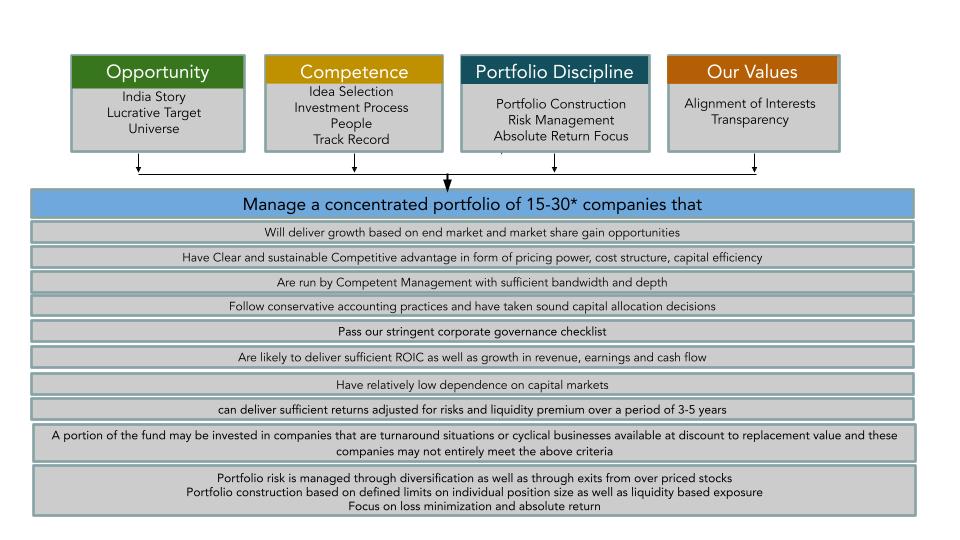

Our Approach

We believe in investing heavily in resources to support our detail oriented approach. Our Fund Manager and Advisor to the Fund together bring complementary but rich and relevant experience spanning over two decades each, and have had a track record of excellence in equity research and portfolio management respectively. Because of their prior education and experience in technology sector, they are very comfortable understanding complex industry dynamics that may shape the future of companies available for investment.

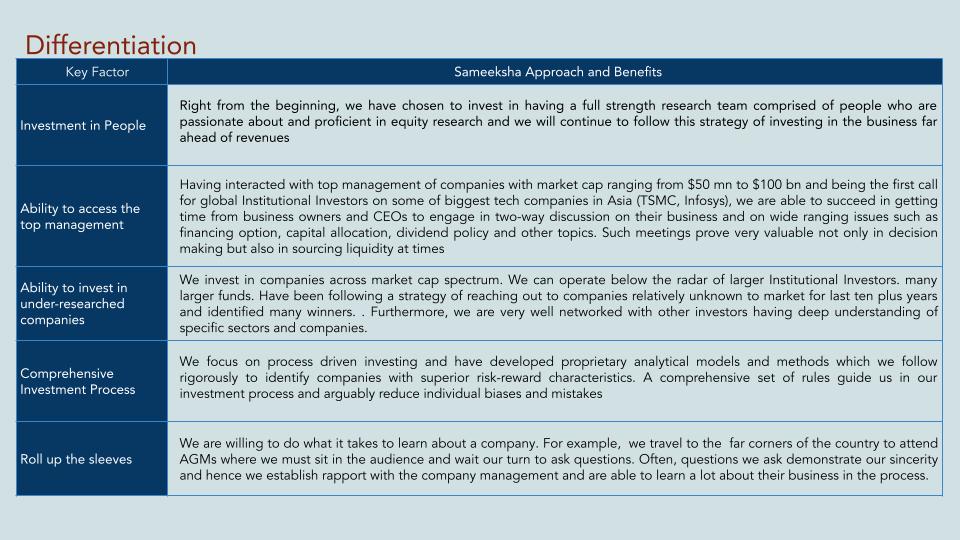

We focus on process driven investing and have developed proprietary analytical models and methods which we follow rigorously to identify companies with superior risk-reward characteristics. A comprehensive set of rules guide us in our investment process and arguably reduce individual biases and mistakes.

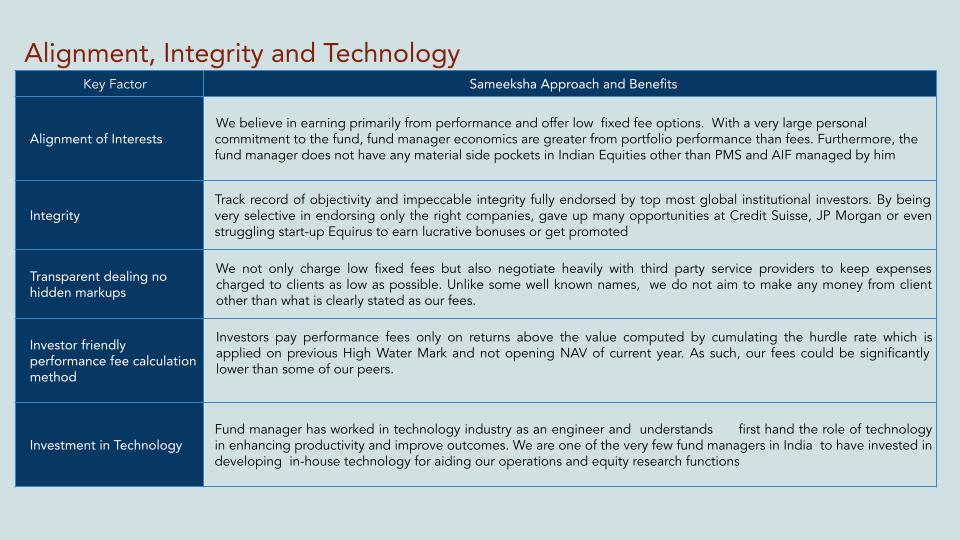

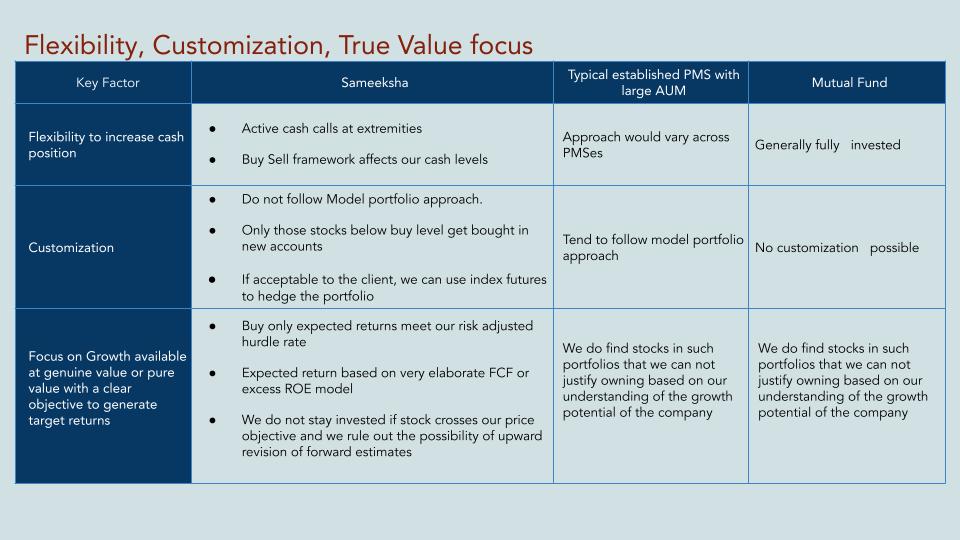

We pursue an absolute return strategy and invest in equities with a long term (three year plus) horizon but do not restrict ourselves to any specific holding period. We have an additional advantage of being able to invest also in small and midsize companies that are outside the radar of many large investors but offer opportunity for high returns because of both growth in earnings as well as valuation. We do not follow the model portfolio approach prevalent among our peers and instead structure portfolios based on merits of fresh investments at any given point in time. We have been able to deliver strong absolute and relative performance without taking full market exposure. Most importantly, we believe in earning from performance and believe that our fee structure is designed in accordance with that principle. We urge investors to fully understand nuances of various fee structures and not just focus on the sticker prices.

Fund Objective and Strategy

-

- Provide superior long term returns while protecting against permanent loss of capital using Long biased strategy:

-

- Invest in long-term growth opportunities in Indian companies across market capitalization (with greater emphasis on mid and small cap companies that are not fully discovered) that have superior business model, sufficiently large market opportunity to deliver growth, strong and shareholder focused management and are available at price that would result in sufficiently attractive risk adjusted returns over a horizon of at least two years

-

- Have an option of investing in Index Futures in order to partially hedge the portfolio

-

- Manage market exposure by modulating cash position in the portfolio depending on the opportunity set and attractiveness of investment ideas and through the use of index futures and options

-

- Follow rigorous fundamental research-driven and rule based investment process that is disciplined and yet leaves enough room for creativity and ingenuity; Investment process entails interactions with the companies through common as well as uncommon means, detailed financial model on the company as well as the industry to properly size up the growth opportunity, completion of a detailed check-list and review of investment argument by the entire research team

-

- Unlike many peers, Sameeksha does not follow model portfolio approach as it nullifies the key advantage offered by PMS rules. For any new investor, we invest in companies from our existing portfolio only if it merits fresh investment in a given company at prevailing market price.

-

- Focus on long-term return and hence may experience short term volatility, but will use its research capability to minimize the permanent loss of capital and will adhere to established risk guidelines

Investment Strategy

The Opportunity:

-

- With a young and growing population, the Indian economy will enjoy strong growth for a longer horizon than many other large economies of the world.

-

- Penetration levels and consumption per capita levels of a vast range of products and services suggest a long period ahead of high single digit to double digit growth. This creates numerous opportunities to invest in established as well as emerging companies.

-

- India is not one market but many markets: Urban versus Rural, Bottom of the pyramid all the way to the super luxury. As such, Indian economy is already large to offer sizable growth opportunity for a whole range of goods and services covering the entire spectrum of luxury to bare necessity.

-

- Government is in full throttle mode to revive manufacturing in India. India possesses competitive advantage to achieve this. Availability of cheap abundant labour allows manufacturing-oriented companies to create competitive advantage and gain share in the global market.

-

- Indian Paradox: Though India has been a difficult place to do business, there is a strong entrepreneurship culture that leads to formation and scaling up of some great companies. These companies erect competitive barriers and earn high returns on capital.

-

- India has been a good market to invest in equities across market capitalization and will remain so due to vibrant startup eco system and large domestic market.

Competence: Our Research and Investment Process

Our Portfolio Discipline

-

- Sameeksha’s proprietary multi-layered stock selection checklist: Process based stock selection helps get rid of any personal bias

-

- Value Versus Quality Matrix: Not just a high bar for quality, but also a value discipline that drives Buy/Hold/Sell Decisions

-

- Active sell framework: Stocks that approach our forward price objective are reevaluated for Hold versus Sell decision. Results in automatic modulation of cash position

-

- Detailed standardized Financial Model template embedded with unique dynamic DCF: Unique dynamic DCF enables us to quickly build high quality financial models on the company and industry and help us understand value