Sharp fall in top position leads to underperformance; Top-Decile Performance for AIF** ; For PMS, 58th consecutive month*** of alpha generation with median Alpha of ~8.7%**** till date* and Upside Capture of 101% with Downside capture of 55%*****

* Period ending 31st December, 2025, ** Three-year period for PMS and AIF, also five year period for PMS, *** Rolling five-year returns of all the Multicap PMSes reporting to PMS Bazaar, **** For rolling five year periods from inception till date, ***** Five-year Period In December 2025, the markets reflected a clear divergence between …

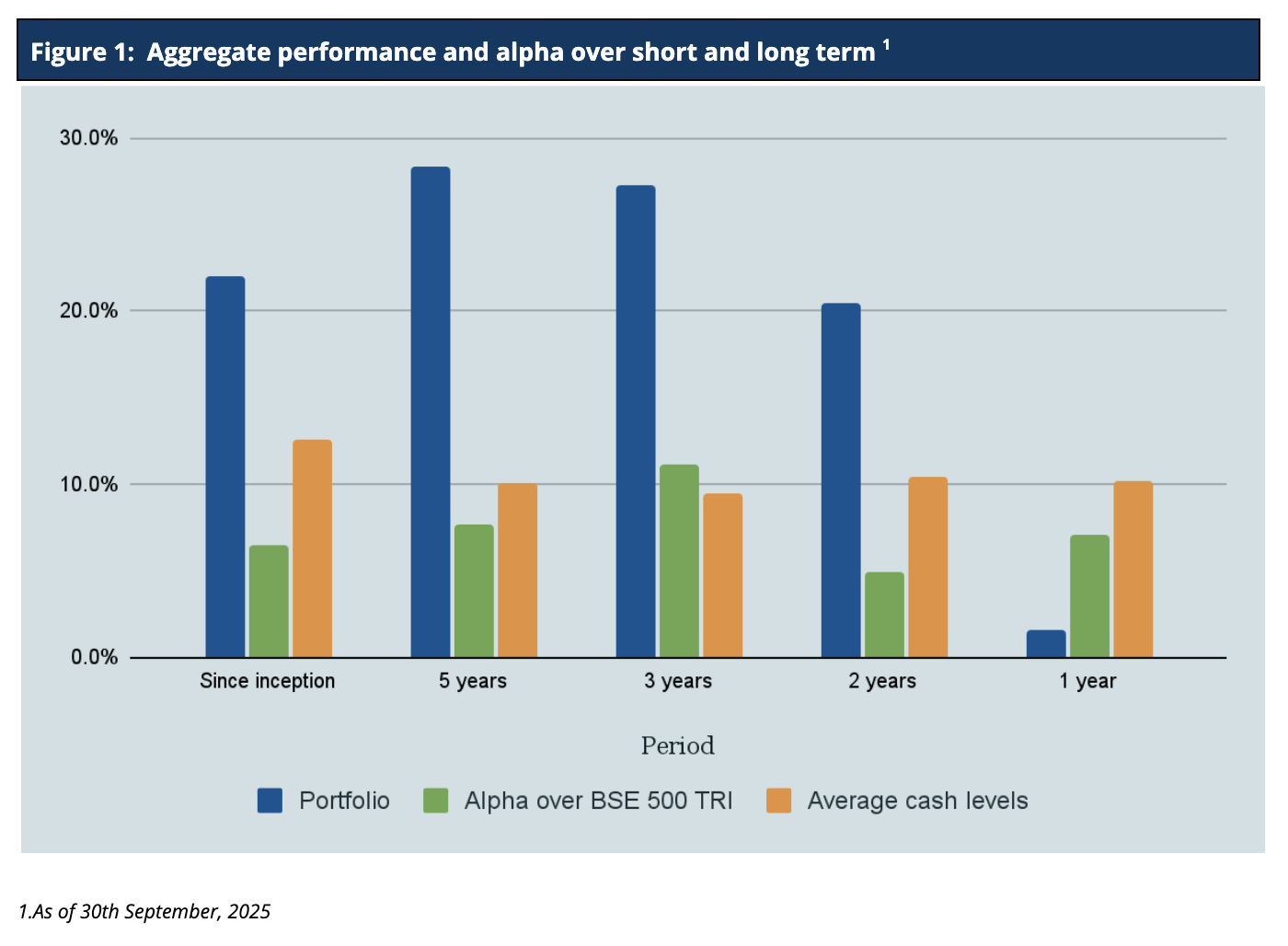

September 2025*: Our AIF ranked second for the sixth consecutive month** ; 55th consecutive month*** of top decile performance for our PMS with median Alpha of ~9.4%**** till date* and Downside capture of only 47%*****

* Period ending 30th September, 2025, ** Three-year period, *** Rolling five-year returns of all the Multicap PMSes reporting to PMS Bazaar, **** For rolling five year periods from inception till date, ***** Five-year Period In September 2025, the constructive medium-term view remained intact, supported by the RBI’s upgrade on India’s FY26 GDP growth to …

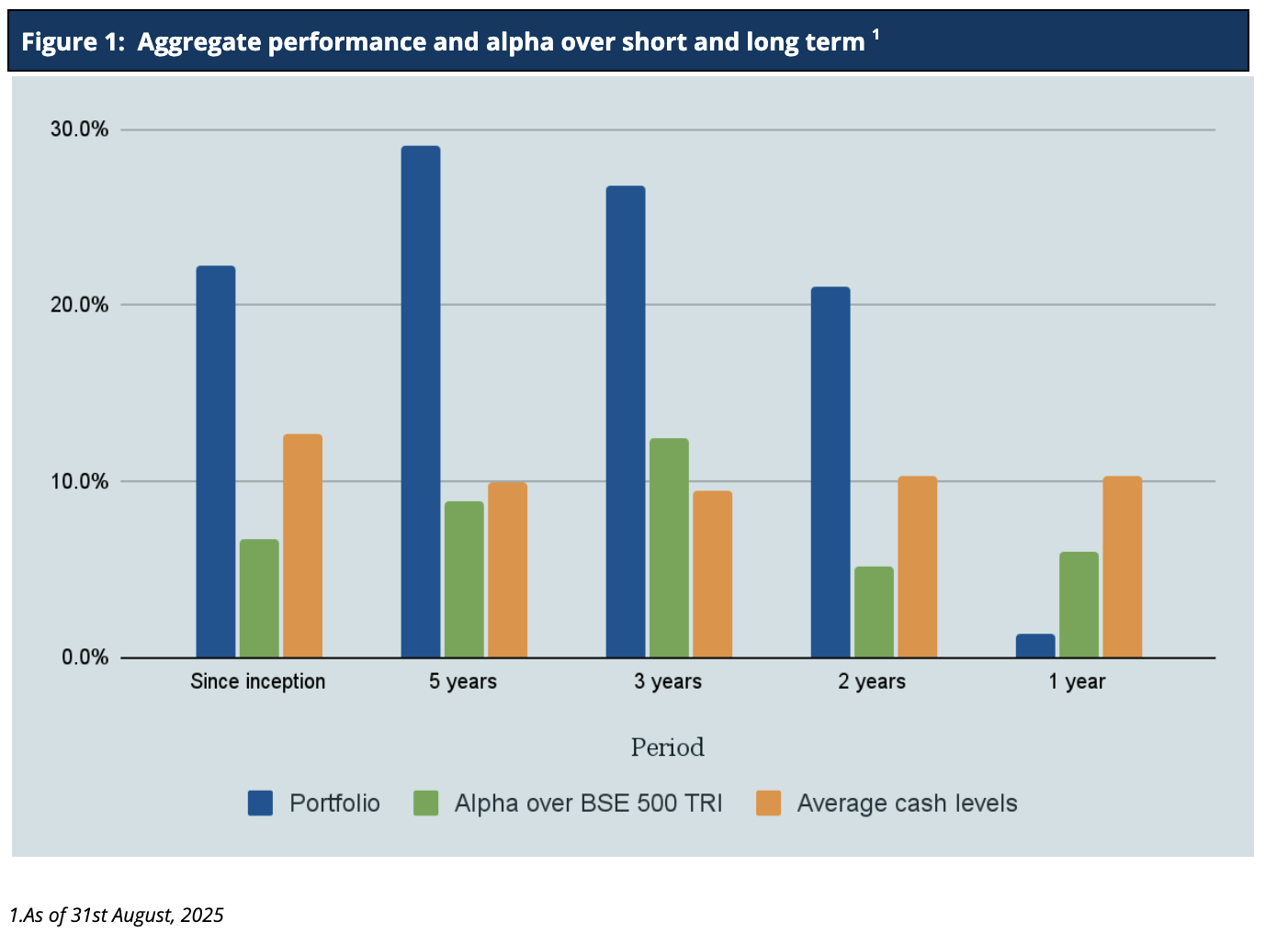

August 2025*: Our AIF ranked second for the fifth consecutive month**; 54th consecutive month*** of top decile performance for our PMS with median Alpha of ~9.2%**** till date1 and Downside capture of only 47%*****

* Period ending 31st August, 2025, ** Three-year period, *** Rolling five-year returns of all the Multicap PMSes reporting to PMS Bazaar, **** For rolling five year periods from inception till date, ***** Five-year Period In August 2025, Indian equities were volatile with the Nifty Smallcap 250 index sharply correcting by 3.72%, significantly underperforming the …

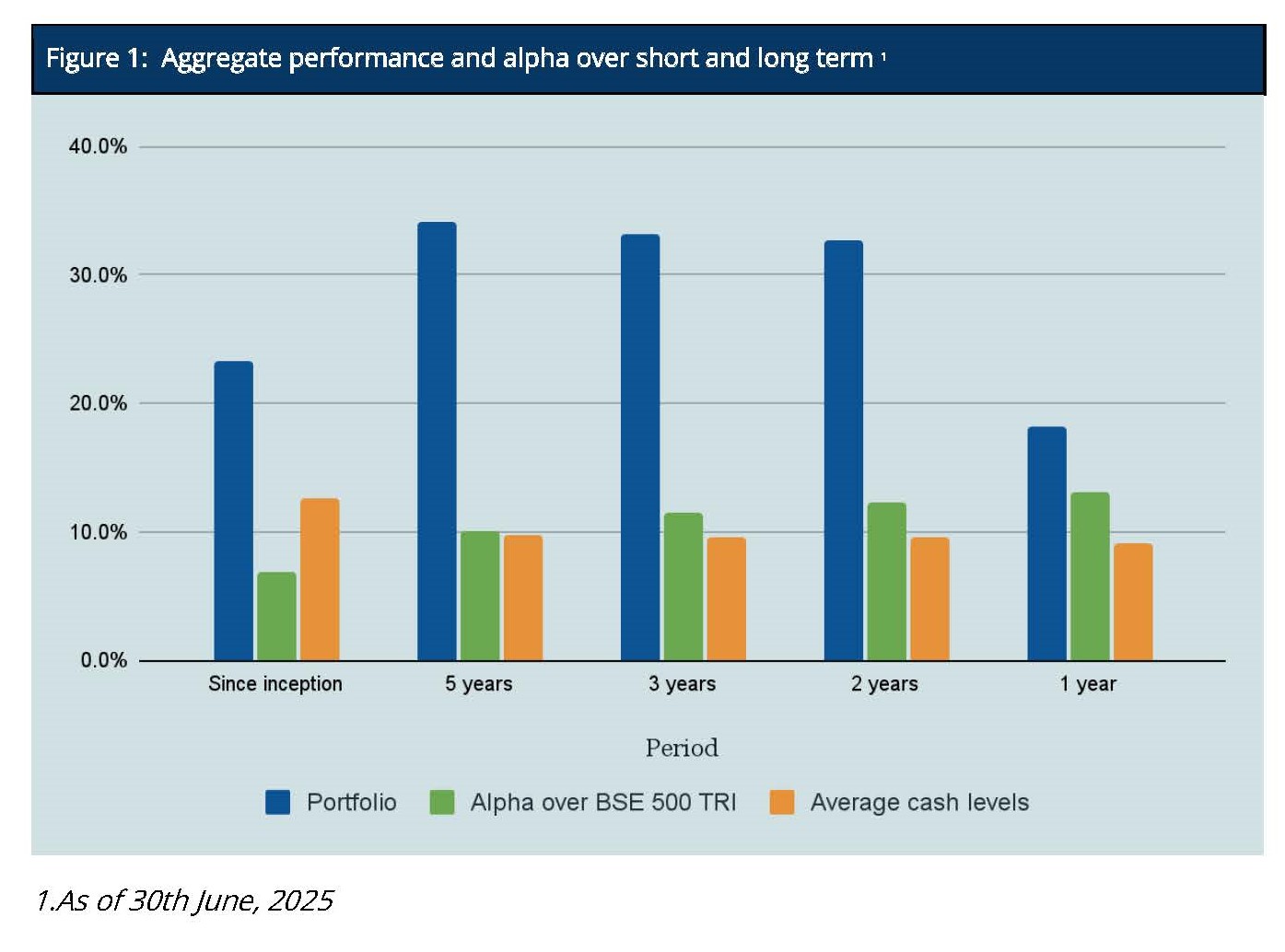

June 2025*: Our AIF ranked second again out of forty-five AIFs *****; 52nd consecutive month month** of top decile performance for our PMS with median Alpha of ~9%*** till date*and Downside capture**** of only 41%;

* Period ending 30th June, 2025, ** Rolling five-year returns of all the Multicap PMSes reporting to PMS Bazaar *** For rolling five and three-year periods from inception till date **** Five-year Period ****Three-year period In June 2025, Indian equity markets continued their upward trajectory, supported by a strong rebound in domestic mutual fund flows …

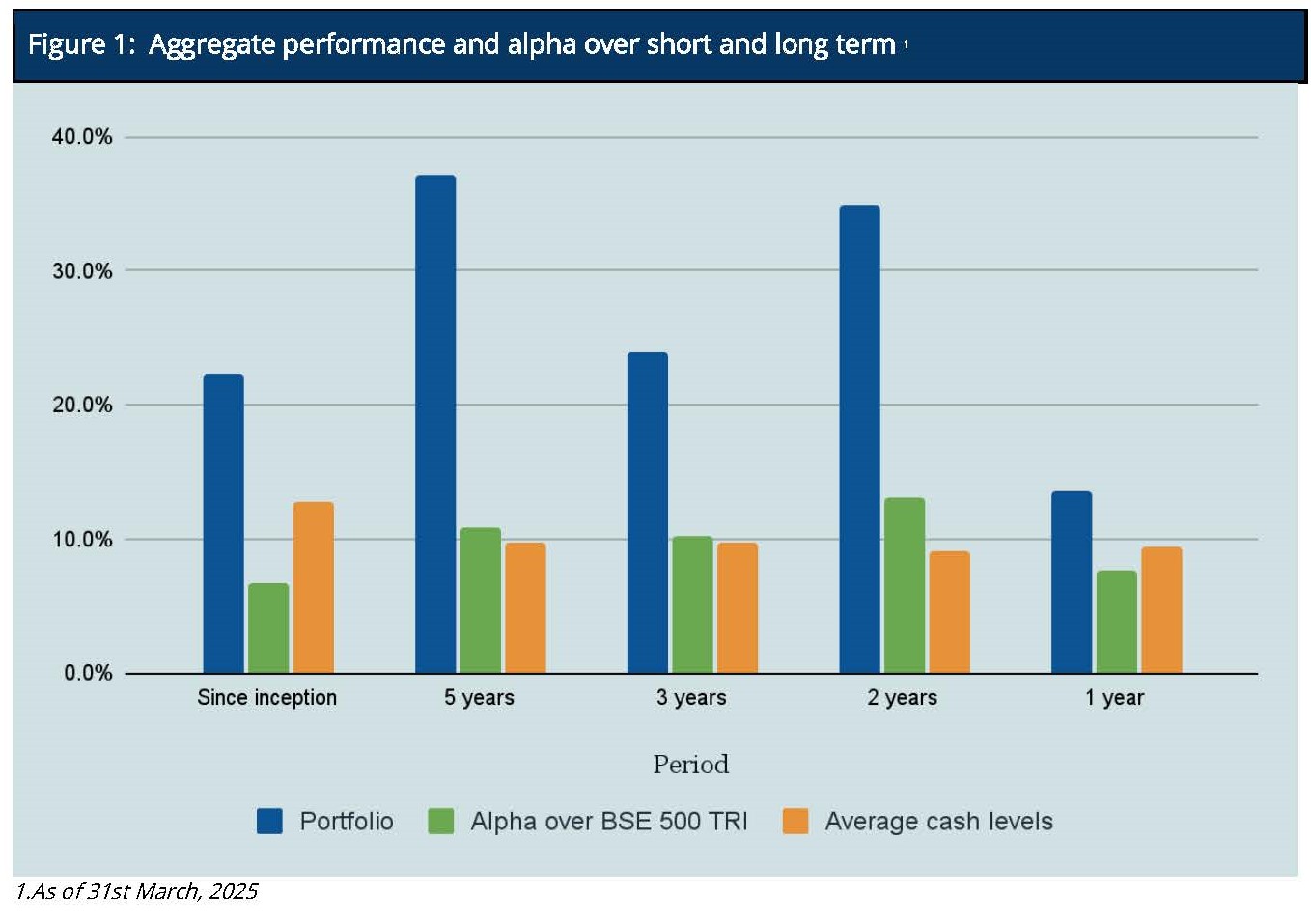

March 2025* : Concluded FY25 with a notable alpha of 7.7%*, Consecutive 49 months of Top Decile Performance** , Upside capture *** 106%, Downside capture *** 62%

* Period ending 31st March, 2025, ** All Multicap PMSes reporting to PMS Bazaar *** Five year Period In March 2025, the Indian equity market demonstrated a notable recovery, ending a five-month losing streak and closing the fiscal year on a positive note. The upturn was supported by renewed foreign inflows, improved economic indicators, and …

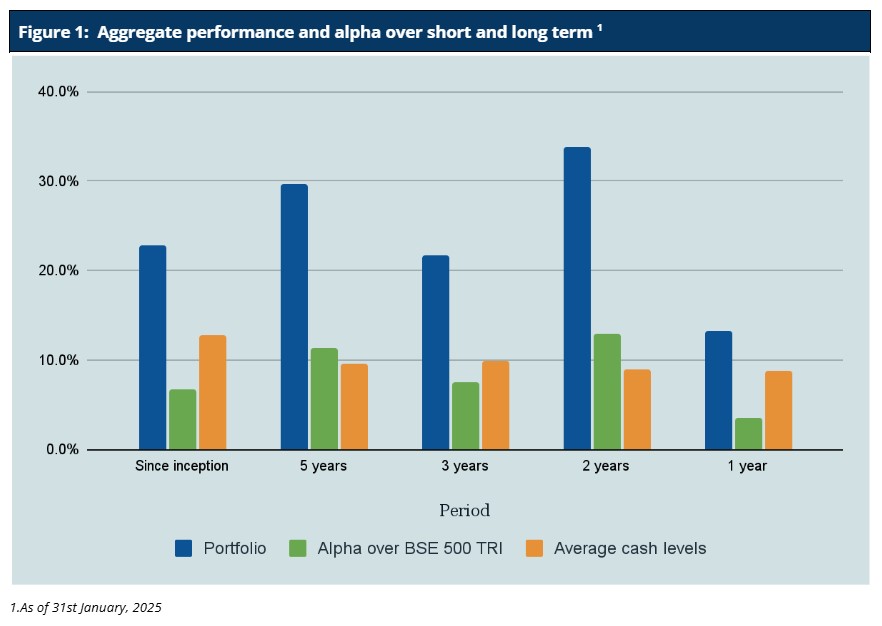

January 2025* : Top Five again, 47th consecutive month of top decile performance ** Upside capture *** 107%, Downside capture *** 52%

* Period ending 31st January, 2025 ** Among multicap PMSes reporting to PMS Bazaar for five year period *** Five year Period The Indian equity Market has experienced a sharp decline from the start of this calendar year and continues to be that way at time of this writing. In the month of January, the …

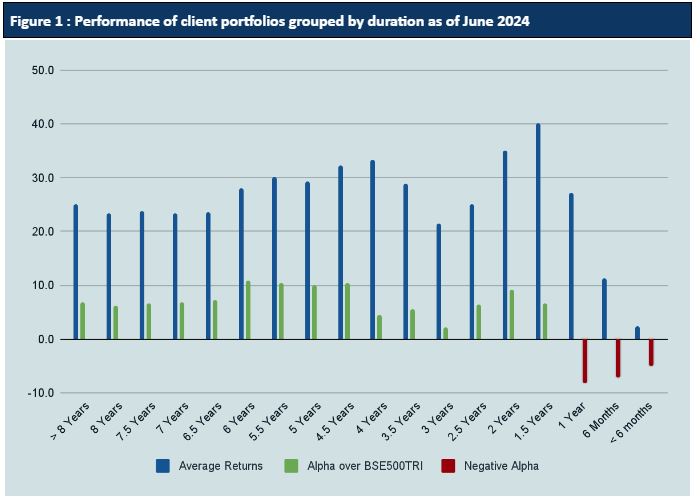

Performance of Sameeksha over 7 months

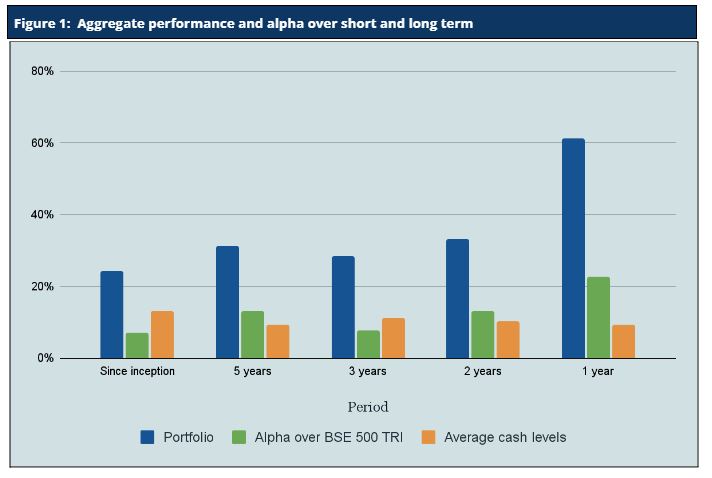

In this note, we address two specific issues. Underperformance on an aggregate basis over the the period between November 2023 to June 2024 and performance of new accounts opened in November-December 2023. We have prepared this note to address questions we have received about the same and to also put that into the context of …

April 2024* : Thirty eighth consecutive month of top decile performance**, upside capture*** 112%, downside capture*** 54%

* Period ending 30th April, 2024, ** Among multicap PMSes for five year period, *** Five year Period In the month of April, the benchmark S&P BSE 500 TRI has grown by 3.44%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 6.23% (net of all fees and expenses) while having cash levels …