In this letter, we discuss (a) our experience dealing with last eight weeks of extreme volatility, (b) how we navigated through this turbulent period (which admittedly may not be over yet), (c) how we are positioned for the market ahead, (d) analysis of significant portfolio decisions we took, and (e) how the outcome would have changed had we not taken that route.

We entered this Covid-19 led crash with a significant market outperformance. As of 20th February 2020, on an aggregate basis, we were up 23% for YTD (for year ending March 31st 2020) versus CNX500 up 3% helping us come out among the top performing funds on a 12 as well as 36 month basis. During any period of increased stock market volatility especially on the downside, a Long-Only fund manager is required to address multiple trade-offs: selling versus staying put, modulating the cash level versus managing churn and achieving good performance at the end not just on the before tax but also after tax basis. We have dealt with the same dilemma over the last several weeks. When faced with a task to decide among multiple trade-offs, we strive to retain our focus on generating absolute and relative performance notwithstanding diverse feedback we receive from investors and product evaluation specialists at various wealth management firms on some of these trade-offs.

Excuse the double negative but it was not that we were not concerned about the spread of this contagion. We were very much focussed on how China contains the epidemic and took a sigh of relief when China showed first signs of tackling the spread. At the same time though, the exponential spread had just begun in places such as Italy, Iran and Korea. Within a couple of days, reports came of the spread of Covid-19 on the shores of the United States and there began the market melt-down. We certainly regret having missed out doing some early selling. However, not focusing on what has already happened but rather on what lies ahead, we took a call to reduce the equity exposure and increased cash positions by selling stocks that we felt were at higher risk of a fall or at a risk of larger percentage declines notwithstanding the conviction in the long term potential of the companies we owned.

Timing the market is not something we aim to do. However, when the world is faced with a major economic shock, share prices (especially from elevated levels) do adjust sharply and more rapidly for companies that could see material near term or more importantly longer term impact. We evaluated our portfolio and did take action to sell off such names that we felt were at risk of sharp correction. Admittedly, we did not sell down some mid and small names which have corrected sharply as well. However, we know that such names see much greater impact due to liquidity than due to concerns about long term fundamentals during market distress.

Over the last few years, one thing that has been abundantly clear to us is that most likely due to computer driven trades, markets do move at much faster pace than before. Having built a substantial cash position (34% as of March 12th 2020), we knew very well that we were taking a risk of leaving money on the table when the market rebounds. We saw this first hand in the summer of 2019. Though stocks sold off sharply after a disappointing budget, they bounced back even more rapidly post tax cut just a couple of months later.

As such, having built a large cash position, we chose to sharpen our focus on factors that could cause the market to recover : early signs that pandemic is being contained, success of medical therapies, signposts of trough valuation in individual stocks and market and monetary and fiscal stimulus. We have traced past market crashes and mapped how some of these indicators (pandemic related indicators being unique to current crash) played out during the market crash and recovery later on. What we saw in late March was unprecedented fiscal and monetary stimuli being announced by major governments as well as albeit preliminary reports that certainly medical treatments held promise. At the same time a number of stocks across market capitalisation in some sectors and across sectors in small and mid cap became available at very attractive prices. We also observed insider buying of unprecedented magnitude. Finally there were early signs of flattening of the epidemic curve. India in particular has fared relatively better thanks to lock down and other measures taken by the government. Indian government also announced a Rs. 1.7 Lakh crore (USD 22.6 billion) of stimulus package for the poor which are affected the most. RBI, with its policy measures also announced 75 bps cut in repo rate. While the stimulus announced might not be sufficient, we expected the government to come up with additional measures to bring the economy back on track.

Conditions were clearly coming in place for a sharp rebound and we did act swiftly but just a little too swiftly, as it turns out. We were just a couple of days early in re-entering the market. We reduced our cash position from 34% to 14% during March 17-20 2020. However, the market corrected by 13% on the next trading day i.e. March 23rd 2020 and made a bottom that day. Of course time will tell if that was indeed the bottom but from that bottom S&P 500 (US index) has recovered 28.5% NIFTY has recovered 21.8% and CNX500 has recovered 22% as of April 17th April 2020.

Redeployment of cash needed us to really screen through a large number of companies – some for which we have done work before as well as some new ones. Our aim has been to reposition the portfolio for stronger gains over coming years. We were able to zero in on some names that we could not buy earlier due to valuation. Certainly, that meant that we had to work extra hard during the lock-down period. However, as Warren Buffet has said “become greedy when others are fearful”. And to satisfy our greed, we must do the detailed work which makes up our research process.

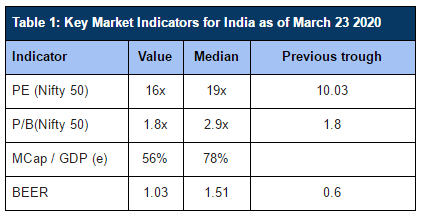

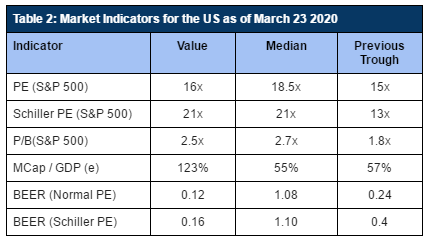

It is worth pointing out however that stocks in some of the most “loved” sectors did not correct to levels that would meet our buy criteria. That remains an enigma for us because the saying goes that a genuine market bottom is only reached when the “best” company becomes available at a bargain value. Having said that, enough of the indicators of market bottom were hit on March 23rd 2020, whether it was Price/book or market cap to GDP or BEER (Bond Equity Earning Yield Ratio). Table 1 and 2 indicates some of those indicators.

During this process of first increasing cash and then buying back stocks, we have also chosen to allow a larger number of holdings in the portfolio than we normally do for a few key reasons. First, there is a clear uncertainty with respect to the extent of current economic slump and pace of recovery post the slump. Hence, it is prudent to not have heavy concentration like before. While we can be confident about the long term potential of businesses we own, near term hit on earnings can sharply affect share prices and in that regard, it is more desirable to have a somewhat lower concentration. Second, small cap stocks got battered again taking the Nifty Smallcap 100 index back to levels last seen in 2014.

As such opportunities have certainly emerged in small and mid cap space. However because of liquidity constraints in smaller cap stocks, our liquidity related risk management criteria and our focus on absolute return potential meant that we needed to buy a larger number of positions and create a basket of holdings in small and mid cap stocks. We certainly would ideally like to increase concentration over time once we ride through the current period of uncertainty. However, that would be done purely based on upside potential of stock ideas. It is not as if we have abandoned our strategy of running a concentrated portfolio. Just to put things in perspective, top five and ten stocks represented 52% and 74% of our portfolio as of February 28th 2020. Those figures now stand at 44% and 64% respectively. In fact, out of the top ten names we previously owned, seven still remain in the portfolio.

A natural question that may arise is what benefit did we derive from raising and then reducing cash level and thus churning the portfolio through this turbulent period. There is always a debate about buy and hold strategy versus the strategy to take active cash calls. Had we not taken any active call, our portfolio value as of 7th April would have been down by additional 12% vis-a-vis our actual portfolio on the same date.

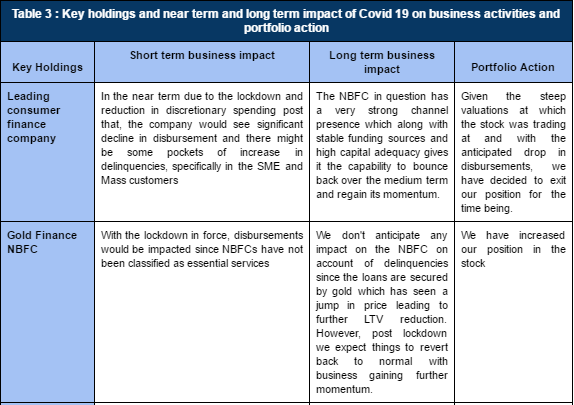

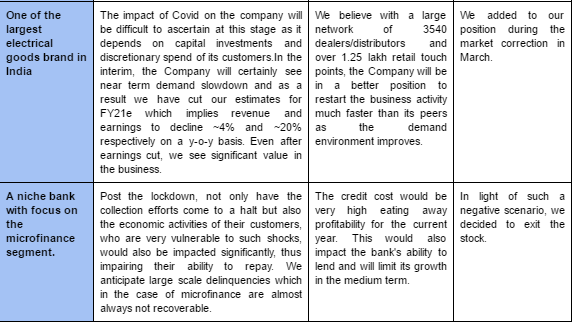

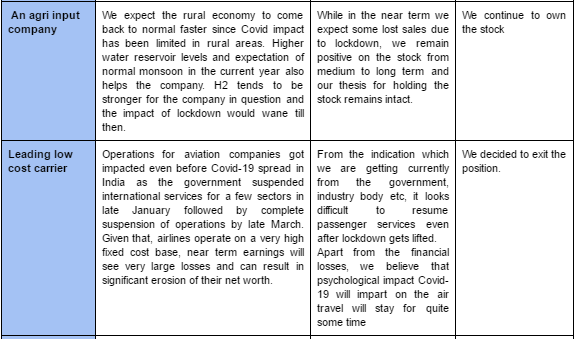

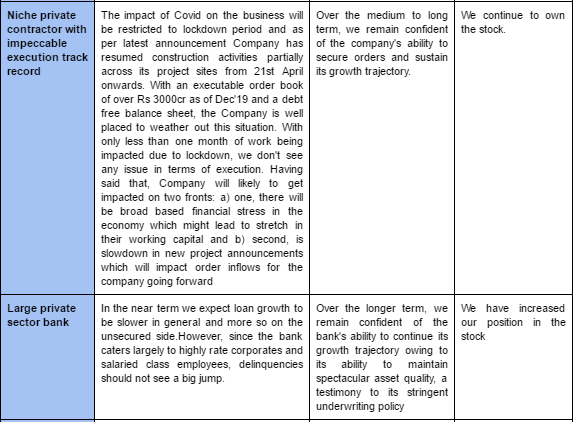

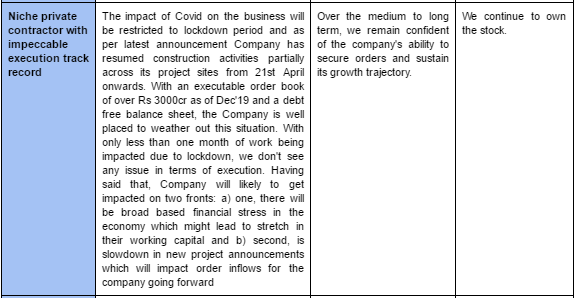

So what did we sell and how did the stocks we sold do? We exited from our position in a leading consumer finance company that enjoyed high price/book valuation justified due to the growth potential and profitability of the business. However over the next few quarters, the impact on their business could be substantial. From our price of selling the stock fell 45% at the bottom and even now it is down 39% from our date of selling. We also exited from our position in a leading aviation company. Ironically, this company will only come out stronger through the current crisis and could even win market share. However, the absolute impact on their earnings, cash flows and net worth from this crisis will be material and hence we expect a valuation reset. Interestingly, we also heard later that Berkshire Hathway has trimmed their holdings in Aviation stocks. On a collective basis, the portfolio of stocks we sold has gone down by 22% as of 17th April 2020. Compared to this, the portfolio of stocks we held on are down 5% as of the same date. Finally, the portfolio of stocks we bought are up 3.5% till date. We recognize these are all short term performance indications. However, we reiterate that we primarily sold names that we felt there would be some valuation reset that won’t recover in a hurry. In Table 3, we summarize our key holdings, our view of impact on their business near term and long term and portfolio action we took.

We further analyzed how our portfolio would have done had we deployed some hedging through index derivatives as additional protection during the period we increased cash position. Such hedging would have made sense because there was a correction across the board with some mid and small cap stocks correcting even more sharply. Our calculations suggest that a hedge position taken at time we increased cash position and unwound when we decreased would have positively contributed to the portfolio performance by 8.5%.

We reiterate that we invest with a long term view and would like to own names over several years. However, vagaries of Indian market force us to churn part of the portfolio during such extreme periods are such that some of the most desirable businesses get valued way above a fair value based on discounting a very long stream of cash flows based on a fairly optimistic set of assumptions. We would like to call this Indian market anomaly that is formed because it is incredibly hard and often expensive to short stocks in India and when there is a multiple years of capital inflow into certain funds that follow a strategy of buying “high quality” stocks at almost any valuation, it becomes a self fulfilling prophecy: Such strategies can perform well attracting even more capital and thus driving up prices of shares in those portfolios even further. Throughout our career, we have valued intellectual integrity and objectivity and while we can easily chase the same names and make our life a lot easier (by not having to search harder and harder for true value), we do not see us adding any value to our clients by doing so. We offer a differentiated strategy which is certainly resulting in a higher portfolio churn but our end outcome has been that of meaningful outperformance and we will continue to work hard to retain that.

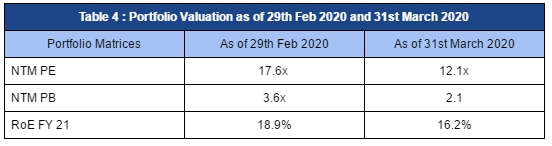

It is also instructive to look at how valuation of our portfolio changed through this correction and portfolio rejig. We summarize this shift in Table 4. While a large change could be attributed to correction in stocks, there is also an element of shift to names available at attractive prices that meet our investment criteria.

There are still many open questions about how various factors still at play would affect the economy: COVID-19, debacle of one of the major debt funds, risk of NPAs across sectors and so on. We are positioned for an economic recovery, not a prolonged recession. We believe in the collective human ingenuity to tackle the current crisis and come out. We realize that the uncertainties abound today and probability is certainly not negligible of an outcome that involves far greater pain than implied by share prices today. However, with flattening of the COVID-19 curve across the world, ongoing clinical trials of various medical therapies, increasing availability of rapid testing solutions, efforts to find a vaccine and heightened level of public awareness along with current and future measures to help the economy recover, we view odds in favor of a deep but short recession. It is quite possible though that we may need to adjust our portfolio positions either to reduce specific company or sector risk or to position us for stronger upside in future. We ask that Investors remain prepared for such shifts in our portfolio during this turbulent time.