Author: Sameeksha Capital

January 2024* : Thirty Fifth Consecutive Month Of Top Decile Performance**, Upside Capture*** 115%, Downside Capture*** 58%

* Period ending 31st January, 2024 ** Among multicap PMSes for five year period *** Five year Period In the month of January, the benchmark S&P BSE 500 TRI has grown by 1.9%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 3.4% (net of all fees and expenses) while having cash …

Number One For The Fifth Consecutive Month* , Top Decile Ranking For The 32nd Consecutive Month*

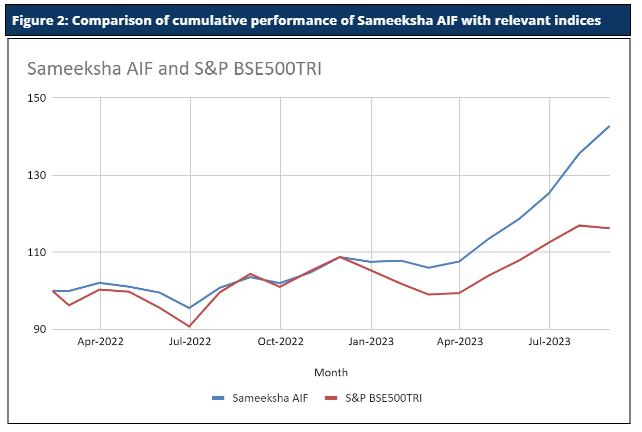

* For Five Year period In the month of October, the benchmark S&P BSE 500 TRI fell 2.9%. Against that, Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 1.2% (net of all fees and expenses), resulting in a meaningful outperformance. Sameeksha AIF (Alternative Investment Fund = “Hedge Fund”) also gained 1.7% (post expenses pre tax), …

On Five Year Basis, Number One For The Fourth Consecutive Month, Top Decile Ranking For The 31st Consecutive Month

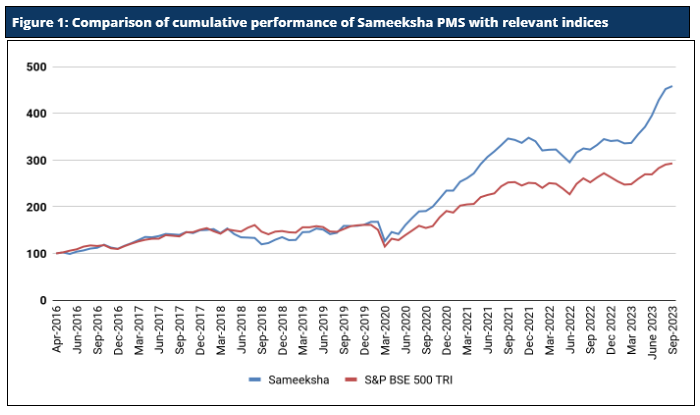

In September 2023, Indian markets decoupled with key global markets; as against 4.5% drop for S&P 500, BSE500 TRI went up 2%. Sameeksha PMS (Portfolio Management Service = Separately Managed Accounts) gained 1.4% (net of all fees and expenses), resulting in a small underperformance. Sameeksha AIF (Alternative Investment Fund = “Hedge Fund”) also gained 1.4% (post …

Five Year Data – Ranked Number One For Three Consecutive Months, Top Decile For 30th Consecutive Month

After a relentless streak of advancement spanning 5 consecutive months from March 2023 to July 2023, the benchmark BSE500 index cooled off in August 2023. In contrast, both the Midcap and Small cap indices stayed buoyant. In August 2023, the benchmark BSE500TRI was down 0.61% while the BSE Midcap and BSE Smallcap were up by …

Big Outperformance For PMS And AIF In A Strong Month, Number One Rank Again For PMS Based On Five Year Performance

After a strong rally in June, the market showed further positive performance for the month of July that led broad market indices to all time high. Lower energy prices over the month were helpful, as was the government’s reversal of a windfall tax on local crude oil sales and fuel exports. The S&P Global India …

Outperformance In Strong Month, At The Top Again For The Five Year Period

The month of June presented a blockbuster rally in the Indian stock market, both the market Indices NIFTY 50 and BSE Sensex to climb to their all-time highs. The month ended on the back of strong inflows from foreign institutional investors (FIIs), robust corporate balance sheets, moderating inflation and growth picking up coupled with expectations …

Outperformance In Strong Month For The Market

The month of June presented a blockbuster rally in the Indian stock market where major indices including the NIFTY 50 and the BSE Sensex climbed their all time high thrice this month. In June 2023, Sameeksha India Equity Fund (‘Sameeksha AIF’), a SEBI registered Category III Alternative Investment Fund gained 5.6% (net of all fees …

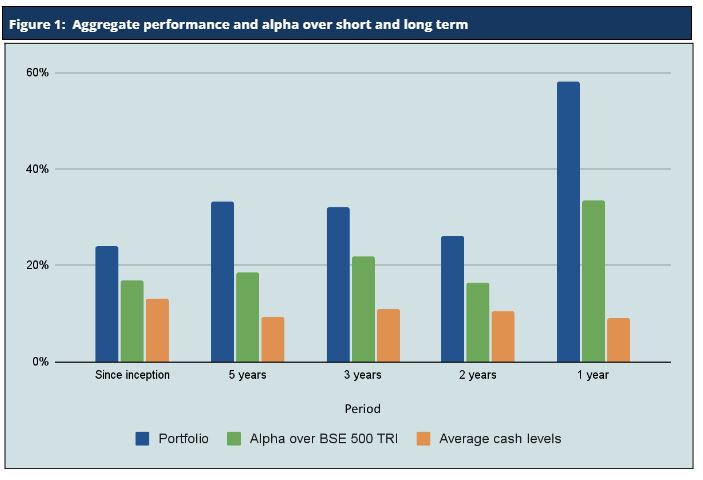

Annual Letter : FY 2022-23 (Year Ending Mar 31, 2023)

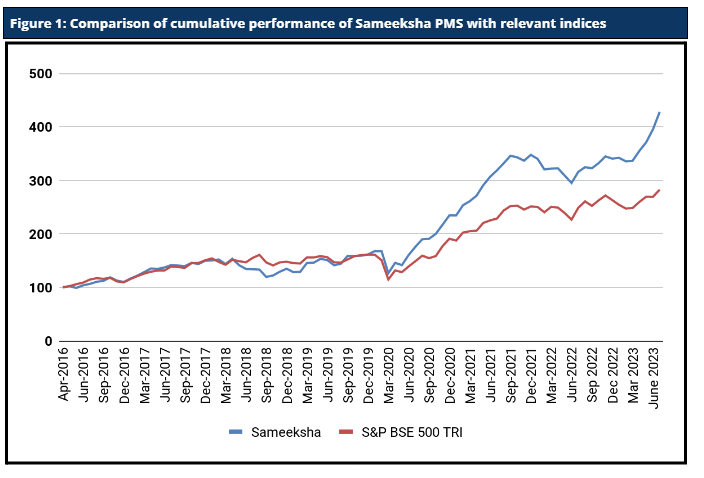

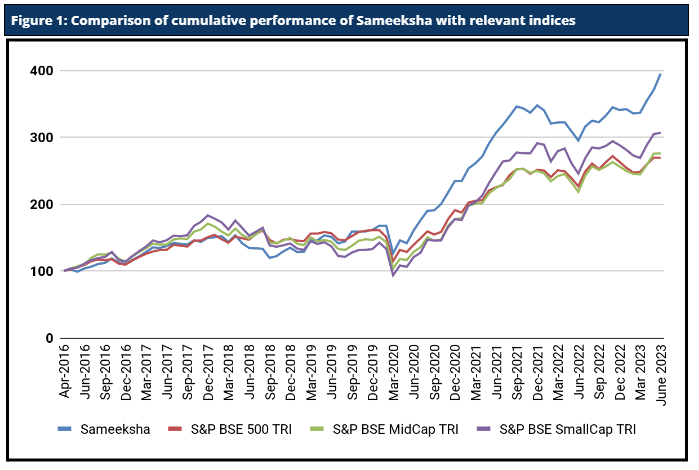

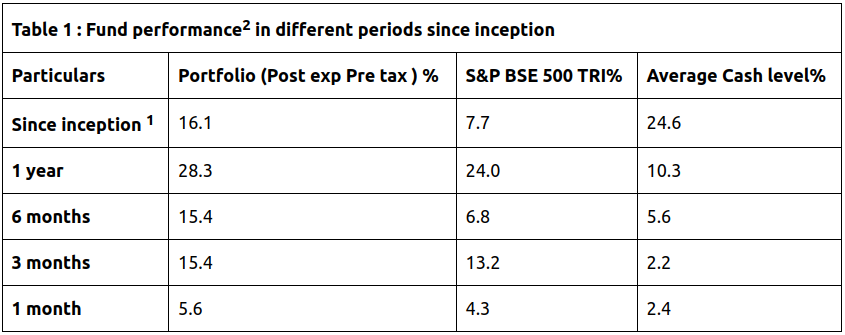

Introduction As of March 31 2023, Sameeksha completed seven years of managing money in Indian equities. Back in late 2015, we started Sameeksha with the objective to manage our investors’ assets just as we manage our own by investing in businesses that were durable and were managed by stewards who view their company capital with …

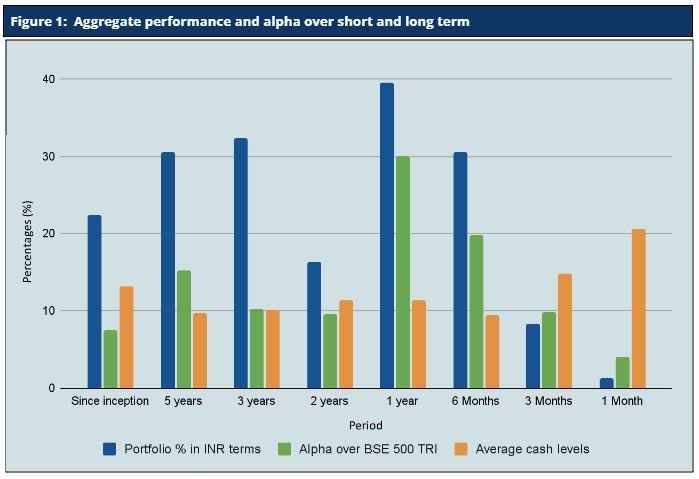

Another Month Of Outperformance, Top Rankings For Three And Five Years Retained

Buoyed by strong news from the Indian Economy (accelerating growth momentum and falling inflation) , the markets posted a strong month. Key market indices including the NIFTY 50 and the BSE Sensex clocked 2.2% and 2.1% respectively for the month of May. Sameeksha PMS gained 4.5% (net of all fees and expenses), and managed to …